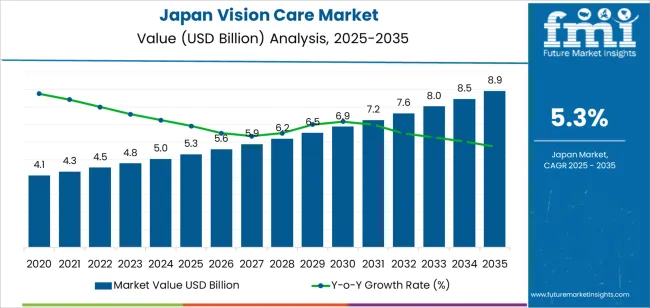

The demand for vision care in Japan is projected to grow from USD 5.3 billion in 2025 to USD 8.9 billion by 2035, reflecting a CAGR of 5.3%. The vision care market includes products and services such as eyeglasses, contact lenses, surgical treatments, and vision correction technologies. This growth is primarily driven by the increasing aging population, the rise in vision-related issues such as myopia and presbyopia, and the expanding use of digital devices that contribute to eye strain and screen-related eye fatigue. As the demand for eye care services and optical solutions rises, the vision care industry is poised for steady growth throughout the forecast period.

The market will also benefit from advancements in optical technologies, such as laser eye surgeries, smart eyewear, and vision correction devices. With the growing emphasis on preventive healthcare and eye health awareness, more consumers are likely to seek early diagnosis and effective treatment options for vision problems. Furthermore, the increasing demand for luxury eyewear and fashionable eyeglasses will also contribute to the market's expansion, particularly in the urban and youth segments.

The inflection point mapping analysis for vision care in Japan highlights critical shifts in market dynamics that lead to changes in growth rates and demand patterns.

From 2025 to 2030, the market will grow from USD 5.3 billion to USD 6.9 billion, reflecting an increase of USD 1.6 billion. This early phase will witness an acceleration in demand, driven by the aging population and the increasing number of vision-related issues in Japan. The inflection point in this period is expected to occur around 2027-2028, when the demand for eye care services and vision correction treatments starts to surge due to a combination of factors, such as greater consumer awareness, technological advancements, and the increasing popularity of laser vision correction. The market's growth rate will be propelled by a focus on preventive vision care and an increasing consumer preference for smart eyewear and high-quality lenses.

From 2030 to 2035, the market will continue to expand, reaching USD 8.9 billion by 2035, contributing an additional USD 2.0 billion in growth. During this phase, the growth momentum will stabilize, reflecting an inflection point in 2032-2033, where the market shifts from rapid growth to more mature demand for vision correction solutions. While the pace of growth may moderate, it will be sustained by advancements in eyewear technology, the growing prevalence of age-related vision problems, and the continued shift towards personalized and smart vision care products. The market will also benefit from rising demand for corrective surgeries and eye health products, but the growth rate will become more consistent as the market matures, with fewer disruptive changes.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 5.3 billion |

| Forecast Value (2035) | USD 8.9 billion |

| Forecast CAGR (2025-2035) | 5.3% |

Demand for vision care in Japan is increasing as the population ages and digital device use expands. With a large segment of the population now over age sixty five, age related vision disorders such as cataracts, glaucoma and presbyopia are prevalent, driving demand for corrective eyewear, contact lenses and surgical treatments. Rising screen time among younger generations has also contributed to the growth in digital eye strain and myopia, prompting increased use of eyewear designed for blue light filtering and vision correction. Access to vision care services, including regular eye examinations and specialized treatments, supports this demand as well.

Another factor is the expansion of online and retail vision care channels combined with innovation in optics and diagnostic technologies. Japanese consumers value high quality lenses, customized fitting and advanced surgical solutions, and brands are responding with premium intraocular lenses, smart eyewear and tele optometry services. The rise of e commerce has made it easier for consumers to explore and purchase vision care products and services. Nonetheless, factors such as variance in insurance coverage, cost of treatment and alternative vision correction options like refractive surgery present challenges. Despite these challenges, population trends, lifestyle shifts and technological progress suggest that demand for vision care in Japan will continue to grow.

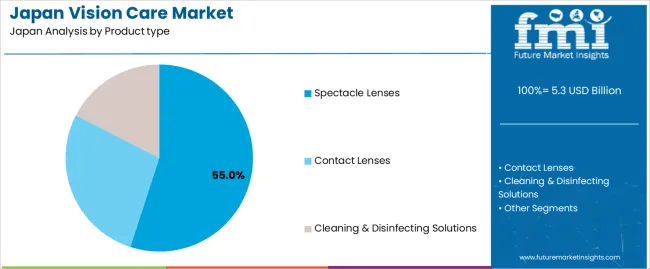

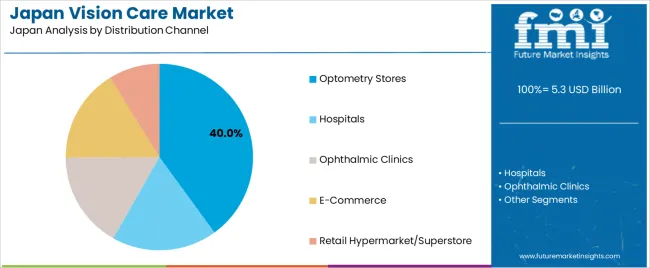

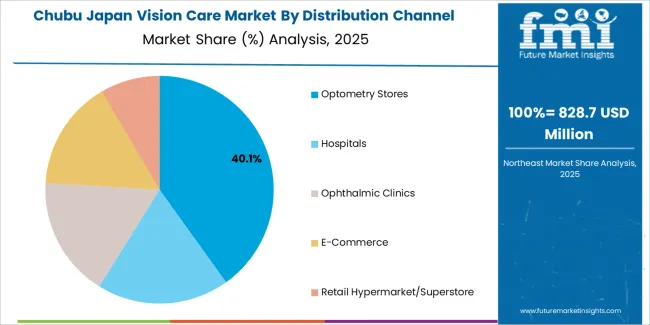

The demand for vision care products in Japan is driven by product type and distribution channel. The leading product type is spectacle lenses, holding 55% of the market share, while optometry stores lead the distribution channel segment, accounting for 40% of the demand. Vision care products, including spectacle lenses, contact lenses, and cleaning solutions, are essential in addressing the growing need for eye care and improving quality of life. With the aging population in Japan and increasing screen time, demand for both corrective lenses and preventive vision care continues to rise, making these products critical to consumer health and comfort.

Spectacle lenses lead the vision care market in Japan, capturing 55% of the demand. Spectacle lenses are the most widely used solution for individuals with refractive errors such as nearsightedness, farsightedness, and astigmatism. In Japan, where a significant portion of the population requires vision correction, spectacle lenses remain the preferred choice due to their accessibility, ease of use, and affordability.

The demand for spectacle lenses is also driven by advancements in lens technology, such as blue light-blocking lenses, photochromic lenses, and lenses designed for specific conditions like presbyopia. These innovations cater to the increasing consumer focus on both functional and aesthetic needs, with an emphasis on products that protect eye health, especially with the growing concerns about digital eye strain. As more individuals seek high-quality, comfortable, and stylish solutions for their vision needs, spectacle lenses will continue to be the dominant product in the vision care market in Japan.

Optometry stores are the leading distribution channel for vision care products in Japan, accounting for 40% of the demand. These stores play a crucial role in providing eye care services, including eye exams, prescription lenses, and fitting services for contact lenses. They are the preferred choice for consumers seeking professional guidance on eye health and vision correction, making them a key player in the distribution of spectacle lenses, contact lenses, and cleaning solutions.

The strong demand for optometry stores is also driven by the personalized services they offer, such as prescription checks, adjustments, and expert advice on the best vision care products for individual needs. As the demand for vision correction and eye health awareness continues to grow in Japan, particularly with an aging population, optometry stores will remain a dominant force in distributing vision care products. Additionally, these stores are central to the growing trend of consumers opting for comprehensive eye exams and personalized vision solutions, further strengthening their position in the market.

Demand for vision care in Japan is influenced by the country's aging population, increasing screen time, and the need for both corrective and preventive eye care. Age-related conditions like presbyopia, cataracts, and dry eyes are prevalent, driving the demand for eyewear and treatments. Additionally, the widespread use of digital devices contributes to digital eye strain and increases the need for eyewear that helps with screen time. Consumer interest in both health and fashion-related eyewear further drives the demand for products and services in the vision care market.

What Are the Primary Growth Drivers for Vision Care Demand in Japan?

Growth in Japan's vision care sector is supported by several factors. First, the aging population is a key driver, as older adults often need corrective solutions for age-related eye conditions. Second, the rising use of smartphones, computers, and other devices increases the prevalence of eye strain and myopia, especially among younger generations. Third, there is a growing consumer focus on preventive eye health, which encourages regular eye exams and the use of eyewear. Finally, fashion-conscious consumers are driving demand for premium eyewear, leading to growth in designer eyewear and customized lenses.

What Are the Key Restraints Affecting Vision Care Demand in Japan?

Despite the strong growth drivers, there are several constraints. High costs for premium lenses, advanced diagnostic treatments, and designer eyewear may limit access for some consumers. The market for routine corrective lenses is becoming saturated, which slows growth in basic eyewear products. Additionally, in some regions, there are access disparities, with fewer optometrists in rural areas, limiting availability. Regulatory and reimbursement challenges in some segments of vision care may also impact the adoption of newer services or advanced technologies.

What Are the Key Trends Shaping Vision Care Demand in Japan?

Several trends are shaping the demand for vision care in Japan. Tele-optometry and online retail platforms are making eye care services and products more accessible, especially in urban areas. The growing popularity of smart eyewear, such as lenses with blue-light filtering or augmented reality features, is driven by the increasing screen time among consumers. Premiumization and customization in eyewear, including fashionable frames and personalized lenses, are on the rise. Additionally, there is an increasing emphasis on preventive eye health, early detection, and managing eye strain, as consumers become more proactive in their eye care.

The demand for vision care in Japan is being driven by factors such as an aging population, increasing digital screen time, and a growing awareness of eye health. Vision care products and services, including eye exams, corrective lenses, and surgeries like LASIK, are becoming increasingly important as the prevalence of eye conditions such as presbyopia, myopia, and cataracts rise. The Japanese healthcare system is highly advanced, with a strong focus on preventative care, which further promotes the adoption of vision care services. Regional demand for vision care varies based on population demographics, urbanization, and access to healthcare. Below is a regional breakdown of the demand for vision care in Japan, highlighting the key drivers in each area.

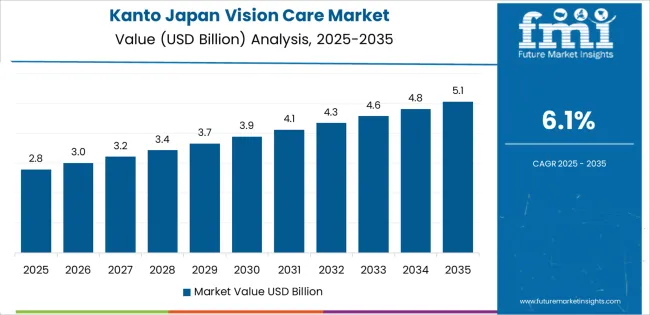

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.7% |

| Kanto | 6.1% |

| Kinki | 5.4% |

| Chubu | 4.7% |

| Tohoku | 4.2% |

| Rest of Japan | 3.9% |

Kyushu & Okinawa leads the demand for vision care in Japan with a CAGR of 6.7%. The region’s aging population is a major contributing factor, as older adults are more prone to vision-related issues like cataracts and age-related macular degeneration. Kyushu & Okinawa also has a large number of healthcare facilities that cater to the needs of seniors, which drives the demand for regular eye exams, treatments, and corrective eyewear. Additionally, the region’s focus on promoting wellness and preventive healthcare further supports the increasing adoption of vision care services.

Okinawa, in particular, is known for its long life expectancy, and as a result, the demand for vision care services to address the eye health of the elderly is high. The accessibility of vision care services in this region, coupled with growing awareness about eye health, ensures sustained demand for both corrective lenses and surgical interventions.

Kanto, with a CAGR of 6.1%, shows strong demand for vision care. As Japan’s most populous and economically active region, Kanto, which includes Tokyo, is a key market for vision care products and services. The region’s large urban population has an increasing need for eye exams, corrective eyewear, and treatments for digital eye strain due to high screen time. Kanto is home to some of Japan’s leading hospitals and eye care specialists, further boosting access to top-tier vision care services.

The region's busy lifestyle and emphasis on wellness also drive the demand for regular eye health checkups and corrective solutions. As Kanto continues to grow and urbanization increases, the demand for vision care services is expected to remain strong, supported by both preventive care and the need for effective treatments for age-related vision conditions.

The Kinki region, with a CAGR of 5.4%, shows steady demand for vision care. Kinki includes major cities like Osaka, Kyoto, and Kobe, which are home to a large, diverse population. The growing aging population in this region contributes to the increasing need for vision care services, as older individuals often require treatments for conditions like cataracts, presbyopia, and other age-related vision problems.

The region’s well-developed healthcare infrastructure, with numerous specialized eye care centers and clinics, ensures that residents have access to high-quality services. Furthermore, the rising awareness of the importance of eye health in Kinki, coupled with the region’s active lifestyle and focus on preventative healthcare, drives steady demand for vision care services. While the growth rate is slightly lower than in Kyushu & Okinawa and Kanto, Kinki remains an important region for the vision care market in Japan.

Chubu demonstrates moderate growth in the demand for vision care, with a CAGR of 4.7%. The region, which includes Nagoya and surrounding industrial areas, has a growing population that increasingly values eye health. As with other regions in Japan, the aging demographic in Chubu is a key driver of vision care demand, particularly for treatments aimed at addressing age-related vision impairments. Additionally, Chubu’s strong industrial base and increasing focus on wellness among its residents help contribute to the steady demand for vision care.

Chubu’s relatively lower growth rate compared to more urbanized areas like Kanto and Kyushu & Okinawa can be attributed to its more conservative adoption of advanced vision care technologies. However, as awareness of eye health continues to grow and healthcare accessibility improves, the demand for vision care services is expected to increase at a steady pace.

Tohoku shows a CAGR of 4.2%, while the Rest of Japan follows with a CAGR of 3.9%. These regions experience slower growth in vision care demand compared to the more industrialized and urbanized areas of Japan. In rural regions like Tohoku and the Rest of Japan, the focus on preventive healthcare and access to specialized vision care services is not as prominent as in urban centers.

While the aging population in these regions does contribute to the demand for vision care, the adoption of advanced eye care technologies and regular eye health checkups is slower due to limited access to healthcare infrastructure and fewer specialized eye care centers. However, as Japan continues to prioritize health and wellness for all ages, the demand for vision care services in these areas is likely to increase gradually.

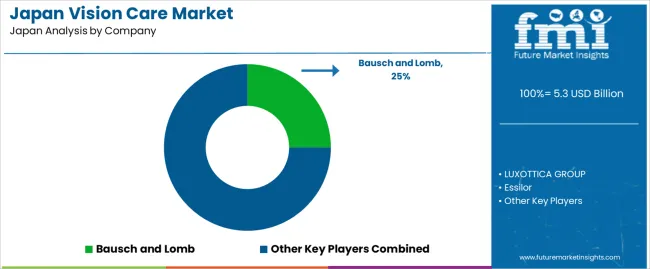

The vision care industry in Japan is growing due to the increasing demand for high-quality eyewear solutions, driven by an aging population, greater awareness of eye health, and advancements in vision correction technologies. Companies like Bausch & Lomb Corporation (holding approximately 25% market share), EssilorLuxottica and Carl Zeiss AG are key players in this industry. As more consumers seek to correct vision impairments or improve their eye health, the need for premium optical products, including prescription glasses, contact lenses, and lenses for digital eye strain, continues to rise.

Competition in the vision care industry is largely driven by product innovation, customer experience, and technology integration. Companies are investing in advanced lens technologies, such as blue light filtering lenses, anti-reflective coatings, and progressive lenses, to meet consumer demands for enhanced comfort, clarity, and protection. Another area of competition is in the eyewear frames market, with companies like Essilor Luxottica leading in frame design and offering a wide range of styles to suit different tastes.

Additionally, there is a growing trend toward smart eyewear and augmented reality glasses, creating new opportunities for innovation. Marketing materials typically highlight factors such as lens technology, comfort, durability, style options, and eye protection features. By aligning their products with the increasing consumer demand for stylish, functional, and health-conscious eyewear solutions, these companies aim to strengthen their position in the Japanese vision care industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Product Type | Spectacle Lenses, Contact Lenses, Cleaning & Disinfecting Solutions |

| Distribution Channel | Optometry Stores, Hospitals, Ophthalmic Clinics, E-Commerce, Retail Hypermarket/Superstore |

| Key Companies Profiled | Bausch & Lomb Corporation, EssilorLuxottica, Carl Zeiss AG |

| Additional Attributes | The market analysis includes dollar sales by product type and distribution channel categories. It also covers regional demand trends in Japan, driven by the increasing need for corrective eyewear and vision care solutions. The competitive landscape highlights key manufacturers in the vision care industry, focusing on innovations in lenses, cleaning solutions, and advanced vision correction technologies. Trends in the increasing adoption of online sales channels and the role of e-commerce in driving market growth are explored, along with advancements in lens materials and design. |

The global demand for vision care in japan is estimated to be valued at USD 5.3 billion in 2025.

The market size for the demand for vision care in japan is projected to reach USD 8.9 billion by 2035.

The demand for vision care in japan is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in demand for vision care in japan are spectacle lenses, contact lenses and cleaning & disinfecting solutions.

In terms of distribution channel, optometry stores segment to command 40.0% share in the demand for vision care in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Avocado Oil in Western europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA