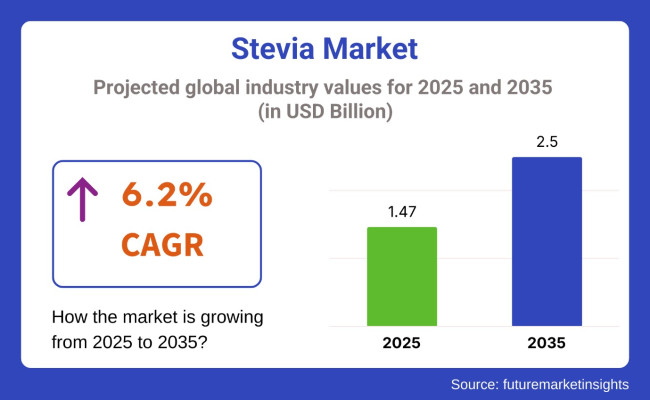

The global stevia market is set to record a valuation of USD 1.47 billion in 2025 and USD 2.5 billion by 2035. Demand for stevia is projected to register a compound annual growth rate (CAGR) of 6.2% during the forecast period. As compared to the historical period, demand for natural, plant-derived sweeteners is likely to see a steady upward trajectory. This growth is primarily driven by a heightened focus on sugar reduction in consumer diets, influenced by rising obesity and diabetes prevalence.

According to the World Health Organization, global obesity rates have nearly tripled over the last decade, prompting regulatory action. Countries such as the USA, UK, and Mexico have enacted sugar taxes, encouraging manufacturers to seek non-nutritive sweeteners like stevia. With zero calories and a zero glycemic index, it has emerged as a go-to sugar substitute in the health-focused food landscape.

Popularity remains high in the food and beverage industry. The trend comes from food producers innovating zero-calorie sweeteners in various forms, including high-purity steviol glycosides (Reb A, Reb M) for soft drinks, low-calorie yogurts, flavored waters, and baked goods.

For instance, The Coca-Cola Company relies on stevia in beverages like Coca-Cola Life and Sprite Green. On the other hand, PepsiCo uses stevia for G Zero and Rockstar Pure Zero energy lines. Key applications of natural sweeteners align with clean labels and low-calorie product development goals. Applications also comply with the broader functional food ingredient market with a preference for non-caloric and plant-based sweetening agents.

Key players are investing in fermentation-based and bioconversion technologies. Cargill, for example, developed EverSweet®, a stevia sweetener created using fermentation with yeast. The stevia market player enables a scalable production of Reb M and Reb D with minimal environmental impact. Another player, Ingredion, acquired PureCircle.

The acquisition aimed to expand the portfolio to offer better-tasting, high-solubility stevia extracts, positioning it as a complete natural sweetener solution provider. Strategic partnerships define competitive positioning in the stevia industry. For example, Cargill and DSM’s joint venture, Avansya, aims to deliver cost-effective, high-purity sweeteners to industrial customers. In addition, integration in meal replacements, functional beverages, and sports nutrition expands its relevance in health-driven categories.

Explore FMI!

Book a free demo

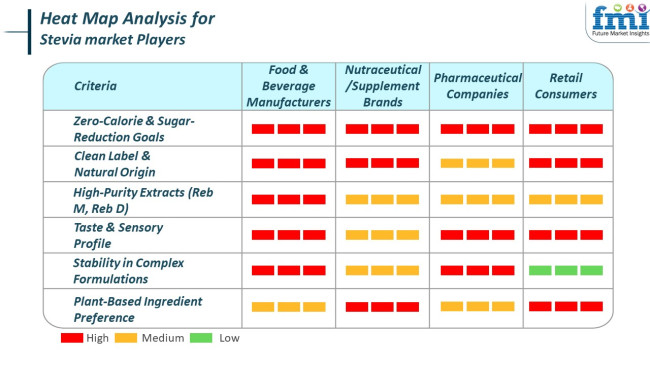

Analysis of stevia consumption trends includes purchasing criteria across key end-user segments. Top demand segments for stevia include food and beverage producers, nutraceutical and dietary supplement manufacturers, pharmaceutical industry players, and retail consumers. The table below shows a heat map of demand generated and estimated across key end-user segments in the industry.

Food and beverage manufacturers generate the highest demand for zero-calorie sweeteners due to rising regulatory and consumer pressure to cut down on added sugars. Key food and beverage companies such as PepsiCo, Nestlé, and Unilever have reformulated several product lines with high-purity stevia extracts such as Reb M and Reb D. Such steps are key to meeting clean-label and calorie-reduction goals.

For instance, PepsiCo uses it in Gatorade Zero and Lipton Diet Iced Tea. Besides this, a shift in the use of food and beverage sweeteners is growing with consumer demand for natural, low-calorie beverages. Also, integration in yogurt, baked goods, flavoured waters, and dairy-free alternatives shows its adaptability across diverse formulations. In addition to this, cross-innovation opportunities arise between the sugar beet pectin market and the stevia market for sugar-free formulations.

The nutraceutical and dietary supplement industry is another key end user. Health-focused brands increasingly depend on it to sweeten protein powders, gummies, and functional beverages without adding unnecessary sugars. Producers also continue to expand relevance in health-driven categories, similar to players in sugar-based excipients market. In addition, brands like GNC and Optimum Nutrition promote stevia for weight management and post-workout formulations due to its non-glycemic and natural origin attributes. As a result, it aligns with consumer preferences for plant-based ingredients in wellness products.

Pharmaceutical segment sees a differentiated use case of stevia. Demand is rising for oral syrups, chewable tablets, and pediatric supplements. Besides this, non-cariogenic and heat-stable properties make it ideal for applications where sugar is unsuitable. Such properties particularly help diabetic and dental-sensitive formulations. In addition to this, demand for tabletop stevia sweeteners, liquid drops, and baking blends continues to surge among retail consumers. Leading brands like Truvia and SweetLeaf are gaining household traction by offering convenient, natural sugar substitutes.

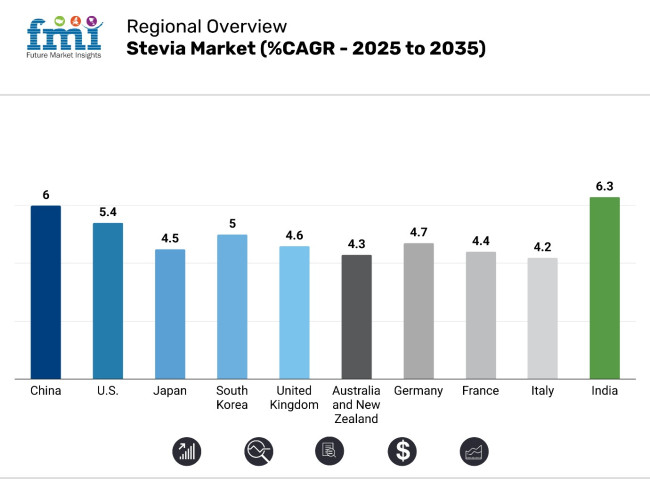

The stevia industry study identifies top trends across 30+ countries. Stevia producers operating in top opportunist countries can identify key strategies based on extraction, production, consumption, demand, and adoption trends of stevia. India is the fastest-growing stevia market, followed by China. The chart below draws focus on the growth potential of the top ten stevia markets during the forecast period.

The stevia industry in the United States, with a CAGR growth of 5.4% during the 2025 to 2035 period, is spearheaded by well-established food and beverage sectors, along with rising consumer interest in natural and non-GMO content. Federal healthcare policies and the FDA further fuel the sugar-reduction demand. Branded high-profile companies such as Cargill (Truvia), PureCircle (Ingredion subsidiary), and GLG Life Tech are industry leaders, driving high-purity steviol glycosides development. Heavy investment in product diversification in stevia application in carbonated drinks, dairy, and plant-based foods reflects the depth of use. Effective distribution channels and collaborations with international F&B companies solidify the USA's position as a global leader in the stevia industry.

With a 4.6% CAGR, the UK stevia market growth is driven by the growing demand for lower-sugar alternatives for beverages, bakery, and breakfast cereals. The UK Soft Drinks Industry Levy (Sugar Tax) has prompted food and beverage companies to use natural sweeteners. Clean-label trends brought about by consumer scrutiny of ingredients enable product innovation. Leaders such as Tate & Lyle and PureCircle lead the uptake in mainstream retail chains. Private-label brands also employ to meet sustainability and wellness objectives. Robust regulatory support and active engagement in EU food innovation initiatives sustain the UK's upward trend.

The stevia market in Germany is growing steadily at a CAGR of 4.7% due to innovative policies by the government that promote natural alternatives to sugar and high consumer health literacy. The country's strong manufacturing base and love for organic, high-quality products have favored the use in dairy, bakery, and nutrition bars. Players like Südzucker AG and German Beneo have developed innovative formulations to be resistant to bitterness and enhance stability. Greater transparency of food labeling and exposure to health-oriented food expos enhance visibility. Germany's EU health policy harmonization and need for sugar tax reform increase appeal and future-proof development.

The industry in France is set to registera 4.4% CAGR. This reflects a cultural shift within a country moving towards gourmet yet healthy consumption. French food culture highly appreciates natural ingredients, and their use is encouraged in high-end desserts, yogurts, and drinks. Strategies by the government to address obesity and reduce sugar intake create institutional backing. Other players, such as Roquette Frères, are leading the research and development with proprietary products and low-calorie baking systems incorporating it. Increased consumer pull for artisan and wellness-supportive formulas increases the consumption of the product. The twin focus in France on gastronomy and wellness continues to shape the European stevia market.

Demand for stevia in Italy grows at 4.2% CAGR, and shifts in preventive wellness and Mediterranean diet conformity drive the Italian stevia market. Stevia is applied extensively in low-sugar gelatos, pastries, and fruit-flavored beverages, satisfying consumers' demands for taste and health. The artisanal nature of the Italian food industry is changing to accommodate contemporary health trends, with companies like Giulio Grossi leading with high-purity stevia extracts. Public health initiatives against excessive sugar intake promoted by government support also propel demand. Italy's vibrant food retailing industry and emerging health food startups have increased Stevia's reach in different demographic groups.

Consumption of stevia in South Korea is set to grow at a 5% CAGR during the forecast period. K-beauty and well-food success overflows to beverage and meal replacers through its use. The top players, such as CJ CheilJedang and Daepyung Co., use stevia in food products catering to calorie- and diabetic customers. The government's dietary guide to sugar consumption and the food labeling reform momentum support the industry. Stevia is being increasingly combined with probiotics and botanicals to form value-added products that are appropriate for South Korea's health-conscious consumers and urbanized retail environment.

Japan's stevia market expands at a 4.5% CAGR under the impact of advanced consumer behavior and a robust R&D environment. The market is focused on functional beverages, processed foods, and dietary supplements that are enriched with highly purified steviol glycosides. Companies such as Mitsubishi Corporation and Morita Kagaku Kogyo are creating advanced blends to remove bitterness and improve solubility. Demographics in Japan, such as aging and managing chronic conditions, are conducive to the acceptance of low-calorie, diabetic foods. Nutritional government campaigns and multi-sector alliances provide industry players with an opportunity in the health-oriented food innovation market in Japan.

China's stevia market is expected to grow with a strong CAGR of 6.0%, bolstered by government support for sugar reduction and urbanization, for the demand for healthy food packaged. China is one of the world's largest producers, and industry titans such as GLG Life Tech and Qufu Xiangzhou are well-placed in cultivation and extraction technology. Low production costs in the market and vertical integration enable bulk export as well as affordable domestic use. Stevia's use as a food ingredient for beverages, milk, and sauce is growing at a consistent pace. Strategic policy initiatives under Healthy China 2030 also further encourage the use of high-end food reformulation ingredients.

Growing at a rate of 4.3% CAGR, the Australia-New Zealand stevia market is passing through wellness branding and clean-label innovation. The two countries have high rates of incidence of lifestyle disease, which fuels health-conscious consumption. Sugar replacement demand is most robust in children's nutrition, sports drinks, and plant food applications. Firms like Naturally Sweet Products and BioVittoria are riding this wave by providing high-quality stevia for domestic consumption and export. Regulators openly encourage food reformulation efforts, and supermarket retail chains sell stevia-filled SKUs prominently. Industry cooperation across sectors is also causing the industry to gain traction in conventional applications such as herbal teas and pet foods.

India takes the lead in growth through a CAGR of 6.3% due to growing health problems caused by excessive sugar intake, such as obesity and diabetes. Government FSSAI Eat Right movement and GST-exempt status for extracts further aid producers and consumers. Sugar-free SKUs are in the lead and are seeing growth in India's food and beverage market, especially traditional Indian sweets, snacks, and drinks. Stevia World Agrotech, Zindagi, and NutraSweet Natural Products are scaling up and resorting to awareness drives. Ayurvedic unification with modern nutrition in India offers global innovation a distinct edge.

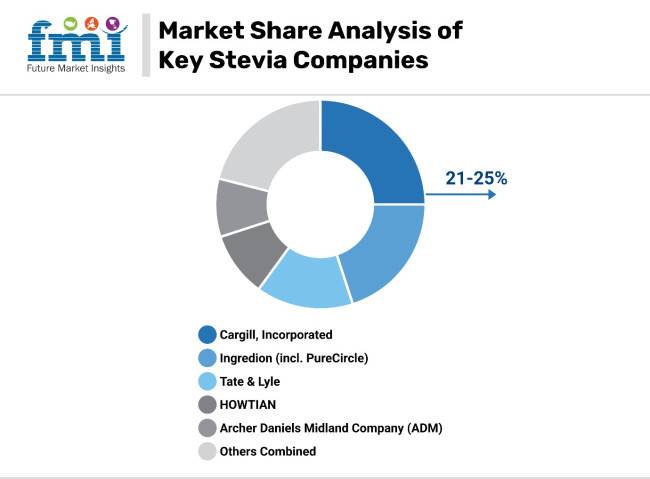

The stevia industry study reports market concentration of Tier 1, Tier 2, and Tier 3 players. Tier 1 players such as Cargill and Ingredion lead the market, though at a lower margin gap from another player. On the other hand, Tier 2 and Tier 3 players look at emerging end-use segments of stevia.

Market analysts see stevia as a rapidly-growing segment with consumer-driven innovation despite being regulation sensitive. As food and beverage manufacturers adopt stevia-based formulations, research and development efforts increase significantly in the industry.

The chart based on share analysis of key stevia companies below shows the fragmented landscape with Cargill Inc. holding a significant position. Threats from emerging stevia producers are high as these players compete to meet application-, product-, and regional-based demands.

The stevia market share in 2025 reflects significant consolidation among top stevia manufacturers, with major global companies like Cargill, Ingredion (which owns PureCircle), and Tate & Lyle holding top positions. High-level technological capabilities, vertical integration along production stages, and strong collaborations with global industry players in the food & beverage segment define the competitive landscape. This segmentation of the stevia market by company captures essential analysis for stakeholders involved with the industry, where strategic investment and expansion take center stage.

Cargill retains leadership among leading stevia players with innovation in fermentation-based stevia extracts, specifically glucose-free and Reb-M glycosides. Ingredion, considerably bolstered by the PureCircle acquisition, grew very fast in developing markets, especially in Latin America and also Asia Pacific. Tailored sweetness profiles to suit local tastes place Ingredion firmly in the global competitive arena. Tate & Lyle spearheads the clean-label innovation movement, integrating it into varied sugar reduction strategies across bakery, dairy and functional beverages categories.

HOWTIAN, China's leading exporter of plant-derived ingredients, capitalizes on widespread agri-control to produce glycosides affordably. Archer Daniels Midland Company (ADM) proactively broadens the application of its products by specifically developing research and development on sweetener substitutes, with a focus on taste modification methods in nutraceutical and health-focused markets. Strategic alliances promote competitiveness in this industry. Ingredion works closely with global flavor houses to optimize sweetness profiles, whereas Cargill collaborates on joint development initiatives with cutting-edge food-tech startups. Tate & Lyle sponsors initiatives in precision nutrition.

Development in the stevia industry is highly dependent on the accuracy refinement of glycosides, i.e., Reb M and Reb D. Both substances accurately mimic the sweetness profile of conventional sugar with very little bitterness. Industry players favor cutting-edge production methods, using biosynthesis and enzymatic conversion to produce cleaner, scalable glycoside production. Efficient production techniques have a direct impact on adoption across various product forms, such as powders, granules and liquid extracts.

Regulatory approval continues to be a key to market growth. Regular approval by leading agencies like the FDA (United States), EFSA (European Union) and regulatory bodies in China and India makes international market acceptance easier. Compliance with changing regulatory approvals by region continues to ensure ongoing growth and worldwide market penetration. In addition, quantifiable sustainability measures like lower water usage, sustainable land use, and low-carbon manufacturing increasingly drive market differentiation. Stevia manufacturers' increased commitment towards sustainability raises demand for eco-friendly production. Businesses leading in innovation, sustainable sourcing, compliance and application support are set to capture the future growth in the Stevia Market Share Analysis Report.

The stevia industry is segmented by form, type, and region. Based on the form, it is classified into powder extract, liquid, and leaf. A study on the market is also carried out, categorizing it into conventional and unconventional types. The following section shows investment opportunities across the supply chain for producers, extractors, distributors, and suppliers.

Conventional type holds 63% of the stevia market share in 2025, with significant demand from the food and beverage industry. Demand is likely to rise gradually, particularly due to its use as a natural sweetener and sugar substitute. The traditional types comprise the more popular glycosides such as Reb-A and Reb-B. The popularity of these glycosides is likely to remain high in functional beverages and nutraceuticals.

This is due to the already established regulatory approvals from the FDA and EFSA, deeming it safe for consumption. Besides this, there are numerous advantages to the market demand for plant-based ingredients, and conventional stevia is highly placed as a primary option by manufacturers as an affordable, compliant, and reliable ingredient, spanning a broad spectrum of products. Leading companies like Cargill, Ingredion (PureCircle), and Tate & Lyle dominate this space with their stevia-based sweeteners, helping to drive the widespread adoption of conventional stevia in mainstream consumer products like diet sodas, baked goods, and snacks.

The unconventional segment is experiencing momentum with a 37% share as consumers are more concerned with organic foods and sustainable sources. It includes varieties that have been grown through organic means. These will cater to the increasing demand for clean-label products and consumer health-related trends. Also, the growing interest in plant-based ingredients encourages the trend toward unconventional types due to the attraction of organic and natural sweeteners.

Emerging stevia market players such as GLG Life Tech and Sweegen have also started entering this part of the business by investing in the supply of unconventional type under organic certification standards. These factors are expected to open up the unconventional stevia market, especially in those regions that practice sustainability and health consciousness.

In 2025, the industry is segmented into powder extract and liquid stevia, each capturing an end-use consumer segment. Powder extract commands a greater share, 60% of the market, the reason being powder stability and flexibility, making it a natural choice in food and beverage applications. Powdered form is known to be used in many products, such as baking mixes, functional beverages, and nutraceuticals. The most prominent companies dealing with powdered high-purity stevia used in diet sodas, energy drinks, and confectionery include Cargill (under the Truvia brand), PureCircle (an Ingredion company), etc.

Amongst the most-preferred glycosides in this segment is Reb-A, which gives the sweetness of sugar without calories. Cost-effectiveness, long shelf life, and FDA and EFSA recognition as meeting regulatory requirements are some of the reasons powdered stevia is popular. It has been approved for a long time as a safe replacement for sugar. The demand for plant-based ingredients and the emerging trend of clean-label products further nurtured the growth of powdered form.

In addition to this, liquid stevia takes up around 25% of the market share and is sold as a beverage. Liquid extracts derived from companies like Tate & Lyle and GLG Life Tech are used in the manufacturing of ready-to-drink beverages such as teas, flavored waters, and sports drinks.

It's gaining popularity as more consumers are opting for sugar-free and low-calorie drinks, and the health-conscious eating trend is growing. As the demand for natural plant-based sweeteners continues to mount, especially in the markets that aim to mitigate sugar intake, the area of liquid stevia in the market is expected to be promoted and expanded. More opportunities are likely to arise from market players such as Sweegen and Stevia Corp, which are involved in liquid enrichment through innovative formulations designed to satisfy the changing tastes of health-conscious consumers looking for sugar alternatives.

Market dynamics play a key role in Stevia's demand analysis through a thorough assessment of growth factors, challenges, opportunities, and threats. Key growth drivers directly influence the revenue generated by stevia suppliers, while challenges offset or slow down the industry from realizing its true revenue potential. In this section, analysts suggest key opportunities, threats, drivers, and challenges for players to take calculated risks while planning their next move to grow in the stevia market during the forecast period.

Increasing Demand for Natural, Low-Calorie Sweeteners

The stevia market is picking up strong momentum, driven by mounting health consciousness and consumers' demand for clean, natural food. The trend has also propelled growth in the natural sweeteners market, with food and beverage manufacturers reaching out to stevia in an effort to reduce sugar without sacrificing taste. Stevia market trends in 2025 support robust alignment with customers' need for zero-calorie products, further pushing it into the mainstream.

Using stevia demand forecasts, firms are expanding production and investment in application versatility and taste profile modification. Drivers within the industry have an attractive potential for innovation and growth in Stevia, particularly for decision-makers considering long-term investment in the Stevia supply chain.

Regulatory and Sensory Issues Limit Broader Usage

Drivers and barriers to market growth are marked by significant issues impacting more extensive industry uptake. One major issue is taste perception, in that some extracts have been shown to leave a bitter aftertaste, which affects product acceptance. At the same time, the stevia regulatory landscape poses multi-faced challenges, most significantly for companies expanding operations to cross-global markets with varying standards of compliance.

Second, issues of farm yield volatility and processing limitations can impact operational efficiency in stevia production. Stevia market entry barriers and the need for special consumer education in emerging markets further compound these. Decision-makers must navigate these while providing innovation, compliance, and consumer trust.

New Markets and Applications Opportunities for Expansion

Industry prospects indicate stevia export opportunities and expansion into new product categories. Advances are opening the door for greater use in pharmaceuticals, dietary supplements, and personal care products, revealing stevia investment opportunities for value chain players.

Emerging growth markets in Asia-Pacific and Latin America are becoming ideal hotspots for demand. Since mature regulatory systems provide consolidated supply chains, these markets provide the best opportunities for strategic development. Moreover, extraction and formulation technologies become more advanced to focus on stevia technological advancements that enhance use flexibility and minimize bitterness, increasing the appeal of the product among high-growth markets.

Competitive and Market Risks Pose Growth Threats

The stevia industry remains exposed to external threats that can challenge its long-term growth. Increased stevia competitive landscape pressures come from other natural sweeteners like monk fruit and sugar alcohols, which can shift buyer preferences. Additionally, stevia pricing trends are influenced by shortages in raw materials or geopolitical factors in planting and transporting stevia.

Climate change and environmental uncertainty affect the world's stevia supply chain management, especially for countries heavily relying on stevia cultivation. Finally, misleading data or mistrust from consumers over natural sweeteners shapes market forces, and companies hence have to undertake transparent marketing and regulation adherence.

The stevia market size is estimated to be USD 1.47 billion in 2025.

Cargill Inc. leads stevia production with 21-25% market share in 2025.

Stevia will not replace sugar globally but there is a steady increase in demand for stevia at the CAGR of 6.2% during the forecast period.

Yes. Regulations affecting stevia product labeling vary from country to country.

Food and beverage manufacturers adopt stevia-based formulations to target consumers demanding healthy sweeteners.

The industry is segmented into conventional and unconventional.

The market is studied by key categories on the basis of powder extract, liquid, and leaf.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia, Belarus, and the Middle East & Africa.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.