The Latin America bakery ingredient market is set to grow from an estimated USD 6,998.7 million in 2025 to USD 12,533.6 million by 2035, with a compound annual growth rate (CAGR) of 6.0% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 6,998.7 million |

| Projected Latin America Value (2035F) | USD 12,533.6 million |

| Value-based CAGR (2025 to 2035) | 6.0% |

The increasing casual dining restaurant (QSR) and snack trend in Latin America are the main driving forces behind sales growth for bakery ingredients. The fast-food chains, cafes, and snack brands that are expanding their assortment of bread, cookies, and pastries are in high demand for ingredients like mixes, glazes, and flavors.

According to the latest, portable baked products are more popular than before, with consumers looking for easy and fast snacking options driving the need for quick-preparations and consistently-used high quality bread making ingredients. The extensive colonial culture and preferences of the citizens Latin America still have an effect on the need for local baked goods.

These traditional ones like pan de muerto, empanadas, and the many breads must be prepared with the classic ingredients like flour, yeast, and sweeteners. The regional palate that feeds off these cultural staples is a strong propeller of the bakery market therefore there will always be a demand for products that feature these recipes and manufacturing directives.

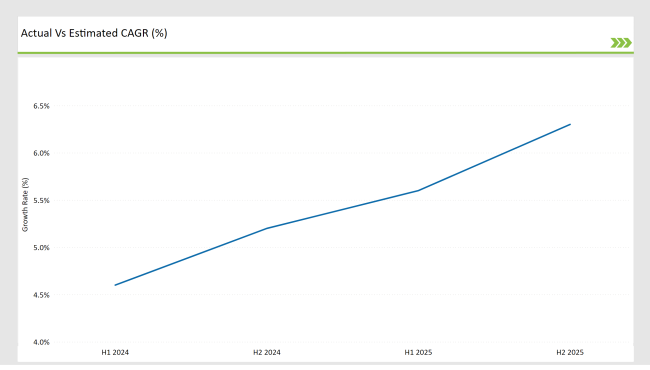

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America bakery ingredient market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America bakery ingredient market, the is predicted to grow at a CAGR of 4.6% during the first half of 2024, with an increase to 5.2% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 5.6% in H1 and is expected to rise to 6.3% in H2. This pattern reveals a decrease of 14 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 21 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | Rafael Pamias was appointed as the new CEO of Grupo Bimbo, succeeding Daniel Servitje , who remains as Chairman of the Board of Directors. This leadership change is expected to influence the company's strategic direction in the bakery ingredients sector. |

The Shift Toward Authentic and High-Quality Bakery Products in Latin America

The region is experiencing a surge in the popularity of artisanal and premium bakery products as the local populace is willing to pay more for authentic and quality bread. The popularity of artisanal breads, exclusive cakes, and specific desserts has started because people seek such products that are more flavorful, authentic, and made with local ingredients.

This dynamic contributes to the market for oils and fats that are usually special for these products, thereby giving them desirable texture, flavor, and overall quality. Enzymes also emerge as a significant part of the baking process, in contrast with their traditionally limited role, by providing dough consistency, texture, and shelf life which is the reason that premium products stay fresh and of good quality for longer.

The continuation of this trend predicts that the bakers will give a priority to the high-end consumers' expectations in terms of the raw materials as they innovate and are committed to a better quality.

Optimizing Production and Reducing Costs: The Future of Bakery Technology

The baking sector has made great progress with the advent of new technologies, such as the use of automated production lines which have now become essential in the industrial baking processes. These improvements have resulted in extra demand for functional materials that increase productivity, quality, and palate.

Besides that, leavening agents and enzymes namely are more commonly used to fine-tune doughmaking by way of improving baking quality such as volume, texture, and fina. The enzymes help retain freshness by extending the shelf life, while the leavening agents which give the products a rise and structure to items like bread and cakes, are the key element for that.

The combination and the use of these ingredients help producers cater to the needs of both good quality and economical prices that they want to achieve through cuts in production costs and increased output. The aforementioned developments are positively changing the face of the Latin American bakery industry.

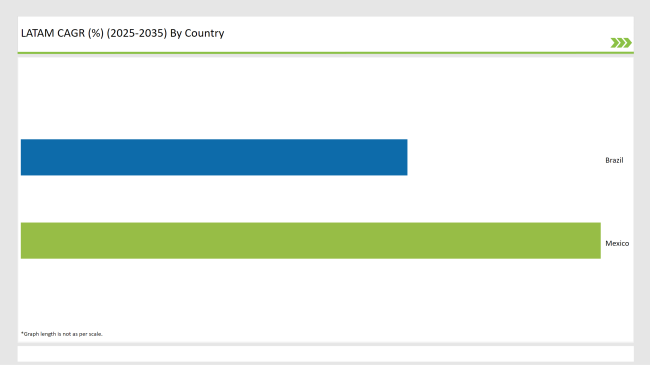

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The brisk increase in the number of quick-service restaurants (QSRs) and the corresponding rise of a snack culture in Brazil is the primary factor for the need for ready-to-eat bakery goods such as sandwiches, rolls, and snack cakes.

As customers opt for more food choices that can be taken on the road and are readily available, QSRs are the ones that are adapting with the addition of more bakery-based products. Their accompanying need for the ingredients that could positively change the texture, taste, and the length of time before consumption, is therefore arising.

For the accomplishment of that, starches, emulsifiers, and the use of raising agents are being adopted to modify the flour for the right consistency, obtain the desired adding of air, and the addition of the right point of time in-baking of bread, thereby allowing for greater uniformity and quality against the production of mass.

The demand for convenient, packaged baked goods is soaring in Mexico, propelled by bustling urban lifestyles and the growing number of dual-income households. Consumers have chosen pre-packed breads, cakes, and cookies due to the ease they offer, hence, the high quality is a must for the bakery ingredients needed.

Additives like baking powder, starches, and preservatives are the primary quisites for having comparable consistence, structure, and prolonged duration of these goods. The sale of bakery items that are easy to eat and have a long shelf life is now common, especially in retail stores and online food markets.

At the same time, Mexican food culture plays a major role in the demand for authentic bakery products such as pan de muerto, empanadas, and sweet rolls. These treats require yeast, flour, and sweeteners to be what they are, i.e., for them to get their typical taste and texture. The local fondness for baked products specific to the region always brings back the need for ingredients that move through the traditional production processes.

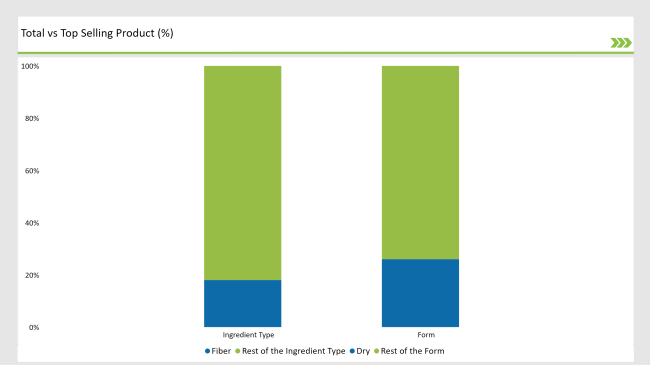

% share of Individual categories by Form and Ingredient Type in 2025

The increased interest in dry form bakery ingredients in Latin America is due to the fact that they are easy to handle and can be stored for longer. The shelf life of dry ingredients such as flours, starches, and dry mixes is longer than that of liquid alternatives, which leads to good product quality through reduced wastage.

In warm, humid climates, the situation becomes extremely difficult as foodstuffs spoil quicker, making this not a good solution. Furthermore, dry components do not need refrigeration or any other form of special storage particularly, they can be transported and stored much more efficiently than wet ones.

As a result, both dry and wet products are suitable for large-scale distribution agents across all regions of Latin America, thus offering significant logistics and storage cost savings for manufacturers, which in turn is fostering their retail and industrial acceptance.

A new trend in the Latin American bakeware market is the use of gluten-free and plant-based bakery products due to the fiber content. People are now using ingredients, such as oats, chia seeds, and flaxseeds that contain high amounts of fiber in their bread, snacks and other baked goods as the demand for plant-based and health-conscious food is increasing.

In this way, the incorporation of these specific ingredients grants the presence of fiber, omega-3 fatty acids, and other health benefits. Furthermore, with the advent of functional foods, fiber-enriched baked goods are being widely consumed.

Fiber, an important nutrient in gluten-free, low-carb, and diabetic-friendly products, is included because of its effectiveness in aiding digestion and its role in blood sugar control, adding to this finding that health-conscious consumers enjoy digestive and metabolic benefits.

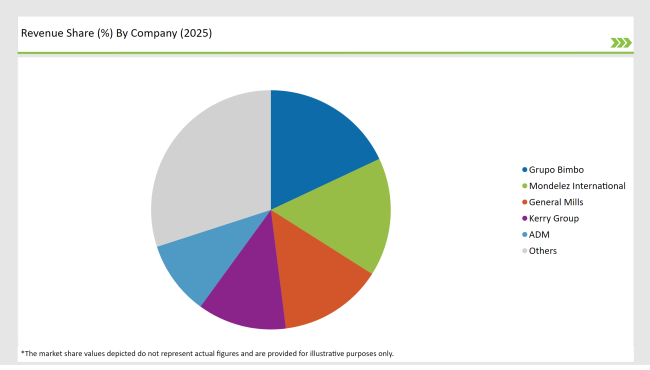

2025 Market share of Latin America Bakery Ingredient Manufacturers

Note: above chart is indicative in nature

The Latin America bakery ingredients market is moderately consolidated, with the traditional giants, Cargill, Kerry Group, and BASF SE being on top through their technological supremacy, global scales, and recognized branding.

These companies put into work their stronghold points and creative thinking to the fullest in order to be the first to meet the market taste for quality, functional flour and other bakery ingredients. Besides, local companies such as Grupo Bimbo and Ingredion target unique Latin American needs by creating tailor-made product.

As per Form, the industry has been categorized into Dry and Liquid

As per Ingredient Type, the industry has been categorized into Fiber, Emulsifiers, Enzymes, Starches, Oils, Fats, and Shortenings, Baking Powder and Mixes, Preservatives, Colors and Flavors, and Leavening Agents.

As per Application, the industry has been categorized into Foodservice Industry (Bread, Cookies and Biscuits, Rolls and Pies), Cakes and Pastries and Others.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America bakery ingredient market is projected to grow at a CAGR of 6.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 12,533.6 million.

Latin America’s rich culinary heritage and local preferences continue to influence the demand for traditional baked goods such as pan de muerto, empanadas, and various types of bread.

Leading manufacturers include Grupo Bimbo, Mondelez International, General Mills, Kerry Group, and ADM.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA