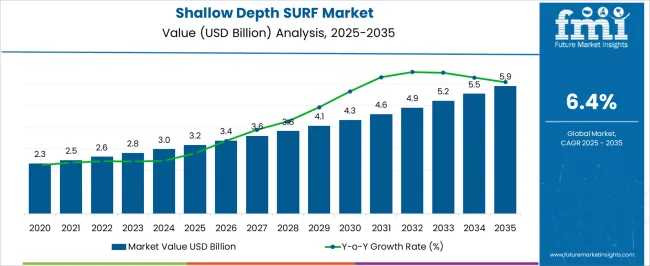

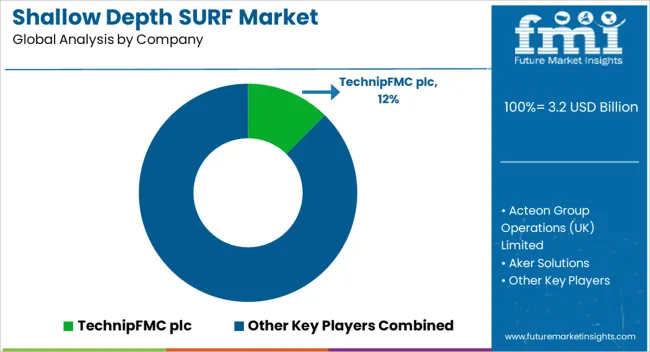

The shallow depth SURF market is estimated at USD 3.2 billion in 2025 and is forecasted to reach USD 5.9 billion by 2035, reflecting a CAGR of 6.4%. The year-on-year growth pattern, with values rising from USD 3.2 billion in 2025 to USD 3.8 billion by 2028 and further to USD 4.6 billion by 2031, illustrates a progressive upward curve. Such expansion indicates that subsea umbilicals, risers, and flowlines continue to hold vital importance in offshore development projects, especially where shallow-water operations remain more cost-efficient compared to deepwater fields.

This year-on-year rise demonstrates how operators are relying on proven offshore infrastructure to ensure production reliability, making shallow depth SURF a preferred option in many project portfolios. By 2035, the shallow depth SURF market is expected to record USD 5.9 billion, showing clear resilience and steady investor confidence. The values, steadily climbing from USD 5.2 billion in 2032 to USD 5.9 billion in 2035, highlight how consistent adoption is driven by both replacement projects and new shallow-water developments.

Trajectory reflective of how offshore operators prioritize risk management and cost control, where shallow depth SURF solutions are recognized for delivering a balance of efficiency and reliability. While the CAGR may not appear explosive compared to high-growth sectors, the YoY growth curve underscores the fact that shallow-depth SURF markets offer long-term dependability, ensuring a stable role in the broader energy infrastructure landscape.

| Metric | Value |

|---|---|

| Shallow Depth SURF Market Estimated Value in (2025 E) | USD 3.2 billion |

| Shallow Depth SURF Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The shallow depth SURF market has achieved a notable position within its parent industries, largely because of its critical role in connecting subsea wells to production facilities in less complex offshore environments. Within the subsea equipment market, shallow depth SURF commands nearly 18–20% share, as operators prefer it for cost-effective and reliable field development. In the offshore oil and gas market, the share is about 12–14%, reflecting its presence in early-stage and marginal field projects where shallow waters are targeted for quicker returns.

The subsea umbilicals, risers, and flowlines (SURF) market shows a higher reliance, with shallow depth solutions holding almost 22–24% share, since these systems are often the backbone of shallow water developments.

Offshore engineering and construction registers around 10–12% share, where shallow depth SURF is a key element in installation and project execution strategies. In the broader energy infrastructure market, the contribution stands near 8–10%, as SURF projects support the expansion of regional energy supplies.

The shallow depth SURF (Subsea Umbilicals, Risers, and Flowlines) market is expanding steadily, supported by increased offshore oil and gas field developments in shallow water regions. Industry updates and project announcements have indicated that shallow water operations remain a cost-effective choice compared to deepwater projects, particularly in regions with mature offshore infrastructure.

Technological advancements in subsea engineering, including improved riser design and corrosion-resistant materials, have enhanced operational reliability and extended asset life. Growing investments in life extension of aging shallow water fields, combined with brownfield tie-back projects, have further fueled demand for SURF solutions.

The market’s future outlook is also shaped by the gradual integration of renewable energy-related subsea infrastructure, such as offshore wind and hybrid energy systems. Demand is expected to be concentrated in key offshore basins with established supply chains and favorable regulatory frameworks.

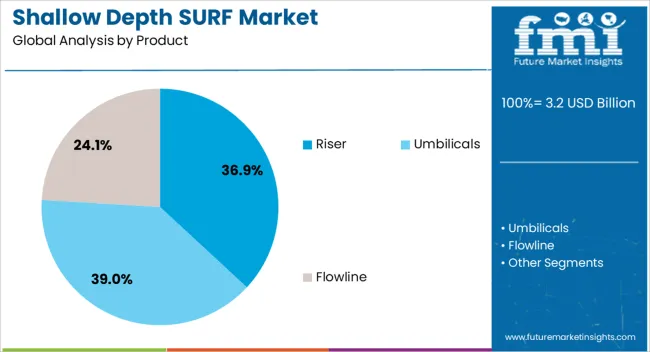

The shallow depth SURF market is segmented by product and geographic regions. By product, the shallow depth SURF market is divided into Riser, Umbilicals, and Flowline. Regionally, the shallow depth SURF industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Riser segment is projected to account for 36.9% of the shallow depth SURF market revenue in 2025, retaining its position as a critical product category. This growth is attributed to the vital role risers play in connecting subsea infrastructure to surface facilities, ensuring the uninterrupted flow of hydrocarbons or production fluids.

Offshore operators have increasingly prioritized robust riser systems capable of withstanding environmental forces, vessel motions, and varying operating pressures. Advancements in flexible and rigid riser technologies have expanded their applicability, enabling cost-effective deployment in diverse shallow water conditions.

Additionally, ongoing replacement of aging riser systems in mature fields has driven a steady aftermarket demand. Industry trends also indicate growing adoption of hybrid riser configurations, combining the advantages of multiple designs to optimize performance and reduce operational risks. As offshore activity in shallow waters continues to grow, driven by both oil and gas and renewable energy projects, the Riser segment is expected to maintain a substantial share of the market.

The shallow depth SURF market is expanding due to increased offshore oilfield development and growing relevance in renewable energy projects. Standardization, modular designs, and digital integration are reshaping industry practices, while the cost advantages of shallow-water operations strengthen demand. However, challenges like installation costs, environmental impacts, and supply chain constraints continue to affect the market.

Despite these issues, the long-term outlook remains positive as operators prioritize reliable, adaptable subsea infrastructure for both traditional oil and gas as well as emerging offshore renewable energy applications.

The demand for shallow depth subsea umbilicals, risers, and flowlines (SURF) is gaining momentum as offshore oil and gas projects continue to expand in shallow waters. Many operators are focusing on shallow-water reserves due to lower exploration and production costs compared to deepwater drilling. SURF systems ensure reliable subsea connectivity and fluid transport, making them indispensable in maintaining production efficiency. With energy companies balancing cost efficiency and productivity, shallow-water SURF deployment is being prioritized as a practical solution to extend the lifespan of existing assets while supporting new offshore projects.

Significant opportunities exist as shallow depth SURF solutions are increasingly being integrated with offshore renewable projects, particularly in floating wind energy and subsea power distribution. These systems can be adapted for power transmission, control, and monitoring applications, making them valuable beyond traditional oil and gas. Emerging regions investing in offshore infrastructure, such as Southeast Asia, Africa, and Latin America, are creating new prospects for suppliers. Companies offering flexible SURF solutions tailored to renewable applications stand to capture untapped revenue streams while diversifying risk beyond the oil and gas sector.

A key trend shaping the shallow depth SURF market is the adoption of standardized equipment and modular designs to reduce installation and maintenance costs. Operators are also leaning toward digital monitoring and predictive analytics for real-time performance evaluation of subsea systems. Remote monitoring capabilities reduce downtime while increasing operational safety. Furthermore, the push for subsea tiebacks and smaller-scale developments is encouraging demand for lightweight and flexible SURF components. These evolving trends emphasize efficiency, adaptability, and smarter asset management across the offshore landscape, driving the market’s transition toward integrated, cost-effective solutions.

The shallow depth SURF market faces challenges from harsh offshore environments, which can accelerate equipment wear and corrosion, leading to higher maintenance requirements. Installation costs, though lower than deepwater projects, still present a considerable financial burden for smaller operators. Supply chain constraints and raw material price volatility also add pressure on service providers. Additionally, regulatory requirements for environmental protection increase compliance costs. To overcome these hurdles, industry players must focus on developing corrosion-resistant materials, optimizing installation techniques, and adopting digital tools that minimize operational disruptions and reduce long-term expenses.

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

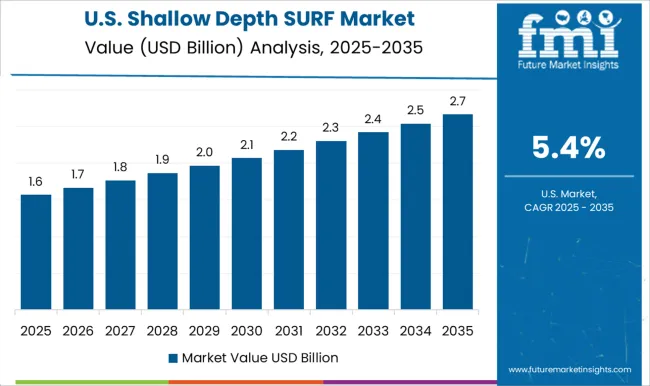

| USA | 5.4% |

| Brazil | 4.8% |

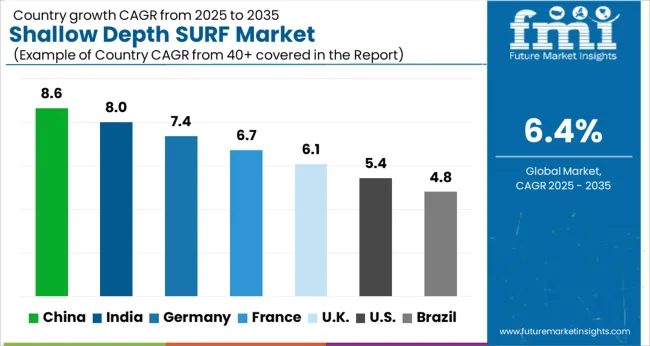

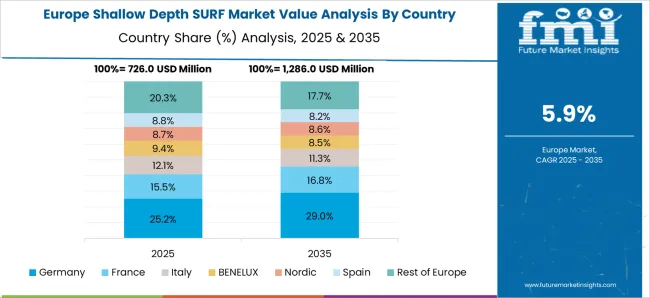

The global shallow depth subsea umbilicals, risers, and flowlines (SURF) market is forecasted to grow at a CAGR of 6.4% between 2025 and 2035. China leads with a growth rate of 8.6%, followed by India at 8% and France at 6.7%. The United Kingdom is expected to record a CAGR of 6.1%, while the United States trails at 5.4%. Rising offshore exploration, investments in subsea oilfield development, and demand for energy reliability are supporting this market’s expansion. While emerging nations such as China and India drive growth through expanding exploration projects, developed economies such as France, the UK, and the USA rely on advanced engineering capabilities and offshore infrastructure modernization. This report includes insights on 40+ countries; the top markets are shown here for reference.

The shallow depth SURF market in China is projected to grow at a CAGR of 8.6%. Offshore energy exploration projects in shallow waters continue to expand as the country seeks to meet its rising energy consumption. Local oil and gas companies are investing in subsea infrastructure to enhance efficiency and reliability in extraction. Government support for expanding domestic offshore capabilities strengthens the market outlook. With increasing technological expertise and partnerships with global subsea engineering firms, China is expected to maintain leadership in shallow depth SURF adoption.

The shallow depth SURF market in India is expected to expand at a CAGR of 8%. Demand is largely driven by offshore oil and gas exploration in the Arabian Sea and Bay of Bengal. India’s growing reliance on energy imports has encouraged expansion of local offshore projects. National oil companies are increasingly adopting subsea systems to optimize extraction efficiency and reduce operational costs. With infrastructure development and strategic investments in offshore assets, India is positioning itself as a key regional market for shallow depth SURF solutions.

The shallow depth SURF market in France is forecasted to grow at a CAGR of 6.7%. The country’s expertise in offshore engineering and established oilfield service providers play a central role in driving demand. France continues to support subsea infrastructure upgrades in collaboration with global offshore operators. The integration of high-performance risers and flowlines into shallow-water projects is a key factor sustaining the market. France’s emphasis on maintaining reliable offshore assets ensures steady growth, supported by companies with strong engineering and subsea innovation capabilities.

The shallow depth SURF market in the United Kingdom is anticipated to grow at a CAGR of 6.1%. The North Sea remains a crucial contributor, where operators are modernizing shallow-water infrastructure. Continuous investments in extending the lifespan of existing fields create steady demand for SURF solutions. The UK benefits from a strong base of subsea engineering companies, making it a hub for offshore innovation. Despite mature oilfields, the focus on enhancing efficiency and reliability in shallow-water projects sustains market momentum.

The shallow depth SURF market in the United States is projected to record a CAGR of 5.4%. Offshore fields in the Gulf of Mexico are the primary drivers of demand. Companies are investing in upgrading subsea infrastructure to maximize extraction efficiency in shallow-water projects. USA-based service providers continue to offer advanced SURF solutions, focusing on reducing operational risks and downtime. While the country shows slower growth compared to Asia, its strong offshore engineering capabilities and established oil and gas base ensure steady demand.

The shallow depth SURF market is shaped by strong competition among integrated service providers and specialized equipment manufacturers. TechnipFMC, Saipem, and Aker Solutions lead with comprehensive subsea portfolios, and their brochures highlight turnkey project execution, pipeline installation efficiency, and proven offshore track records. Halliburton, Baker Hughes, and Schlumberger position themselves on technological depth and field service expertise, stressing reliability in shallow offshore environments. Oceaneering International and John Wood Group emphasize inspection, repair, and maintenance offerings, with brochures that underline lifecycle extension and cost predictability for operators.

Mid-tier specialists such as Dril-Quip, Inc., Acteon Group, and DeRegt Cables showcase adaptable solutions and cable systems designed for offshore flexibility, carving space in specific niches. Material and component suppliers add further competition. Prysmian Group, JDR Cable Systems, and ArcelorMittal Downstream Solutions focus their brochures on high-performance subsea cables and steel structures, presenting themselves as reliable back-end partners for large EPC contractors. Tenaris and VALLOUREC emphasize pipe integrity and fatigue resistance, appealing to buyers needing robust shallow-water deployment systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Product | Riser, Umbilicals, and Flowline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TechnipFMC plc, Acteon Group Operations (UK) Limited, Aker Solutions, ArcelorMittal Downstream Solutions, Baker Hughes Company, DeRegt Cables, Dril-Quip, Inc., Halliburton, JDR Cable Systems Ltd, John Wood Group PLC, Oceaneering International, Inc., Prysmian Group, Saipem, Schlumberger Limited, Tenaris, and VALLOUREC |

| Additional Attributes | Dollar sales by component type (umbilicals, risers, flowlines) and water depth range (0–500m, 500–1000m) are key metrics. Trends include rising demand for cost-efficient shallow water oil and gas projects, growth in subsea infrastructure installations, and preference for modular solutions. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global shallow depth SURF market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the shallow depth SURF market is projected to reach USD 5.9 billion by 2035.

The shallow depth SURF market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in shallow depth SURF market are riser, umbilicals, scr, flexible, others and flowline.

In terms of , segment to command 0.0% share in the shallow depth SURF market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Depth Filtration Market Size, Growth, and Forecast 2025 to 2035

Depth Sensing Market Trends - Growth & Forecast 2025 to 2035

Deep Depth Subsea Umbilicals, Risers and Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Multi Depth Corrugated Box Market Size and Share Forecast Outlook 2025 to 2035

Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Surface Water Sports Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Service Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Forecast and Outlook 2025 to 2035

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Market Size and Share Forecast Outlook 2025 to 2035

Surface Mount Technology Market Size and Share Forecast Outlook 2025 to 2035

Surfing Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Disinfectant Chemicals Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA