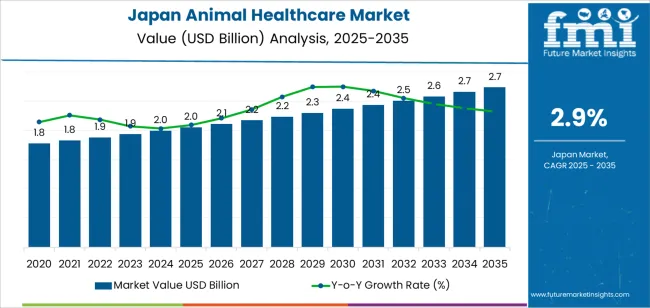

The demand for animal healthcare in Japan is expected to grow from USD 2.0 billion in 2025 to USD 2.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 2.9%. The increasing pet ownership and growing awareness of animal health are key factors driving this growth. As pets are increasingly viewed as family members, their owners are willing to invest more in high-quality veterinary services and products. Japan’s strong focus on animal welfare and advanced veterinary healthcare infrastructure contributes to the demand for innovative animal healthcare solutions.

Japan’s aging population is also influencing the rise in demand for animal healthcare, as older individuals often have pets that require specialized care. Veterinary services for preventive care, diagnostics, treatments, and specialized services such as oncology and rehabilitation are expected to see increased demand. Moreover, pet owners in Japan are placing greater emphasis on wellness, nutrition, and preventive treatments, contributing to the overall growth of the animal healthcare industry.

The development of new treatments and technologies, as well as the growing focus on pet insurance and healthcare accessibility, further support the expansion of the animal healthcare sector. The veterinary care industry is evolving with more advanced diagnostic tools, therapeutics, and specialized services, offering opportunities for veterinary clinics and hospitals to meet the rising demand. With a continued emphasis on high-quality care, animal healthcare in Japan will maintain steady growth through 2035.

Between 2025 and 2030, the demand for animal healthcare in Japan will increase from USD 2.0 billion to USD 2.4 billion, adding USD 0.4 billion. During this phase, pet owners will continue to demand higher quality veterinary services, driven by the rising number of pets and an increasing focus on preventive and specialized care. This growth will be particularly evident in urban areas where pet ownership is more common, and where veterinary clinics are offering advanced medical technologies and treatments.

From 2030 to 2035, the demand for animal healthcare is expected to grow from USD 2.4 billion to USD 2.7 billion, adding USD 0.3 billion. As the industry matures, growth will be more gradual, but will still be supported by the rising number of elderly pets requiring specialized care and the continued trend of treating animals as family members. Veterinary practices will continue to innovate, providing high-quality care for pets, while increasing access to healthcare services for pet owners in both rural and urban areas.

| Metric | Value |

|---|---|

| Demand for Animal Healthcare in Japan Value (2025) | USD 2.0 billion |

| Demand for Animal Healthcare in Japan Forecast Value (2035) | USD 2.7 billion |

| Demand for Animal Healthcare in Japan Forecast CAGR (2025-2035) | 2.9% |

The demand for animal healthcare in Japan is growing as the pet ownership rate continues to rise, and more pet owners seek advanced medical care for their animals. Japan's aging population, along with a growing number of single-person households, has led to increased pet adoption, with pets often seen as companions and family members. This trend is driving the demand for high-quality veterinary care, including preventive healthcare, diagnostics, and treatment for a wide range of animal health conditions.

Japan’s well-established livestock and agriculture sectors are contributing to the demand for animal healthcare products and services. As the country places a strong emphasis on animal welfare and the health of its agricultural animals, veterinary care for livestock is becoming an essential part of Japan's food safety and quality assurance measures. This includes healthcare solutions for disease prevention, treatment, and overall farm animal management.

Technological advancements in veterinary medicine, including diagnostic tools, pharmaceuticals, and digital health solutions, are further fueling the growth of the animal healthcare industry in Japan. As pet owners become more aware of their pets’ health needs and veterinary care options, and as agricultural practices evolve to ensure the welfare of livestock, the demand for animal healthcare services and products is expected to continue expanding steadily through 2035.

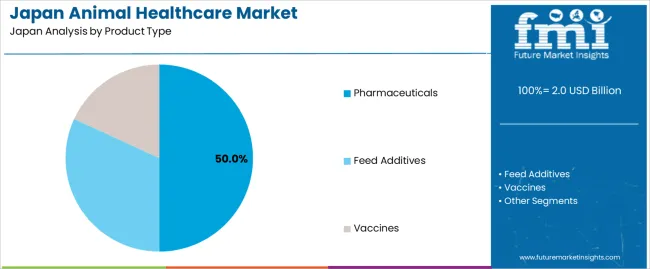

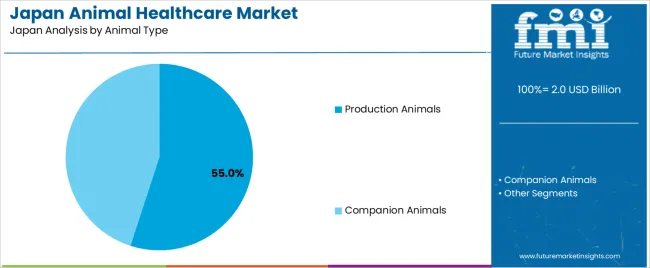

Demand for animal healthcare in Japan is segmented by product type and animal type. By product type, demand is divided into pharmaceuticals, feed additives, and vaccines, with pharmaceuticals holding the largest share at 50.0%. The demand is also segmented by animal type, including production animals and companion animals, with production animals leading the demand at 55.0%. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Pharmaceuticals account for 50% of the demand for animal healthcare in Japan. Pharmaceuticals are essential for treating a wide range of animal health conditions, including infections, metabolic disorders, and chronic diseases. The demand is driven by the need for effective treatment solutions for both livestock and pets, ensuring health maintenance, disease prevention, and improved productivity. In livestock, pharmaceuticals play an important role in maintaining herd health and preventing outbreaks that could impact production. In companion animals, growing awareness of pet health and an increase in veterinary visits contribute to the demand for medicines. As Japan continues to advance in veterinary care and pet ownership rises, pharmaceuticals remain the most widely used and relied-upon category in animal healthcare.

Production animals account for 55% of the demand for animal healthcare in Japan. Japan’s livestock sector—covering cattle, poultry, and swine—relies heavily on healthcare products to maintain productivity, prevent disease outbreaks, and ensure food safety. The demand is driven by the need to support high-quality meat, dairy, and poultry production, all of which depend on healthy and well-managed animals. Increasing regulatory emphasis on animal welfare and disease control also contributes to higher usage of healthcare products in production animals. While companion animal care continues to grow, production animals remain the priority due to their economic importance and the scale of livestock farming in Japan. Hence, production animals dominate the demand for animal healthcare in the country.

Demand for animal healthcare in Japan is influenced by expansion of companion animal ownership and strong expectations around animal well-being. Dogs, cats, and other pets are treated as family members, so preventive care, diagnostics, and treatments for chronic conditions are given higher priority. At the same time, livestock and poultry producers seek to protect productivity and quality standards, which keeps interest strong in vaccines, biosecurity solutions, and parasite control. Veterinary clinics and animal hospitals play a central role, shaping product choices through treatment protocols and brand familiarity. Cost sensitivity among some pet owners, together with reimbursement gaps and uneven access to advanced diagnostics outside large cities, moderates the pace of premium product adoption. These elements together define the present demand environment for animal healthcare in Japan.

What Are the Primary Growth Drivers for Animal Healthcare Demand in Japan?

Several drivers support expansion. First, companion animal ownership in urban and suburban areas has been increasing, with smaller households and ageing population structures promoting deeper emotional attachment to pets and higher healthcare spending. Second, awareness campaigns by veterinarians and manufacturers promote preventive care such as regular vaccinations, parasite prevention, and wellness checkups, which creates recurring product usage. Third, interest in specialty care for oncology, dermatology, and orthopedic issues supports diagnostic imaging, advanced pharmaceuticals, and nutritional support products. Fourth, livestock producers in Japan face pressure to maintain herd health and product quality, encouraging use of vaccines, biosecurity products, and feed additives that support health performance. Taken together, these drivers are likely to keep animal healthcare demand in Japan on a positive trajectory.

What Are the Key Restraints Affecting Animal Healthcare Demand in Japan?

Several restraints continue to shape outcomes. Cost of veterinary services, diagnostics, and branded pharmaceuticals can limit adoption of advanced treatment options, especially for households without pet insurance. Insurance penetration for pets, while rising, remains uneven, which can delay or discourage higher value procedures. Small animal clinics in regional areas may face capacity constraints or lack access to cutting edge diagnostic equipment, leading to more conservative treatment decisions. For livestock, pressure to control production costs can restrict spending on premium health products unless clear economic benefits are demonstrated. Regulatory timelines for new veterinary drugs and vaccines can slow product introductions. These restraints create variation in animal healthcare access and intensity across different regions and customer groups in Japan.

What Are the Key Trends Shaping Animal Healthcare Demand in Japan?

Key trends include growing emphasis on preventive and wellness oriented care for companion animals, with routine health checks, vaccinations, and parasite prevention accepted as basic standards among engaged owners. Use of diagnostic imaging, blood panels, and genetic tests is becoming more common in advanced clinics, which strengthens demand for related equipment and consumables. Interest in functional pet nutrition, prescription diets, and supplements that support joint health, skin condition, and digestive balance is increasing. Digital tools for appointment booking, teleconsultation, and health record management are starting to influence how owners interact with clinics. In livestock segments, more structured herd health programs and data driven monitoring of performance indicators encourage consistent use of vaccines and health management products.

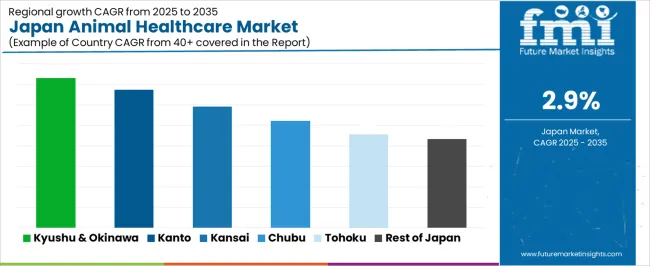

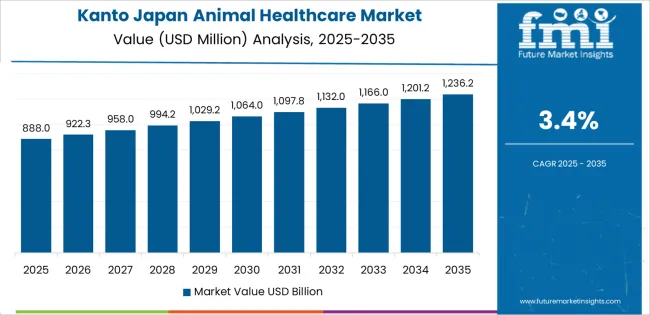

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.7% |

| Kanto | 3.4% |

| Kinki | 3.0% |

| Chubu | 2.6% |

| Tohoku | 2.3% |

| Rest of Japan | 2.2% |

The demand for animal healthcare in Japan is growing across all regions, with Kyushu & Okinawa leading at a 3.7% CAGR. This growth is driven by increasing pet ownership, a growing focus on animal health, and rising consumer awareness of the importance of veterinary care. Kanto follows with a 3.4% CAGR, supported by Tokyo’s significant urban pet population and the demand for advanced veterinary services. Kinki shows a 3.0% CAGR, with growing interest in high-quality pet healthcare. Chubu experiences a 2.6% CAGR, influenced by expanding pet care services. Tohoku and the Rest of Japan show more moderate growth at 2.3% and 2.2%, respectively, reflecting rising adoption of veterinary care in rural and less urbanized regions.

Kyushu & Okinawa is experiencing the highest demand for animal healthcare in Japan, with a 3.7% CAGR. The region’s growth is primarily driven by a rising number of pet owners and an increasing focus on animal health. Kyushu, particularly in cities like Fukuoka, has seen a steady increase in pet ownership, with many pet owners seeking advanced healthcare solutions for their animals. Okinawa’s warm climate and growing interest in pets have also contributed to this trend.

As pets are increasingly considered family members in Kyushu & Okinawa, there is a growing demand for high-quality veterinary services, including preventive care, specialized treatments, and pet wellness. The region's strong cultural shift towards pet care, along with increased access to modern veterinary clinics and services, is expected to continue driving the growth of animal healthcare. The focus on responsible pet ownership and animal well-being is helping to fuel the demand for veterinary services and products.

Kanto is seeing steady growth in demand for animal healthcare, with a 3.4% CAGR. The region, particularly Tokyo, is home to a large and growing pet population. As pet ownership continues to rise, there is an increasing need for veterinary care, including routine check-ups, vaccinations, and specialized treatments. Kanto’s strong retail infrastructure also ensures that pet healthcare products and services are easily accessible to a wide consumer base.

The region’s focus on innovation in pet care, along with the growing awareness of animal health, is driving the demand for high-quality veterinary services. Many pet owners in Kanto are willing to invest in their pets' health and well-being, opting for advanced treatments and wellness services. The region’s increasing number of veterinary professionals and clinics is helping to meet the growing demand for animal healthcare services. With a high concentration of pet owners and a strong focus on animal welfare, Kanto is expected to continue to experience steady growth in animal healthcare.

Kinki is experiencing steady growth in demand for animal healthcare, with a 3.0% CAGR. The region's strong presence in the pet industry, particularly in cities like Osaka and Kyoto, is contributing to the rise in demand for veterinary services. As the region sees a steady increase in pet ownership, especially among urban populations, there is a greater need for professional veterinary care, including preventive services, diagnostics, and treatments for various pet health conditions.

Kinki’s strong consumer interest in high-quality pet care products and services, combined with an increasing focus on animal wellness, is further driving the demand for veterinary care. Pet owners in the region are increasingly aware of the importance of regular veterinary visits and specialized treatments. As the pet healthcare industry expands in Kinki, the region is poised for continued growth, with an emphasis on innovative services and pet care solutions.

Chubu is seeing moderate growth in demand for animal healthcare, with a 2.6% CAGR. The region's growing pet care industry, particularly in cities like Nagoya, is driving the adoption of veterinary services. As more people in Chubu adopt pets, there is an increasing need for animal healthcare services, including preventive care, wellness check-ups, and treatments for illnesses and injuries.

The rise in disposable income and the growing awareness of pet health in Chubu are contributing to this demand. As consumers in the region invest more in pet care, the demand for high-quality veterinary services and products is expected to continue to grow steadily. The region’s focus on providing specialized services for pets, including surgery, rehabilitation, and emergency care, is helping to meet the needs of pet owners. As pet ownership continues to rise in Chubu, so will the demand for comprehensive animal healthcare.

Tohoku is experiencing steady growth in demand for animal healthcare, with a 2.3% CAGR. As the region’s pet ownership increases, so does the need for veterinary services to care for these animals. With a more rural population, the demand for basic and specialized veterinary care is growing as pet owners seek professional services for health maintenance and disease prevention.

The increasing awareness of the importance of regular veterinary visits and the rising standard of care for pets in Tohoku are key drivers of this growth. Local veterinary clinics are expanding their offerings to include preventive health services, diagnostics, and treatments. As the region’s pet care infrastructure continues to develop, the demand for animal healthcare services will continue to rise, albeit at a slower pace compared to more urbanized areas.

The Rest of Japan is experiencing moderate growth in demand for animal healthcare, with a 2.2% CAGR. Although the growth is slower than in urbanized regions, there is increasing awareness about animal health in rural areas, contributing to a gradual rise in demand for veterinary services. As pet ownership increases in smaller towns and rural regions, the need for preventive healthcare and veterinary treatments is growing.

The availability of veterinary clinics and mobile veterinary services in the Rest of Japan is helping to meet this demand. Pet owners in these regions are becoming more conscious of their pets’ health needs and are seeking services such as vaccinations, health screenings, and treatments. As the region’s pet care services expand and consumer awareness of animal health continues to rise, the demand for animal healthcare will grow steadily, even though it remains moderate compared to more urbanized regions.

The demand for animal healthcare in Japan is steadily increasing, driven primarily by a shift toward companion animals and advanced veterinary treatments. As pet ownership rises and animal wellness becomes more prioritized, veterinary clinics are expanding services such as diagnostics, therapeutics, and preventive care. Concurrently, livestock and poultry sectors are intensifying health measures to address biosecurity and production efficiency, reinforcing demand for animal‑health products across both companion and food‑animal segments.

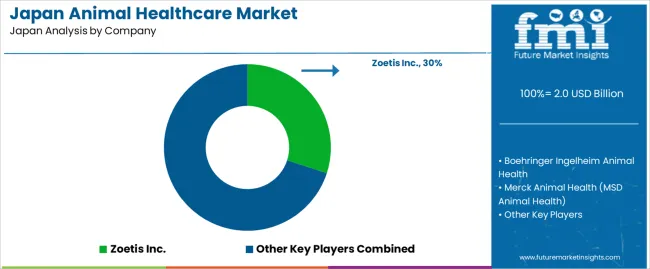

In the Japanese industry, Zoetis Inc. holds an estimated 30.0% share, reflecting its strong brand presence and broad product offerings in veterinary pharmaceuticals and biologics. Other significant players include Boehringer Ingelheim Animal Health, Merck Animal Health (MSD Animal Health), Elanco Animal Health Incorporated, and Ceva Santé Animale, all of which support animal‑healthcare demand with specialized therapeutics, vaccines, and diagnostics targeted at Japanese veterinary and livestock channels.

Japan’s aging household demographic is increasingly embracing pets, prompting greater investment in preventive and advanced veterinary care; meanwhile, regulatory and productivity pressures in the livestock sector are driving uptake of animal‑health interventions. The expansion of pet‑insurance coverage and consumer willingness to spend on premium pet services are boosting demand. While challenges such as high treatment and product costs, regulatory approval timelines, and competition from generic alternatives exist, the outlook for animal‑healthcare demand in Japan remains positive as the industry continues to evolve and mature.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Product Type | Pharmaceuticals, Feed Additives, Vaccines |

| Animal Type | Production Animals, Companion Animals |

| Key Players Profiled | Zoetis Inc., Boehringer Ingelheim Animal Health, Merck Animal Health, Elanco Animal Health, Ceva Santé Animale |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Additional Attributes | Dollar sales by product type, animal type, and regional distribution with a focus on companion and production animals |

The global demand for animal healthcare in japan is estimated to be valued at USD 2.0 billion in 2025.

The market size for the demand for animal healthcare in japan is projected to reach USD 2.7 billion by 2035.

The demand for animal healthcare in japan is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in demand for animal healthcare in japan are pharmaceuticals, feed additives and vaccines.

In terms of animal type, production animals segment to command 55.0% share in the demand for animal healthcare in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA