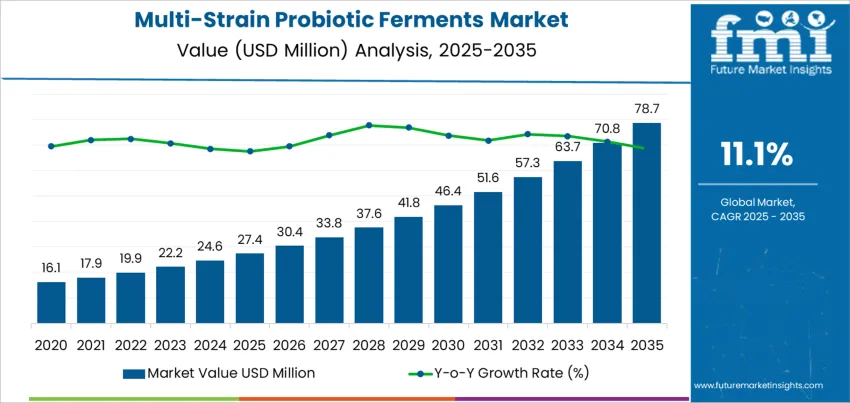

In 2025, the multi-strain probiotic ferments market is valued at USD 27.4 million and is projected to reach USD 78.7 million by 2035 at a CAGR of 11.1%. Early growth reflects rising formulation complexity in functional foods, dietary supplements, and medical nutrition products that require multi-strain efficacy rather than single-strain activity. Food and beverage manufacturers increase the use of blended ferments in yogurt, beverages, powders, and gummies to improve gut health positioning and strain diversity claims. Pharmaceutical and clinical nutrition segments also contribute as research supports broader microbiome modulation using multiple bacterial strains. Production investment during this phase focuses on controlled fermentation, higher yield cultures, and improved strain stability during processing and storage.

From 2030 onward, market expansion is shaped by deeper penetration into mainstream nutrition and personalized health programs. Demand rises from about USD 46.4 million in 2030 toward USD 78.7 million by 2035 as multi-strain products move beyond specialty shelves into mass retail and institutional nutrition. Application growth broadens into immune support, metabolic health, and age-related digestive care. Key producers include global ingredient suppliers, contract fermentation specialists, and branded nutrition companies building proprietary strain libraries. Competitive strategy centers on strain validation, survivability through shelf life, and consistent batch performance. Regulatory clarity around probiotic labeling in major markets supports wider adoption, while clinical backing strengthens positioning in therapeutic nutrition channels.

Between 2025 and 2030, the Multi-Strain Probiotic Ferments Market is projected to grow from USD 27.4 million to USD 46.4 million, creating an absolute expansion of USD 19.0 million and setting an 11.1 % compound annual trajectory. This phase sits on top of the 2020–2024 build-up, where demand already climbed from USD 16.1 million to 24.6 million, so manufacturers enter 2025 with scaled fermentation capacity and validated formulation portfolios. Growth is driven by wider clinical positioning of multi-strain concepts in immunity, digestive health, and women health platforms, plus stronger penetration in ready-to-drink and spoonable functional foods. Contract fermenters and brand owners use this period to secure long-term strain supply, regulatory dossiers, and clinical evidence pipelines, supporting consistent innovation and launches.

From 2030 to 2035, market value increases from USD 46.4 million to USD 78.7 million, adding USD 32.3 million, so the second half of the decade contributes a larger share of global expansion than the first. The growth curve steepens as multi-strain systems move from niche differentiators to baseline expectation in premium probiotics, medical nutrition, and practitioner channels. Higher counts per dose, targeted strain consortia, and delivery formats designed for gut, oral, and skin axes raise value density per unit sold. At the same time, consolidation among ingredient suppliers and CDMOs shifts bargaining power toward scaled players able to guarantee cold-chain integrity, strain identity, and multi-country compliance, reinforcing revenue concentration as absolute market size accelerates for global brands and retailers.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 27.4 million |

| Forecast Value (2035) | USD 78.7 million |

| Forecast CAGR (2025–2035) | 11.1% |

The global multi strain probiotic ferments sector first expanded through the commercialization of traditional fermented foods and the early supplement industry that focused on digestion support. Initial formulations relied heavily on single strains, but limitations in consistency and scope of benefits led manufacturers to combine multiple strains within controlled fermentation systems. This shift aligned with advances in microbial screening, strain preservation, and industrial fermentation control. Food processors adopted these ferments to improve functional positioning of yogurts, cultured drinks, and fortified foods. Supplement brands followed with capsules and powders built on fermented blends rather than isolated cultures. Early growth was anchored in organized retail, cold storage infrastructure, and clinical nutrition channels that supported repeat consumer adoption.

The next phase of global development will be driven by repositioning probiotic ferments as multipurpose nutritional foundations rather than condition-specific additives. Multi strain systems are now being aligned with immune modulation, metabolic health, womens wellness, and aging nutrition. Non-dairy fermentation platforms using oats, soy, coconut, and legumes will widen inclusion across dietary preferences and intolerance profiles. Manufacturing emphasis will shift toward shelf stability, standardized strain survivability, and compatibility with ambient distribution. Regulatory scrutiny around strain identity and functional claims will shape formulation strategies. As personalization becomes more relevant in nutrition, region-specific strain selection will increase. Multi strain probiotic ferments are set to integrate more deeply into everyday foods rather than remain confined to supplements alone.

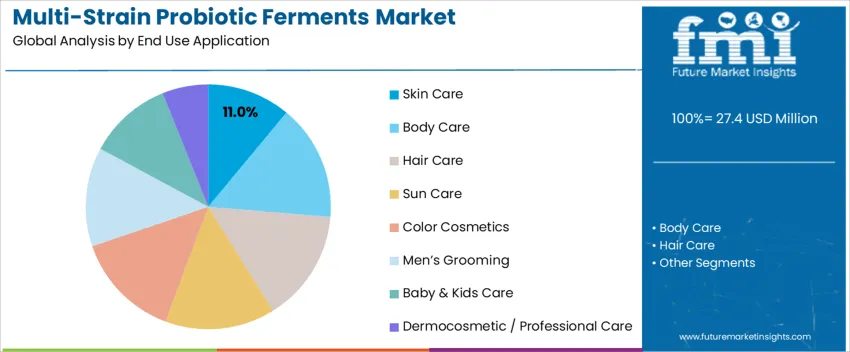

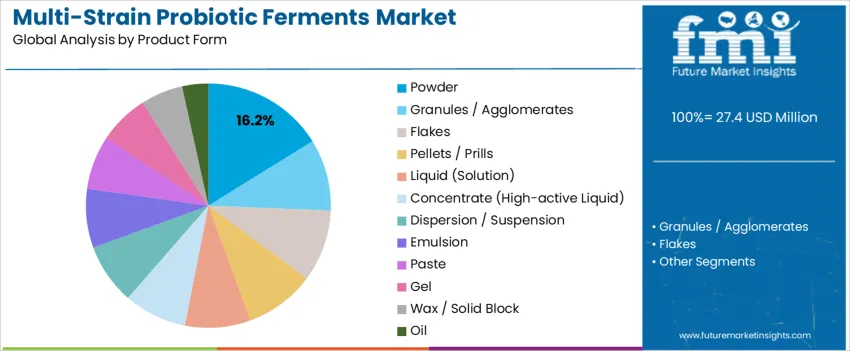

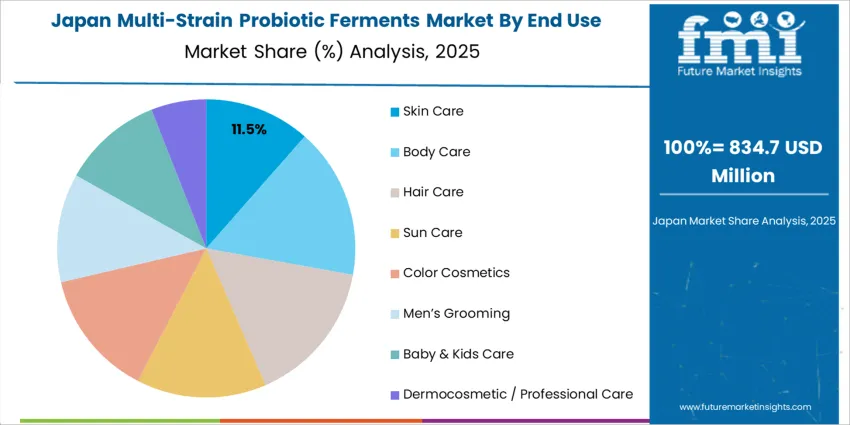

Global demand for multi strain probiotic ferments is structured by end use application and product form, with strong concentration across East Asia, Western Europe, and North America. Skin care represents an 11.0% share, supported by formulation activity in South Korea, Japan, France, and the USA. Body care, hair care, sun care, color cosmetics, men grooming, baby and kids care, and dermocosmetic or professional care follow across both mass and professional channels. On the product form side, powders hold a 16.2% share alongside liquid solutions, concentrates, dispersions, emulsions, gels, oils, and solid formats. Selection trends reflect stability requirements, microbial activity preservation, and formulation flexibility across regional manufacturing hubs.

Skin care accounts for 11.0% of global multi strain probiotic ferment usage. This share is supported by rising adoption of microbiome focused cosmetic formulations positioned around barrier repair, hydration balance, and surface flora regulation. Probiotic ferments are increasingly incorporated into facial cleansers, serums, toners, and creams where extended skin contact enhances perceived functional value. Demand is strongest in South Korea, Japan, the USA, and Western Europe, where innovation cycles in dermocosmetics remain active across both clinical and mass retail categories.

Skin care also benefits from higher ingredient loading per unit compared with rinse off body and hair formats. Professional and dermocosmetic brands rely on fermented actives to support product positioning in acne care, post procedure recovery, and sensitivity relief. Product development pipelines in France, Germany, and the USA continue to emphasize probiotic based differentiation within regulated cosmetic frameworks. These formulation priorities reinforce skin care as the leading global application for multi strain probiotic ferments.

Powder form holds a 16.2% share of global multi strain probiotic ferment demand. This leadership reflects superior shelf stability, controlled moisture exposure, and consistent microbial concentration during formulation. Powders allow precise dosing across emulsions, gels, masks, and dry cosmetic systems, which supports standardized batch performance across high volume production lines in Asia, Europe, and North America.

Powder formats also improve transport efficiency in global supply chains by reducing leakage risk and lowering refrigeration dependence during cross border shipping. Contract manufacturers favor powders for compatibility with automated blending systems and predictable quality retention across varying climate zones. Regulatory documentation and microbial specification control remain more standardized for powdered inputs in export markets. These processing, logistics, and compliance advantages sustain powder as the dominant global product form for multi strain probiotic ferments.

The multi-strain probiotic ferments market is shaped by rising interest in targeted gut health, immune support, and digestive comfort across age groups. Brands are moving from generic “probiotic” claims toward clearly defined strain combinations addressing specific outcomes such as bloating, mood, or antibiotic recovery. Fermented dairy, plant-based drinks, and ready-to-mix concentrates all act as carriers for these blends. Clinical evidence for individual strains is growing, yet formulating stable multi-strain systems under varied storage conditions remains demanding. Regional taste preferences, regulatory claim limits, and retail education levels together determine how quickly multi-strain ferments gain share in functional nutrition portfolios.

Global demand for multi-strain probiotic ferments grows as consumers seek more precise digestive and immune benefits than single-strain products often promise. Healthcare professionals increasingly discuss microbiome balance, prompting shoppers to look for diversity in strain composition. Food manufacturers value multi-strain systems because they can hedge performance across different processing and storage environments. Rising incidence of lifestyle-related digestive discomfort encourages regular consumption of fermented foods and beverages rather than occasional supplements. E-commerce and practitioner-led brands promote advanced blends with clear strain listings, reinforcing the perception that multiple well-chosen strains deliver broader, more reliable functional support.

Growth in multi-strain probiotic ferments faces technical, regulatory, and commercial constraints. Formulators must balance strain compatibility, oxygen sensitivity, and temperature tolerance while maintaining viable counts through manufacturing and distribution. Regulatory frameworks in many regions restrict strong health claims, which makes it difficult to communicate differentiated benefits for specific strain combinations. Refrigerated transport and cold-shelf placement increase cost and complexity, especially in emerging markets. Retailers already manage crowded functional categories, so shelf space for new multi-strain ferments can be limited. These factors slow the pace at which multi-strain formats replace simpler, established probiotic offerings.

Several trends are reshaping multi-strain probiotic ferments. Brands are designing blends aligned with life stages, such as early childhood, active adults, and older consumers, with strain mixes tailored to each group. Combination products pairing multi-strain ferments with prebiotic fibers or postbiotic metabolites are gaining visibility. Manufacturers explore non-dairy bases including oats, soy, and fruit matrices to reach lactose-averse and flexitarian consumers. There is growing emphasis on transparent strain naming and CFU disclosure, moving away from vague “proprietary blend” language. Digital tools, including microbiome tests and subscription services, increasingly guide consumers toward specific multi-strain ferment formats.

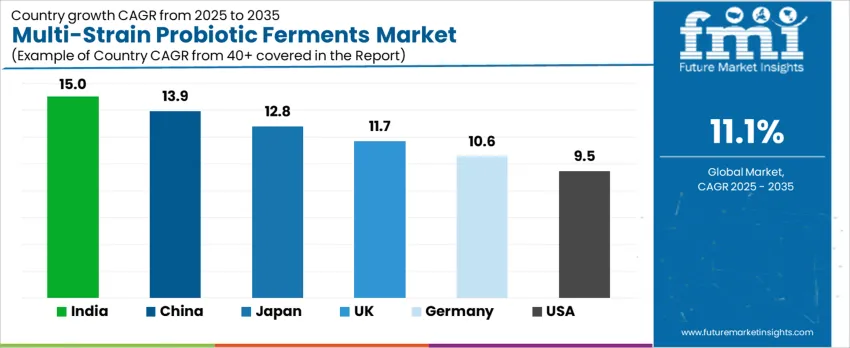

| Country | CAGR (%) |

|---|---|

| India | 15.0% |

| China | 13.9% |

| Japan | 12.8% |

| UK | 11.7% |

| Germany | 10.6% |

| USA | 9.5% |

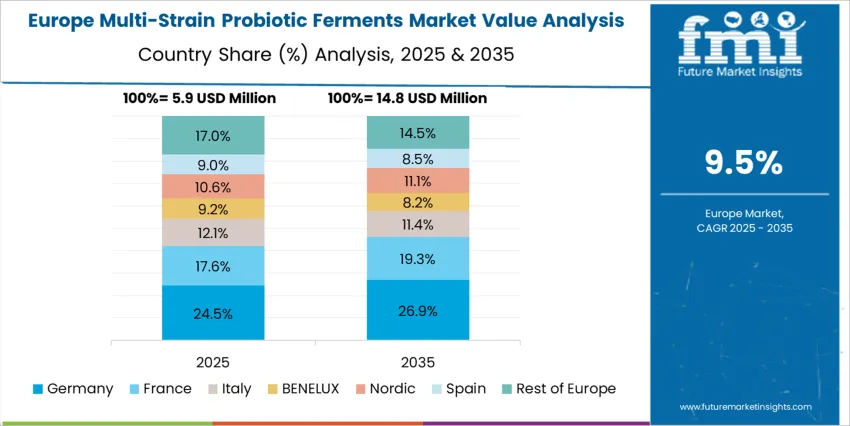

The multi strain probiotic ferments industry shows strong global growth momentum, led by India at a 15.0% CAGR, supported by rising awareness of digestive health, functional nutrition intake, and domestic nutraceutical production. China follows at 13.9%, driven by large scale fermentation capacity and expanding health supplement demand. Japan at 12.8% reflects stable integration of probiotics into everyday dietary products. The UK and Germany record 11.7% and 10.6% growth, supported by functional food innovation and clinical nutrition adoption. The USA shows comparatively lower growth at 9.5%, reflecting a mature but steadily expanding probiotics industry.

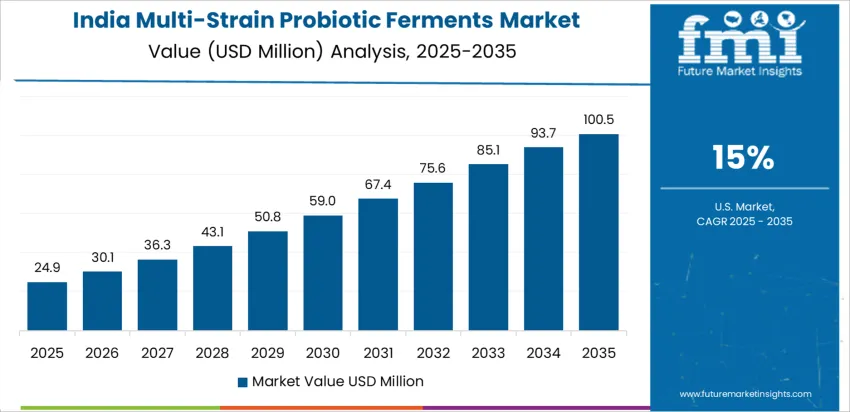

India records a CAGR of 15.0% through 2035 for multi-strain probiotic ferment growth, driven by rising digestive health awareness, expanding functional food consumption, and strong uptake of dietary supplements across urban and semi urban populations. Pharma nutrition brands and dairy processors actively integrate multi-strain formats into beverages, powders, and capsules. Medical recommendations for gut health and immunity support sustained consumer adoption. Local manufacturing capacity expansion improves product accessibility and pricing. Growth is reinforced by online wellness retail expansion and preventive healthcare spending trends across younger and aging population groups.

China posts a CAGR of 13.9% through 2035 for multi-strain probiotic ferment growth, supported by strong consumer demand for immunity support, digestive wellness, and preventive nutrition products. Infant nutrition, yogurt drinks, and powdered supplements remain the primary application areas. Domestic dairy leaders and biotech firms scale fermentation capacity to meet rising demand. Hospital nutrition programs and pharmacy retail drive structured product distribution. Growth aligns closely with rising urban health spending and premium nutrition brand penetration across tier one and tier two cities with expanding middle income populations.

Japan reflects a CAGR of 12.8% through 2035 for multi-strain probiotic ferment growth, shaped by advanced functional food usage, clinical nutrition integration, and strong aging population demand. Probiotic beverages, sachets, and capsules remain embedded in daily dietary routines. Scientific validation and strain specific formulation drive product trust. Food manufacturers emphasize targeted digestive and metabolic health positioning. Aging related gut health management sustains long term consumption stability. Growth remains driven by product refinement rather than volume expansion across a health literate and supplement mature consumer base.

The UK records a CAGR of 11.7% through 2035 for multi-strain probiotic ferment growth, supported by preventive wellness adoption, strong sports nutrition usage, and expanding digestive health supplement demand. Retail pharmacies, supermarkets, and online wellness platforms distribute a wide range of multi-strain formats. Medical guidance on gut microbiome health strengthens consumer confidence. Plant based food trends also support probiotic integration into non dairy products. Demand remains strongly linked to lifestyle wellness spending and weight management oriented product consumption across adult populations.

Germany shows a CAGR of 10.6% through 2035 for multi-strain probiotic ferment growth, supported by strong pharmaceutical nutrition use, hospital based dietary management, and preventive digestion care among aging consumers. Probiotic sachets and medical grade supplements dominate volume. Regulatory discipline reinforces high product quality standards. Health insurance linked nutrition guidance improves patient compliance. Demand remains centered on clinical and pharmacy driven distribution rather than lifestyle marketing. Growth reflects medical nutrition credibility and long term digestive disorder management rather than impulse wellness consumption.

The USA records a CAGR of 9.5% through 2035 for multi-strain probiotic ferment growth, shaped by dietary supplement market maturity, sports nutrition usage, and preventive digestive health adoption. Capsules, gummies, and powdered blends remain the leading formats. Direct to consumer brands and subscription models strengthen regular intake patterns. Physician recommended gut health programs contribute to medical channel sales. Growth is steady rather than rapid due to high market penetration, with innovation focused on strain diversity and targeted health outcomes rather than first time consumer entry.

Global demand for multi strain probiotic ferments is rising as interest in gut health, immune support, and functional nutrition grows worldwide. Consumers increasingly favour products that claim broad spectrum benefits derived from multiple microbial strains. Food and beverage manufacturers, dietary supplement producers, and nutraceutical firms are incorporating multi strain ferments to create functional foods, drinks, and capsules that cater to digestive health, wellness, and preventive health trends. Advances in microbiome science and improved manufacturing and stabilization techniques support product development and supply scalability. Growth in awareness of microbiome balance across regions fuels adoption.

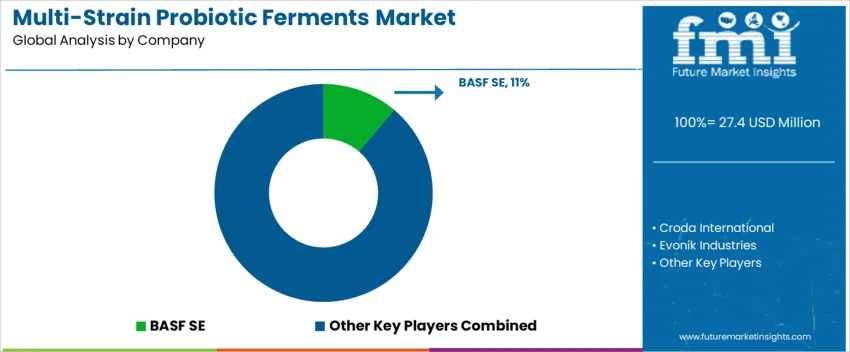

Leading ingredient suppliers shaping this market include BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan active ingredient businesses), Dow Inc., Ashland, Clariant, and specialist providers such as Seppic, Lubrizol, Lonza, Inolex and others. Market data suggest that the broader probiotic ingredients market is expanding at a compound annual growth rate (CAGR) of approximately 8–9%. In this context, companies with strong fermentation, formulation, and supply chain capabilities capture significant market share. Large diversified chemical and specialty ingredient firms leverage scale and regulatory compliance expertise to supply multi strain probiotic blends at global scale. Smaller niche providers support custom formulations and specialized applications, maintaining a diversified competitive landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End Use Application | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care, Functional Foods, Dietary Supplements, Medical Nutrition |

| Product Form | Powder, Granules / Agglomerates, Flakes, Pellets / Prills, Liquid (Solution), Concentrate (High-active Liquid), Dispersion / Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | USA, China, Japan, South Korea, India, Germany, UK, France, Italy, Brazil, Argentina, Mexico, Saudi Arabia, South Africa, Russia, others |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan actives), Dow / Dow Inc., Ashland, Clariant, Seppic / Others (Lubrizol, Lonza, Inolex), Other regional and niche suppliers |

| Additional Attributes | Dollar by sales by end use application and product form; regional CAGR and growth outlook; multi-strain formulation adoption; clinical validation and regulatory compliance tracking; distribution channels including retail, DTC, e-commerce, and institutional buyers; product form prevalence in powders, liquids, and emulsions; regional preference for strain libraries; supply chain logistics for cold chain and ambient stability; strain survivability, CFU consistency, and shelf-life performance; innovation trends including prebiotic/postbiotic combinations, non-dairy matrices, and personalized nutrition; competitive positioning of global vs regional suppliers. |

The global multi-strain probiotic ferments market is estimated to be valued at USD 27.4 million in 2025.

The market size for the multi-strain probiotic ferments market is projected to reach USD 78.7 million by 2035.

The multi-strain probiotic ferments market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in multi-strain probiotic ferments market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 16.2% share in the multi-strain probiotic ferments market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multistrain Probiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Multistrain Probiotics in EU Size and Share Forecast Outlook 2025 to 2035

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Probiotic Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic for Kids Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Fermented Milk Market Growth & Demand Forecast 2025 to 2035

Probiotic for Men Market Analysis by Product, Sales Channel and Strain Type Through 2035

Probiotic Cheese Market Cheese Type, Bacteria Type, Sales Channel and Others through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA