The global PET (Polyethylene Terephthalate) packaging industry is witnessing substantial growth due to increasing demand for lightweight, cost-effective, and recyclable packaging solutions across multiple industries, including food & beverage, pharmaceuticals, and personal care. Advances in PET recycling technology, sustainability initiatives, and increasing regulatory support for eco-friendly materials are reshaping the competitive landscape.

Market growth is driven by consumer preference for sustainable packaging, government regulations promoting circular economy practices, and innovations in lightweight, durable, and reusable PET packaging solutions. As cost-efficiency and quality become priorities, manufacturers are investing in advanced PET recycling, bio-based PET, and smart packaging solutions.

Market Leaders & Competitive Landscape

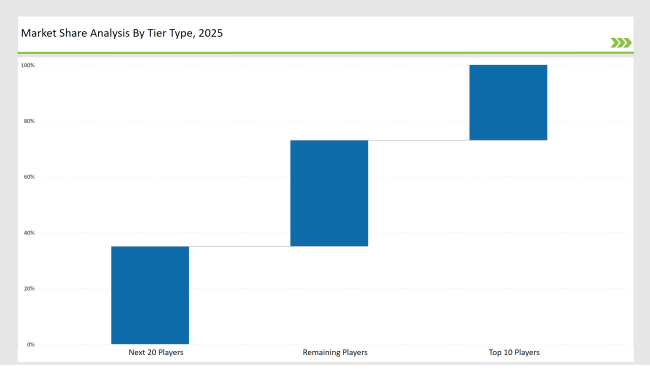

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Berry Global, ALPLA) | 12% |

| Rest of Top 5 (Indorama Ventures, Plastipak) | 9% |

| Next 5 of Top 10 | 6% |

The demand for high-quality PET packaging is increasing across multiple industries:

Manufacturers are focusing on innovative solutions to meet evolving market needs:

Year-on-Year Leaders

To stay competitive in the PET packaging industry, suppliers should focus on:

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Berry Global, ALPLA |

| Tier 2 | Indorama Ventures, Plastipak, Graham Packaging |

| Tier 3 | Nampak, Retal, Alpha Packaging |

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched fully recyclable PET packaging (March 2024) |

| Berry Global | Introduced lightweight PET bottle designs (July 2023) |

| ALPLA | Expanded rPET bottle production (October 2023) |

| Indorama Ventures | Developed advanced PET recycling technology (February 2024) |

| Plastipak | Innovated in refillable PET packaging (May 2024) |

The PET packaging industry is transitioning toward sustainability, efficiency, and material innovation. Key players are emphasizing:

The industry is expected to advance in:

Rising demand for lightweight, cost-effective, and sustainable packaging solutions.

Amcor, Berry Global, ALPLA, Indorama Ventures, and Plastipak.

Recycled PET (rPET), bio-based PET materials, and smart packaging solutions.

Asia-Pacific, North America, and Europe.

Companies are investing in bio-based PET, advanced recycling technologies, and eco-friendly production methods.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA