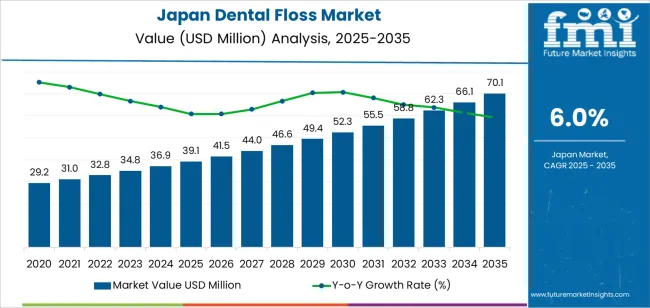

The demand for dental floss in Japan is projected to grow from USD 39.1 million in 2025 to USD 70.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.0%. As dental care awareness continues to rise, Japanese consumers are increasingly adopting oral hygiene practices that emphasize the importance of flossing. Dental floss is a key product in preventing gum disease, improving oral health, and maintaining overall well-being. The demand for dental floss is closely linked to the growing focus on preventative dental care, as more people recognize the long-term health benefits of flossing.

Japan’s dental health industry continues to expand with an increasing emphasis on educating consumers about the role of flossing in maintaining healthy teeth and gums. The growth is driven by the rising awareness of oral hygiene, particularly as Japan’s aging population requires more advanced dental care. Improvements in the availability and quality of dental floss products, including floss made from natural materials, flavored options, and ergonomic designs, are expected to further fuel the demand. As dental floss becomes a more common part of daily routines, it will continue to see growing adoption across various age groups.

Between 2025 and 2030, the demand for dental floss in Japan will increase from USD 39.1 million to USD 41.5 million. This gradual increase reflects the steady adoption of oral care products as Japanese consumers increasingly focus on long-term health and preventative care. With dental professionals continually recommending flossing as part of a comprehensive dental hygiene routine, this steady growth is expected to continue.

From 2030 to 2035, the demand for dental floss is projected to accelerate, reaching USD 70.1 million by 2035. This acceleration will be driven by ongoing innovations in product offerings, particularly with an emphasis on eco-friendly packaging and materials. As consumers seek more sustainable options, the introduction of biodegradable or recyclable floss products will help drive market growth. The increasing role of dental floss in daily hygiene regimens, supported by greater healthcare awareness, will continue to fuel demand. The overall growth in the sector will reflect both changing consumer preferences and the growing importance of preventative oral health practices.

| Metric | Value |

|---|---|

| Demand for Dental Floss in Japan Value (2025) | USD 39.1 million |

| Demand for Dental Floss in Japan Forecast Value (2035) | USD 70.1 million |

| Demand for Dental Floss in Japan Forecast CAGR (2025 to 2035) | 6.0% |

The demand for dental floss in Japan is growing as more consumers focus on daily oral-care routines. Dental professionals stress the importance of flossing for preventing gum disease, plaque buildup, and tooth decay. As awareness of oral health improves, flossing is becoming more widely adopted by both younger individuals and older populations. This increased focus on oral hygiene is contributing to the rising demand for dental floss.

The ageing population in Japan and the growing incidence of lifestyle-related health conditions are further driving the uptake of flossing products. Older adults, along with individuals with chronic health conditions, are more likely to prioritise preventive dental care, with flossing becoming a key habit for maintaining good oral health. The availability of various types of floss, such as those for sensitive gums, orthodontic treatments, and tight interdental spaces, makes these products accessible to a broader range of consumers.

Innovation in floss design and materials is also contributing to growth. Japanese consumers are opting for floss options that are easy to use, comfortable, and effective, such as mint-coated, wax-free, and biodegradable floss. The rise of online retail channels has made these products more accessible, allowing consumers to easily purchase new floss formats. As oral care is increasingly viewed as an integral part of overall wellness, dental floss in Japan is gaining more attention. With continued product innovation and wider distribution channels, the demand for dental floss in Japan is set to grow steadily through 2035

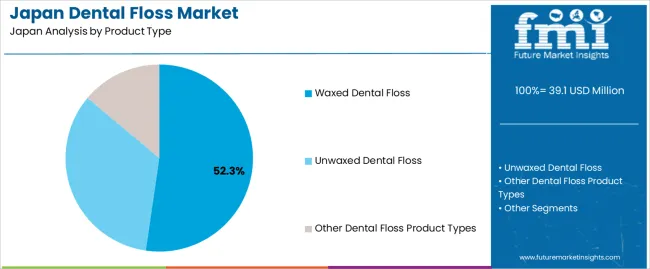

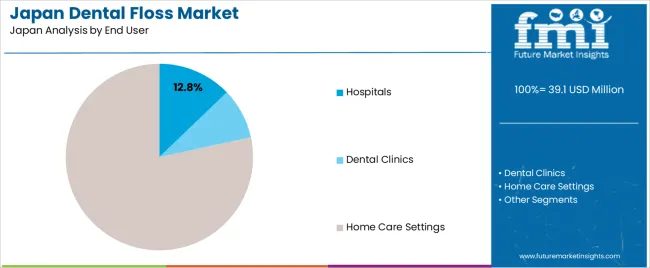

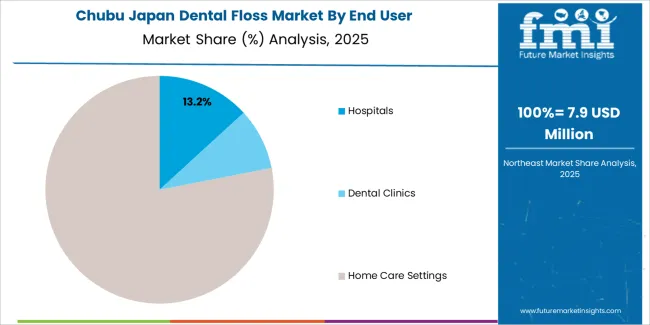

Demand for dental floss in Japan is segmented by product type and end user. By product type, demand is divided into waxed dental floss, unwaxed dental floss, and other dental floss product types, with waxed dental floss holding the largest share at 52%. The demand is also segmented by end user, including home care settings, dental clinics, and hospitals, with home care settings leading the demand at 78.4%. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Waxed dental floss accounts for 52% of the demand for dental floss in Japan. Waxed floss is preferred due to its smooth texture, which allows it to glide easily between teeth, making the flossing process more comfortable and efficient. The wax coating helps prevent the floss from fraying, ensuring that it remains durable and effective during use. This makes waxed floss a popular choice for both regular users and those with tighter gaps between their teeth. Waxed dental floss is often seen as more hygienic and effective in removing plaque and food particles, contributing to its dominance in the market. As consumers continue to prioritize oral hygiene and convenience, the demand for waxed dental floss is expected to remain strong.

Home care settings account for 78.4% of the demand for dental floss in Japan. The majority of dental floss used is for personal, at-home oral care. With increasing awareness of the importance of dental hygiene and the growing focus on preventive healthcare, consumers are using dental floss as part of their daily oral care routine to maintain healthy teeth and gums. The convenience of using dental floss at home, coupled with its affordability and effectiveness in preventing gum disease and cavities, drives its popularity.

The rise in health-consciousness and the increasing availability of dental care products in supermarkets and pharmacies has made dental floss more accessible, reinforcing its demand in home care settings. As people become more proactive about their oral health, the home care segment will continue to dominate the dental floss market in Japan.

In Japan, demand for dental floss is increasing due to heightened awareness of oral hygiene and preventive dental care among consumers and dental professionals. An ageing population, alongside rising rates of chronic health conditions linked with oral health, encourages more consistent interdental cleaning. Trend‑drivers include adoption of floss picks, waxed/unwaxed types and biodegradable floss materials. Retailers and e‑commerce platforms are expanding floss options, colour/branding and convenience formats, which supports uptake. Restraints include ingrained habits favouring brushing only (ignoring flossing), relatively high cost of premium floss products (especially eco‑friendly ones), and compatibility concerns (tight tooth spacing, dental work) which may reduce perceived ease‑of‑use and discourage regular use.

Demand for dental floss in Japan is growing because both consumers and dental professionals recognise flossing’s role in preventing gum disease, cavities and bad breath, especially in older adults and individuals with implants or orthodontic work. The shift toward preventative health and wellness in Japan drives interest in accessible oral‑care solutions. In addition, product innovation such as waxed thread for smoother use, floss picks for convenience and eco‑friendly biodegradable options makes flossing more appealing. Online retail growth and home‑care routines also boost availability and visibility of floss products, facilitating increased purchase and usage across urban and ageing households.

Technological advancements are propelling demand for dental floss in Japan by making products more user‑friendly, effective and aligned with consumer expectations. Innovations include wax coatings for smoother glide, textured or multifilament designs for better plaque removal, floss picks and holders to simplify usage, and biodegradable or compostable thread materials aimed at environmentally conscious users. Digital marketing and subscription models improve access and repeat purchase. These enhancements help overcome traditional barriers such as difficult threading or discomfort, making flossing more accessible for older adults or people with limited dexterity and therefore supporting broader adoption.

Despite positive momentum, adoption of dental floss in Japan is impeded by several factors. One major challenge is behavioural: brushing remains the dominant oral hygiene habit, and consumers may skip flossing or use incorrect technique, limiting flossing effectiveness and perceived benefit. Cost can also be a barrier: premium, specialized or eco‑friendly floss variants come at higher prices, which may deter budget‑sensitive buyers. Manufacturers and retailers face supply‑chain and retail‑spacing issues (for example, making floss picks or premium threads visible and accessible). Alternative interdental tools such as water‑flossers or interdental brushes may divert attention away from traditional floss, limiting growth in that segment.

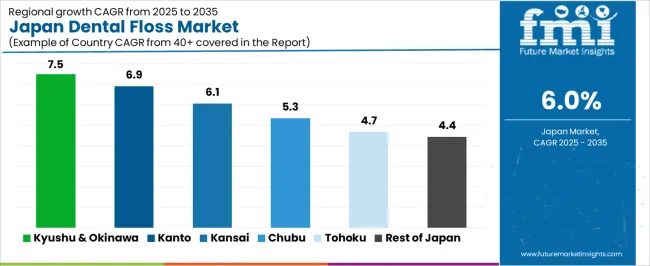

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 7.5 |

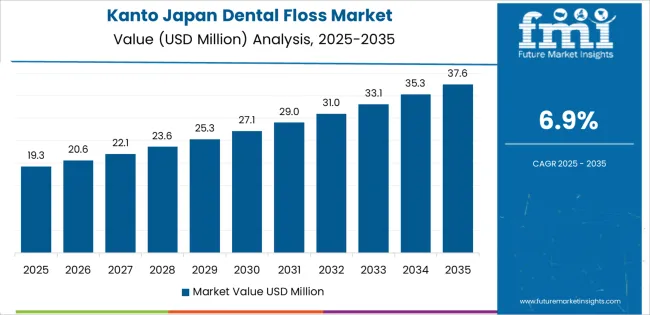

| Kanto | 6.9 |

| Kinki | 6.1 |

| Chubu | 5.3 |

| Tohoku | 4.7 |

| Rest of Japan | 4.4 |

Demand for dental floss in Japan is increasing across all regions, with Kyushu & Okinawa leading at a 7.5% CAGR. This growth is driven by the region's increasing focus on oral hygiene and growing consumer awareness of dental health. Kanto follows with a 6.9% CAGR, supported by its large urban population and high demand for health and wellness products. Kinki shows a 6.1% CAGR, with rising awareness of the importance of dental care and an expanding retail market for personal hygiene products. Chubu experiences a 5.3% CAGR, driven by the region’s growing health-conscious population. Tohoku sees a 4.7% CAGR, with steady growth driven by increasing awareness of oral health and hygiene. The Rest of Japan shows a 4.4% CAGR, with consistent demand driven by smaller markets and regional dental health campaigns.

Kyushu & Okinawa are experiencing the highest demand for dental floss in Japan, with a 7.5% CAGR. This growth is largely driven by the region’s increasing focus on oral hygiene and growing awareness of the importance of maintaining good dental health. Kyushu, in particular, has seen an uptick in health-conscious consumers who are prioritizing oral care as part of their overall wellness routine. The region’s expanding retail sector, including both traditional and online stores, is supporting the availability of dental floss products.

Okinawa’s emphasis on longevity and healthy living has contributed to heightened awareness around oral hygiene, further driving demand for dental floss. The region’s growing aging population also plays a role, as older adults often require additional oral care products to maintain dental health. As consumer habits continue to shift towards prevention and self-care, demand for dental floss is expected to remain strong in Kyushu & Okinawa.

Kanto is experiencing steady demand for dental floss in Japan, with a 6.9% CAGR. The region’s large urban population, particularly in cities like Tokyo and Yokohama, contributes significantly to the rising demand for dental care products. As consumers become more health-conscious, the adoption of regular oral care routines, including the use of dental floss, has increased. Kanto’s diverse consumer base and high standards for personal hygiene are key drivers of this demand.

The growing trend of preventive healthcare and increasing awareness of oral diseases such as gum disease and cavities are encouraging more people to adopt daily flossing habits. Retailers and e-commerce platforms in Kanto are expanding their offerings to include a variety of dental floss products, catering to consumer preferences for convenience and quality. As the region continues to prioritize wellness, demand for dental floss is expected to continue to rise, with Kanto leading in both innovation and consumer adoption.

Kinki is seeing moderate demand for dental floss in Japan, with a 6.1% CAGR. The region, which includes major urban centers like Osaka and Kyoto, has a growing focus on oral hygiene and overall health. As consumers in Kinki become more aware of the importance of dental care, they are increasingly incorporating dental floss into their daily oral care routines. The demand is further supported by the expanding availability of dental care products in retail outlets, supermarkets, and pharmacies.

Kinki’s high population density and emphasis on health and wellness make it an attractive market for personal care products, including dental floss. Furthermore, the region’s rising awareness of gum disease and its link to general health has contributed to increased adoption of preventive oral care practices. As consumer habits continue to evolve, demand for dental floss in Kinki is expected to remain strong, driven by both younger and older populations seeking to maintain good oral health.

Chubu is experiencing steady demand for dental floss in Japan, with a 5.3% CAGR. The region’s growing health-conscious population, particularly in cities like Nagoya, is driving the demand for oral hygiene products like dental floss. Chubu has a strong industrial base and a sizable middle class, both of which contribute to increased spending on health and wellness products. As more consumers seek to prevent oral health issues, such as gum disease and tooth decay, dental floss has become an essential part of daily oral care routines.

Retailers in the region are expanding their offerings to meet this demand, providing a wider variety of dental floss options. Chubu’s increasing focus on healthcare and prevention is creating a more informed consumer base that understands the benefits of using dental floss regularly. With the region’s growing interest in personal health and hygiene, the demand for dental floss is expected to continue its steady rise.

Tohoku is experiencing moderate demand for dental floss in Japan, with a 4.7% CAGR. This growth is driven by the region’s increasing awareness of oral health, particularly as it relates to the aging population. Tohoku, known for its agricultural base, has seen a rise in the use of dental products as more individuals seek to prevent oral health issues commonly associated with aging. As the region's population becomes more health-conscious, especially older adults, demand for dental floss is growing steadily.

Tohoku's expanding healthcare and dental industries, including increased access to oral care education, have further contributed to the rise in demand. Local retailers are offering a wider variety of dental floss products to cater to diverse consumer preferences. As awareness of the importance of daily flossing continues to spread, particularly among older adults, demand for dental floss in Tohoku is expected to continue growing, albeit at a more moderate pace compared to other regions.

The Rest of Japan is seeing the lowest demand for dental floss, with a 4.4% CAGR. While this region does not have the same level of urbanization and healthcare infrastructure as regions like Kanto or Kyushu, it is still experiencing steady growth in the demand for dental floss products. Smaller cities and rural areas are increasingly adopting oral hygiene practices as awareness of the importance of maintaining good dental health rises. Local pharmacies, supermarkets, and retailers are offering more oral care options, including dental floss, to meet this growing demand.

The Rest of Japan’s aging population is also contributing to this trend; as older individuals seek preventive measures to maintain their oral health. As health education continues to expand and more people prioritize preventive care, the demand for dental floss is expected to remain steady in the Rest of Japan, despite slower growth compared to more urbanized regions.

In Japan, the demand for dental floss is steady, driven by an increasing focus on preventive oral hygiene and the aging population’s oral care needs. The market includes both waxed and unwaxed floss, widely distributed across households, pharmacies, and online channels. The sector is experiencing moderate growth, driven by awareness around the importance of gum health and interdental cleaning.

Key players in this market include Procter & Gamble with a 45.1% share, Colgate-Palmolive, Johnson & Johnson, and Sunstar Suisse SA. These companies stand out due to their strong brand presence, extensive distribution networks through pharmacies and drugstores, and product differentiation offering variants like mint-flavored floss, tape floss, and specialized products for orthodontic users. Their marketing strategies emphasize the importance of daily flossing as part of a comprehensive oral care routine.

Several factors shape the competitive landscape. The rising awareness of gum health and interdental cleaning, along with the growing importance of preventive oral care, is driving demand for floss products. The shift to online retail is making premium floss more accessible to consumers. Challenges include the relatively low usage rates of floss in some population segments, cost sensitivity, and competition from alternative oral care tools like floss picks and interdental brushes. Companies that can maintain strong brand equity, innovate their products, ensure wide availability, and educate consumers about the benefits of flossing will be best positioned to lead Japan's dental floss segment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Waxed Dental Floss, Unwaxed Dental Floss, Other Dental Floss Product Types |

| End User | Home Care Settings, Dental Clinics, Hospitals |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Procter & Gamble Company, Colgate-Palmolive, Johnson & Johnson, Sunstar Suisse SA, Prestige Consumer (DenTek Oral Care Inc.) |

| Additional Attributes | Dollar sales by product type and end user; regional CAGR and adoption trends; demand trends in dental floss; growth in home care settings, dental clinics, and hospitals; technology adoption for oral care; vendor offerings including product variations and packaging solutions; regulatory influences and industry standards |

The demand for dental floss in japan is estimated to be valued at USD 39.1 million in 2025.

The market size for the dental floss in japan is projected to reach USD 70.1 million by 2035.

The demand for dental floss in japan is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in dental floss in japan are waxed dental floss, unwaxed dental floss and other dental floss product types.

In terms of end user, hospitals segment is expected to command 12.8% share in the dental floss in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Floss Market Analysis – Trends & Future Outlook 2025-2035

Demand for Dental Floss in USA Size and Share Forecast Outlook 2025 to 2035

Dental Repair Membranes for Implant Procedures Market Size and Share Forecast Outlook 2025 to 2035

Dental Cavity Filling Materials Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA