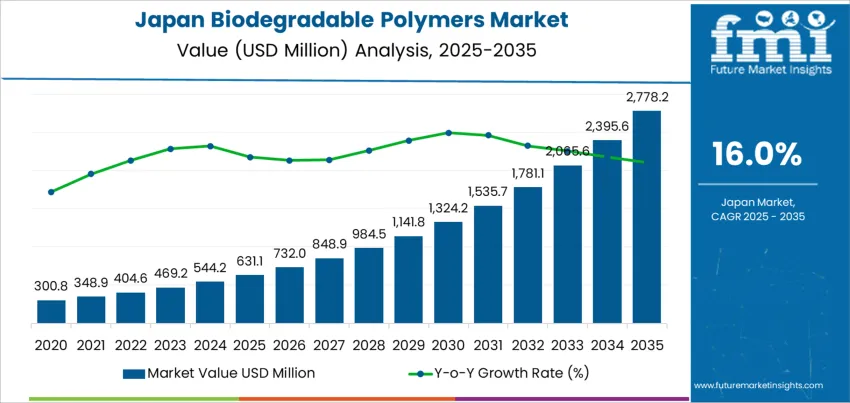

The demand for biodegradable polymers in Japan is expected to grow significantly from USD 631.1 million in 2025 to USD 2,778.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 16%. Biodegradable polymers are gaining traction due to growing environmental concerns and increasing regulatory pressures aimed at reducing plastic waste. These polymers are used across various sectors, including packaging, agriculture, and textiles, making them critical in Japan's move toward more sustainable materials. As both consumers and industries prioritize eco-friendly alternatives, the demand for biodegradable polymers is expected to rise rapidly throughout the forecast period.

The market will experience significant growth, with a steady increase in demand each year. Starting at USD 631.1 million in 2025, the market is projected to reach USD 732.0 million in 2026, followed by USD 848.9 million in 2027. By 2029, the demand will reach USD 1,141.8 million, with a sharp rise in the following years. By 2035, the market is forecasted to reach USD 2,778.2 million, reflecting a substantial shift toward sustainable alternatives as the adoption of biodegradable polymers expands across industries.

The biodegradable polymers market in Japan is expected to grow rapidly over the next decade. From USD 631.1 million in 2025, the market will increase to USD 732.0 million in 2026 and USD 848.9 million in 2027. By 2029, the demand for biodegradable polymers will grow to USD 1,141.8 million, marking the first major breakpoint in the market's growth trajectory. This is followed by a sharper rise, with demand reaching USD 1,324.2 million by 2030 and continuing upward. By 2035, the market will reach USD 2,778.2 million, reflecting a significant shift toward sustainable polymer solutions across multiple industries.

The breakpoint analysis reveals key inflection points in the market's growth. After 2029, the rate of growth is expected to accelerate significantly, marking a shift from gradual increases to more rapid expansion as industries adopt biodegradable polymers at a higher pace. The early years of the forecast (2025-2029) show steady growth, but after this point, the market is expected to experience an exponential rise driven by both regulatory pressures and technological advancements in polymer development. The largest breakpoint occurs after 2029, marking a transition to a much faster-growing segment.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 631.1 million |

| Industry Forecast Value (2035) | USD 2,778.2 million |

| Industry Forecast CAGR (2025-2035) | 16% |

The demand for biodegradable polymers in Japan is rising amid growing environmental concerns, stricter regulation on plastics, and shifting consumer and corporate preferences toward sustainability. Biodegradable polymers — including types such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), starch based blends, and other compostable or bio based plastics — are increasingly viewed as alternatives to conventional petroleum derived plastics. In the packaging sector, especially for single use containers, food packaging, disposable items and retail packaging, biodegradable polymers are gaining adoption because they offer improved environmental credentials and help reduce plastic pollution. This shift reflects both government encouragement and private sector sustainability commitments. The broad push for a circular economy, reduction of plastic waste, and lowering carbon footprints supports wider use of biodegradable polymers across packaging, consumer goods and other applications. As companies and consumers become more conscious of environmental impact, demand for these eco friendly polymers continues to expand.

Beyond packaging, biodegradable polymers are seeing growing demand in multiple other sectors such as agriculture, textiles, consumer goods, and medical and hygiene products. In agriculture, biodegradable films and mulch sheets help reduce soil contamination and waste from traditional plastic sheets. In textiles and non woven hygiene applications, biodegradable polymer based fibres and materials are gradually replacing conventional plastics. In medical and healthcare, biodegradable polymers find use in disposable items, medical packaging, and possibly drug-delivery systems or bio resorbable materials, thanks to ongoing innovation in materials science. Technical advances have improved mechanical properties, thermal stability, and processing ease of biopolymers, reducing the performance gap with conventional plastics. These improvements broaden the practical usage range beyond niche or disposable items. As regulatory pressure mounts and sustainability becomes a stronger business imperative, the adoption of biodegradable polymers across varied sectors is set to rise steadily in Japan over the next decade.

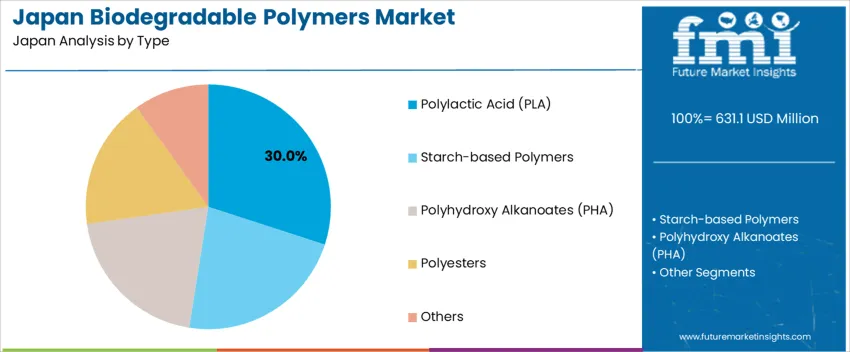

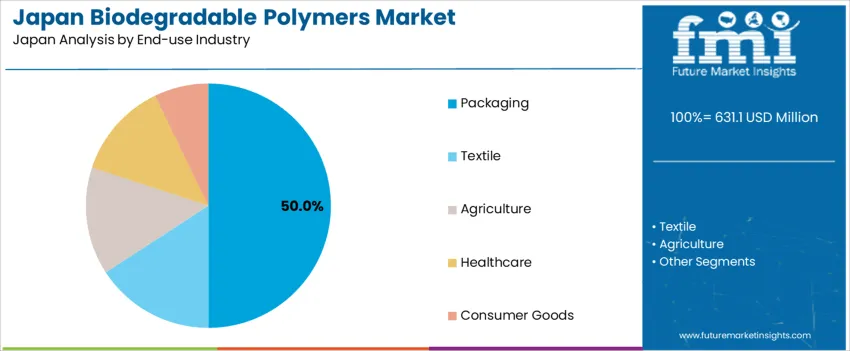

The demand for biodegradable polymers in Japan is primarily driven by type and end-use industry. The leading type is polylactic acid (PLA), accounting for 30% of the market share, while packaging is the dominant end-use industry, capturing 50% of the demand. Biodegradable polymers are increasingly being used as environmentally friendly alternatives to conventional plastics, offering solutions for waste reduction and sustainability across various industries. As consumer and industry demand for eco-friendly materials continues to grow, biodegradable polymers are becoming a central focus of the Japanese market.

Polylactic acid (PLA) is the leading type of biodegradable polymer in Japan, holding 30% of the market share. PLA is a biopolymer made from renewable resources such as corn starch or sugarcane, which makes it a sustainable alternative to petroleum-based plastics. PLA is widely used in packaging, consumer goods, and textiles due to its biodegradability, compostability, and ability to perform like conventional plastics in a variety of applications.

The demand for PLA is driven by increasing awareness of plastic pollution and the need for environmentally responsible materials. As industries in Japan continue to prioritize sustainability and reduce their environmental footprint, PLA is becoming a preferred choice for packaging solutions, especially in food and beverage containers, single-use items, and retail packaging. PLA's versatility and environmental benefits ensure that it remains a dominant force in the biodegradable polymer market, with growth expected as demand for sustainable products rises.

Packaging is the largest end-use industry for biodegradable polymers in Japan, accounting for 50% of the demand. The packaging sector is under increasing pressure to reduce its environmental impact, particularly regarding single-use plastics, which are major contributors to waste and pollution. Biodegradable polymers, particularly PLA and starch-based polymers, offer a viable solution for packaging applications, providing the necessary strength, flexibility, and functionality while being environmentally friendly.

The demand for biodegradable polymers in packaging is driven by both consumer preference for sustainable products and stricter government regulations on plastic waste. As packaging producers in Japan work to meet the growing demand for eco-friendly alternatives, biodegradable polymers are increasingly used for food packaging, disposable items, and retail packaging. With the rising emphasis on reducing plastic waste and the continued push for sustainable practices across industries, the packaging sector is expected to remain the largest driver of demand for biodegradable polymers in Japan.

Demand for biodegradable polymers in Japan has been rising steadily in recent years. The market for bio-based biodegradable plastics was valued at about USD 328.7 million in 2025 and is projected to reach roughly USD 654.1 million by 2035. This growth reflects increased use of these materials in packaging, consumer goods, agriculture, and other sectors. Rising adoption of biodegradable polymers supports waste reduction and aligns with regulatory and industry shifts toward more environmentally conscious materials. As performance and availability of such polymers improve, their use in a wider array of applications in Japan is expected to expand.

What are the Drivers of Demand for Biodegradable Polymers in Japan?

One key driver is the strong demand for packaging solutions that reduce plastic waste impact. Packaging accounts for a major portion of biodegradable polymer use in Japan, especially for food, retail, and consumer-goods packaging. Growth in sectors such as agriculture, textiles, and consumer goods also supports polymer use, as these industries seek alternatives to conventional plastics.

Advances in polymer production and material performance have increased the viability of biodegradable polymers, making them more competitive with traditional plastics. Regulatory pressure and industry shifts towards waste-management requirements and reuse or recycling norms encourage adoption of biodegradable materials. Finally, growing consumer awareness about environmental impact and demand for products that rely on renewable-content materials support wider acceptance and increased demand.

What are the Restraints on Demand for Biodegradable Polymers in Japan?

One restraint is the higher cost of biodegradable polymers compared to conventional plastics, which may limit adoption among cost-sensitive producers or end-users. Performance limitations remain a challenge in certain applications: some biodegradable polymers may offer lower durability, reduced mechanical strength, or limited shelf life compared with traditional plastics, making them less suitable for high-stress or long-term use.

The supply and feedstock constraints for some bio-based polymers can also hinder large-scale adoption, especially where demand volatility or raw-material competition exists. In addition, limited infrastructure for industrial composting or proper disposal and recycling of biodegradable plastics may reduce real-world benefits and discourage use in some segments. These factors collectively slow wider penetration beyond packaging and selected end-uses.

What are the Key Trends Influencing Demand for Biodegradable Polymers in Japan?

A major trend is growing adoption in packaging applications, especially food and retail packaging, driven by regulatory pressure and shifting consumer preferences toward lower-impact materials. Another trend is diversification of polymer types. Bio-based polymers such as polylactic acid (PLA), starch blends, polyhydroxyalkanoates (PHA), and others are gaining share, reflecting efforts to match application requirements with material properties.

Increased research and development, along with improved processing and manufacturing capabilities, have enhanced performance and cost-effectiveness of biodegradable polymers, supporting expansion into new sectors such as agriculture, consumer goods, textiles or non-woven products. Policy and regulatory developments, including packaging waste rules and waste-management regulation, are reinforcing demand for biodegradable polymer materials over conventional plastics. Over time, these trends are broadening the use base beyond traditional segments, supporting volume growth and diversification of end-use applications across Japan.

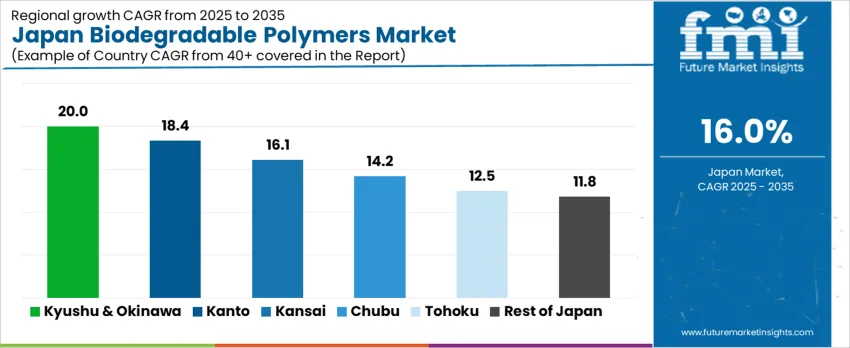

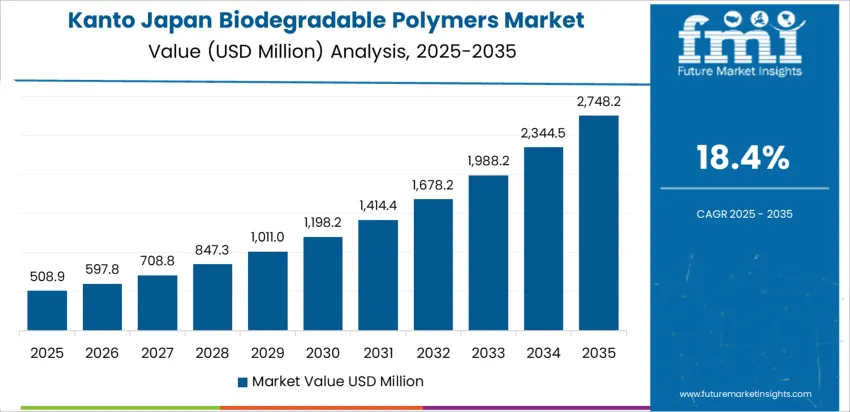

The demand for biodegradable polymers in Japan shows robust growth across regions, with Kyushu & Okinawa leading at a CAGR of 20%. Kanto follows with a CAGR of 18.4%, driven by its strong industrial base and environmental initiatives. The Kinki region shows steady growth at 16.1%, while Chubu, Tohoku, and the Rest of Japan exhibit slower growth, with respective CAGRs of 14.2%, 12.5%, and 11.8%. These regional differences reflect varying levels of industrialization, consumer awareness of sustainability, and government initiatives to reduce plastic waste.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 20 |

| Kanto | 18.4 |

| Kinki | 16.1 |

| Chubu | 14.2 |

| Tohoku | 12.5 |

| Rest of Japan | 11.8 |

The demand for biodegradable polymers in Kyushu & Okinawa is projected to grow at an exceptional CAGR of 20%, driven by the region's growing focus on sustainability and the environment. Kyushu & Okinawa have increasingly prioritized eco-friendly solutions to address plastic pollution, particularly in their rich natural environments and coastal areas. The region’s agriculture and food industries are adopting biodegradable polymers for packaging materials, driven by both consumer demand for sustainable products and government initiatives promoting the reduction of single-use plastics. Additionally, the region’s tourism industry, which relies on maintaining its pristine natural beauty, is pushing businesses to adopt more environmentally friendly materials, contributing to the strong demand for biodegradable polymers. As the region continues to embrace green technologies and eco-conscious practices, the demand for biodegradable polymers is expected to rise significantly.

In Kanto, the demand for biodegradable polymers is expected to grow at a CAGR of 18.4%, driven by the region’s industrial activities, environmental policies, and consumer preferences for sustainable products. As Japan's economic and industrial hub, Kanto is home to a large number of companies in sectors such as packaging, consumer goods, and electronics, all of which are increasingly adopting biodegradable polymers as part of their sustainability strategies. The region’s focus on reducing plastic waste and adhering to stricter environmental regulations has led to increased adoption of eco-friendly alternatives, particularly in packaging. The growing awareness of the environmental impact of plastic waste, combined with government initiatives promoting biodegradable materials, is fueling demand for biodegradable polymers. As Kanto continues to lead in sustainability innovation and green technology, demand for biodegradable polymers is expected to remain strong.

The demand for biodegradable polymers in the Kinki region is projected to grow at a CAGR of 16.1%, reflecting the region’s strong industrial base and increasing adoption of eco-friendly materials. Kinki, which includes major cities like Osaka and Kyoto, has a well-established manufacturing sector, particularly in food packaging and consumer goods, where biodegradable polymers are becoming more widely used as alternatives to traditional plastics. The region’s growing awareness of environmental issues, coupled with its commitment to reducing plastic waste, is driving the demand for biodegradable polymers. Additionally, the popularity of eco-conscious consumer products and packaging solutions is contributing to the adoption of biodegradable materials in various industries, ensuring steady growth in demand for biodegradable polymers in Kinki.

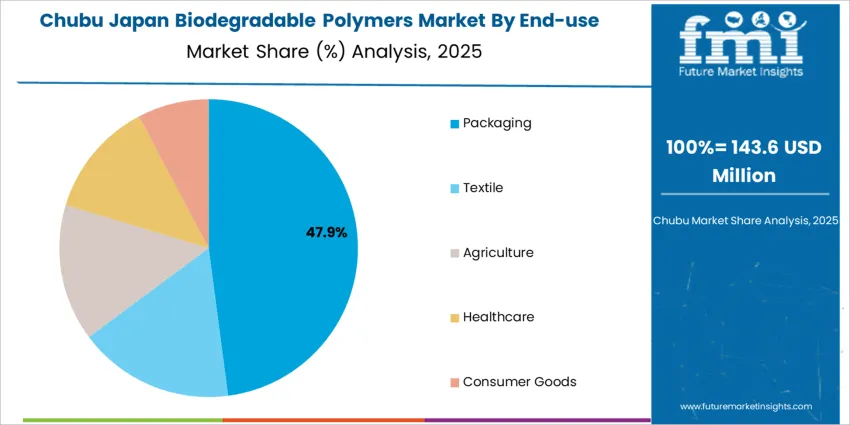

The demand for biodegradable polymers in Chubu is expected to grow at a CAGR of 14.2%, driven by the region’s industrial activities and increasing focus on sustainability in manufacturing processes. Chubu, home to industrial cities like Nagoya, has a strong presence in automotive, electronics, and packaging industries, all of which are exploring more sustainable materials to meet regulatory requirements and consumer demand for eco-friendly solutions. The region’s growing emphasis on reducing environmental impact and adopting green technologies is contributing to the adoption of biodegradable polymers in various sectors, particularly in packaging and consumer goods. While growth in Chubu is somewhat slower than in Kyushu & Okinawa and Kanto, the region’s increasing focus on sustainability and eco-conscious manufacturing ensures continued demand for biodegradable polymers.

In Tohoku, the demand for biodegradable polymers is projected to grow at a CAGR of 12.5%, reflecting a more gradual adoption compared to other regions. Tohoku, with its relatively rural landscape and smaller industrial base, has seen slower adoption of biodegradable materials in comparison to more urbanized regions. However, as environmental concerns continue to gain traction, demand for biodegradable polymers is increasing, particularly in agriculture and packaging applications. The region’s growing interest in sustainable farming practices and the need for eco-friendly packaging solutions in the food industry are contributing to the demand for biodegradable polymers. While growth is more modest, Tohoku’s increasing focus on sustainability ensures steady growth in the demand for these materials over time.

In the Rest of Japan, the demand for biodegradable polymers is expected to grow at a CAGR of 11.8%, reflecting moderate but steady adoption across rural and less industrialized areas. This region, which includes smaller prefectures and less densely populated areas, has traditionally had lower levels of industrial activity and slower adoption of new technologies. However, as awareness of environmental issues and plastic pollution rises, there is growing demand for eco-friendly alternatives, particularly in packaging and agriculture. The Rest of Japan’s increasing efforts to reduce plastic waste and promote sustainability in everyday products are helping to drive demand for biodegradable polymers. While the growth rate remains slower than in more industrialized regions, the continued push for environmental responsibility will ensure gradual but consistent demand for biodegradable polymers in these areas.

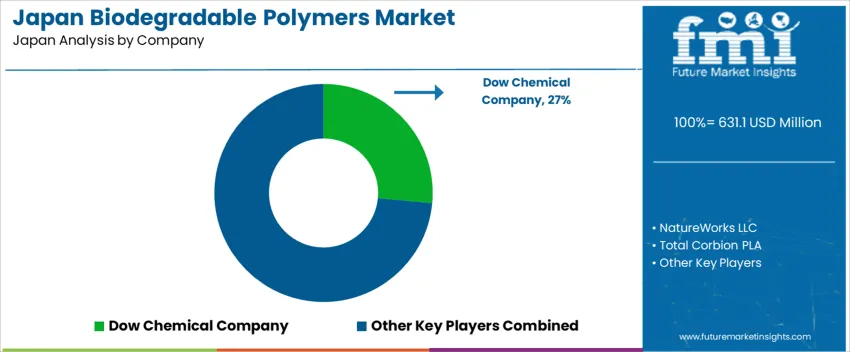

Demand for biodegradable polymers in Japan is increasing as manufacturers and consumers respond to rising environmental awareness and regulatory pressure on plastics. Major firms in this sector include Dow Chemical Company (holding about 26.5% share), NatureWorks LLC, Total Corbion PLA, and Braskem. These companies supply biodegradable polymers such as polylactic acid (PLA) and bio based polyesters used for packaging, disposable tableware, agricultural films, and selected consumer goods. Japanese packaging producers and brands increasingly turn to these materials to meet sustainability goals and respond to consumer preferences for eco friendly products.

Competition in this industry hinges on three main factors: material performance, cost competitiveness, and supply reliability. Providers strive to deliver biodegradable polymers with mechanical and thermal properties close to conventional plastics, to ensure compatibility with existing processing equipment and product requirements. Cost remains a key challenge, and firms that can scale production and optimize feedstock use tend to gain an advantage. Another competitive element is certification and compliance: polymers that meet industrial compostability standards or provide clear environmental claims are more likely to be adopted by Japanese manufacturers. Companies also offer technical support to help converters adapt processes and achieve required output quality. By aligning their offerings with demand for sustainable materials, regulatory expectations, and manufacturing efficiency, these firms aim to strengthen their position in Japan’s biodegradable polymers market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Type | Starch-based Polymers, Polylactic Acid (PLA), Polyhydroxy Alkanoates (PHA), Polyesters, Others |

| End-use Industry | Packaging, Textile, Agriculture, Healthcare, Consumer Goods |

| Key Companies Profiled | Dow Chemical Company, NatureWorks LLC, Total Corbion PLA, Braskem |

| Additional Attributes | The market analysis includes dollar sales by type, end-use industry, and company categories. It also covers regional demand trends in Japan, driven by the increasing adoption of biodegradable polymers in packaging, textiles, and consumer goods. The competitive landscape highlights key manufacturers focusing on innovations in biodegradable polymer production, particularly in sustainable packaging solutions. Trends in the growing demand for eco-friendly alternatives in agriculture, healthcare, and textile applications are explored, along with advancements in polymer biodegradability and regulatory factors. |

The demand for biodegradable polymers in Japan is estimated to be valued at USD 631.1 million in 2025.

The market size for the biodegradable polymers in Japan is projected to reach USD 2,778.2 million by 2035.

The demand for biodegradable polymers in Japan is expected to grow at a 16.0% CAGR between 2025 and 2035.

The key product types in biodegradable polymers in Japan are polylactic acid (pla), starch-based polymers, polyhydroxy alkanoates (pha), polyesters and others.

In terms of end-use industry, packaging segment is expected to command 50.0% share in the biodegradable polymers in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Polymers Market Growth 2025 to 2035

Biodegradable Bone Graft Polymers Market Size and Share Forecast Outlook 2025 to 2035

Demand for Biodegradable Polymers in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Biodegradable Microbeads in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Biodegradable Plastic in Japan Size and Share Forecast Outlook 2025 to 2035

Biodegradable Microencapsulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA