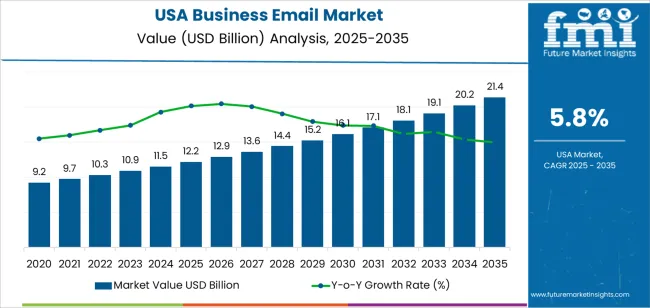

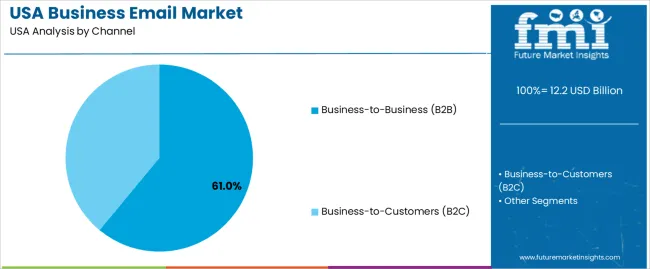

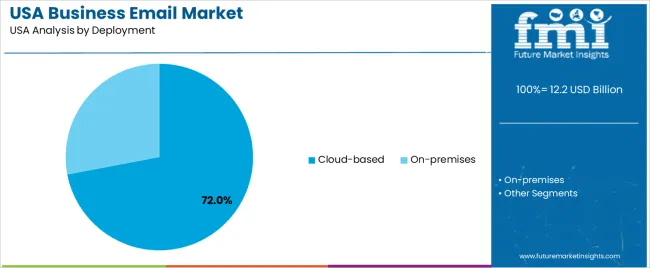

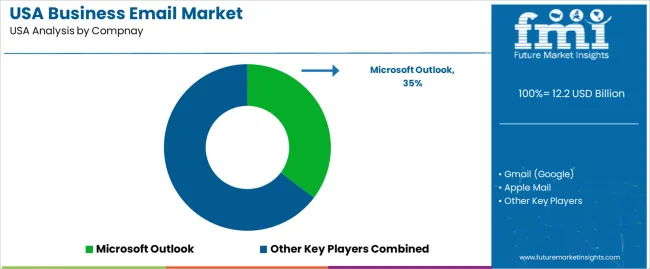

In 2025, the demand for business email in the USA is valued at USD 12.2 billion and is projected to reach USD 21.4 billion by 2035 at a CAGR of 5.8%. Market growth is anchored in the continued role of email as the core identity and authentication layer for enterprise software access, client communication, and regulatory archiving. Business-to-business USAge dominates with a 61% share as corporate workflows, vendor management, and compliance reporting remain email-centric. Cloud-based deployment accounts for 72% of total installations, reflecting migration away from legacy on-premises infrastructure toward scalable subscription platforms. Adoption is reinforced by cross-integration with productivity suites, identity management systems, and cybersecurity monitoring tools used across finance, healthcare, and professional services.

After 2030, value expansion is driven more by security layering and platform consolidation than by new user creation. Demand rises from about USD 16.1 billion in 2030 toward USD 21.4 billion by 2035 as enterprises invest in encryption, phishing detection, zero-trust access, and regulatory retention controls. Business-to-customer communication holds 39% share through marketing automation, service notifications, and transaction messaging. Microsoft Outlook, Gmail, Apple Mail, Zoho Mail, and ProtonMail anchor competitive activity across different security and enterprise integration tiers. Vendor strategy centers on uptime reliability, sovereign data hosting, anti-spoofing resilience, and enterprise-grade compliance features aligned with USA data protection and audit frameworks.

The overall demand for business email in USA increases from USD 12.2 billion in 2025 to USD 16.1 billion by 2030, adding USD 3.9 billion in absolute value. This phase reflects steady expansion in enterprise communication infrastructure as cloud migration, hybrid work models, and cybersecurity compliance reshape corporate IT spending. Growth is supported by rising deployment of secure email gateways, multi-factor authentication, encryption services, and compliance archiving across regulated industries such as banking, healthcare, and government. Demand remains USAge anchored rather than price driven, with value growth coming from higher per-seat security layers, spam filtering sophistication, and integration with collaboration ecosystems rather than basic mailbox provisioning.

From 2030 to 2035, the market expands from USD 16.1 billion to USD 21.4 billion, adding a larger USD 5.3 billion within five years. This back weighted acceleration reflects the shift of business email from a standalone communication tool into a core digital identity and security control layer. Advanced threat protection, behavioral phishing detection, AI based filtering, and zero trust email access models raise value per user. As regulatory scrutiny over data privacy, breach disclosure, and communication auditability intensifies, email platforms evolve into compliance infrastructure rather than simple productivity tools, pushing demand from stable IT spending into higher value enterprise risk management budgets.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 12.2 billion |

| Forecast Value (2035) | USD 21.4 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

Business email remains central to corporate communication in the USA even as newer tools emerge. Many organizations continue to rely on email for formal exchanges, record keeping, and external correspondence because it supports auditability, traceability, and cross-department visibility. In complex or regulated businesses, critical communications such as legal notices, contracts, purchase orders, compliance documentation, and customer correspondence still flow primarily through email. The consistency, reliability, and asynchronous nature of email make it suitable for distributed teams, remote work, and multi-channel coordination - conditions that have grown more common in recent years.

Looking forward, growth in demand for business email solutions will be shaped by increasing regulatory complexity, hybrid working models, and integration needs with broader enterprise systems. Firms will seek advanced email platforms that offer secure encryption, compliance logging, email archiving, identity management, and smooth integration with collaboration and CRM tools. Smaller firms and startups may adopt hosted business email services rather than build in-house infrastructure. At the same time, competition from real-time messaging, collaboration suites, and project-management platforms could restrict growth. Market expansion will depend on how well email platforms adapt to security requirements, mobile USAge, and hybrid workflows rather than simply replacing personal email with business accounts.

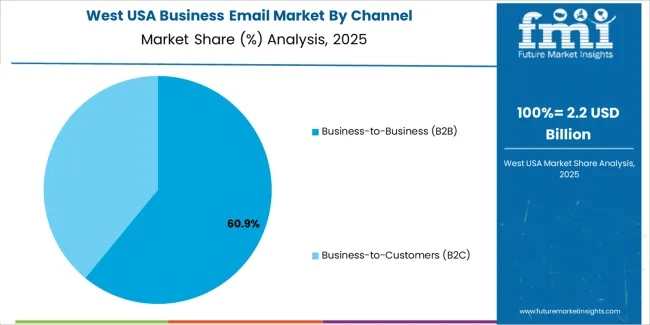

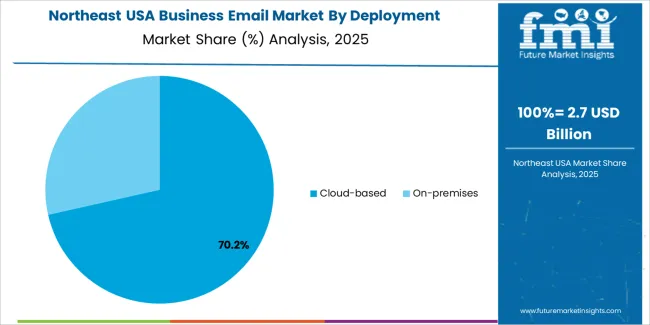

The demand for business email in the USA is structured by communication channel and deployment model. Business to business USAge accounts for 61% of total demand, while business to customer communication represents the remaining share. By deployment, cloud based platforms hold 72.0% of total adoption, followed by on premises systems. Demand patterns are shaped by enterprise communication volume, regulatory compliance requirements, scalability needs, and cybersecurity controls. These segments reflect how internal collaboration, external customer engagement, and IT infrastructure strategies determine email platform selection across corporate, commercial, and service sectors in the USA.

Business to business communication accounts for 61% of total business email demand in the USA due to the high volume of inter-organizational messaging that supports operations, procurement, logistics coordination, and financial transactions. Enterprises rely on email for contract exchange, invoice processing, document approval, and regulatory correspondence. Large corporations, professional services firms, manufacturers, and technology companies generate continuous internal and external business traffic that sustains elevated email USAge levels across daily operations.

B2B communication also requires structured email systems that support encryption, data retention, and audit trails for compliance. Legal, banking, healthcare administration, and government contractors rely on secure business email to meet documentation obligations. Email remains the primary formal communication channel for supplier negotiations and service confirmations. These compliance intensity, transaction volume, and operational dependency factors position B2B as the dominant channel for business email demand across the USA.

Cloud based deployment accounts for 72.0% of total business email demand in the USA due to its scalability, cost efficiency, and centralized management capabilities. Cloud platforms allow enterprises to add or remove users without physical infrastructure expansion. Automatic software updates, security patching, and system maintenance reduce internal IT workload across organizations of all sizes. Cloud email also supports remote workforce operations and multi-location access without reliance on corporate network boundaries.

Cloud based systems further offer advanced security controls such as multi factor authentication, threat detection, and data loss prevention tools. Integration with collaboration platforms, document sharing systems, and customer relationship management software strengthens workflow automation. Subscription pricing supports predictable budgeting across annual IT spending cycles. These operational efficiency, security, and integration advantages position cloud deployment as the dominant model for business email adoption across the USA.

Demand for business email in the USA is driven by its role as the primary identity layer for corporate communication, authentication, and workflow access. Every enterprise system, from finance and HR to customer support and cloud platforms, is anchored to email-based identity. Growth in remote work, distributed teams, and contractor-based staffing increases dependence on secure, role-based business email accounts. Legal documentation, compliance notices, customer correspondence, and transaction confirmations continue to require formal email channels. These functional, legal, and access-control roles make business email a core digital utility rather than a simple messaging tool.

How Do Enterprise Operations, Compliance, and Client Communication Shape Demand?

USA enterprises rely on business email for regulated communication across healthcare, finance, insurance, legal services, and government contracting. Audit trails, retention policies, and legal discovery requirements reinforce continued use of structured email systems. Client onboarding, invoice delivery, contract exchange, and service notifications still depend heavily on email rather than chat platforms. Sales teams, procurement units, and vendor coordination workflows remain email-centric for traceability. Integration with CRM, ERP, and ticketing platforms further anchors email in daily operations. These compliance-heavy and external communication needs sustain structurally stable demand.

What Security, Cost, and Platform Pressures Restrain Market Expansion?

Business email demand in the USA faces constraints from rising cybersecurity threats, cost of advanced protection layers, and platform consolidation. Phishing, impersonation, and ransomware risks force companies to invest in encryption, filtering, and zero-trust access controls, raising total cost of ownership. Small firms struggle with premium security subscriptions. Platform bundling inside large cloud productivity suites reduces vendor diversity and price flexibility. Employee fatigue from overloaded inboxes also drives partial shift toward collaboration tools for internal use. These pressures limit unchecked volume growth while strengthening demand for secure enterprise-grade solutions.

How Are Security Automation, AI Filtering, and Workflow Integration Reshaping Demand?

Business email in the USA is evolving into an automated security and workflow control system rather than a passive communication pipe. AI-driven spam detection, behavioral threat analysis, and automated incident response now operate in real time. Smart routing links emails directly to CRM cases, procurement approvals, and service tickets. Data loss prevention policies monitor outbound content for compliance risk. Encrypted external email portals support sensitive document exchange. These trends show business email shifting into an intelligent compliance and risk-management interface at the core of USA enterprise communication infrastructure.

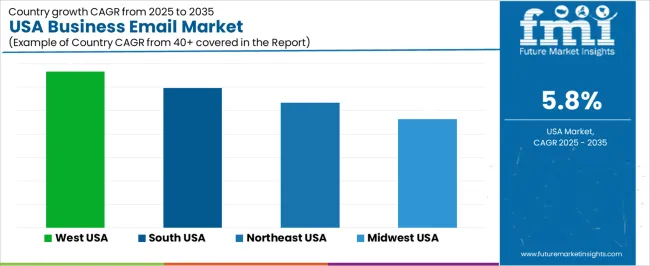

| Region | CAGR (%) |

|---|---|

| West | 6.7% |

| South | 6.0% |

| Northeast | 5.3% |

| Midwest | 4.6% |

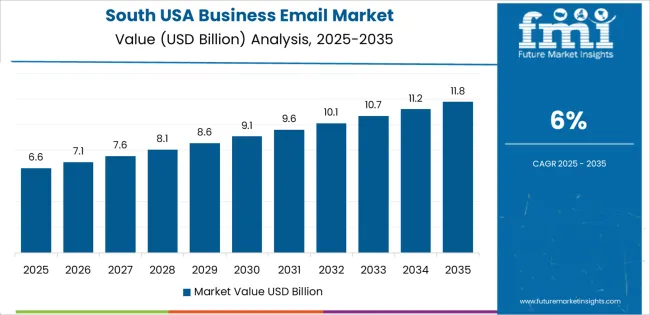

The demand for business email in the USA is expanding steadily across all regions, with the West leading at a 6.7% CAGR. Growth in this region is supported by a high concentration of technology firms, startups, and digital service providers that rely heavily on secure and scalable email platforms. The South follows at 6.0%, driven by rapid growth in small and mid sized enterprises, expanding service sectors, and rising digital adoption among traditional businesses. The Northeast records 5.3% growth, supported by dense corporate activity, financial services, and professional firms with consistent demand for enterprise communication tools. The Midwest shows comparatively moderate growth at 4.6%, reflecting steady digital adoption among manufacturing, logistics, and regional business hubs transitioning toward cloud based communication systems.

Expansion in the West reflects a CAGR of 6.7% through 2035 for business email demand, supported by high concentration of technology companies, digital first enterprises, and cloud based service adoption. Software firms, ecommerce sellers, and digital media agencies depend on secure email platforms for client interaction and marketing operations. Startup density sustains continuous account creation and license upgrades. Cybersecurity requirements also raise demand for encrypted business communication tools. Demand remains USAge intensive rather than headcount driven, with scalable subscriptions supporting steady revenue flow across enterprise, mid sized, and small digital businesses.

The South advances at a CAGR of 6.0% through 2035 for business email demand, driven by rapid small business formation, logistics expansion, and growth in healthcare administration and professional services. Real estate firms, construction contractors, regional banks, and medical offices rely on email for daily operations and client documentation. Migration inflows increase new business formation across suburban markets. Cloud hosted email systems dominate adoption due to cost sensitivity and ease of setup. Demand remains volume driven, aligned with steady business registration growth and service sector employment expansion.

The Northeast records a CAGR of 5.3% through 2035 for business email demand, shaped by dense professional services employment, financial institutions, and strong education and healthcare sectors. Law firms, insurance providers, universities, and hospital systems rely on structured email communication for compliance and documentation. High regulatory oversight supports continued demand for secure archiving and audit trails. Urban office density sustains large installed user bases. Growth remains steady and stability driven, with upgrades focused on security, storage, and integration rather than new account creation.

The Midwest expands at a CAGR of 4.6% through 2035 for business email demand, supported by manufacturing administration, regional banking, logistics coordination, and wholesale trade communication needs. Industrial firms rely on email for procurement, supplier coordination, and order documentation. Agricultural supply chains maintain steady transactional messaging requirements. Cost control remains a key purchasing factor, favoring bundled productivity suites. Demand stays operational and predictable, guided by stable enterprise employment rather than rapid digital service expansion across regional commercial and industrial business networks.

Demand for business email services in the USA remains strong because companies, nonprofits, institutions, and freelancers consistently need reliable communication channels that support official correspondence, collaboration, record keeping, and client relations. As remote work, hybrid workplaces, and digital business operations grow, secure, cloud based and feature rich email platforms become essential. Business continuity requirements, regulatory compliance, data retention, and integration with productivity tools and collaboration suites drive adoption. Small and medium businesses value cost effective, easy to deploy email hosting. Large enterprises favor enterprise grade email infrastructure with advanced security, user management, and compliance support.

Leading providers in the USA business email market include Microsoft Outlook (via Microsoft 365), Gmail (via Google Workspace), Apple Mail, Zoho Mail, and privacy focused services such as ProtonMail. Gmail holds a large share among business users thanks to its integration with Google’s productivity ecosystem and widespread familiarity. Outlook remains widely used in enterprise and corporate settings due to deep integration with Microsoft Office tools and Exchange services. Apple Mail is common among companies using Apple devices. Zoho Mail serves many small and medium sized businesses that seek domain based email hosting with flexible pricing. ProtonMail and similar secure mail providers attract users prioritizing encryption and privacy. This mix of major global platforms and niche providers ensures that businesses of all sizes and needs find appropriate email solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Channel | Business-to-Business (B2B), Business-to-Customer (B2C) |

| Deployment | Cloud-based, On-premises |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Microsoft Outlook, Gmail (Google), Apple Mail, Zoho Mail, ProtonMail |

| Additional Attributes | Dollar by sales by channel (B2B 61%, B2C 39%), Dollar by sales by deployment (Cloud 72%, On-premises 28%), Regional CAGR (West 6.7%, South 6.0%, Northeast 5.3%, Midwest 4.6%), Enterprise adoption trends, AI filtering and automation integration, Cybersecurity layer adoption, Compliance and regulatory alignment, Hybrid work integration |

The demand for business email in USA is estimated to be valued at USD 12.2 billion in 2025.

The market size for the business email in USA is projected to reach USD 21.4 billion by 2035.

The demand for business email in USA is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in business email in USA are business-to-business (b2b) and business-to-customers (b2c).

In terms of deployment, cloud-based segment is expected to command 72.0% share in the business email in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Business Email Market Analysis by Channel, Deployment, and Region Through 2035

Cloud Business Email Market Report – Trends & Forecast 2017-2027

Demand for Business Process as a Service in USA Size and Share Forecast Outlook 2025 to 2035

Business Jet Market Size and Share Forecast Outlook 2025 to 2035

Business Storage Units Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Business Cloud VoIP & UC Services Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Business Process Automation (BPA) Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA