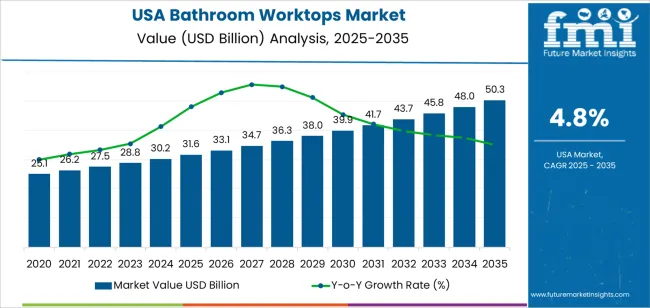

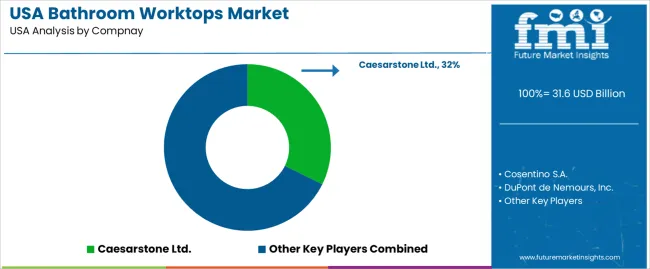

Bathroom worktop demand in the USA is valued at USD 31.6 billion in 2025 and is forecast to reach USD 50.3 billion by 2035 at a CAGR of 4.8%. Growth in the first half of the outlook period is shaped by steady residential remodeling activity, housing turnover, and replacement cycles rather than new home construction alone. Master bathroom upgrades and multi-bathroom homes drive higher per-household installation volumes. Engineered stone, quartz, and solid surface materials account for a large share of early demand due to durability, stain resistance, and design consistency. Retail demand is anchored in home improvement chains, while builder-grade projects support baseline volumes through standardized specifications in suburban housing developments.

After 2030, value expansion becomes more design-driven than purely volume-led. Demand rises from about USD 39.9 billion in 2030 toward USD 50.3 billion by 2035 as consumers favor thicker profiles, integrated sinks, and seamless backsplash designs in both premium and mid-range homes. Aging housing stock across urban centers supports sustained retrofit demand, while multi-family developments increase specification-driven procurement. Commercial applications in hotels, healthcare facilities, and office refurbishments add incremental value through higher durability requirements. Supplier competition centers on surface finish consistency, chip resistance, and moisture performance. Long-term growth reflects a mix of aesthetic-driven replacement, higher material value per installation, and continued reliance on centralized retail and contractor distribution networks across the USA.

Bathroom worktops track residential renovation cycles and new housing starts more directly than most interior furnishing categories, making their demand closely tied to construction economics and home equity-driven spending. Demand in USA increases from USD 31.6 billion in 2025 to USD 33.1 billion by 2026 and USD 34.7 billion by 2027, reaching USD 39.9 billion by 2030 and adding USD 8.3 billion from the 2025 base. This phase reflects steady remodeling activity, replacement of laminate with engineered stone surfaces, and higher installation rates in multi-family housing. Growth is supported by upgrades toward quartz, solid surface composites, and prefabricated vanity tops that balance cost, durability, and aesthetic consistency.

From 2030 to 2035, the market expands from USD 39.9 billion to USD 50.3 billion, adding USD 10.4 billion in the second half of the decade. This back weighted acceleration reflects rising square footage per bathroom in single-family homes, higher renovation frequency in aging housing stock, and deeper penetration of premium materials such as natural stone blends and textured engineered surfaces. Value per installation increases with integrated backsplashes, custom edge profiles, and moisture-resistant finishes. As bathrooms continue to evolve into high-value wellness and comfort spaces, worktops shift from basic fixtures toward design-centered investment components, strengthening long-term demand momentum.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 31.6 billion |

| Forecast Value (2035) | USD 50.3 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

Demand for bathroom worktops in the USA has grown with rising home renovation and new housing activity. As homeowners invest in bathroom upgrades, the installation or replacement of wash-basin counters, vanity tops, and integrated sink surfaces increased. Developers and contractors responded by offering a variety of materials natural stone, engineered composites, laminates, and solid-surface worktops to cater to different budgets and aesthetic preferences. Larger bathrooms in suburban homes and frequent remodeling cycles boosted demand for worktops that combine durability, water resistance, and design appeal. Over time, as bathrooms became more than utilitarian spaces and contributed to home value, the demand base expanded beyond newbuilds to include remodelers and second-home owners.

Looking ahead, future demand will be shaped by evolving consumer priorities in design, functionality, and sustainability rather than growth in housing volume alone. Increased interest in spa-like bathrooms, built-in storage solutions, and seamless vanity design will push demand for custom-cut worktops and integrated surface solutions. Advances in composite materials, lower-maintenance surfaces, and cost-effective manufacturing will attract buyers seeking quality without overpaying. On the other hand, economic pressures, shifts toward minimalistic or compact housing, and demand for low-cost renovations could moderate premium worktop uptake. The segment will likely stabilize around replacement cycles and aesthetic-upgrade demand rather than continuous expansion driven by new housing starts.

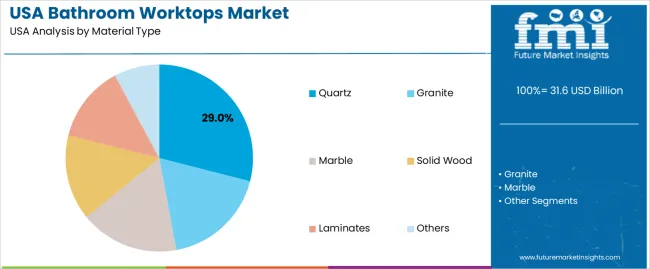

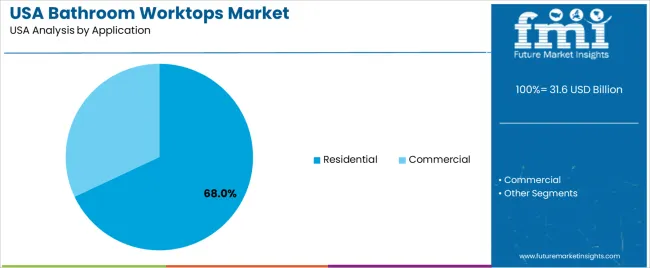

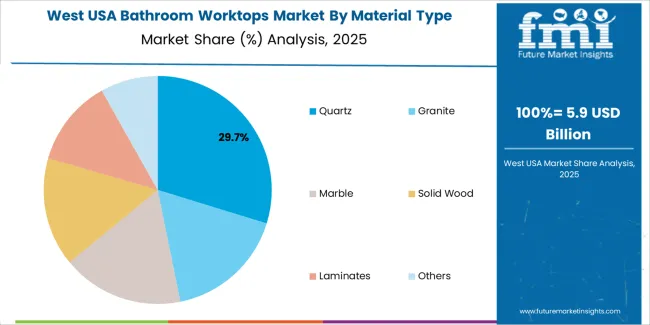

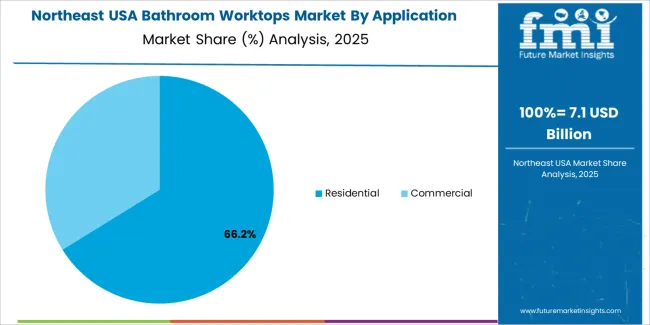

The demand for bathroom worktops in the USA is structured by material type and application. Quartz accounts for 29% of total demand, followed by granite, marble, solid wood, laminates, and other composite surfaces. By application, residential use represents 68.0% of total consumption, while commercial installations account for the remaining share. Demand behavior is shaped by moisture resistance, surface durability, hygiene requirements, visual consistency, and remodeling activity. These segments reflect how material performance characteristics and end use priorities influence worktop selection across private homes, hospitality properties, healthcare facilities, and retail washroom installations in the USA.

Quartz accounts for 29% of total bathroom worktop demand in the USA due to its strong moisture resistance, consistent surface appearance, and low maintenance requirements. Engineered quartz surfaces are non porous, which limits water absorption, stain penetration, and bacterial growth in wet bathroom environments. This performance advantage supports widespread use in residential vanities, master bathrooms, and guest washrooms where hygiene and long term surface integrity are critical. Quartz also delivers uniform color and pattern control, which appeals to homeowners seeking consistent design across multiple rooms.

Quartz worktops also offer high resistance to chipping, scratching, and surface wear under daily use conditions. Fabrication processes allow precise edge profiling and custom sizing for modern vanity designs. Availability through national home improvement chains and regional fabricators supports accessible distribution. These durability, hygiene performance, and aesthetic consistency factors sustain quartz as the leading material segment in the USA bathroom worktop demand structure.

Residential applications account for 68.0% of total bathroom worktop demand in the USA due to sustained new housing construction and high levels of renovation activity. Homeowners regularly replace bathroom surfaces as part of remodeling projects focused on improving functionality, aesthetics, and property value. Bathrooms rank among the most frequently upgraded spaces in residential dwellings, which directly supports steady worktop replacement cycles across single family homes, apartments, and condominiums.

Residential buyers prioritize durability, water resistance, and visual appeal alongside price accessibility. Growth in multi bathroom homes further increases total residential worktop volume per property. Retail driven remodel programs, contractor installations, and do it yourself upgrade trends all reinforce residential dominance. Financing programs and home equity driven renovations also support continued surface replacement activity. These housing turnover, renovation intensity, and consumer driven design factors position residential use as the dominant application segment for bathroom worktops in the USA.

Bathroom worktops in the USA are no longer treated as secondary surfaces but as anchor elements in renovation planning. Homeowners now prioritize durability, stain resistance, and visual continuity over purely decorative upgrades. Aging housing stock drives frequent bathroom refits focused on moisture resistance and long-term maintenance reduction. Multi-bathroom homes increase total surface demand per household during remodel cycles. Real estate resale strategies also influence material selection, as updated worktops are used to signal functional modernization. This positions bathroom worktops as infrastructure components tied directly to property value perception rather than accessory fixtures.

Much of the USA housing inventory was built decades ago with laminate or tiled bathroom surfaces that now show water damage, delamination, and seam failure. Home equity-backed renovations and insurance-funded repairs accelerate worktop replacement after plumbing leaks and flood events. Storm-prone regions contribute episodic demand spikes following water intrusion claims. Condominium retrofits further drive standardized surface upgrades across multiple units at once. These financing and damage-driven triggers create demand patterns that are event-based rather than tied only to lifestyle spending or home décor trends.

Bathroom worktop demand in the USA is tightly constrained by installed cost rather than product price alone. Stone, quartz, and solid-surface materials require fabrication, templating, and professional installation, which often exceed the material cost itself. Weight limitations in older floor systems restrict slab thickness and material choice. Lead times from fabricators affect project scheduling and contractor workflows. Budget-sensitive homeowners opt for prefabricated tops to avoid customization cost. These structural installation and labor economics shape real demand more than design preference alone.

USA buyers increasingly select bathroom worktops based on seam elimination and water containment rather than visual texture. Integrated sinks reduce leak points and mold formation in high-use family bathrooms. Non-porous surfaces gain preference for hygiene control and reduced cleaning labor. Shallow backsplashes and one-piece vanity tops simplify wall interfaces in rental and multi-family units. Light-reflective finishes improve perceived space in compact urban bathrooms. These functional design shifts show that bathroom worktop demand is now governed by moisture engineering and cleaning economics rather than surface aesthetics alone.

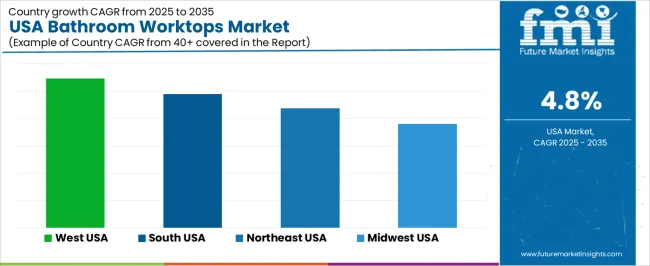

| Region | CAGR (%) |

|---|---|

| West | 5.5% |

| South | 4.9% |

| Northeast | 4.4% |

| Midwest | 3.8% |

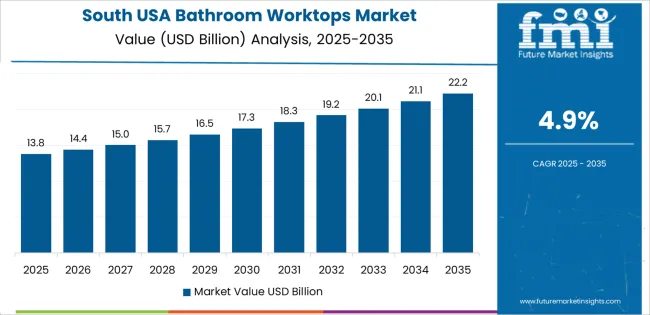

The demand for bathroom worktops in the USA is growing steadily across all regions, with the West leading at a 5.5% CAGR. Growth in this region is supported by strong residential renovation activity, higher spending on premium bathroom interiors, and steady demand from hospitality and short term rental developments. The South follows at 4.9%, driven by population growth, expansion in single family housing, and rising demand for cost effective remodeling solutions. The Northeast records 4.4% growth, supported by urban apartment renovations, replacement demand, and institutional refurbishment projects. The Midwest shows comparatively moderate growth at 3.8%, reflecting stable housing activity, slower renovation cycles, and more price sensitive purchasing behavior in home improvement markets.

Expansion in the West reflects a CAGR of 5.5% through 2035 for bathroom worktop demand, supported by strong residential renovation activity, premium condominium development, and steady hospitality refurbishment across coastal metros. Homeowners favor quartz, engineered stone, and solid surface materials for durability and modern aesthetics. High second home ownership also contributes to recurring replacement cycles. Interior designers influence material upgrades toward moisture resistance and integrated sink formats. Demand remains renovation led rather than new build led, with consistent purchasing tied to lifestyle driven remodeling and short term rental property upgrades.

The South advances at a CAGR of 4.9% through 2035 for bathroom worktop demand, driven by suburban housing expansion, large scale homebuilding, and growing hotel construction in tourism focused cities. New single family homes contribute significant first fit installation volumes. Cultured marble and laminate surfaces remain popular due to cost efficiency. Warm climate supports steady remodeling tied to property resale cycles. Demand stays volume driven rather than design driven, with builders and contractors guiding material selection based on installation speed, pricing stability, and broad availability from regional fabricators.

The Northeast records a CAGR of 4.4% through 2035 for bathroom worktop demand, shaped by dense urban housing stock, apartment renovations, and stable refurbishment cycles across older residential properties. Limited bathroom space favors compact vanity designs with integrated tops. Stone composites and porcelain slabs gain traction for durability. Cold climate moisture management influences material choice toward low porosity surfaces. Demand remains replacement led rather than new build driven, with predictable purchasing tied to tenant turnover, cooperative housing upgrades, and periodic hospitality modernization across metropolitan markets.

The Midwest expands at a CAGR of 3.8% through 2035 for bathroom worktop demand, supported by stable household formation, practical remodeling behavior, and steady independent contractor activity. Homeowners prioritize durability, ease of maintenance, and value pricing over premium finishes. Solid surface and laminate materials dominate demand. Remodeling activity follows long ownership cycles rather than frequent upgrades. Regional fabricators and home improvement retailers anchor distribution. Demand remains necessity driven and predictable, aligned with slower housing mobility and budget conscious renovation patterns across suburban and semi-rural communities.

Demand for bathroom worktops in the USA is rising as homeowners increasingly invest in home renovation, modernisation, and resale value upgrades. Growth in new construction and remodelling of bathrooms including redesigns aimed at aesthetic upgrade, durability, and functionality supports demand. Consumers favour materials that resist moisture, stains, and wear while delivering a clean, premium look. Rising interest in spa style bathrooms, integrated vanities, and easy maintenance surfaces drives use of engineered stone, quartz, solid surface, and composite worktops. Growth in multi bathroom homes and demand for durable, water resistant surfaces contribute to rising replacement and new installation volumes.

Key companies shaping the bathroom worktop and countertop supply base include Caesarstone Ltd., Cosentino S.A., DuPont de Nemours, Inc., Wilsonart International, and Formica Group. Caesarstone and Cosentino lead in engineered stone and quartz worktops, supplying high end vanity tops and luxury surfaces. DuPont and Wilsonart supply solid surface and laminate based worktops suited for mid range and remodel segments. Formica serves both residential and commercial projects with budget conscious laminate and composite solutions. These suppliers shape the market through broad distribution networks, material variety, and ability to meet diverse consumer needs from premium to economy segments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Material Type | Quartz, Granite, Marble, Solid Wood, Laminates, Others |

| Application | Residential, Commercial |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Caesarstone Ltd., Cosentino S.A., DuPont de Nemours, Inc., Wilsonart International, Formica Group |

| Additional Attributes | Dollar by sales by material type, Dollar by sales by application, Dollar by sales by region, Regional CAGR, Multi-bathroom and retrofit penetration, Residential remodeling influence, Commercial refurbishment impact, Material durability and moisture resistance, Integrated sink and backsplash adoption, Design-led value growth, Distribution through retail and contractor networks |

The demand for bathroom worktops in USA is estimated to be valued at USD 31.6 billion in 2025.

The market size for the bathroom worktops in USA is projected to reach USD 50.3 billion by 2035.

The demand for bathroom worktops in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in bathroom worktops in USA are quartz, granite, marble, solid wood, laminates and others.

In terms of application, residential segment is expected to command 68.0% share in the bathroom worktops in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bathroom Worktops Market Analysis - Trends & Forecast 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Furniture Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Cabinets Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Remodeling Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Bathroom Mirror Wiper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA