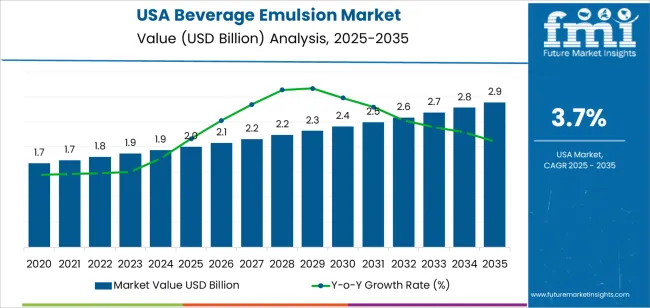

The demand for beverage emulsion in the USA is expected to grow from USD 2.0 billion in 2025 to USD 2.9 billion by 2035, reflecting a CAGR of 3.7%. The increasing demand for flavored beverages, the rise of functional drinks, and the growing trend of health-conscious consumption are key drivers of this growth. Beverage emulsions, which help deliver consistent flavor and texture across various drinks, are becoming an essential ingredient in the development of juices, energy drinks, smoothies, and dairy products. As consumers continue to seek convenient and flavorful drink options, the demand for beverage emulsions is expected to rise steadily.

Innovations in beverage formulations, such as incorporating natural and organic ingredients, are contributing to the growth of beverage emulsions. As consumers become more aware of the ingredients in their food and drinks, the preference for clean-label products is increasing. This shift towards transparency and healthier options is driving beverage companies to explore new emulsification techniques that allow them to create functional, nutrient-rich beverages without compromising on flavor. The growing popularity of non-alcoholic beverages, as well as the expansion of the plant-based beverage segment, will further boost the demand for beverage emulsions in the USA.

From 2025 to 2030, the demand for beverage emulsions is expected to grow from USD 2.0 billion to USD 2.5 billion, adding USD 0.5 billion in value. This phase will contribute significantly to the overall expansion, driven by the increasing consumption of flavored and functional beverages. As beverage companies focus on enhancing the sensory experience of their products, the demand for emulsions will rise. The trend towards healthier, functional drinks, including those with added vitamins, minerals, and probiotics, will support this growth. The shift towards more natural ingredients and the growing popularity of plant-based beverages will drive the need for emulsification solutions that meet the demands of clean-label products.

From 2030 to 2035, the demand for beverage emulsions will grow from USD 2.5 billion to USD 2.9 billion, contributing USD 0.4 billion in value. While growth continues, it will slow down as the sector matures. The demand will remain strong, fueled by the continued expansion of the functional beverage and plant-based beverage categories. However, the rate of increase will be more gradual due to industry saturation and a more stable demand for beverage emulsions. Product innovation will continue, but the focus will shift towards optimizing formulations and improving existing products. Despite the slower pace of growth, the ongoing demand for clean-label and functional beverages will ensure continued adoption of beverage emulsions across various beverage categories.

| Metric | Value |

|---|---|

| Demand for Beverage Emulsion in USA Value (2025) | USD 2.0 billion |

| Demand for Beverage Emulsion in USA Forecast Value (2035) | USD 2.9 billion |

| Demand for Beverage Emulsion in USA Forecast CAGR (2025-2035) | 3.7% |

The demand for beverage emulsion in the USA is growing as the beverage industry continues to innovate with new flavors, functional drinks, and health-oriented products. Beverage emulsions, which are used to combine ingredients that do not naturally mix (like oil and water), are essential for creating stable, homogenous products in beverages such as flavored waters, energy drinks, smoothies, and alcoholic beverages. As consumers seek more complex flavors and functional benefits, the demand for emulsions that can enhance taste, texture, and nutritional value is on the rise.

A key driver of this growth is the increasing consumer preference for beverages that offer both sensory appeal and functional benefits, such as energy-boosting ingredients, electrolytes, vitamins, and probiotics. Beverage emulsions help incorporate ingredients like oils, flavors, and other nutrients that are essential for these functional drinks. With the popularity of beverages that support health and wellness, including weight management and hydration, emulsions are becoming critical to meeting the diverse needs of the industry.

The shift toward more natural and clean-label products is contributing to the demand for beverage emulsions. As consumers become more conscious of ingredient transparency and sustainability, there is an increasing focus on using natural, safe emulsifiers in beverages. This trend is pushing beverage manufacturers to develop emulsions that meet both consumer preferences for healthier ingredients and the need for product stability and shelf life. As the industry for functional and innovative beverages continues to grow, the demand for beverage emulsion in the USA is expected to rise steadily through 2035.

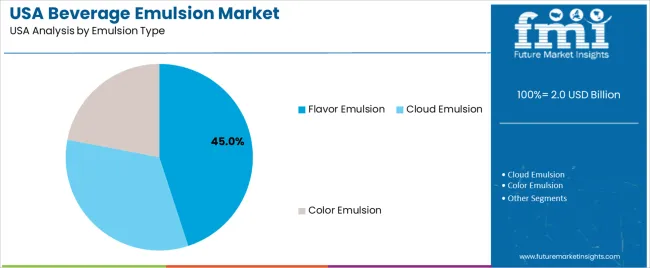

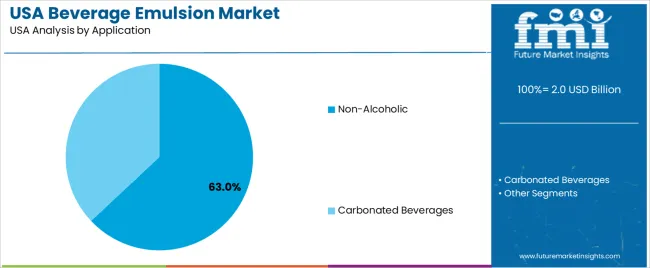

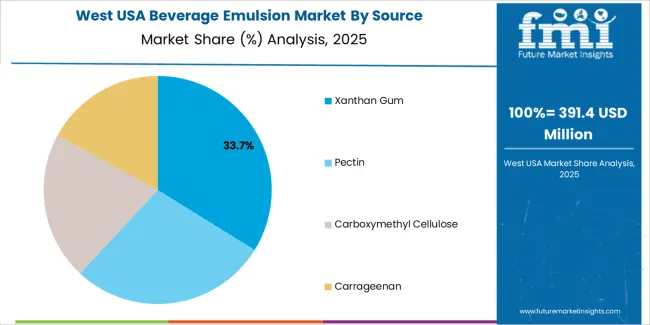

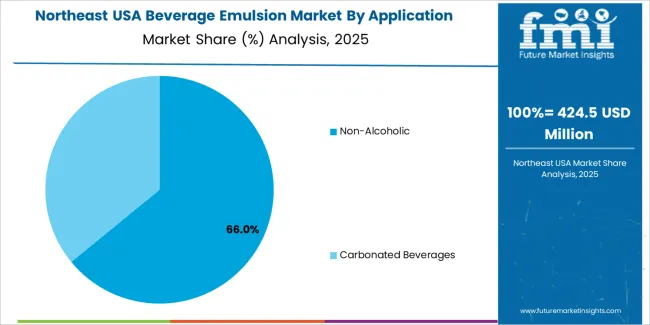

Demand for beverage emulsion in the USA is segmented by emulsion type, application, source, and region. By emulsion type, demand is divided into flavor emulsion, cloud emulsion, and color emulsion, with flavor emulsion holding the largest share at 45%. The demand is also segmented by application, including non-alcoholic and carbonated beverages, with non-alcoholic beverages leading at 63%. In terms of source, xanthan gum, pectin, carboxymethyl cellulose, and carrageenan are the primary ingredients used in emulsions. Regionally, demand is distributed across West USA, South USA, Northeast USA, and Midwest USA.

Flavor emulsion accounts for 45% of the demand for beverage emulsion in the USA. The dominant share is primarily driven by the increasing need for flavor enhancement in both non-alcoholic and carbonated beverages. As consumer preferences for diverse and innovative flavors grow, flavor emulsions provide a consistent and stable means of incorporating concentrated flavors into liquid products. These emulsions enable a more intense, uniform distribution of flavor throughout the beverage, enhancing taste and mouthfeel. Flavor emulsions are essential in products like fruit juices, energy drinks, and flavored water, where bold and long-lasting flavors are key to consumer satisfaction. The growth of the beverage industry, coupled with the expanding variety of flavored products, ensures that flavor emulsions remain the leading type in the industry, meeting the rising demand for new and exciting beverage options.

Non-alcoholic beverages account for 63% of the demand for beverage emulsion in the USA. This segment’s dominance is driven by the widespread consumption of beverages like fruit juices, bottled water, soft drinks, and flavored teas. Non-alcoholic beverages are a growing category, with consumers increasingly seeking refreshing, flavorful, and functional drink options. Emulsions play a key role in enhancing flavor, cloudiness, and color, improving the overall sensory experience of these drinks. The demand for healthy and innovative non-alcoholic beverages, such as low-sugar, vitamin-enriched, or plant-based options, further supports the need for beverage emulsions. As consumers seek variety in their drink choices, emulsions help provide stable and appealing textures and flavors in non-alcoholic beverages. The increasing focus on wellness and hydration is also contributing to the growth of non-alcoholic beverages, further fueling the demand for emulsions.

Demand for beverage emulsion in the USA is growing as beverage producers increasingly turn to emulsifiers to ensure consistency in flavor, texture, color, and stability in a wide variety of drinks. These emulsions enable water-insoluble ingredients like oils, vitamins, botanicals, and flavor compounds to remain evenly dispersed in water-based beverages such as juices, flavored waters, dairy alternatives, and functional drinks. The demand for ready-to-drink (RTD) beverages and functional drinks, as well as the popularity of plant-based, low-sugar, and novel flavor options, is boosting the use of beverage emulsions. As beverage formulations become more diverse, emulsions play a key role in maintaining the desired quality, appearance, and shelf life of drinks. Formulation complexity and regulatory pressures on additives may pose challenges to broader adoption.

Why is Demand for Beverage Emulsion Growing in USA?

Demand is rising as more beverage producers look for ways to create drinks that maintain a consistent taste, texture, and visual appeal over time. The growing popularity of functional beverages, such as those containing added nutrients, vitamins, or botanicals, is a significant driver for emulsifiers. These ingredients often do not mix easily with water, requiring emulsions to ensure stability and prevent separation. The shift towards plant-based beverages, low-calorie formulations, and novel flavor profiles further increases the need for emulsifiers. The trend toward healthier and more convenient beverage options are fueling the demand for emulsified drinks that maintain quality while offering added nutritional value.

How are Technological & Industry Innovations Driving Beverage Emulsion Demand in USA?

Technological advancements in emulsification techniques and ingredient formulation are driving the demand for beverage emulsions in the USA. Improved emulsifiers, such as those based on natural or plant-derived sources, are gaining popularity as clean-label and non-synthetic alternatives. These innovations help beverage producers create more stable, visually appealing, and palatable products, particularly in functional beverages and plant-based drinks. Advances in processing methods allow for the inclusion of new, complex ingredients like functional oils, proteins, and herbal extracts, which are more effectively integrated into beverages through emulsification. These technological improvements are expanding the range of beverage products that can benefit from emulsions, thus increasing demand.

What are the Key Challenges and Risks That Could Limit Beverage Emulsion Demand in USA?

Despite the growing demand, there are challenges that could limit the broader adoption of beverage emulsions in the USA. One significant hurdle is the complexity of formulating beverages with multiple functional ingredients, such as vitamins, oils, or botanical extracts, which can affect stability, taste, and appearance. Regulatory restrictions and growing demand for clean-label products may limit the use of certain emulsifiers, especially synthetic ones, requiring the development of more expensive natural alternatives. Consumer preferences for minimal additives or simple ingredient lists may limit the appeal of emulsified beverages. The cost of production and formulation, particularly for premium or specialized emulsifiers, could also restrict their adoption by smaller producers or price-sensitive industrys.

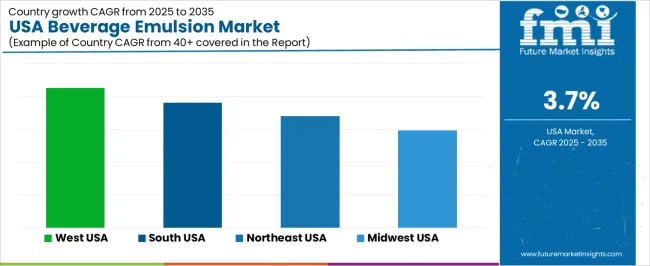

| Region | CAGR (%) |

|---|---|

| West USA | 4.3% |

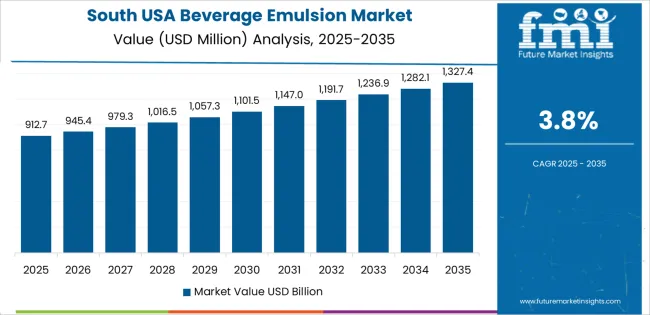

| South USA | 3.8% |

| Northeast USA | 3.4% |

| Midwest USA | 3.0% |

Demand for beverage emulsion in the USA is growing steadily, with West USA leading at a 4.3% CAGR, driven by the region’s strong beverage industry and health-conscious consumer base seeking stable and natural products. South USA follows with a 3.8% CAGR, supported by the region’s increasing production of ready-to-drink beverages and energy drinks, where emulsions are essential for texture and flavor stability. Northeast USA shows a 3.4% CAGR, driven by the region’s demand for innovative, clean-label, and functional drinks, while Midwest USA experiences a 3.0% CAGR, supported by the region’s focus on mass-produced drinks and functional beverages. As demand for healthier, convenient, and functional beverages continues to rise, beverage emulsions will play a key role in maintaining product consistency and quality across the country.

West USA leads the demand for beverage emulsion, growing at a 4.3% CAGR. The region’s strong food and beverage industry, particularly in states like California, Oregon, and Washington, is a key driver of this growth. Beverage emulsions are widely used in the production of flavored drinks, energy beverages, and functional drinks, which are increasingly popular in the West due to the health-conscious consumer base. The demand is further supported by the rise of plant-based, organic, and natural products, with emulsions playing a crucial role in stabilizing ingredients and improving the texture of these beverages. The growing trend of wellness and functional beverages, such as probiotics, detox drinks, and enhanced waters, contributes to the expanding industry for beverage emulsions. As West USA continues to innovate in the beverage industry, demand for emulsions is expected to remain strong.

South USA is experiencing steady demand for beverage emulsion, with a 3.8% CAGR. The region’s growing beverage industry, including soft drinks, fruit juices, and energy beverages, is fueling this growth. Beverage emulsions are crucial for creating stable formulations, particularly in beverages that contain multiple ingredients like oils, flavors, and colorants. The demand for beverage emulsions is further supported by the rising popularity of ready-to-drink beverages, which are convenient for consumers with busy lifestyles. The South’s strong food and beverage manufacturing base, especially in states like Texas and Florida, also contributes to the increasing use of emulsions in mass production. As consumers seek healthier, more functional drinks, emulsions play a vital role in enhancing taste, texture, and consistency in these products. As demand for flavored and functional beverages continues to rise, South USA will see continued growth in the beverage emulsion industry.

Northeast USA is seeing moderate growth in demand for beverage emulsion, with a 3.4% CAGR. The region’s diverse consumer base, particularly in urban centers like New York and Boston, is driving the demand for flavored and functional beverages, where emulsions are essential for ensuring stability and consistency. The growing popularity of organic, plant-based, and health-focused drinks, such as smoothies, plant milks, and energy drinks, is boosting the use of beverage emulsions. Northeast USA’s emphasis on innovation in food and beverage products, as well as the growing demand for premium, natural beverages, contributes to the rise in emulsion use. As more consumers seek natural and sustainable ingredients in their drinks, emulsions are becoming a vital ingredient to maintain product quality. This demand for emulsions is expected to rise steadily as more beverage manufacturers focus on clean-label formulations and functional ingredients.

Midwest USA is experiencing steady demand for beverage emulsion, with a 3.0% CAGR. The region’s large food and beverage manufacturing base, particularly in states like Illinois and Ohio, plays a key role in driving the demand for emulsions. Beverage emulsions are widely used in mass-produced drinks, including sodas, juices, and flavored water, to improve texture, flavor stability, and appearance. The Midwest’s growing interest in functional beverages, including fortified waters and energy drinks, contributes to the rise in demand for beverage emulsions. As the region’s beverage industry continues to innovate with new flavors and formulations, emulsions play a vital role in maintaining product consistency. Although the growth rate in the Midwest is slower than in other regions, steady consumer demand for a variety of flavored and functional drinks ensures a consistent industry for beverage emulsions in the region.

The demand for beverage emulsions in the USA is rising as manufacturers seek to create stable, flavorful, and visually appealing beverages with improved texture and mouthfeel. Beverage emulsions are essential in the formulation of flavored drinks, energy drinks, juices, and alcoholic beverages, enabling the uniform dispersion of ingredients such as oils, flavors, and colorants. As consumer preferences shift towards more complex flavors, healthier alternatives, and clean-label ingredients, the demand for beverage emulsions is growing. The increasing popularity of functional beverages, including low-sugar, fortified, and plant-based drinks, further boosts the need for high-quality emulsions to enhance product stability and consumer appeal.

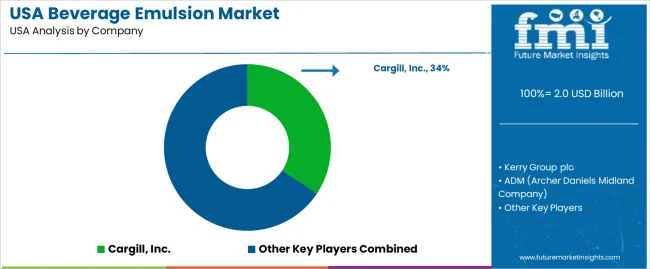

Leading companies in the beverage emulsion industry in the USA include Cargill, Inc., Kerry Group plc, ADM (Archer Daniels Midland Company), Ingredion Incorporated, and Tate & Lyle PLC. Cargill, Inc. leads the industry with a share of 34.3%, providing a wide range of beverage emulsions designed to enhance the flavor, texture, and stability of beverages. Kerry Group plc offers emulsions for various applications, focusing on flavor enhancement and consumer-friendly ingredients. ADM specializes in emulsions that support beverage formulation with clean-label solutions, while Ingredion Incorporated provides emulsions tailored to meet the evolving needs of the beverage industry, including natural and organic solutions. Tate & Lyle PLC offers a variety of emulsions for the beverage sector, focusing on functionality, quality, and sustainability.

Competition in the beverage emulsion industry is driven by factors such as innovation, flavor development, and the demand for cleaner, more sustainable products. Companies compete by offering emulsions that improve beverage texture, prevent ingredient separation, and enhance the sensory experience of the drink. The growing trend toward health-conscious and functional beverages is pushing manufacturers to develop emulsions that cater to dietary needs, such as low-calorie, plant-based, or sugar-free options.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Source | Xanthan Gum, Pectin, Carboxymethyl Cellulose, Carrageenan |

| Application | Non-Alcoholic, Carbonated Beverages |

| Emulsion Type | Flavor Emulsion, Cloud Emulsion, Color Emulsion |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Cargill, Inc., Kerry Group plc, ADM (Archer Daniels Midland Company), Ingredion Incorporated, Tate & Lyle PLC |

| Additional Attributes | Dollar sales by source, application, and emulsion type; regional CAGR and adoption trends; demand trends in beverage emulsions; growth in non-alcoholic and carbonated beverages sectors; technology adoption for emulsification in beverage formulations; vendor offerings including flavor, cloud, and color emulsions; regulatory influences and industry standards |

The demand for beverage emulsion in USA is estimated to be valued at USD 2.0 billion in 2025.

The market size for the beverage emulsion in USA is projected to reach USD 2.9 billion by 2035.

The demand for beverage emulsion in USA is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in beverage emulsion in USA are xanthan gum, pectin, carboxymethyl cellulose and carrageenan.

In terms of application, non-alcoholic segment is expected to command 63.0% share in the beverage emulsion in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Polymer Emulsion Market Report – Trends, Demand & Industry Forecast 2025-2035

USA Non-Alcoholic Malt Beverages Market Insights – Trends, Demand & Growth 2025-2035

Demand for Food & Beverage OEE Software in USA Size and Share Forecast Outlook 2025 to 2035

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Emulsion Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA