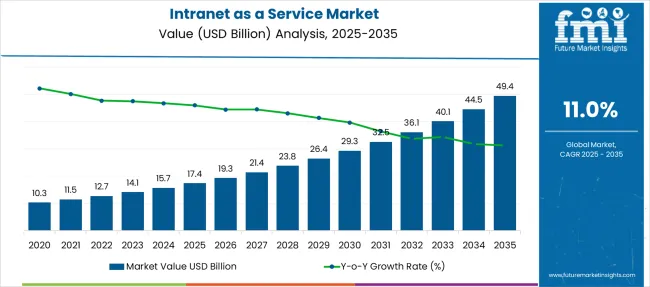

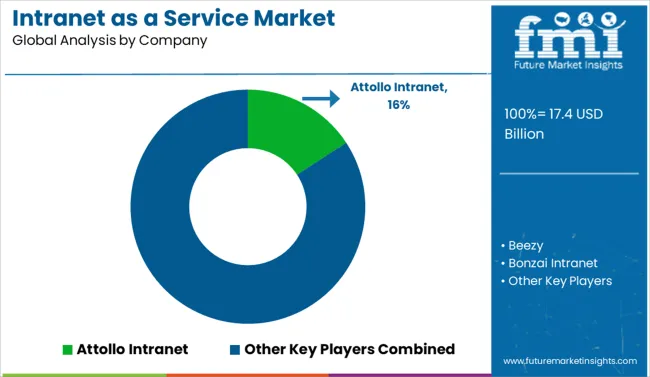

The Intranet as a Service Market is estimated to be valued at USD 17.4 billion in 2025 and is projected to reach USD 49.4 billion by 2035, registering a compound annual growth rate (CAGR) of 11.0% over the forecast period.

| Metric | Value |

|---|---|

| Intranet as a Service Market Estimated Value in (2025 E) | USD 17.4 billion |

| Intranet as a Service Market Forecast Value in (2035 F) | USD 49.4 billion |

| Forecast CAGR (2025 to 2035) | 11.0% |

The intranet as a service market is witnessing accelerated growth due to rising enterprise demand for centralized communication platforms that are scalable, user friendly, and cloud ready. Organizations are prioritizing digital workplace transformation and employee engagement, which has driven adoption of modern intranet solutions that integrate seamlessly with productivity tools, collaboration apps, and enterprise content systems.

Cloud native architecture, real time content management, and mobile access are key enablers driving flexibility and continuous engagement. In addition, growing emphasis on remote and hybrid work environments has prompted companies to invest in intranet services that offer unified access to documents, policies, workflows, and organizational updates.

Security, compliance, and ease of deployment are further influencing decision making across industries. The market outlook remains favorable as businesses continue to align internal communication infrastructure with evolving workforce expectations and digital strategies.

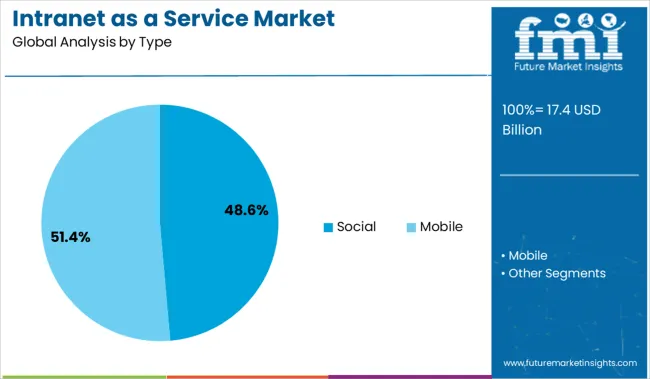

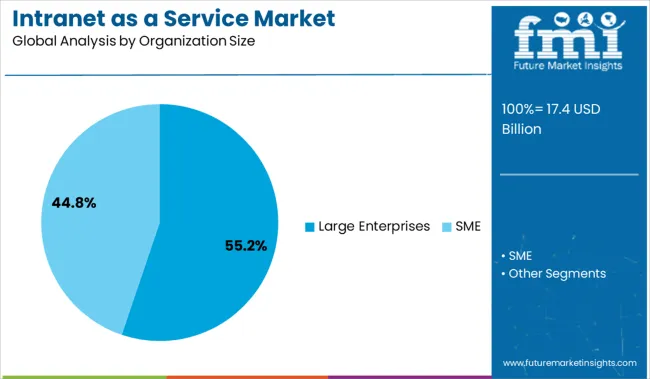

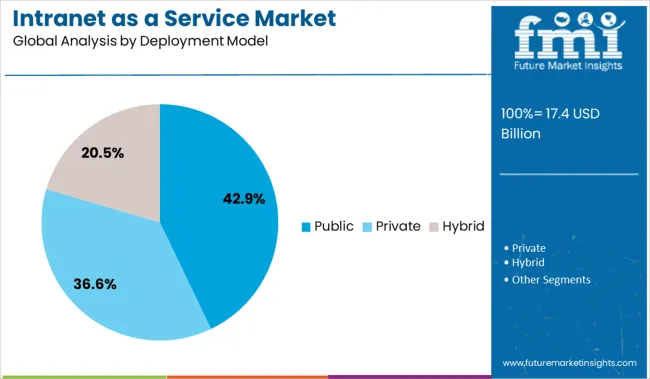

The intranet as a service market is segmented by type, organization size, deployment model, and industry and geographic regions. The intranet as a service market is divided by type into Social and Mobile. In terms of organization size, the intranet as a service market is classified into Large Enterprises and SMEs. Based on the deployment model of the intranet as a service market, it is segmented into Public, Private, and Hybrid. The intranet as a service market is segmented by industry into IT & Telecommunication, Healthcare, Manufacturing, Media & Entertainment, Banking & Financial Services, Education, and Others. Regionally, the intranet as a service industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The social segment is projected to represent 48.60 percent of total revenue by 2025 within the type category, making it the leading segment. This is attributed to the increasing need for employee engagement, peer to peer interaction, and collaborative knowledge sharing within organizations.

Social intranet solutions promote transparency, feedback culture, and employee recognition, helping to improve retention and productivity. Integration of chat functions, activity feeds, and forums into intranet environments has become a priority for enterprises seeking to build inclusive and agile work cultures.

As workforce demographics shift toward digitally native employees, the demand for interactive and socially enabled platforms continues to rise, securing the social segment’s dominance in the type category.

The large enterprises segment is expected to contribute 55.20 percent of total market revenue by 2025 under the organization size category, positioning it as the dominant user group. This leadership is driven by the scale and complexity of operations within large organizations, which require structured and comprehensive internal communication systems.

Large enterprises are more likely to invest in advanced intranet features such as workflow automation, analytics dashboards, multilingual support, and compliance monitoring. Their ability to allocate budget toward platform customization and integration with enterprise systems further supports widespread adoption.

Additionally, large organizations face greater needs for onboarding, knowledge transfer, and employee alignment across geographies, reinforcing the use of intranet as a service solutions to streamline internal processes.

The public deployment model segment is forecasted to hold 42.90 percent of market revenue by 2025 within the deployment category, making it the leading deployment model. This trend is supported by the benefits of cost efficiency, rapid implementation, and scalability associated with public cloud environments.

Organizations leveraging public deployment benefit from automatic updates, lower infrastructure overhead, and secure access across distributed teams. The model is particularly attractive to firms prioritizing agility and reduced maintenance burden.

Enhanced support for integrations with SaaS applications and enterprise productivity suites has further strengthened its appeal. As more companies transition toward cloud first strategies, the public deployment model continues to gain traction and dominate the intranet as a service deployment landscape.

Demand for intranet as a service is accelerating as hybrid workforces scale and IT teams prioritize low-code digital workplaces. Sales of cloud-native intranet platforms are being driven by modular integrations, advanced search personalization, and enterprise-grade compliance frameworks.

Demand for intranet as a service grew 27% YoY in 2025, with enterprises replacing legacy on-prem portals to support distributed teams. Financial firms in North America migrated to multi-tenant intranet platforms with federated content access, reducing email dependency by 33%. Asia-Pacific corporations deploying multilingual, mobile-first portals saw a 19% jump in internal engagement metrics. Enterprises using role-based access and adaptive content targeting reported a 21% improvement in HR policy reach and training completions. These consolidation efforts are helping CIOs streamline communication layers while maintaining enterprise-grade control, particularly in sectors with strict audit and archiving requirements.

Sales of low-code intranet solutions increased 31% as IT departments sought faster deployment with reduced developer dependency. Manufacturing firms integrated pre-built connectors for SAP, Salesforce, and Microsoft 365, accelerating portal rollout by 42%. Healthcare groups leveraged drag-and-drop intranet builders with HIPAA compliance modules to meet security benchmarks without external dev support. Middle East telecom operators deployed no-code content workflows that reduced change request cycles from 12 to 3 days. Vendors offering analytics dashboards and AI-based search personalization saw repeat license renewals climb by 18%, as enterprises prioritized platforms that deliver both productivity gains and measurable ROI.

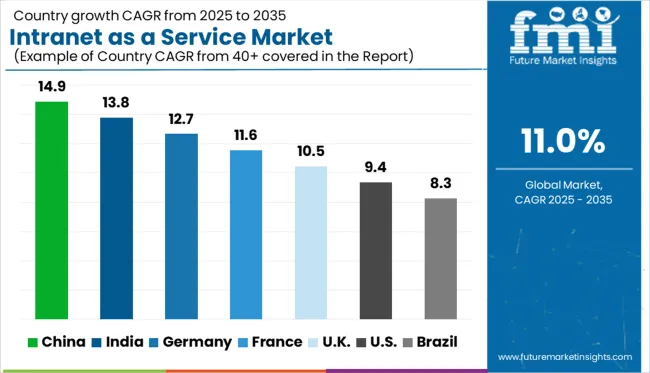

| Country | CAGR |

|---|---|

| China | 14.9% |

| India | 13.8% |

| Germany | 12.7% |

| France | 11.6% |

| UK | 10.5% |

| USA | 9.4% |

| Brazil | 8.3% |

The global market is projected to grow at a CAGR of 11.0% from 2025 to 2035. Leading the global landscape, China (BRICS) records a standout CAGR of 14.9%, exceeding the global average by 3.9 percentage points, driven by rapid enterprise digitization, cloud-first strategies, and AI-enabled workplace platforms. India (BRICS) follows with 13.8% (+2.8 pp), supported by expanding tech startups, hybrid workforce growth, and government-backed digital transformation programs. Among OECD economies, Germany posts 12.7% (+1.7 pp), fueled by increased demand for secure, scalable collaboration systems across industrial and professional services sectors. The UK sees steady growth at 10.5% (–0.5 pp), while the United States registers 9.4% (–1.6 pp), reflecting a more mature SaaS environment with slower but consistent cloud intranet adoption. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is forecast to grow at a robust CAGR of 14.9% from 2025 to 2035 in the intranet as a service landscape, spurred by digital workplace transformation and domestic cloud adoption. Between 2020 and 2024, the market was fragmented with limited SaaS penetration in smaller enterprises. However, demand for integrated intranet platforms is accelerating as enterprises pursue scalable internal communication tools across distributed teams.

India’s market for intranet as a service is projected to expand at a CAGR of 13.8% through 2035, supported by hybrid workforce models and strong SaaS adoption among mid-sized enterprises. In the 2020–2024 period, fragmented legacy systems limited collaboration efficiency. The transition to modern, cloud-hosted intranet platforms is now accelerating, particularly among IT, retail, and banking verticals.

Germany is expected to register a CAGR of 12.7% between 2025 and 2035, as demand rises for secure, GDPR-compliant intranet platforms. From 2020 to 2024, adoption was cautious due to strict data localization concerns. As enterprise IT budgets shift toward cloud-first infrastructure, modern intranet solutions with on-premise control options are gaining preference.

The UK market is anticipated to grow at a CAGR of 10.5% through 2035, fueled by public sector modernization and enterprise focus on employee engagement. Between 2020 and 2024, legacy SharePoint-based systems limited agility. Now, demand is shifting toward scalable, mobile-ready intranet platforms optimized for hybrid work environments.

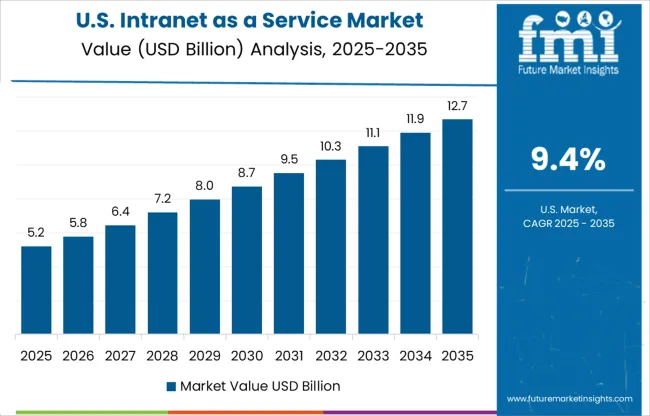

The USA market is forecast to post a CAGR of 9.4% during the 2025–2035 period, with demand rising across tech, finance, and education sectors. During 2020–2024, many organizations used a mix of communication tools rather than unified intranet systems. A shift toward centralized digital workspaces is now under way, aimed at boosting productivity and internal transparency.

Sales of intranet as a service platforms are accelerating in 2025, driven by hybrid work models and demand for centralized digital workplaces. Attollo Intranet leads the market with a significant share, owing to strong mid-market adoption and rapid deployment capabilities. Microsoft continues to expand SharePoint Online integrations, while Slack Technologies and LumApps are gaining traction via communication-focused intranet layers. Beezy and Unily are focusing on enterprise-grade personalization, whereas Simpplr and Happeo are preferred for usability in remote teams. Igloo Software and ThoughtFarmer are investing in AI-powered content recommendations. LiveTiles and Powell Software are scaling presence through modular intranet frameworks. As organizations shift from legacy portals to cloud-native platforms, the competitive landscape is evolving around security, UX, and third-party app interoperability.

In January 2024, Microsoft launched the redesigned Viva Connections desktop experience, featuring improved branding, announcements, a hero section, and a dashboard layout now globally available across desktop, tablet, and mobile platforms.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.4 Billion |

| Type | Social and Mobile |

| Organization Size | Large Enterprises and SME |

| Deployment Model | Public, Private, and Hybrid |

| Industry | IT & Telecommunication, Healthcare, Manufacturing, Media & Entertainment, Banking & Financial Services, Education, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Attollo Intranet, Beezy, Bonzai Intranet, Claromentis, Happeo, Hubfly, Igloo Software, Interact, Jive Software, LLC, LiveTiles, LumApps, Microsoft, Powell Software, Simpplr, Slack Technologies, LLC, ThoughtFarmer, Thoughtonomy, ThoughtSpot, Unily, and Wizdom |

| Additional Attributes | Dollar sales by deployment model and organization size, demand dynamics across enterprise and SMB segments, regional trends in cloud vs on‑prem intranet adoption, innovation in social collaboration tools and AI‑driven knowledge hubs, environmental impact of IT consolidation, and emerging use cases in remote workforce engagement. |

The global intranet as a service market is estimated to be valued at USD 17.4 billion in 2025.

The market size for the intranet as a service market is projected to reach USD 49.4 billion by 2035.

The intranet as a service market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in intranet as a service market are social and mobile.

In terms of organization size, large enterprises segment to command 55.2% share in the intranet as a service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Gas Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Data as a Service (DaaS) Market Analysis by Pricing Model, Deployment Type, End User, and Region Through 2035

Asset Management Services Market Size and Share Forecast Outlook 2025 to 2035

GPU as a Service Market Size and Share Forecast Outlook 2025 to 2035

HSM-as-a-Service Market Size and Share Forecast Outlook 2025 to 2035

Car Washing Service Market Size and Share Forecast Outlook 2025 to 2035

Massage Therapy Service Market - Growth & Forecast 2025 to 2035

Waste Recycling Services Market by Application, Product Type, and Region - Growth, Trends, and Forecast 2025 to 2035

Industry Share Analysis for Massage Therapy Service Providers

Cash Management Services Market – Trends & Forecast 2025 to 2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

WiFi as a Service Market Size and Share Forecast Outlook 2025 to 2035

Talent as a Service Market Size and Share Forecast Outlook 2025 to 2035

Fast Food & Quick Service Restaurant Market Trends – Growth & Forecast 2025 to 2035

Backend-As-A-Service Market Size and Share Forecast Outlook 2025 to 2035

Carpool As A Service Market Size and Share Forecast Outlook 2025 to 2035

Banking as a Service (BaaS) Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Die Casting Services Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA