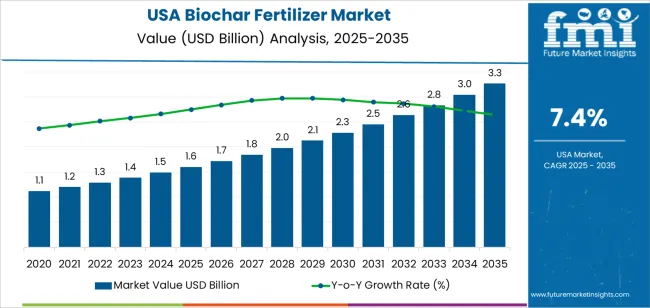

Biochar fertilizer demand in the USA is valued at USD 1.6 billion in 2025 and is projected to reach USD 3.3 billion by 2035 at a CAGR of 7.4%. Early market expansion is shaped by rising adoption in row crops, specialty crops, and pasture management as growers seek long-term soil conditioning rather than short-cycle nutrient response alone. Corn, soybean, and horticulture producers drive much of the early uptake due to biochar’s role in nutrient retention, water holding capacity, and soil structure improvement. Adoption also reflects greater use in carbon-based soil amendment programs supported by regional agronomic trials. Distribution growth is led by blending facilities, soil amendment suppliers, and cooperatives serving the Midwest, California, and Southeast production belts.

After 2030, demand growth in the USA becomes more programmatic and contract based rather than purely discretionary. Market value rises from about USD 2.3 billion in 2030 toward USD 3.3 billion by 2035 as biochar use is embedded into multi-year soil management plans for regenerative farming, land reclamation, and erosion control. Specialty segments such as vineyard soils, orchards, turf, and greenhouse production contribute higher per-acre value than broad-acre crops. Supply chains evolve toward regional pyrolysis hubs using forestry residues, crop waste, and manure feedstocks. Pricing in this phase reflects feedstock availability, transport radius, and certification requirements tied to soil carbon accounting programs rather than commodity fertilizer benchmarks.

Biochar fertilizer demand in USA rises from USD 1.6 billion in 2025 to USD 1.7 billion by 2026 and USD 1.8 billion by 2027, reflecting steady integration into soil conditioning and carbon-enriched nutrient management programs. By 2030, the market reaches USD 2.1 billion, adding USD 0.5 billion from the 2025 base. This phase is shaped by expanding use in row crops, specialty horticulture, and pasture management where growers target moisture retention, nutrient efficiency, and soil structure improvement. Adoption remains closely tied to state-level agricultural programs, renewable biomass availability, and regional pyrolysis capacity, keeping growth controlled and supply-linked rather than speculative.

From 2030 to 2035, the market expands more sharply from USD 2.1 billion to USD 3.3 billion, adding USD 1.2 billion within five years. This back-weighted acceleration reflects wider penetration into large-scale field agriculture, carbon farming programs, and precision nutrient delivery systems. Higher application rates, pelletized biochar blends, and integration with organic and regenerative farming practices raise both volume and value density. As carbon accounting frameworks, soil productivity incentives, and crop resilience strategies converge, biochar fertilizer shifts from a niche soil amendment into a structurally embedded input across diversified USA agricultural production systems.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.6 billion |

| Forecast Value (2035) | USD 3.3 billion |

| Forecast CAGR (2025–2035) | 7.4% |

The biochar fertilizer segment in the USA developed from long term pressures on soil productivity, input efficiency, and environmental compliance. Conventional fertilizer systems improved yields but also contributed to nutrient runoff, soil degradation, and declining organic matter in many cropping regions. Biochar entered as a soil conditioning material rather than a direct nutrient source, valued for its ability to improve porosity, moisture retention, and nutrient holding capacity. Early adoption was concentrated in organic farming, specialty crops, horticulture, and degraded soils where resilience mattered more than short term yield response. Interest expanded as research connected biochar use with improved microbial activity and reduced nutrient leaching across variable soil profiles.

Future expansion will depend on how tightly biochar becomes integrated with regenerative agriculture, carbon accounting, and long term input reduction strategies. Growers evaluating drought risk, irrigation efficiency, and fertilizer cost volatility are giving more weight to soil amendments that deliver multi season benefits. Biochar also gains relevance where climate policy links soil carbon storage with farm level incentives. Barriers remain significant. Production consistency varies by feedstock and process, which complicates performance predictability. Upfront cost limits broad adoption in row crops. Standardization gaps, uneven agronomic data across regions, and uncertainty around classification as fertilizer versus soil amendment will continue to slow large scale penetration despite strong agronomic logic.

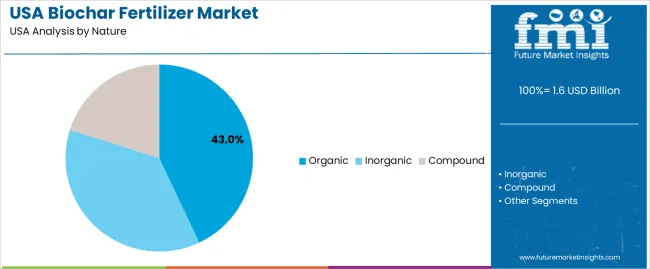

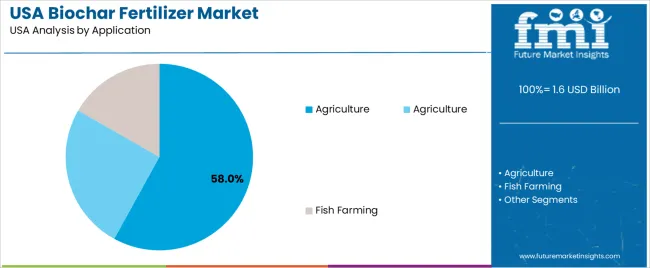

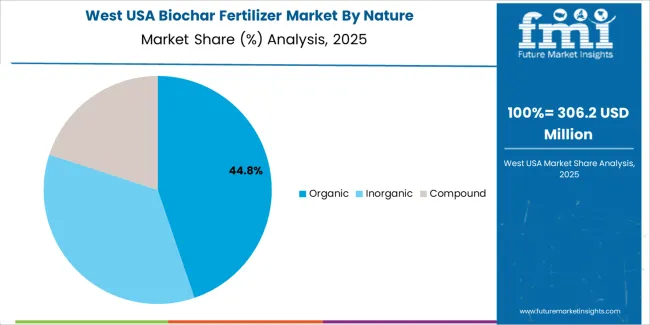

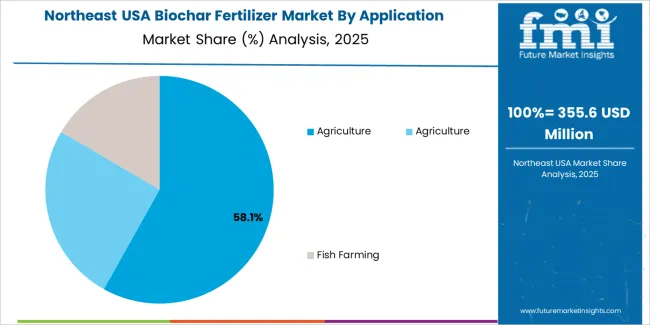

The demand for biochar fertilizer in the USA is structured by nature and application. Organic biochar accounts for 43% of total demand, followed by inorganic and compound variants incorporated into blended soil improvement programs. By application, agriculture represents 58.0% of total consumption, while fish farming forms a smaller but growing share. Demand behavior is shaped by soil quality improvement targets, long-term nutrient management needs, moisture retention performance, and regulatory alignment with farming standards. These segments reflect how production methods and end-use objectives influence biochar fertilizer selection across field crops, horticulture, soil remediation, and aquatic farming operations in the USA.

Organic biochar accounts for 43% of total biochar fertilizer demand in the USA due to its close alignment with organic and regenerative farming practices. Organic biochar is valued for its ability to improve soil structure, enhance microbial habitat, and increase long-term nutrient retention without introducing synthetic residues. Farmers apply organic biochar across vegetable cultivation, fruit orchards, vineyards, and greenhouse production, where soil biological balance directly influences yield stability. Its porous structure improves water holding capacity and reduces nutrient leaching, which supports consistent crop performance across variable weather conditions. These functional soil benefits make organic biochar well suited to operations seeking to improve productivity through non-chemical soil conditioning methods.

Organic biochar also benefits from strong acceptance under certified organic farming standards, which supports its use in regulated food production systems. Supply chains based on agricultural residues, wood waste, and forestry byproducts support steady feedstock availability. Organic growers value its long service life within soil profiles, where benefits accumulate across multiple seasons. Educational outreach from agricultural extension programs and soil health initiatives further supports adoption among small and mid-scale farms. These regulatory approval, agronomic performance, and sourcing stability factors collectively sustain organic biochar as the leading nature segment in the USA biochar fertilizer demand structure.

Agriculture accounts for 58.0% of total biochar fertilizer demand in the USA due to its wide application across row crops, specialty crops, pastures, and controlled environment farming. Biochar is used to improve cation exchange capacity, enhance root zone aeration, and stabilize nutrient availability in degraded or compacted soils. These functions support stronger early plant establishment and improved nutrient uptake efficiency. Large commercial farms apply biochar to address soil variability across production zones, while specialty growers apply it for moisture control and root health management. These agronomic advantages support steady demand across diverse cropping systems.

Biochar adoption in agriculture is also supported by soil conservation initiatives and carbon management programs that promote long-term soil carbon storage. Multi-season effectiveness improves cost efficiency compared with single-cycle fertilizers. University-led field trials and state level conservation programs continue to document yield stability and input reduction benefits. Farmers also apply biochar to reduce nutrient runoff into surrounding water systems. These land scale application needs, soil protection objectives, and conservation alignment factors position agriculture as the dominant application segment for biochar fertilizer demand in the USA.

Demand for biochar fertilizer in the USA is driven by long-term soil productivity concerns rather than short-term yield gains alone. Large farming regions face declining organic matter, compaction, and nutrient leaching after decades of intensive cropping. Biochar offers structural soil improvement by increasing porosity, water retention, and microbial habitat. Specialty crop growers use it to stabilize root-zone conditions in high-value production systems. Carbon credit programs tied to soil carbon storage also create secondary demand incentives. These agronomic and economic pressures position biochar as a regenerative soil input rather than a conventional nutrient amendment.

Biochar fertilizer demand in the USA varies strongly by irrigation intensity, soil texture, and crop rotation systems. Western irrigated farms adopt biochar to improve water-holding efficiency in sandy soils. Midwest row-crop producers apply it to reduce nitrogen loss and improve cation exchange in compacted soils. Horticulture, greenhouse, and orchard systems use biochar to stabilize root conditions over long planting cycles. Organic growers adopt it as a non-synthetic soil conditioner. These regional and crop-specific soil pressures shape where biochar moves from experimental input into a recurring production tool.

Biochar fertilizer expansion in the USA is restrained by production cost, application economics, and performance variability across soil types. Transporting bulky biochar over long distances quickly erodes cost competitiveness against traditional fertilizers. Application rates vary widely by soil condition, which complicates standard farm budgeting. Yield response is often indirect and time-dependent rather than immediately visible. Particle size, feedstock source, and pyrolysis method also influence performance consistency. These cost, logistics, and agronomic uncertainty factors prevent biochar from becoming a universal fertilizer substitute.

Biochar in the USA is increasingly sold as a carrier within blended fertilizer systems rather than as a standalone soil amendment. Nutrient-impregnated biochar improves nitrogen retention and reduces volatilization losses. Precision spreaders allow targeted root-zone application instead of field-wide broadcasting. Carbon measurement protocols now track long-term sequestration from biochar-treated fields for offset programs. Livestock manure and digestate are also being stabilized using biochar for odor and nutrient management. These shifts show biochar fertilizer moving into integrated nutrient management and carbon accounting systems rather than remaining a niche soil additive.

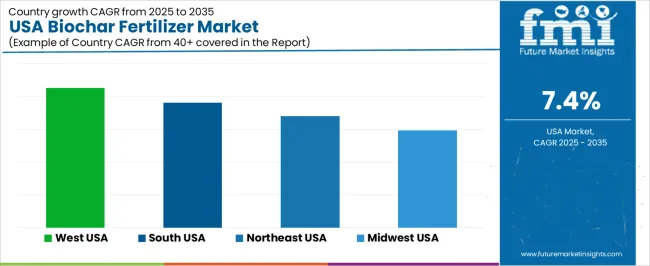

| Region | CAGR (%) |

|---|---|

| West | 8.5% |

| South | 7.6% |

| Northeast | 6.8% |

| Midwest | 5.9% |

The demand for biochar fertilizer in the USA is growing steadily across all regions, led by the West at an 8.5% CAGR. Growth in this region is supported by strong adoption in specialty crops, vineyards, and sustainable soil management practices across California and neighboring states. The South follows at 7.6%, driven by large scale row crop farming, soil conditioning needs, and interest in improving nutrient efficiency in warm climate agriculture. The Northeast records 6.8% growth, supported by organic farming, horticulture, and controlled environment agriculture. The Midwest shows comparatively moderate growth at 5.9%, reflecting gradual integration of biochar into large acre commodity crop systems where traditional fertilizer practices remain dominant.

Expansion in the West reflects a CAGR of 8.5% through 2035 for biochar fertilizer demand, supported by specialty crop farming, soil restoration programs, and strong adoption in vineyards, orchards, and vegetable production. Water retention needs in arid zones encourage use of biochar for moisture control and soil structure improvement. Organic farming clusters in California and Pacific Northwest apply biochar for nutrient efficiency management. Research led soil amendment trials also support adoption. Demand remains agronomy driven rather than subsidy driven, with growers focused on yield stability and soil conditioning benefits.

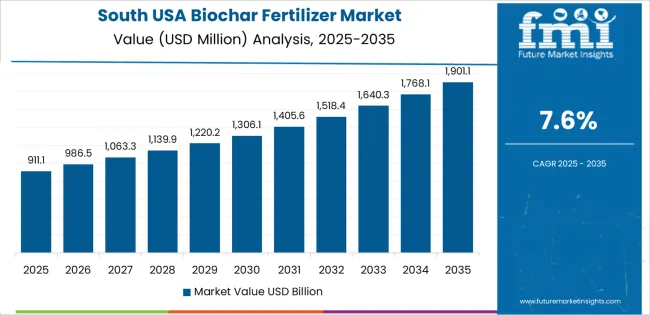

The South advances at a CAGR of 7.6% through 2035 for biochar fertilizer demand, driven by row crop farming, pasture management, and expanding poultry litter conversion programs. Corn, cotton, and soybean cultivation relies on soil amendment strategies to manage nutrient runoff and microbial balance. High rainfall increases interest in soil structure stabilization. Poultry waste derived biochar supports localized supply chains. Demand remains volume driven, tied to large acreage farming rather than high value specialty crops, with adoption driven by soil productivity management and runoff control needs.

The Northeast records a CAGR of 6.8% through 2035 for biochar fertilizer demand, shaped by mixed farming systems, horticulture, and soil remediation programs. Market gardens, greenhouses, and small livestock operations apply biochar for nutrient retention and pH balance. Legacy soil contamination sites also use biochar for remediation and land reuse. Cold climate limits growing seasons, increasing focus on soil productivity per cycle. Demand remains application specific rather than widespread, with steady adoption tied to controlled environment agriculture and land reclamation projects.

The Midwest expands at a CAGR of 5.9% through 2035 for biochar fertilizer demand, supported by large scale corn and soybean farming, soil carbon programs, and conservation agriculture practices. Heavy clay soils benefit from improved aeration and nutrient retention. Farm scale adoption remains selective due to cost sensitivity across broad acreage operations. Ethanol plant waste conversion supports localized biochar availability. Demand remains gradual and trials based, driven by university extension programs and soil health initiatives rather than rapid commercial scale deployment.

Demand for biochar fertilizer in the USA is increasing as growers and agricultural producers seek soil improving and carbon sequestering amendments that enhance soil health, water retention, and nutrient efficiency. Interest in regenerative agriculture and sustainable land use encourages adoption of biochar among farmers, landscapers, and horticultural operations. Use of biochar supports soil structure enhancement, reduced need for chemical fertilizers, and better resilience against drought and heavy rainfall. Demand also extends to turf management, urban landscaping, composting, and garden markets where consumers and professionals value organic soil enrichment and long term soil fertility.

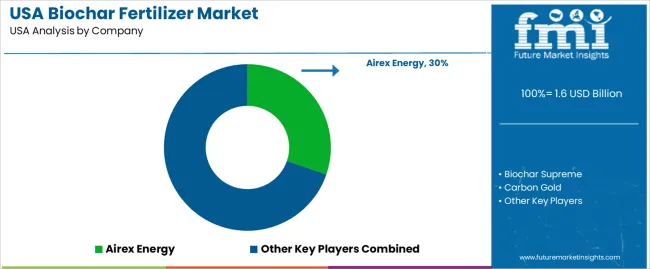

Key suppliers in the US biochar fertilizer market include Airex Energy, Biochar Supreme, Carbon Gold, American BioChar Company, and Aries Clean Technologies. Airex Energy and Biochar Supreme supply bulk and bagged biochar products for agricultural and landscaping use. Carbon Gold and American BioChar Company serve horticulture, turf, and garden markets with specialty blends tailored for soil amendment and plant health. Aries Clean Technologies provides industrial scale biochar solutions, including biochar derived from waste biomass, targeting large acre agriculture and composting operations. These firms shape the market through product variety, quality controls, supply logistics, and the ability to serve both commercial and retail end users.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Nature | Organic, Inorganic, Compound |

| Application | Agriculture, Fish Farming |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Airex Energy, Biochar Supreme, Carbon Gold, American BioChar Company, Aries Clean Technologies |

| Additional Attributes | Dollar by sales by nature, Dollar by sales by application, Dollar by sales by region, Regional CAGR, Integration with regenerative agriculture programs, Adoption in specialty crops and horticulture, Carbon accounting and soil carbon incentive programs, Distribution via cooperatives and blending facilities, Feedstock type and pyrolysis method |

The demand for biochar fertilizer in USA is estimated to be valued at USD 1.6 billion in 2025.

The market size for the biochar fertilizer in USA is projected to reach USD 3.3 billion by 2035.

The demand for biochar fertilizer in USA is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in biochar fertilizer in USA are organic, inorganic and compound.

In terms of application, agriculture segment is expected to command 58.0% share in the biochar fertilizer in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biochar Fertilizer Market Outlook – Growth, Demand & Forecast 2025 to 2035

Demand for Water Soluble Fertilizers in USA Size and Share Forecast Outlook 2025 to 2035

Fertilizer Packaging Market Forecast and Outlook 2025 to 2035

Fertilizer Tester Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Value Added Coatings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fertilizer Applicators Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA