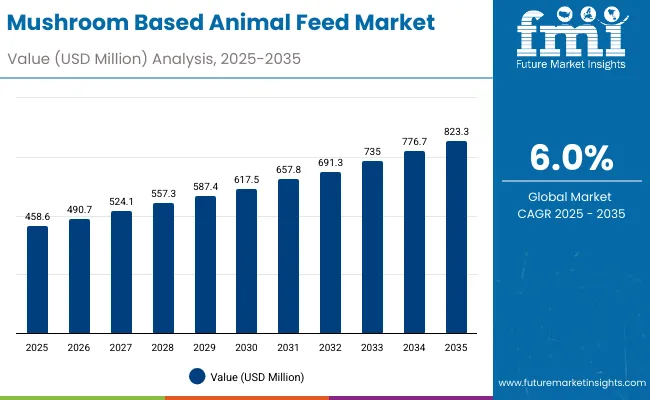

The mushroom-based animal feed market, valued at USD 458.6 million in 2025, is set to reach USD 823.3 million by 2035, growing at 6% CAGR during the forecast period. Mushroom-based animal feed encompasses sophisticated protein processing systems coordinating waste stream utilization, fermentation technologies, and bioactive compound extraction across diverse livestock, aquaculture, and specialty animal applications.

Edible mushroom waste processing provides cost-effective protein alternatives through agricultural byproductvalorization, achieving protein levels ranging from 15% to 25% while maintaining essential amino acid profiles comparable to conventional protein sources. Button mushroom substrate processing yields consistent nutritional profiles with enhanced digestibility characteristics suitable for monogastric species applications.

Mushroom-Based Animal Feed Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 458.6 million |

| Market Forecast (2035) | USD 823.3 million |

| Growth Rate | 6% CAGR |

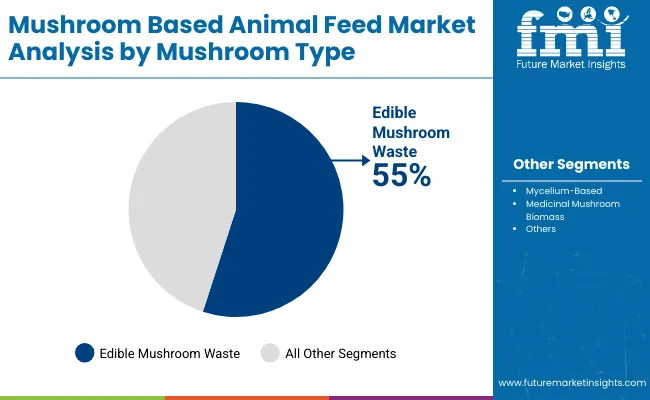

| Leading Mushroom Type | Edible Mushroom Waste Segment |

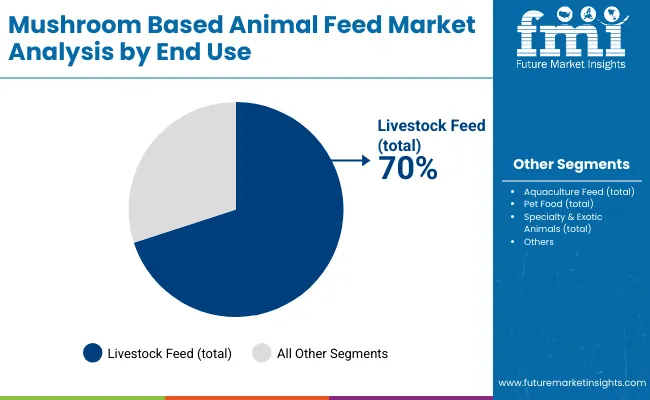

| Primary End-Use Species | Livestock Feed Applications |

Livestock applications drive primary market demand through requirements for alternative protein sources, mycotoxin binding capabilities, and immune system enhancement in cattle, swine, and poultry production systems. Feed mill integration utilizes standardized processing protocols to achieve consistent inclusion rates between 2% and 8% of total feed formulations while maintaining palatability and performance characteristics. Commercial poultry operations leverage mushroom-based ingredients to achieve improved gut health profiles and reduced antibiotic dependency in broiler and layer production systems.

Aquaculture applications include fish and shrimp feed formulations requiring specialized protein digestibility and water stability characteristics essential for aquatic species nutrition. Tilapia and catfish feeding programs utilize mushroom meal as fishmeal replacement achieving comparable growth performance while reducing feed costs and environmental impact. Shrimp feed applications require precise processing to achieve optimal particle size distribution and nutrient density profiles compatible with crustacean feeding behavior and digestive physiology.

The market demonstrates strong fundamentals with edible mushroom waste capturing a dominant share through reliable protein capabilities and cost optimization. Livestock applications drive primary demand, supported by increasing feed efficiency requirements and operational nutrition development. Geographic expansion remains concentrated in developed markets with established feed manufacturing infrastructure, while emerging economies show accelerating adoption rates driven by agricultural modernization initiatives and rising protein accessibility standards.

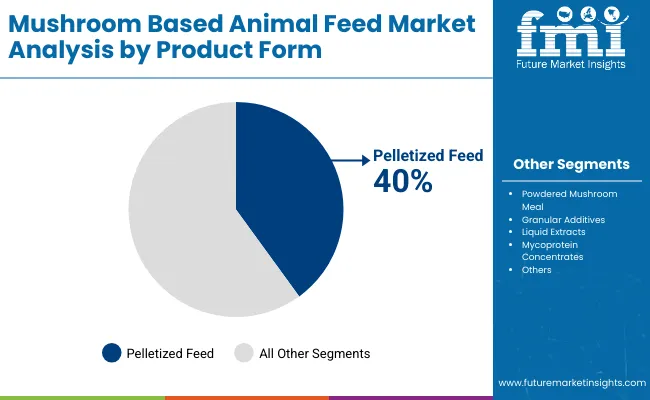

The market segments by mushroom type into edible mushroom waste, mycelium-based, and medicinal mushroom biomass. End-use species segmentation divides the market into livestock feed, aquaculture feed, pet food and specialty animals, reflecting distinct requirements for nutritional efficiency, species-specific needs, and feed processing infrastructure standards. Product format segmentation covers pelletized feed, powdered mushroom meal, granular additives, liquid extracts, and mycoprotein concentrates, demonstrating varied processing requirements and application efficiency standards..

Edible mushroom waste applications command the leading position in the mushroom-based animal feed market with 55% market share through advanced processing features, including superior cost characteristics, operational efficiency, and protein optimization that enable feed manufacturers to achieve optimal nutrition across diverse livestock and aquaculture applications.

The segment benefits from feed mill preference for cost-effective protein alternatives that provide consistent nutritional characteristics, reduced ingredient complexity, and operational efficiency optimization without requiring significant processing modifications. Advanced design features enable automated quality control systems, protein monitoring, and integration with existing feed mill equipment, where operational performance and nutritional compliance represent critical manufacturer requirements.

Edible mushroom waste applications differentiate through proven operational reliability, consistent protein characteristics, and integration with automated feed management systems that enhance nutrition effectiveness while maintaining optimal quality standards for diverse livestock and aquaculture applications.

Key market characteristics:

Livestock feed applications demonstrate market leadership in the mushroom-based animal feed market with 70% share due to widespread adoption of alternative protein systems and increasing focus on feed efficiency, nutritional optimization, and applications that maximize performance while maintaining cost standards.

Livestock producers prioritize feed consistency, operational efficiency, and integration with existing feeding infrastructure that enables coordinated nutrition operations across multiple production facilities. The segment benefits from substantial feed investment and modernization programs that emphasize the acquisition of alternative protein systems for nutrition optimization and feed efficiency applications.

Livestock facility expansion programs incorporate mushroom-based feed as standard nutrition for feeding operations, while production growth increases demand for consistent feed capabilities that comply with nutrition standards and minimize feeding complexity.

Application dynamics include:

Pelletized feed demonstrates market leadership in the mushroom-based animal feed market with 40% share due to widespread adoption of standard feeding systems and increasing focus on operational convenience, processing efficiency, and applications that maximize handling while maintaining nutrition standards.

Feed manufacturers prioritize processing consistency, operational efficiency, and integration with existing pelleting infrastructure that enables coordinated production operations across multiple feed formulations. The segment benefits from substantial processing investment and modernization programs that emphasize the acquisition of pelletized systems for production optimization and feed efficiency applications.

Feed mill expansion programs incorporate pelletized formats as standard processing for feed operations, while production growth increases demand for consistent processing capabilities that comply with quality standards and minimize manufacturing complexity.

| Category | Factor | Impact |

|---|---|---|

| Driver | Alternative protein demand & feed efficiency requirements (protein replacement, cost reduction) | ★★★★★ |

| Driver | Waste valorization growth & circular economy development | ★★★★★ |

| Driver | Regulatory support & functional feed approval (health benefits, performance enhancement) | ★★★★☆ |

| Restraint | Processing complexity & scale requirements (technology barriers, capital investment) | ★★★★☆ |

| Restraint | Conventional protein competition & cost alternatives | ★★★☆☆ |

| Trend | Functional feed advancement & health integration (bioactive compounds, immune support) | ★★★★★ |

| Trend | Asian market expansion & aquaculture growth | ★★★★☆ |

| Regions/Countries | How to win | What to watch out |

|---|---|---|

| India | Focus on cost-effective feed solutions | Infrastructure challenges; processing availability |

| Germany | Lead with high-quality processing systems | Environmental regulations; facility complexity |

| USA | Provide nutrition-compliant applications | FDA regulations; feed requirements |

| France | Premium quality positioning | Over-specification; regulatory compliance |

| UK | Offer comprehensive feed solutions | Brexit impacts; processing requirements |

| China | Push industrial integration solutions | Quality regulations; technology costs |

| Brazil | Premium efficiency positioning | Feed precision; market maturity |

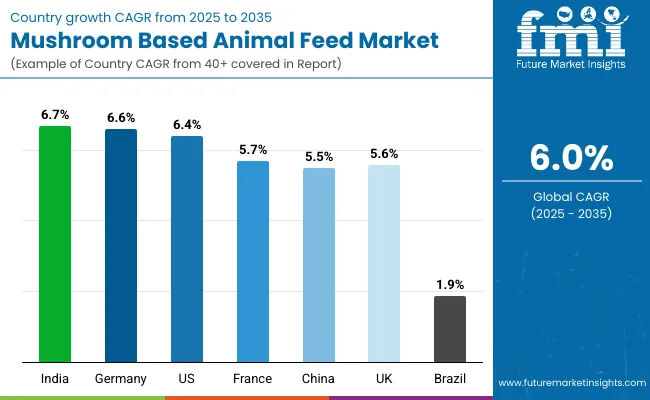

The mushroom-based animal feed market demonstrates varied regional dynamics with growth leaders including India (6.7% growth rate) and Germany (6.6% growth rate) driving expansion through agricultural initiatives and feed capacity development. Steady Performers encompass USA (6.4% growth rate), UK (5.6% growth rate), and France (5.7% growth rate), benefiting from established feed industries and advanced processing adoption. Mature Markets feature China (5.5% growth rate) and Japan (5.9% growth rate), where feed technology advancement and quality requirements support consistent growth patterns.

Regional synthesis reveals South Asian and European markets leading adoption through agricultural expansion and feed development, while North American countries maintain steady expansion supported by technology advancement and regulatory requirements. Emerging markets show strong growth driven by livestock applications and feed modernization trends.

India establishes fastest market growth through aggressive agricultural programs and comprehensive feed capacity development, integrating advanced mushroom-based feed ingredients as standard components in livestock feeding and aquaculture facility installations. The country's 6.7% growth rate reflects government initiatives promoting agricultural modernization and feed development capabilities that mandate the use of alternative protein systems in livestock facilities. Growth concentrates in major agricultural centers, including Maharashtra, Gujarat, and Tamil Nadu, where feed technology development showcases integrated nutrition systems that appeal to producers seeking advanced protein optimization capabilities and operational feeding applications.

Indian feed manufacturers are developing cost-effective nutrition solutions that combine domestic processing advantages with advanced operational features, including automated quality systems and enhanced protein capabilities. Distribution channels through agricultural suppliers and feed service distributors expand market access, while government support for agricultural development supports adoption across diverse livestock segments. Processing capabilities through mushroom cultivation centers and waste processing facilities create supply chain advantages that reduce ingredient costs and improve market accessibility for small-scale producers.

In Baden-Württemberg, Lower Saxony, and North Rhine-Westphalia regions, feed facilities and agricultural operations are implementing advanced mushroom-based nutrition as standard ingredients for feed optimization and operational livestock enhancement, driven by increasing government agricultural investment and feed modernization programs that emphasize the importance of functional feed capabilities. The market holds a 6.6% growth rate, supported by government feed initiatives and agricultural development programs that promote advanced protein systems for livestock facilities.

German operators are adopting feed systems that provide consistent operational performance and nutrition compliance features, appealing in agricultural regions where feed efficiency and quality standards represent critical operational requirements. Market expansion benefits from growing feed processing capabilities and agricultural integration agreements that enable domestic production of advanced nutrition systems for livestock applications.

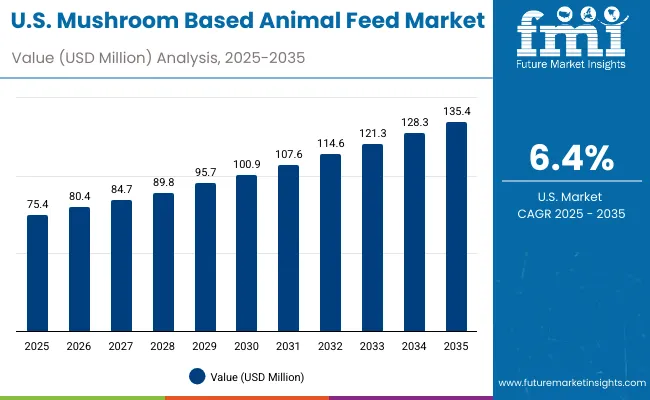

USA establishes nutrition-compliant market development through comprehensive agricultural programs and established feed infrastructure, integrating mushroom-based feed ingredients across livestock facilities and aquaculture applications. The country's 6.4% growth rate reflects mature feed industry relationships and established ingredient adoption that supports widespread use of alternative protein systems in livestock facilities and nutrition-compliant operations. Growth concentrates in major agricultural centers, including Iowa, Nebraska, and North Carolina, where feed technology showcases mature ingredient deployment that appeals to producers seeking proven nutrition capabilities and operational efficiency applications.

American feed manufacturers leverage established distribution networks and comprehensive nutrition capabilities, including compliance programs and technical support that create customer relationships and operational advantages. The market benefits from mature feed standards and regulatory requirements that support ingredient system use while supporting technology advancement and operational optimization.

France's advanced agricultural technology market demonstrates sophisticated mushroom-based integration with documented operational effectiveness in premium livestock applications and modern facility installations through integration with existing quality systems and feed infrastructure. The country maintains a 5.7% growth rate, leveraging traditional quality expertise and precision systems integration in feed technology. Agricultural centers, including Brittany, Grand Est, and Auvergne-Rhône-Alpes, showcase premium installations where feed systems integrate with traditional quality platforms and modern facility management systems to optimize livestock operations and maintain feed quality profiles.

French feed manufacturers prioritize ingredient precision and quality consistency in mushroom-based development, creating demand for premium systems with advanced features, including quality monitoring and automated feed systems. The market benefits from established quality infrastructure and commitment to agricultural standards that provide long-term operational benefits and compliance with traditional quality feeding methods.

UK establishes comprehensive feed development through advanced agricultural programs and established feed infrastructure, integrating mushroom-based systems across livestock facilities and aquaculture applications. The country's 5.6% growth rate reflects growing agricultural industry relationships and established ingredient adoption that supports widespread use of alternative protein systems in livestock facilities and feed-oriented operations. Growth concentrates in major agricultural centers, including East Anglia, Yorkshire, and Southwest England, where feed technology showcases mature ingredient deployment that appeals to producers seeking proven feed capabilities and operational efficiency applications.

British feed manufacturers leverage established supply networks and comprehensive nutrition capabilities, including quality programs and technical support that create customer relationships and operational advantages. The market benefits from established agricultural standards and quality requirements that support feed system use while supporting technology advancement and operational optimization.

China establishes industrial application development through comprehensive facility modernization and technology integration, integrating mushroom-based systems across livestock facilities and specialized agricultural applications. The country's 5.5% growth rate reflects growing industrial investment and increasing adoption of feed technology that supports expanding use of alternative protein systems in Chinese livestock facilities. Growth concentrates in major agricultural areas, including Shandong, Henan, and Jiangsu, where feed technology development showcases integrated nutrition systems that appeal to Chinese producers seeking advanced industrial solutions with facility efficiency compatibility.

Chinese feed manufacturers focus on maintaining technology standards while adopting industrial feed efficiency, creating demand for systems that balance performance with operational advantages. The market benefits from strong industrial infrastructure and growing export opportunities that support feed technology adoption while maintaining quality standards important to Chinese agricultural applications.

Brazil’s mushroom-based feed technology sector advances steadily at a CAGR of 1.9% through 2035, reflecting gradual agricultural integration and growing awareness of alternative protein applications in livestock nutrition. The country’s development trajectory focuses on incremental adoption across key agricultural regions such as São Paulo, Paraná, and Minas Gerais, where feed producers are exploring mushroom-derived protein systems for nutritional enhancement and feed diversification. Industrial adoption remains concentrated among medium to large-scale livestock facilities that seek to balance cost efficiency with sustainable ingredient utilization.

Brazilian feed manufacturers are progressively integrating mushroom-based systems into existing feed processing frameworks to improve protein availability and animal health outcomes. Ongoing government programs promoting sustainable agriculture and domestic feed innovation contribute to awareness, though infrastructural and cost-related barriers limit large-scale implementation. Partnerships between local cooperatives and international feed technology providers are helping expand technical expertise and system compatibility across agricultural supply chains. The industry’s focus on quality consistency and energy-efficient processing systems aligns with Brazil’s long-term sustainability goals.

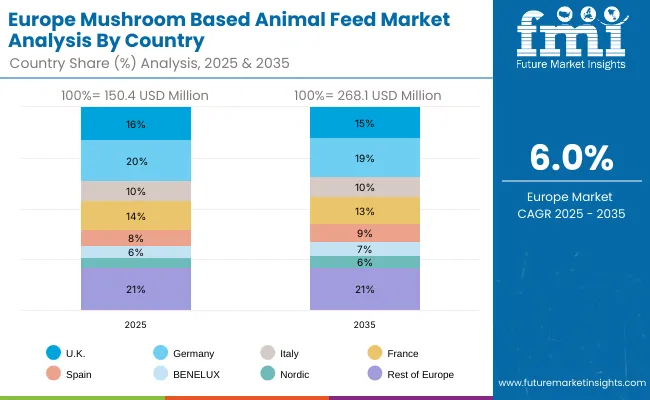

The European mushroom-based animal feed market is projected to represent a significant portion of global consumption, with strong regional distribution across major economies. Germany is expected to maintain its leadership position with USD 30.1 million in 2025, accounting for substantial European market share, supported by its advanced agricultural infrastructure and major livestock centers.

United Kingdom follows with USD 24.1 million, representing significant European market share in 2025, driven by comprehensive agricultural programs and feed technology development initiatives. France holds USD 21.1 million through specialized livestock applications and feed compliance requirements. Italy commands USD 15.1 million, while Spain accounts for USD 12.1 million in 2025. The rest of Europe region maintains USD 31.6 million, attributed to increasing feed system adoption in Nordic countries and emerging agricultural facilities implementing livestock modernization programs.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Processing networks, broad ingredient portfolios, manufacturing facilities | Proven reliability, multi-region support, comprehensive service | Technology refresh cycles; customer lock-in dependency |

| Technology innovators | R&D capabilities; advanced nutrition systems; processing interfaces | Latest technology first; attractive ROI on specialized applications | Service density outside core regions; customization complexity |

| Regional specialists | Local sourcing, fast delivery, nearby technical support | "Close to site" support; pragmatic pricing; local regulations | Technology gaps; talent retention in feed science |

| Application-focused ecosystems | Species expertise, technical support, specialized solutions | Lowest application variation; comprehensive species support | Scaling costs if overpromised; technology obsolescence |

| Service specialists | Quality programs, ingredient supply, technical training | Win service-intensive applications; flexible support | Scalability limitations; narrow market focus |

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 458.6 million |

| Mushroom Type | Edible Mushroom Waste, Mycelium-Based, Medicinal Mushroom Biomass |

| End-Use Species | Livestock Feed, Aquaculture Feed, Pet Food, Specialty & Exotic Animals |

| Product Format | Pelletized Feed, Powdered Mushroom Meal, Granular Additives, Liquid Extracts, Mycoprotein Concentrates |

| Functional Claims | Gut Health & Immunity, Mycotoxin Binding, Antimicrobial/Antiviral, Growth Performance Enhancer, Prebiotic Fiber Source |

| Sales Channel | Direct-to-Farm Supply, Feed Millers & Blenders, Online B2B Platforms, Distributors/Resellers |

| Application Type | Complete Feed Formulations, Additives/Supplements, Premix Blends, Fermentation Substrate for On-Farm Feed |

| Regions Covered | East Asia, Western Europe, South Asia Pacific, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Germany, United States, Japan, India, South Korea, France, United Kingdom, and 25+ additional countries |

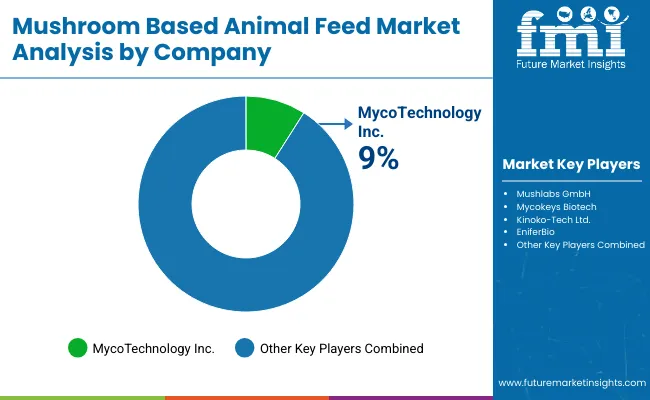

| Key Companies Profiled | MycoTechnology Inc. (human food ingredients), Mushlabs GmbH (mycelium-based foods), Kinoko -Tech Ltd. (fungal protein foods), Enifer (PEKILO® mycoprotein for aquafeed & pet food), plus emerging feed-focused startups such as NoMy and Seaqure Labs. |

| Additional Attributes | Dollar sales by mushroom type and end-use species categories, regional adoption trends across East Asia, Western Europe, and South Asia Pacific, competitive landscape with ingredient suppliers and feed manufacturers, producer preferences for nutrition consistency and operational reliability, integration with feed platforms and quality monitoring systems. |

The mushroom-based animal feed market is valued at USD 458.6 million in 2025.

The market is expected to reach USD 823.3 million by 2035.

The market is projected to grow at a 6% CAGR during the forecast period.

Edible mushroom waste is the leading type, holding approximately 55% market share due to its cost-efficiency and consistent protein characteristics.

Livestock feed applications dominate with 70% share, driven by the need for alternative proteins and improved feed efficiency.

Pelletized feed leads with 40% market share, supported by ease of handling and feed mill compatibility.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Probiotic Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Minerals Market Analysis - Size, Growth, and Forecast 2025 to 2035

Animal Feed Preservative Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Antibiotics Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Antioxidants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Alternative Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Analyzing Animal Feed Additives Market Share & Industry Leaders

Animal Feed Processing Equipment Market Analysis & Forecast by Function, Feed Type, End-User, Automation, and Region through 2025 to 2035

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

Animal Feed Prebiotics Market – Growth, Livestock Nutrition & Demand

Animal Feed Sweetener Market – Growth, Innovations & Market Demand

Animal Feed Protease Market

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

UK Animal Feed Additives Market Trends – Growth, Demand & Forecast 2025–2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA