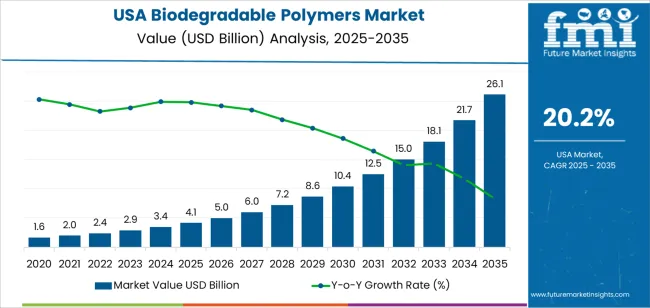

The demand for biodegradable polymers in the USA is projected to grow from USD 4.1 billion in 2025 to USD 26.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 20.2%. This significant growth is driven by increasing consumer demand for sustainable alternatives to traditional plastic materials, as well as regulatory pressures aimed at reducing plastic waste and environmental impact. Biodegradable polymers, which are used in packaging, agriculture, textiles, and various other sectors, offer an eco-friendlier option compared to conventional plastics, contributing to their rising adoption across industries.

The year-over-year (Y-o-Y) growth is substantial, starting at USD 4.1 billion in 2025 and reaching USD 5.0 billion in 2026, followed by USD 6.0 billion in 2027. Over the next several years, the market is projected to continue expanding rapidly, reaching USD 7.2 billion by 2028 and USD 8.6 billion by 2029. By 2035, the market for biodegradable polymers is forecasted to reach USD 26.1 billion, showing a steep upward trajectory driven by growing environmental concerns, regulatory incentives, and the increasing adoption of biodegradable materials across a wide range of industries.

The biodegradable polymers industry in the USA is expected to grow at an accelerated pace over the next decade. From USD 4.1 billion in 2025, the market is forecasted to increase steadily, reaching USD 5.0 billion in 2026 and USD 6.0 billion in 2027. By 2028, the market will expand to USD 7.2 billion, and by 2029, it is projected to reach USD 8.6 billion. Over the following years, the demand will continue to rise sharply, with the market reaching USD 10.4 billion by 2030, USD 12.5 billion by 2031, and USD 15.0 billion by 2032. By 2035, the market will hit USD 26.1 billion, underscoring the rapid growth of the sector.

The market growth curve for biodegradable polymers shows an exponential increase, reflecting the rapid adoption of these materials as businesses and consumers increasingly prioritize sustainability. Early-stage growth from 2025 to 2029 is followed by a steeper ascent after 2030, which is indicative of a shift towards large-scale adoption driven by favorable regulations and advancements in biodegradable polymer technologies. This growth curve highlights the sector’s transition from niche to mainstream as demand for sustainable products accelerates.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 4.1 billion |

| Industry Forecast Value (2035) | USD 26.1 billion |

| Industry Forecast CAGR (2025-2035) | 20.2% |

The demand for biodegradable polymers in the USA is growing in response to rising environmental awareness among consumers, increasing regulatory pressure on conventional plastics, and broader shifts toward sustainable materials. Many companies and consumers now prefer polymers derived from renewable resources like plant starches, which degrade more readily than conventional petroleum based plastics. In packaging applications — especially for food, consumer goods, and single use items — biodegradable polymers such as polylactic acid (PLA), starch based blends, polybutylene succinate (PBS) and polyhydroxyalkanoates (PHA) are increasingly used. These materials reduce reliance on fossil derived plastics and offer compostability under appropriate conditions. The growth of composting infrastructure and municipal efforts to reduce plastic waste encourage adoption of compostable plastics for packaging, waste bags, and disposable items. Biodegradable plastics offer advantage in applications where disposability and environmental footprint matter, which supports their use widely in retail packaging, food service, and consumer products. As recycling alone remains insufficient to handle plastic waste, biodegradable polymers provide an alternative aligned with sustainability trends.

Beyond packaging, demand for biodegradable polymers is rising in sectors such as agriculture, medical and healthcare, textiles, and consumer goods. In agriculture, biodegradable films and mulch sheets are replacing conventional plastic films to reduce soil pollution and improve end of life disposal. In medical and healthcare, bioplastics are used for disposable medical supplies, hygiene products, and compostable medical packaging. Textiles, non woven hygiene products, and certain consumer goods components also increasingly adopt biodegradable polymer based materials. Some automotive and transportation applications now explore bio derived polymers for interior components to reduce carbon footprint. Advances in biopolymer technology continue to improve mechanical properties, thermal stability and processability, which helps overcome past performance limitations compared to conventional plastics. As materials science evolves and regulatory scrutiny of plastic waste increases, the shift toward eco friendly, biodegradable polymer solutions in multiple industries is strengthening.

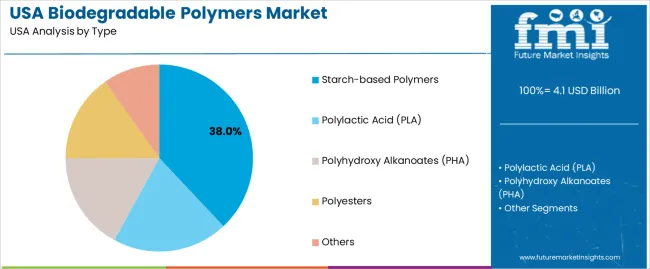

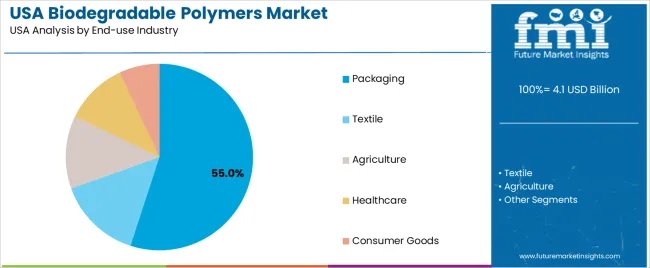

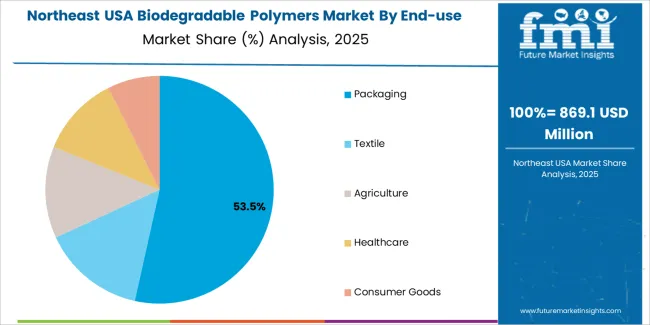

The demand for biodegradable polymers in the USA is primarily driven by type and end-use industry. The leading type is starch-based polymers, accounting for 38% of the market share, while packaging is the dominant end-use industry, capturing 55% of the demand. Biodegradable polymers are gaining popularity as sustainable alternatives to traditional plastics, especially in industries looking to reduce their environmental footprint. The growing demand for eco-friendly materials across various sectors continues to fuel the market for biodegradable polymers in the USA.

Starch-based polymers lead the demand for biodegradable polymers in the USA, holding 38% of the market share. These polymers are derived from renewable sources such as corn and potatoes, making them an attractive alternative to petroleum-based plastics. Starch-based polymers are widely used in packaging, agriculture, and disposable products, thanks to their biodegradability and ability to break down naturally in the environment.

The demand for starch-based polymers is driven by their low cost, renewable sourcing, and environmental benefits. These polymers are often used in applications such as food packaging, agricultural films, and disposable items, where sustainability is a growing concern. As consumer preferences shift toward environmentally friendly products and governments impose stricter regulations on plastic waste, starch-based polymers offer an effective solution. Their versatility and biodegradability make them a dominant choice in the biodegradable polymer market in the USA, with continued growth expected as industries move towards more sustainable practices.

Packaging is the leading end-use industry for biodegradable polymers in the USA, capturing 55% of the market share. The packaging industry is the largest consumer of biodegradable polymers due to increasing demand for sustainable, environmentally friendly materials. Biodegradable polymers are used extensively in food packaging, single-use items, and protective packaging, where the need for biodegradable alternatives to traditional plastics is growing.

The demand for biodegradable polymers in packaging is driven by rising concerns about plastic waste and environmental pollution. As companies face increased pressure to adopt sustainable practices and comply with regulations regarding plastic waste, the demand for biodegradable packaging solutions is rising. Biodegradable polymers, particularly starch-based and PLA-based polymers, are gaining popularity in food packaging, consumer goods, and retail packaging, where they provide both performance and environmental benefits. With ongoing consumer demand for eco-friendly products and growing environmental awareness, packaging remains the dominant end-use sector for biodegradable polymers in the USA.

The demand for biodegradable polymers in the USA has risen steadily in recent years. Recent data estimates the USA biodegradable plastics (a major subset of biodegradable polymers) market value at about USD 2.34 billion in 2025. Demand is expected to grow substantially over the coming years, driven by increasing use in packaging, consumer goods, agriculture, medical and healthcare, textile, and other sectors. The shift in applications from traditional plastics to biodegradable alternatives reflects rising regulatory pressure on single use plastics, growing interest in compostable and renewable content materials, and improved availability of biodegradable polymer types such as starch based polymers, polylactic acid (PLA), polyhydroxyalkanoates (PHA), and other bio derived polymers. As newer feedstocks and polymer types gain traction, demand across multiple industries in the USA is projected to expand.

What are the Drivers of Demand for Biodegradable Polymers in USA?

Several factors are driving demand for biodegradable polymers in the USA. First, packaging demand — including food packaging, retail carry bags, disposable containers, and compostable packaging — is a major driver. As conventional plastic packaging comes under regulatory and public scrutiny, many firms adopt biodegradable polymer based alternatives. Second, growth in sectors such as agriculture (mulch films, horticulture films), medical and healthcare (biocompatible polymers for medical devices, disposable items), textile and non woven applications have expanded demand. Third, improvements in polymer production and processing technologies have lowered costs and improved material performance, making biodegradable polymers more competitive with conventional plastics. Fourth, rising regulatory pressure and corporate policies aimed at reducing plastic waste and controlling environmental impact have incentivised adoption of biodegradable polymers. Fifth, growing consumer demand for products with renewable or bio based content supports uptake of bioplastics across consumer goods, packaging, and disposable segments. These drivers combine to broaden end use applications and encourage wider industrial adoption across the USA.

What are the Restraints on Demand for Biodegradable Polymers in USA?

Despite growth drivers, some factors restrain demand for biodegradable polymers in the USA. One restraint arises from higher production costs and material costs compared to conventional plastics. These cost differences can make biodegradable alternatives less economically attractive for price sensitive applications or large volume uses. Another restraint involves performance limitations: certain biodegradable polymers may have lower strength, reduced thermal resistance or shorter shelf life compared with conventional plastics; this limits their suitability for some applications. Supply chain and feedstock volatility may also constrain production volume or raise costs. Additionally, adoption can be slowed by limited recycling or composting infrastructure suited to biodegradable polymers — without adequate end of life processing, environmental gains may be undermined. Finally, inertia in industries accustomed to conventional plastics, combined with regulatory and certification uncertainties for some biopolymers, may delay broader adoption in certain sectors.

What are the Key Trends Influencing Demand for Biodegradable Polymers in USA?

Several key trends are shaping the evolving demand for biodegradable polymers in the USA. A prominent trend is expansion of applications beyond packaging: biodegradable polymers are increasingly used in agriculture, medical and healthcare items, disposable consumer goods, textiles, and non woven materials. Another trend is diversification of polymer types: starch based blends, PLA, PHA, cellulose derived polymers and other bio based polymers are gaining share as feedstocks and processing methods evolve. Further, advances in production technology and manufacturing processes are improving mechanical and thermal properties of biodegradable polymers, reducing cost differentials with conventional plastics and widening industrial use. Corporate and regulatory pressure to reduce plastic waste and improve life cycle performance of materials is encouraging firms to integrate biodegradable polymers into product lines. Finally, increasing consumer awareness about plastic waste and demand for renewable content or compostable products is supporting growth across packaging, consumer goods and disposable product segments.

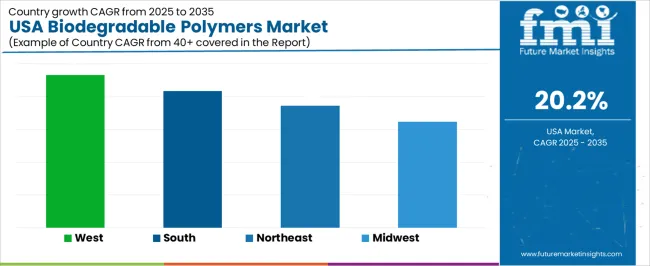

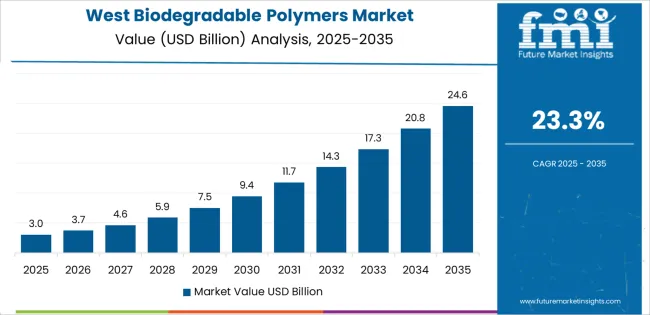

The demand for biodegradable polymers in the USA shows significant growth across regions, with the West leading at a CAGR of 23.3%. The South follows with a CAGR of 20.8%, driven by growing industrial applications in sectors like agriculture, packaging, and consumer goods. The Northeast shows strong growth at 18.6%, supported by its established manufacturing and environmental sustainability initiatives. The Midwest has the lowest growth rate at 16.2%, reflecting a slower adoption in certain industries. These regional differences are influenced by factors such as industrial concentration, consumer demand for sustainable products, and regulatory initiatives aimed at reducing plastic waste.

| Region | CAGR (%) |

|---|---|

| West | 23.3 |

| South | 20.8 |

| Northeast | 18.6 |

| Midwest | 16.2 |

The demand for biodegradable polymers in the West is projected to grow at a remarkable CAGR of 23.3%, driven by several key factors. The West has a strong emphasis on environmental sustainability, with states like California leading the charge in adopting green technologies and promoting the use of biodegradable materials. As the demand for eco-friendly alternatives to traditional plastics rises, industries in packaging, agriculture, and consumer goods are increasingly turning to biodegradable polymers. Additionally, the West’s robust innovation ecosystem, including its concentration of startups and research institutions, is driving the development of advanced biodegradable polymer solutions. Regulatory pressures and consumer preferences for sustainable, biodegradable products further fuel market growth. The West’s commitment to reducing plastic waste and its focus on green technologies ensure that biodegradable polymers will continue to see significant demand.

In the South, the demand for biodegradable polymers is expected to grow at a CAGR of 20.8%, supported by the region’s expanding manufacturing and agricultural sectors. The South is home to a large number of industries, particularly in the packaging, agriculture, and food processing sectors, where biodegradable polymers are gaining popularity as an alternative to traditional plastic materials. The agricultural industry, in particular, is increasingly adopting biodegradable polymers for use in mulch films, seed coatings, and other agricultural applications that help reduce environmental impact. As the region continues to expand its industrial base and prioritize sustainability in production processes, the demand for biodegradable polymers is expected to increase. The South’s growing awareness of environmental concerns and the push for more sustainable practices are key drivers of demand for these materials.

In the Northeast, the demand for biodegradable polymers is projected to grow at a CAGR of 18.6%, supported by the region’s strong manufacturing base and growing focus on environmental sustainability. The Northeast is home to a large number of industries, including packaging, automotive, and consumer goods, all of which are increasingly turning to biodegradable polymers to meet the demand for sustainable products. Additionally, the region’s emphasis on innovation and green technology, coupled with stringent environmental regulations, is driving the adoption of biodegradable polymers. The Northeast’s focus on sustainability, both in terms of consumer behavior and industrial practices, ensures steady growth in the demand for biodegradable polymers. As both businesses and consumers seek more eco-friendly options, the market for biodegradable polymers is expected to expand significantly.

The demand for biodegradable polymers in the Midwest is expected to grow at a CAGR of 16.2%, reflecting a more gradual but steady adoption compared to other regions. The Midwest has a strong industrial base, particularly in the automotive, packaging, and agricultural sectors, all of which are increasingly looking for sustainable alternatives to traditional plastics. However, the growth rate in the Midwest is slower, likely due to the region's more traditional manufacturing practices and slower pace of adopting new materials in some industries. Nonetheless, the growing focus on sustainability and the rising consumer demand for eco-friendly products are pushing manufacturers to explore biodegradable polymers as viable alternatives. As industries in the Midwest continue to modernize and environmental concerns gain prominence, the demand for biodegradable polymers is expected to continue growing, albeit at a more measured pace compared to the West and South.

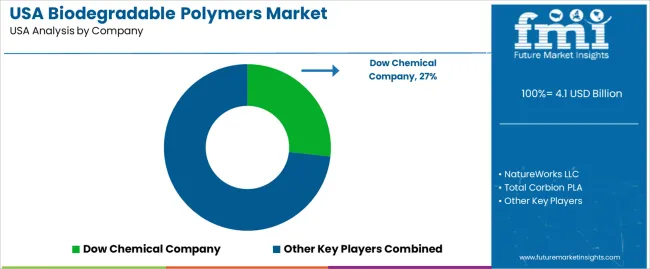

Demand for biodegradable polymers in the United States is growing as manufacturers and consumers increasingly seek sustainable and environmentally friendly alternatives to conventional plastics. Key companies in this market include Dow Chemical Company (holding about 26.7% of the market among major producers), NatureWorks LLC, Total Corbion PLA, and Braskem. Demand comes from sectors such as packaging, disposable foodservice items, agricultural films, and some consumer goods where biodegradable or compostable properties align with regulatory pressures and consumer preferences.

Competition in this industry centers on polymer performance, cost competitiveness, and application versatility. Suppliers offer a variety of biodegradable polymers — including polylactic acid (PLA), bio based poly esters, and other compostable blends — designed to match or approximate the mechanical and thermal properties of traditional plastics while offering improved environmental disposal options. Another competitive axis is the ability to scale production and supply reliably, especially for large-volume packaging customers. Producers also invest in demonstrating compliance with biodegradability and compostability standards relevant in the USA and providing technical support to convertors and brand owners. Marketing materials typically highlight polymer strength, biodegradation profile (e.g. compostable under industrial conditions), processability in standard plastic processing equipment, and sustainability credentials. By aligning materials properties and supply logistics with growing demand for sustainable plastics, these firms aim to expand their presence in the USA biodegradable polymers market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Type | Starch-based Polymers, Polylactic Acid (PLA), Polyhydroxy Alkanoates (PHA), Polyesters, Others |

| End-use Industry | Packaging, Textile, Agriculture, Healthcare, Consumer Goods |

| Key Companies Profiled | Dow Chemical Company, NatureWorks LLC, Total Corbion PLA, Braskem |

| Additional Attributes | The market analysis includes dollar sales by type, end-use industry, and company categories. It also covers regional demand trends in the USA, driven by the increasing adoption of biodegradable polymers in packaging, textiles, and consumer goods. The competitive landscape highlights key manufacturers focusing on innovations in biodegradable polymer production, particularly in sustainable packaging solutions. Trends in the growing demand for eco-friendly alternatives in agriculture, healthcare, and textile applications are explored, along with advancements in polymer biodegradability and regulatory factors. |

The demand for biodegradable polymers in USA is estimated to be valued at USD 4.1 billion in 2025.

The market size for the biodegradable polymers in USA is projected to reach USD 26.1 billion by 2035.

The demand for biodegradable polymers in USA is expected to grow at a 20.2% CAGR between 2025 and 2035.

The key product types in biodegradable polymers in USA are starch-based polymers, polylactic acid (pla), polyhydroxy alkanoates (pha), polyesters and others.

In terms of end-use industry, packaging segment is expected to command 55.0% share in the biodegradable polymers in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Polymers Market Growth 2025 to 2035

Biodegradable Bone Graft Polymers Market Size and Share Forecast Outlook 2025 to 2035

Demand for Biodegradable Microbeads in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Biodegradable Food Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Biodegradable Plastic in USA Size and Share Forecast Outlook 2025 to 2035

Biodegradable Microencapsulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA