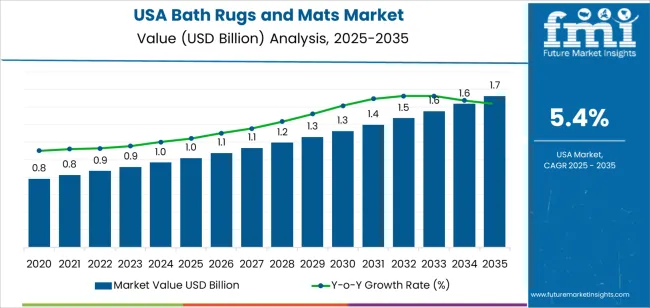

Bath rugs and mats demand in the USA reaches USD 1.0 billion in 2025 and is expected to grow to USD 1.7 billion by 2035 at a CAGR of 5.4%. Early momentum is tied to home renovation cycles, steady housing turnover, and replacement-driven purchases rather than expansion of first-time buyers. Sales are closely linked to bathroom remodeling activity, short-term rental turnover, and seasonal retail refresh programs. Cotton and microfiber constructions dominate unit volumes due to absorbency and ease of laundering, while anti-slip backing remains a primary purchase criterion across mass retail. Growth in this phase is anchored in big-box retail, private label programs, and expanding online home décor assortments.

After 2030, growth becomes more design and channel influenced than volume driven. Demand rises from about USD 1.3 billion in 2030 toward USD 1.7 billion by 2035 as consumers prioritize coordinated bath collections, textured surfaces, and faster-drying materials. Online-first home brands and marketplace platforms expand assortment depth, supporting higher average selling prices through bundled bath sets. Hospitality refurbishment cycles contribute incremental demand through hotels, short-term rentals, and healthcare facilities. Material development shifts toward quick-dry yarns, recycled fibers, and improved latex or TPR backing for durability. Value expansion in this phase is shaped by branding, packaging presentation, and compatibility with broader bathroom décor themes rather than basic functional demand alone.

Bath rugs and mats occupy a hybrid space between functional home textiles and decorative interior accents, which gives their demand curve a stable base with incremental lifestyle-driven uplift. Demand in USA increases from USD 1.0 billion in 2025 to USD 1.1 billion by 2030, adding USD 0.1 billion in absolute value. This phase reflects steady household replacement cycles, consistent residential remodeling activity, and stable demand from multi-unit housing and hospitality refurbishments. Product upgrades during this period center on anti-slip backings, quick-dry fibers, and coordinated bathroom set collections rather than sharp design shifts. Growth remains structurally controlled, supported by routine consumption rather than discretionary spikes.

From 2030 to 2035, the market expands from USD 1.1 billion to USD 1.7 billion, adding USD 0.6 billion in the second half of the decade. This back weighted acceleration reflects higher spending on coordinated home décor, rising penetration of premium microfiber and memory-foam mats, and increasing influence of direct-to-consumer home textile brands. Value per unit rises as customization, color theming, and performance finishes become more common across mass retail and online channels. As bathrooms evolve into higher-value personal wellness spaces, bath rugs and mats shift from low-cost accessories to integrated interior elements, strengthening long-term demand growth.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.0 billion |

| Forecast Value (2035) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

Demand for bath rugs and mats in the USA grew over decades as home construction, bathroom renovations, and interior décor trends expanded. Homeowners often include bath rugs and mats to combine comfort, safety, and stylistic elements in bathrooms. As housing stock aged and bathrooms were updated during remodel cycles, demand surged among both new buyers and renovators seeking soft flooring, water absorption, and slip-resistant surfaces. Retail channels from home goods stores to online marketplaces offered wide variety across price bands, enabling broad consumer access. Seasonal sales, home upgrades, and first-time home purchases kept steady demand cycles across income segments.

Going forward, shifts in consumer behaviour and lifestyle preferences will influence how bath rugs and mats are demanded rather than raw volume growth. Increasing focus on home ambience and wellness may drive purchases of higher-quality, aesthetic rugs with better texture, water absorption, and design appeal. Multiperson and multi-generational households may favour rugs with durability and easy cleaning. On the other hand, trends toward minimalism, smaller living spaces, or water-efficient bathroom designs may reduce demand for heavy textiles. Competition from alternative floor coverings such as quick-dry mats, antimicrobial mats, or non-textile floor solutions could also pressure traditional rug demand. Overall, the segment will likely sustain stable demand but shift toward quality, design, and functionality rather than sheer volume growth.

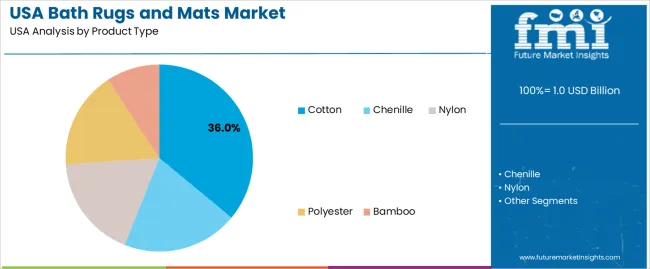

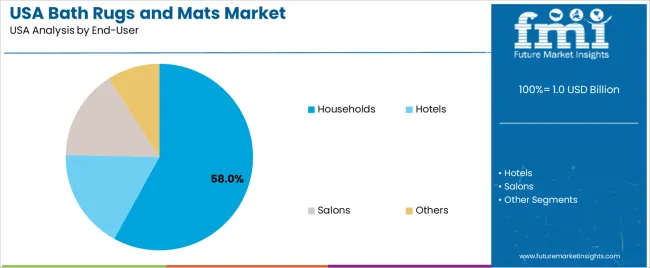

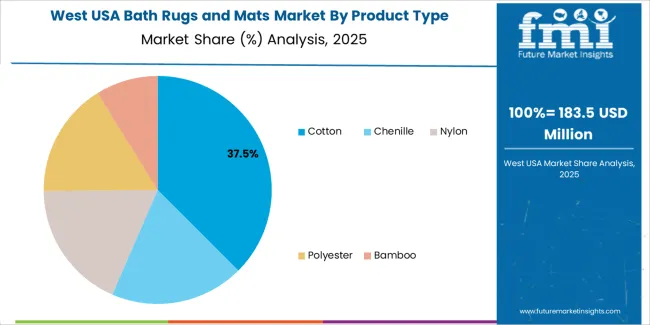

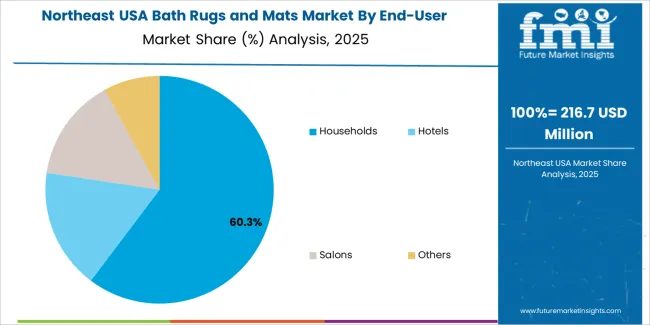

The demand for bath rugs and mats in the USA is structured by product type and end user. Cotton accounts for 36% of total demand, followed by chenille, nylon, polyester, and bamboo used across different comfort and durability segments. By end user, households represent 58.0% of total consumption, followed by hotels, salons, and other commercial users. Demand behavior is shaped by moisture absorption performance, drying time, slip resistance needs, ease of cleaning, and interior styling preferences. These segments reflect how material comfort requirements and USAge intensity define purchasing decisions across residential bathrooms and commercial washroom environments in the USA.

Cotton accounts for 36% of total bath rug and mat demand in the USA due to its high moisture absorption, soft surface texture, and suitability for frequent household use. Cotton fibers absorb water quickly after bathing, which reduces floor wetness and improves safety by limiting slip risks. The soft hand feel of cotton enhances underfoot comfort, which remains a key purchase driver for residential bathrooms. Cotton rugs also perform well under repeated washing cycles, maintaining texture and color stability when processed under standard home laundry conditions.

Cotton further benefits from wide design availability across colors, pile heights, and weaving styles, which supports adoption across diverse interior themes. Domestic and imported cotton supply remains stable, which supports consistent product availability across retail channels. Anti slip backing treatments have improved safety performance without altering fabric softness. These comfort, absorbency, and design flexibility advantages sustain cotton as the leading product type in the USA bath rug and mat demand structure.

Households account for 58.0% of total bath rug and mat demand in the USA due to consistent replacement cycles and high USAge frequency across residential bathrooms. Bath rugs are treated as hygiene related furnishings that require periodic replacement due to moisture exposure, detergent wear, and surface matting. Most homes use multiple bath mats across primary bathrooms, guest bathrooms, and shower areas, which expands volume consumption at the household level. Seasonal décor refresh cycles also contribute to repeat purchasing behavior.

Household buyers prioritize comfort, safety, and ease of maintenance over industrial durability. Online retail and home goods chains provide wide access to affordable multi pack options, which increases purchase frequency. Washing machine compatibility and fast drying performance also influence residential selection. These hygiene routines, multi bathroom USAge patterns, and retail accessibility factors position households as the dominant end user segment for bath rugs and mats in the USA.

Bath rugs and mats in the USA are purchased first for slip prevention and moisture control rather than visual styling. Wet bathroom floors remain a leading cause of household falls, especially among seniors and young children. This safety function drives consistent baseline demand across households regardless of income level. Absorbency, backing grip, and floor adhesion matter more than pattern or brand in many buying decisions. Rental housing, assisted living facilities, and short-term accommodations amplify this safety-driven replacement cycle. These risk-control priorities anchor bath mats as functional safety products within everyday home maintenance.

High residential mobility in the USA directly affects bath rug and mat demand. Apartment turnover, college housing cycles, military relocation, and short-term rental resets all trigger fresh bath textile purchases. Property managers often replace bathroom floor textiles between tenants for hygiene appearance standards. Urban multi-unit living also creates higher humidity and moisture accumulation, elevating mildew risk and accelerating discard rates. Shared bathrooms in dorms and large households further compress lifespan. These occupancy-driven refresh cycles create steady background replacement demand that operates independently from broader home decor spending patterns.

Bath rugs in the USA are exposed to aggressive laundering routines involving hot water, heavy detergents, and frequent tumble drying. Low-cost latex and rubber backings degrade quickly under this stress, driving early replacement. Price sensitivity remains high because many buyers view bath mats as semi-disposable items rather than durable goods. Shrinkage, fiber shedding, and curl-up edges reduce USAble life even when the upper fabric remains intact. These washing and perception dynamics limit premiumization and sustain high unit turnover in the entry and mid-price product tiers.

Buyer expectations for bath rugs and mats in the USA increasingly center on moisture behavior rather than appearance. Quick-dry microfiber, diatomaceous stone surfaces, and structured loop weaves gain traction for faster evaporation and odor control. Low-profile designs that clear door swings and avoid edge curling influence repeat purchases. Anti-microbial fiber treatments are favored in humid regions. Color selection now emphasizes stain concealment and bleach tolerance over coordinated décor themes. These shifts show the category moving toward performance-driven bathroom floor management rather than soft furnishing aesthetics.

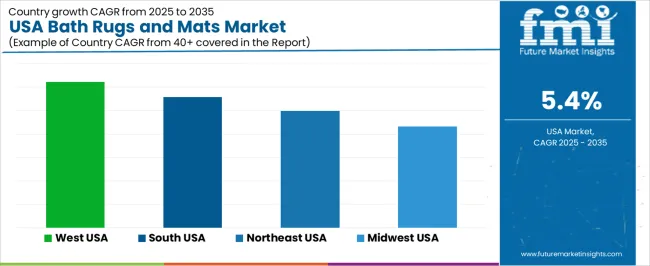

| Region | CAGR (%) |

|---|---|

| West | 6.2% |

| South | 5.6% |

| Northeast | 5.0% |

| Midwest | 4.3% |

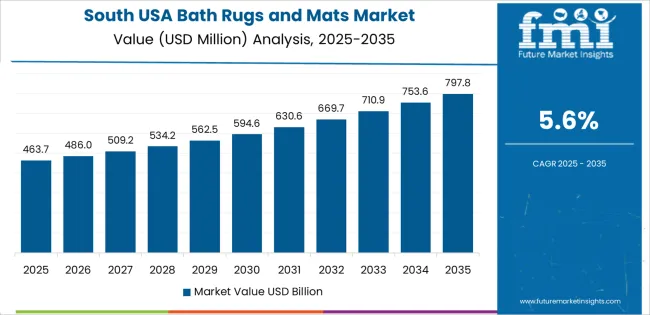

The demand for bath rugs and mats in the USA shows consistent regional growth, led by the West at a 6.2% CAGR. Growth in this region is supported by strong residential renovation activity, higher spending on home furnishings, and steady demand from hospitality and short term rental properties. The South follows at 5.6%, driven by housing expansion, population growth, and rising demand for affordable home textile products. The Northeast records 5.0% growth, supported by replacement demand from urban households, hotels, and institutional buyers. The Midwest shows comparatively moderate growth at 4.3%, reflecting stable housing activity, longer product replacement cycles, and more price sensitive consumer purchasing patterns.

Expansion in the West reflects a CAGR of 6.2% through 2035 for bath rug and mat demand, supported by strong residential renovation activity, premium home decor purchases, and steady hospitality sector upgrades. Coastal urban housing shows higher replacement frequency tied to short term rental turnover. Design focused collections gain stronger traction across lifestyle oriented consumers. Online retail platforms continue to widen category access for premium and mid range products. Demand remains decor and USAge driven, with moisture resistance, quick drying materials, and visual styling guiding purchasing behavior across both residential and commercial bathroom furnishing applications.

The South advances at a CAGR of 5.6% through 2035 for bath rug and mat demand, driven by suburban housing growth, higher household formation, and rising hospitality development. Warm climate conditions support year round bathroom linen USAge and higher wash cycles. Value oriented product ranges dominate sales through large format home goods retailers. New home construction supports steady first fit purchases for family households. Demand remains volume driven rather than design led, with durable materials and easy maintenance guiding consistent purchasing across mass market residential and lodging segments.

The Northeast records a CAGR of 5.0% through 2035 for bath rug and mat demand, shaped by compact urban housing, strong seasonal replacement patterns, and stable hotel refurbishment activity. Cold winters increase use of thicker and absorbent floor coverings. High share of rented housing supports predictable replacement cycles across shared bathrooms. Department stores and specialty home furnishing retailers remain major distribution channels. Demand remains replacement led rather than expansion driven, with purchasing guided by seasonal climate conditions, rental turnover, and periodic hospitality renovation schedules.

The Midwest expands at a CAGR of 4.3% through 2035 for bath rug and mat demand, supported by stable household formation, family oriented communities, and steady brick and mortar retail presence. Practical buying preferences favor durability, slip resistance, and easy wash features. Seasonal climate variation supports moderate replacement aligned with home maintenance cycles. Independent retailers and regional home goods chains dominate distribution. Demand remains necessity driven and predictable, guided by household budget planning, slower residential mobility, and consistent bathroom furnishing needs across suburban and semi rural housing markets.

Demand for bath rugs and mats in the USA is growing as homeowners place greater emphasis on home comfort, hygiene, and bathroom aesthetics. Increased focus on home renovation and interior design supports demand for soft, stylish, and absorbent mats that improve bathroom comfort and safety. Growing consumer preference for products that enhance daily routines, combined with rising disposable incomes and frequent home upgrading cycles, encourages replacement and upgrade of existing bath linens. Demand also rises from rental housing turnover and vacation rental refurbishment, which create recurring needs for mats that balance durability, ease of cleaning, and visual appeal.

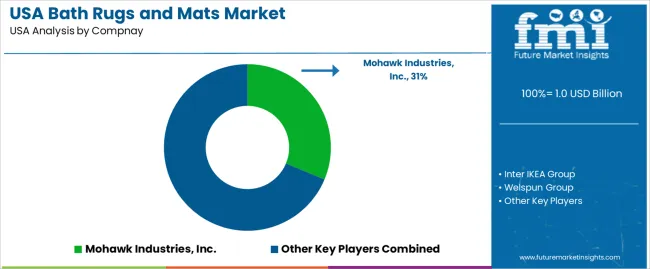

Leading suppliers influencing this market include Mohawk Industries, Inc., Inter IKEA Group, Welspun Group, Springs Global USA, Inc., and Trident Group. Mohawk Industries supplies a wide range of rugs and mats across mass market and premium segments. Inter IKEA Group offers design oriented and affordable bath mats appealing to budget conscious consumers. Welspun and Springs Global provide soft, absorbent mats combining comfort and durability. Trident Group serves both retail and institutional buyers, offering bath mats suited for home, hospitality, and lodging sectors. These firms shape the market by balancing design, quality, price, and distribution reach, meeting diverse consumer needs across the USA.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Cotton, Chenille, Nylon, Polyester, Bamboo |

| End User | Households, Hotels, Salons, Others |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Mohawk Industries, Inc., Inter IKEA Group, Welspun Group, Springs Global USA, Inc., Trident Group |

| Additional Attributes | Dollar by sales by product type, Dollar by sales by end user, Dollar by sales by region, Regional CAGR, Replacement-driven purchasing, Home renovation influence, Hospitality refurbishment contribution, Online and retail channel penetration, Material innovation impact, Safety and anti-slip features |

The demand for bath rugs and mats in USA is estimated to be valued at USD 1.0 billion in 2025.

The market size for the bath rugs and mats in USA is projected to reach USD 1.7 billion by 2035.

The demand for bath rugs and mats in USA is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in bath rugs and mats in USA are cotton, chenille, nylon, polyester and bamboo.

In terms of end-user, households segment is expected to command 58.0% share in the bath rugs and mats in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bath Rugs & Mats Market Growth - Trends & Industry Outlook 2025 to 2035

Demand for Bathroom Worktops in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Preoperative Bathing Solution in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Bath Toy Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Furniture Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Bath Linen and Accessories Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Cabinets Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA