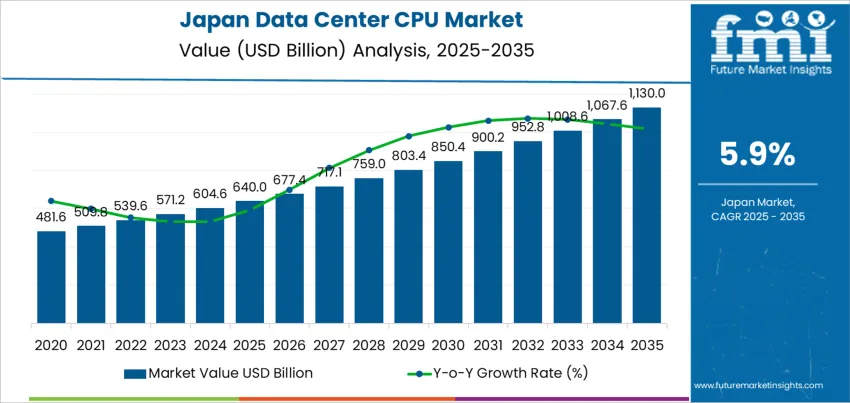

The demand for Data Center CPUs in Japan is expected to grow from USD 640.0 million in 2025 to USD 1,130.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.9%. Data center CPUs play a critical role in handling the increasing demand for data traffic, cloud computing, AI, and machine learning applications. As industries and enterprises continue to adopt these technologies, the need for more powerful processors capable of supporting high-performance computing, real-time data processing, and large-scale storage will grow. The ongoing expansion of cloud infrastructure and digital services will drive demand for these advanced CPUs to meet growing computational requirements.

The growing trend toward digital transformation, AI integration, and the adoption of IoT technologies across industries such as finance, telecommunications, and e-commerce will also fuel the demand. These sectors rely heavily on data centers to store, process, and analyze vast amounts of data. As data volumes continue to rise, high-performance CPUs will be essential for optimizing workloads, improving data transfer speeds, and reducing latency. Data centers will require more powerful and efficient CPUs to maintain seamless operations and meet the needs of next-generation applications. With the ongoing increase in connected devices, big data, and real-time processing, the demand for data center CPUs in Japan is set to grow sustainably over the next decade.

Between 2025 and 2030, the demand for Data Center CPUs in Japan will increase from USD 640.0 million to USD 677.4 million. During this initial phase, the industry will experience moderate growth, driven by the steady adoption of cloud computing, data center expansion, and increasing mobile broadband usage. The growth will be driven by businesses’ growing reliance on cloud infrastructure to store and process large volumes of data. The demand will see gradual increases as companies update their data center hardware and processing power to meet the rising need for computational capacity.

From 2030 to 2035, the demand for Data Center CPUs will see faster acceleration, growing from USD 677.4 million to USD 1,130.0 million. This phase will be marked by rapid adoption of 5G networks, AI applications, and edge computing, all of which require substantial processing power to support real-time data processing, low-latency communication, and complex algorithms. The demand will spike as the need for high-performance computing grows, driven by advancements in edge computing, AI-driven applications, and automated systems across industries. As Japan continues its digital transformation, data centers will increasingly adopt CPUs capable of supporting the demands of next-generation technologies such as cloud-native applications and big data analytics.

| Metric | Value |

|---|---|

| Demand for Data Center CPUs in Japan Value (2025) | USD 640.0 million |

| Demand for Data Center CPUs in Japan Forecast Value (2035) | USD 1,130.0 million |

| Demand for Data Center CPUs in Japan Forecast CAGR (2025-2035) | 5.9% |

The demand for data center CPUs in Japan is increasing due to the rapid growth of data centers driven by the expanding need for cloud computing, big data analytics, and high-performance computing (HPC) applications. Data centers are the backbone of the digital economy, supporting everything from cloud services to artificial intelligence, machine learning, and enterprise resource planning (ERP) systems. As more businesses and consumers rely on digital services and data storage, the demand for high-performance CPUs to power these data centers is rising.

A major driver of this growth is the increasing demand for cloud services and virtualization. The growing shift toward cloud infrastructure, where companies store and process vast amounts of data remotely, is driving the need for more powerful and efficient data center CPUs. These CPUs enable faster processing, better scalability, and energy efficiency, which are crucial for handling the growing volume of data and transactions that modern applications require.

Japan's focus on advancing its digital infrastructure, including the integration of 5G networks, is contributing to the demand for data center CPUs. As 5G adoption accelerates, it creates a need for faster and more powerful computing capabilities to handle the increased volume of data traffic, which is driving the upgrade of existing data centers and the development of new ones. With the continuous advancements in CPU architecture, including multi-core processors and specialized chips for AI workloads, the demand for data center CPUs in Japan is expected to grow steadily through 2035.

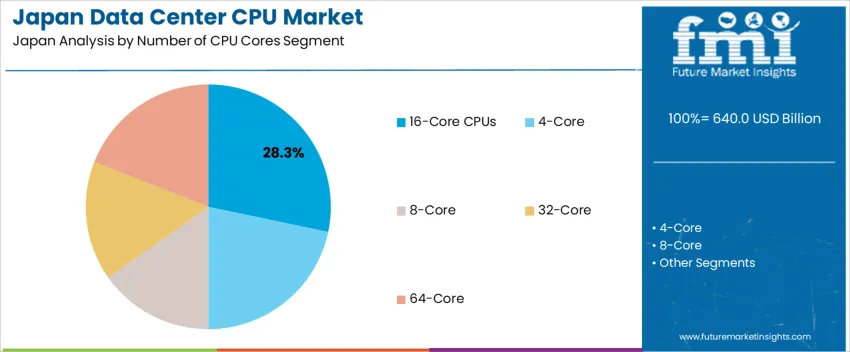

Demand for data center CPUs in Japan is segmented by the number of CPU cores, component type, and region. By CPU core type, demand is divided into 16-core CPUs, 4-core CPUs, 8-core CPUs, 32-core CPUs, and 64-core CPUs, with 16-core CPUs holding the largest share at 28%. The demand is also segmented by component type, including x86 processors, ARM processors, and power processors, with x86 processors leading the demand at 72.5%. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

16-core CPUs account for 28% of the demand for data center CPUs in Japan. These processors are preferred for their optimal balance between performance and energy efficiency, making them ideal for data centers that need to handle high computational workloads without excessive energy consumption. The growing demand for cloud computing, big data analytics, and artificial intelligence (AI) has driven the need for CPUs with higher core counts like the 16-core processors, which provide better parallel processing capabilities. These CPUs are suitable for environments requiring high-speed processing, such as server farms and large-scale enterprise applications. As data centers continue to expand to meet the increasing demand for digital services, the demand for 16-core CPUs is expected to remain strong, driven by their ability to deliver high-performance computing at a reasonable cost.

x86 processors account for 72.5% of the demand for data center CPUs in Japan. x86 architecture has been the standard for data center processors for years, known for its compatibility with a wide range of software applications, operating systems, and workloads. This architecture offers high performance and flexibility, making it suitable for diverse data center needs, from cloud services to enterprise computing. The dominance of x86 processors is also driven by their efficiency in handling multiple tasks, which is critical for data centers that require quick processing and scalability. As the need for high-performance computing continues to rise with the expansion of cloud computing, big data, and AI, x86 processors will remain the primary choice for data centers due to their widespread support, reliability, and performance.

Demand for data‑center CPUs in Japan is rising as the country’s booming data‑center industry expands. Growth in cloud computing, AI/ML workloads, edge computing, and big‑data analytics is prompting data‑center operators to deploy more server infrastructure, which increases demand for CPUs. The surge in demand for high‑density racks and high‑power servers to support AI, HPC, and enterprise workloads further stimulates CPU demand. The rapid build‑out of new data centers across Japan to meet growing digitalization and cloud, IoT, and 5G‑driven requirements supports long‑term CPU demand. Constraints include high costs for power, cooling, and infrastructure upgrades needed for high‑density computing, and limited availability of space and energy resources especially in urban or congested regions.

Why is Demand for Data‑Center CPUs Growing in Japan?

In Japan, demand for data‑center CPUs is growing because enterprises, cloud providers, hyperscalers, and public‑sector organizations increasingly rely on digital infrastructure to support AI, data analytics, cloud services, and online workloads. As businesses migrate services to cloud platforms and as AI, machine learning, big‑data, and enterprise‑IT workloads expand data centers need more compute power. CPUs remain the backbone of server infrastructure, handling general compute, virtualization, orchestration, and mixed‑workload tasks. The push toward domestic data sovereignty, local cloud infrastructure, and deployment of high‑density racks in Japan’s compact data‑center footprint supports a steady increase in server CPU demand nationwide.

How are Technological and Design Innovations Driving Growth of Data‑Center CPUs in Japan?

Technological innovations are enhancing the appeal of data‑center CPUs in Japan by improving processing power, energy efficiency, and integration with modern server architectures. New server‑grade CPUs offer higher core counts, improved multithreading, and better performance-per-watt enabling data centers to support demanding workloads (cloud, AI‑ready, virtualization) without a proportional increase in energy consumption. Coupled with advances in high‑density rack design and efficient cooling/power distribution systems, modern CPUs help data centers maximize compute-per-square‑meter and reduce operational cost per compute unit. As Japanese operators look to balance space, energy, and performance constraints, these innovations make CPU‑based servers more attractive.

What are the Key Challenges Limiting Wider Adoption of Data‑Center CPUs in Japan?

Despite strong demand, several challenges limit growth. First, infrastructure constraints-power supply, cooling, and space pose significant hurdles, especially for high‑density CPU‑intensive data centers in urban Japan. Upgrading legacy facilities to support modern server hardware can be costly and complex. Second, rising energy consumption and environmental concerns increase operation costs and may attract regulatory scrutiny, particularly for AI‑heavy workloads. Third, competition from alternative compute architectures such as GPU‑ or accelerator‑based servers for AI workloads can reduce the share of traditional CPU demand. Finally, supply‑chain and component‑cost volatility may affect procurement timings and capital expenditure plans, leading to uncertainty for some operators.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.2% |

| Kanto | 4.7% |

| Kinki | 4.2% |

| Chubu | 3.7% |

| Tohoku | 3.2% |

| Rest of Japan | 3.1% |

Demand for process automation and instrumentation in Japan is growing steadily, with Kyushu & Okinawa leading at a 5.2% CAGR, driven by the focus on enhancing industrial automation in local manufacturing sectors. The Kanto region follows with a 4.7% CAGR, supported by its strong industrial base and technological hubs. The Kinki region shows a 4.2% CAGR, driven by a high demand for automation in electronics, manufacturing, and automotive industries. Chubu experiences a 3.7% CAGR, with gradual adoption of automation technologies in manufacturing and technology sectors. Tohoku and the Rest of Japan see moderate growth at 3.2% and 3.1%, respectively, as regional industries continue to modernize and integrate automation solutions.

Demand for process automation and instrumentation in Kyushu & Okinawa is increasing at a 5.2% CAGR. This growth is largely driven by efforts to modernize industrial operations in the region’s manufacturing sectors. With a focus on automation, these areas are improving efficiency and meeting the challenges of labor shortages. The region is experiencing investments in digital infrastructure and automation technologies to boost productivity in industries like automotive, electronics, and logistics. Furthermore, Kyushu’s strong tourism sector also pushes the need for smarter, more efficient services, with automation helping drive better resource management in both industrial and service sectors. Local government initiatives to attract technological advancements and foster smart cities are also contributing to demand. As these efforts continue, the demand for advanced instrumentation and automated control systems is expected to grow steadily.

Kanto, particularly Tokyo, is experiencing high demand for process automation and instrumentation, growing at a 4.7% CAGR. The region's strong industrial and technological hubs are the main drivers, with large-scale industries and a massive consumer base relying heavily on automation technologies for productivity and efficiency. As Japan’s financial and technological center, Kanto's industrial sectors, including electronics, automotive, and chemical manufacturing, are adopting automation solutions to maintain their competitive edge. The increasing integration of AI, robotics, and IoT in Kanto’s industries is pushing demand for real-time process monitoring and control. Furthermore, Kanto’s role as a testbed for 5G technology is fueling the demand for advanced instrumentation, which helps integrate automation with smart networks. With an emphasis on enhancing operational efficiency and embracing smart solutions, Kanto’s demand for process automation and instrumentation is expected to remain strong.

In Kinki, the demand for process automation and instrumentation is growing at a 4.2% CAGR, driven by the region’s strong industrial base and focus on advanced manufacturing. Kinki is home to key industrial sectors like automotive, electronics, and steel production, all of which rely heavily on automation and instrumentation to maintain high productivity and operational efficiency. Major cities like Osaka are adopting digital solutions to enhance manufacturing processes and reduce operational costs. The region’s push towards smart factory initiatives is also a significant factor in driving demand, with industries looking to integrate automation with AI and IoT to streamline production. Moreover, Kinki is focusing on sustainability in manufacturing, and automated systems are being adopted to improve energy efficiency and reduce waste. With technological advancements continually advancing, the demand for automation and instrumentation in Kinki will continue to grow.

Chubu’s demand for process automation and instrumentation is expanding at a 3.7% CAGR. The region’s significant manufacturing sector, especially in automotive and technology, is the main driver of this growth. Major cities like Nagoya are at the forefront of integrating automation technologies in production lines, reducing costs, and improving efficiency. Chubu’s industries are increasingly relying on real-time data processing and automation to optimize manufacturing and streamline operations. The rise in digital transformation across sectors like robotics, electronics, and chemicals is further fueling the demand for automated control systems. Furthermore, Chubu is focusing on improving infrastructure and reducing operational costs, which is pushing more industries to adopt automation and smart solutions. As digitalization continues, there is growing demand for more sophisticated process automation solutions, particularly in sectors like automotive manufacturing, where precision and reliability are critical.

Tohoku is witnessing moderate growth in process automation and instrumentation, with a 3.2% CAGR. This is largely due to efforts in modernizing regional industries and enhancing infrastructure. Traditionally, Tohoku has been slower to adopt automation compared to other regions, but increasing investments in upgrading industrial facilities are now pushing growth. The region’s focus on improving connectivity and operational efficiency in sectors like agriculture, manufacturing, and energy is helping boost demand for automation. Furthermore, Tohoku’s initiatives to expand smart infrastructure, including IoT integration, is contributing to the rising need for process instrumentation. As automation technologies continue to evolve, industries in Tohoku are beginning to recognize the benefits of adopting these systems to improve productivity and address labor shortages. With increasing focus on sustainability and digital infrastructure, Tohoku’s automation industry is expected to grow steadily.

The Rest of Japan is seeing steady growth in demand for process automation and instrumentation at a 3.1% CAGR. This is primarily driven by efforts to modernize industries in suburban and rural areas. As regional businesses adopt more automated solutions to increase productivity, there is growing demand for systems that can help streamline operations, especially in manufacturing, agriculture, and logistics. The rise in IoT and digital solutions across smaller industries is also contributing to this growth. Local governments are encouraging digital infrastructure development, which is helping integrate process automation in more remote regions. As mobile and digital technologies continue to advance, the demand for reliable, efficient automation solutions is increasing, albeit at a moderate pace. The push for more sustainable, data-driven industries is also spurring investment in process instrumentation across the Rest of Japan.

The demand for data center CPUs in Japan is rapidly increasing as businesses continue to embrace cloud computing, artificial intelligence (AI), and big data applications. With the expansion of 5G networks and IoT devices, the need for high-performance computing and efficient data processing is more critical than ever. Data centers are being upgraded to handle the growing volume of data and support increasingly complex workloads. As Japan continues to strengthen its position as a technological hub, demand for powerful and scalable CPUs designed for data centers is expected to keep rising.

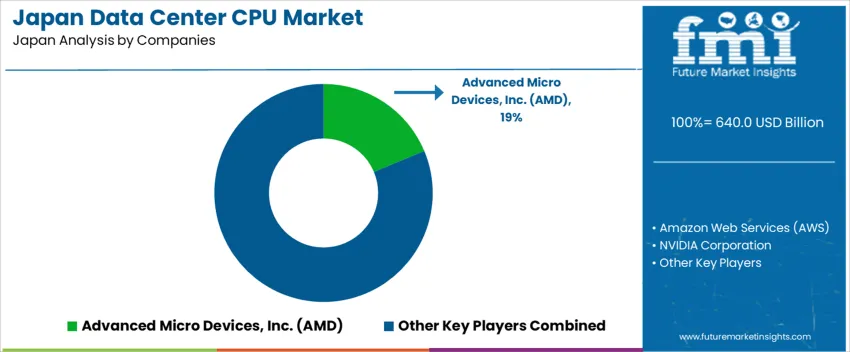

Leading companies in the data center CPU industry in Japan include Advanced Micro Devices, Inc. (AMD), Amazon Web Services (AWS), NVIDIA Corporation, Oracle Corporation, and Intel Corporation. AMD holds a industry share of 18.7%, offering high-performance processors tailored to meet the demands of data centers, particularly with its EPYC line of server CPUs. Amazon Web Services (AWS) has also entered the CPU space with its custom-designed Graviton processors, optimized for cloud computing workloads. NVIDIA Corporation is a major player, particularly with its GPUs that are crucial for AI and deep learning applications in data centers. Oracle Corporation provides cloud-based solutions with specialized processors for enterprise applications, while Intel Corporation continues to be a dominant force with its Xeon processors, known for their reliability and scalability in enterprise data centers.

The competitive dynamics in the data center CPU industry are driven by the need for faster, more energy-efficient processors that can handle the growing demands of cloud computing, AI, and data analytics. Companies compete by offering processors that deliver high performance, scalability, and energy efficiency. As businesses continue to move toward hybrid cloud environments and advanced AI-driven applications, the demand for specialized CPUs that optimize performance for these workloads grows. The ability to provide flexible, scalable, and cost-effective solutions for data centers is a key differentiator in the competitive landscape of Japan's data center CPU industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Number of CPU Cores Segment | 16-Core CPUs, 4-Core, 8-Core, 32-Core, 64-Core |

| Component | x86 Processor, ARM Processors, Power Processors |

| Server Form Factor | 2-Socket Servers, 1-Socket, 4-Socket |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Advanced Micro Devices, Inc. (AMD), Amazon Web Services (AWS), NVIDIA Corporation, Oracle Corporation, Intel Corporation |

| Additional Attributes | Dollar sales by number of CPU cores, component, and server form factor; regional CAGR and adoption trends; demand trends in data center CPUs; growth in cloud computing, server infrastructure, and enterprise sectors; technology adoption for processing power in data centers; vendor offerings including CPU solutions, processors, and services; regulatory influences and industry standards |

The demand for data center CPU in Japan is estimated to be valued at USD 640.0 billion in 2025.

The market size for the data center CPU in Japan is projected to reach USD 1,130.0 billion by 2035.

The demand for data center CPU in Japan is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in data center CPU in Japan are 16-core cpus, 4-core, 8-core, 32-core and 64-core.

In terms of component , x86 processor segment is expected to command 72.5% share in the data center CPU in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Center CPU Market Report - Growth, Innovations & Forecast 2025 to 2035

Market Leaders & Share in the Data Center CPU Industry

Demand for Data Center CPU in USA Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Market Insights – Demand & Growth 2024-2034

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Grid Interface Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Data Center Market Forecast and Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Data Center Refrigerant Market Size and Share Forecast Outlook 2025 to 2035

Data Center Fire Detection And Suppression Market Size and Share Forecast Outlook 2025 to 2035

Data Center Security Market Size and Share Forecast Outlook 2025 to 2035

Data Center Construction Market Size and Share Forecast Outlook 2025 to 2035

Data Center Substation Market Size and Share Forecast Outlook 2025 to 2035

Data Center Immersion Cooling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA