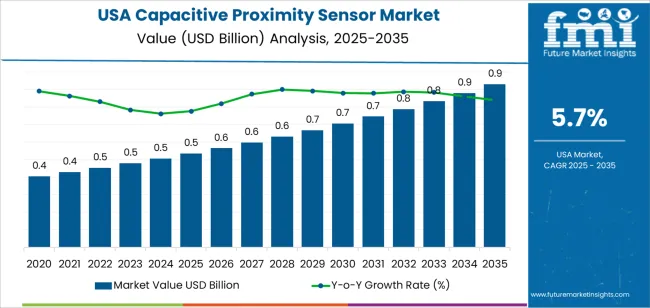

The demand for capacitive proximity sensors in the USA is expected to grow from USD 0.5 billion in 2025 to USD 0.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.7%. Capacitive proximity sensors are used for detecting the presence of objects without physical contact, making them essential in industries like automation, manufacturing, automotive, consumer electronics, and medical devices. These sensors are favored for their high precision and non-contact nature, which make them ideal for detecting a wide range of materials, including metals, plastics, and liquids.

The adoption of capacitive proximity sensors is increasing across various industries as they enable more efficient automation processes, quality control, and safety measures. In manufacturing and automation systems, these sensors play a critical role in motion sensing, object detection, and positioning applications, thereby improving production efficiency and reducing operational costs. Capacitive proximity sensors are increasingly used in smart devices, IoT systems, and robotics, where precise detection and touch sensing are required. As these technologies evolve, the demand for capacitive sensors will continue to rise, driven by technological advancements and the growing need for automation and smart systems in industrial applications.

The total revenue potential for capacitive proximity sensors over the next decade is expected to be USD 0.4 billion. This growth reflects the expanding role of capacitive sensors in industries where automation and contactless detection are critical for improving operational processes, reducing downtime, and enhancing product quality. As industrial automation continues to expand and the demand for smart technologies grows, capacitive proximity sensors will play a central role in shaping the future of various sectors, including automotive, robotics, and consumer electronics.

The industry is expected to see steady growth driven by ongoing technological innovations in the sensor industry, which are making these solutions more efficient, compact, and cost-effective. The rising trend of smart manufacturing and IoT-enabled systems will further increase the adoption of capacitive proximity sensors, particularly in sectors focused on automation, advanced robotics, and smart homes. As industries continue to embrace digital transformation, the demand for capacitive proximity sensors will expand significantly, positioning them as essential components in next-generation systems.

| Metric | Value |

|---|---|

| Demand for Capacitive Proximity Sensors in USA Value (2025) | USD 0.5 billion |

| Demand for Capacitive Proximity Sensors in USA Forecast Value (2035) | USD 0.9 billion |

| Demand for Capacitive Proximity Sensors in USA Forecast CAGR (2025-2035) | 5.7% |

The demand for capacitive proximity sensors in the USA is increasing due to their growing applications across various industries, including automotive, manufacturing, consumer electronics, and automation. Capacitive proximity sensors are widely used for detecting the presence or absence of objects without direct contact, making them ideal for applications requiring non-invasive, reliable, and accurate sensing. As industries continue to prioritize automation and precision, capacitive proximity sensors are becoming a key component in the design of smart systems and devices.

A major driver of this growth is the ongoing trend toward automation and the integration of smart technologies in industries like automotive manufacturing, robotics, and packaging. Capacitive sensors offer high precision and are capable of detecting a wide range of materials, from metals to liquids, which makes them ideal for diverse applications such as assembly line control, quality monitoring, and robotic arms. Their compact size, reliability, and ability to operate in harsh environments contribute to their increasing adoption in industrial applications.

The growing demand for consumer electronics with touch-sensitive and proximity detection features is also fueling the demand for capacitive proximity sensors. As more devices incorporate these features, from smartphones to home appliances, the need for advanced sensors to enable seamless user interactions continues to rise. As the USA continues to embrace automation, smart technologies, and digitalization, the demand for capacitive proximity sensors is expected to grow steadily through 2035, driven by their versatility and importance in various sectors.

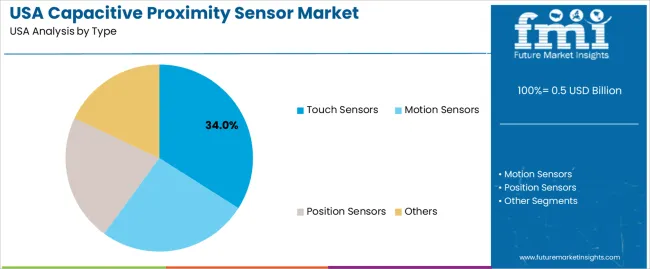

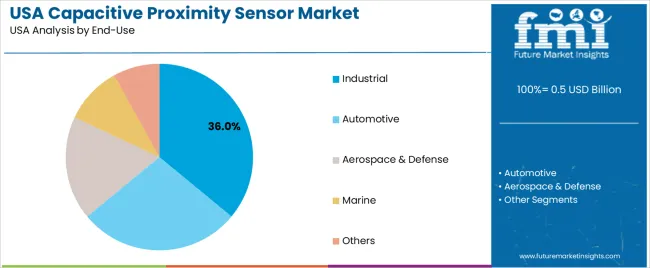

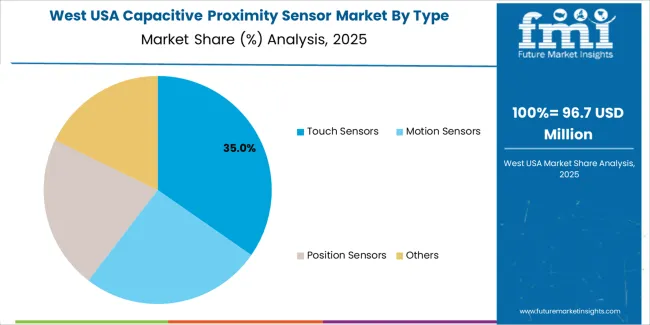

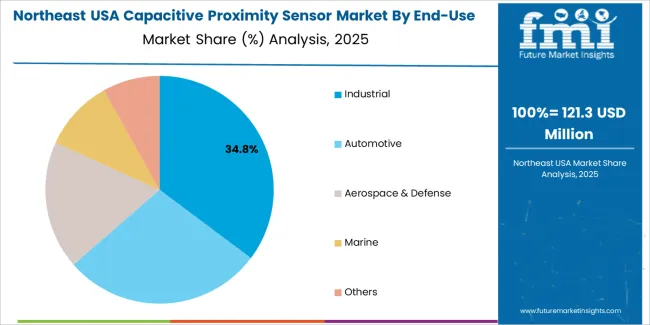

Demand for capacitive proximity sensors in the USA is segmented by type, end-use, and region. By type, demand is divided into touch sensors, motion sensors, position sensors, and others, with touch sensors leading the demand at 34%. The demand is also segmented by end-use, including industrial, automotive, aerospace & defense, marine, and others, with industrial applications leading the demand at 36%. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Touch sensors account for 34% of the demand for capacitive proximity sensors in the USA. These sensors are widely used in smartphones, tablets, and other touch-sensitive devices due to their ability to detect the presence of a finger or hand without requiring physical contact. The increasing demand for touch-based interfaces across various sectors, including consumer electronics, industrial control panels, and automotive applications, drives the demand for touch sensors. Their fast response time, high sensitivity, and durability make them ideal for applications that need precise and reliable touch detection. As technology evolves, and touch interfaces become more integrated into consumer products and industrial systems, the demand for touch sensors will continue to dominate the capacitive proximity sensor industry in the USA. Their versatility and functionality in providing seamless user experiences across a range of devices ensure their continued leadership in the industry.

Industrial applications account for 36% of the demand for capacitive proximity sensors in the USA. These sensors are crucial in industries where non-contact sensing is required, such as in automation systems, robotic arms, conveyor belts, and manufacturing processes. The ability of capacitive proximity sensors to detect the position of objects or machinery with high precision and without physical contact increases operational efficiency and safety. In industrial settings, sensors are used to monitor material composition and proximity, allowing for improved control in harsh environments. As industries continue to embrace automation and precision manufacturing, capacitive proximity sensors will remain a key technology in streamlining operations. The increasing demand for reliable, non-contact sensing solutions to enhance automation and productivity in manufacturing will continue to drive the growth of capacitive proximity sensors in industrial applications across the USA.

Demand for capacitive proximity sensors in the USA is growing as industries in manufacturing, automotive, consumer electronics, and automation increasingly adopt non‑contact sensing technologies. These sensors are valued for their versatility in detecting a variety of materials, including plastics, liquids, and powders. The rise of smart manufacturing, IoT-driven production systems, and the need for precision automation are key drivers of growth in the industry. Automotive applications, including advanced driver assistance systems (ADAS) and automated vehicles, are fueling demand. Adoption is constrained by the high cost of implementation, challenges with integration into existing systems, and reliability concerns in harsh industrial environments where environmental factors, such as dust or humidity, can affect sensor performance.

Why is Demand for Capacitive Proximity Sensors Growing in USA?

In the USA, demand for capacitive proximity sensors is growing due to their ability to detect a wide range of materials, making them indispensable in industries like manufacturing, automotive, and consumer electronics. These sensors are particularly valuable in applications requiring high precision, such as material handling, process control, and robotic automation. The rise of Industry 4.0 and IoT-driven manufacturing has increased the need for sensors that can integrate seamlessly into smart production systems, further boosting demand. The automotive industry's shift toward more advanced safety systems and automation is driving adoption in areas like touchless interfaces and proximity detection systems. These trends have expanded the use cases for capacitive proximity sensors across various industries.

How are Technological and Design Innovations Driving Growth of Capacitive Proximity Sensors in USA?

Technological innovations are significantly driving the growth of capacitive proximity sensors in the USA. New sensor designs offer enhanced sensitivity, smaller form factors, and the ability to detect non-metallic objects, which expands their range of applications. Advances in material science and electronics have led to the development of more reliable sensors that can function in challenging environments, such as those with high humidity or fluctuating temperature conditions. The integration of capacitive proximity sensors into IoT platforms and cloud-based systems allows for real-time data collection, predictive maintenance, and improved operational efficiency. These technological advancements are making capacitive proximity sensors more adaptable and appealing for a broad range of industrial and commercial applications.

What are the Key Challenges Limiting Wider Adoption of Capacitive Proximity Sensors in USA?

One major obstacle is the cost of the technology, as high-quality capacitive sensors can be expensive compared to other types of proximity sensors, such as inductive sensors. While capacitive sensors are highly versatile, they may not perform as well in environments with extreme conditions, such as high levels of dust, moisture, or varying dielectric properties, which can affect their reliability. Another challenge is the integration of capacitive sensors into existing production systems, especially in industries with legacy equipment that may not be compatible with newer sensor technologies. The industry for capacitive proximity sensors remains competitive, with alternative sensing technologies offering better performance in certain applications, which may limit widespread adoption in specific sectors.

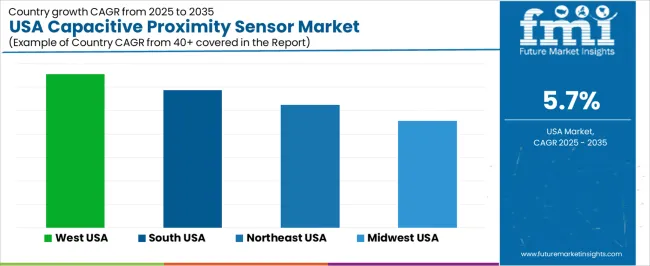

| Region | CAGR (%) |

|---|---|

| West USA | 6.6% |

| South USA | 5.9% |

| Northeast USA | 5.2% |

| Midwest USA | 4.6% |

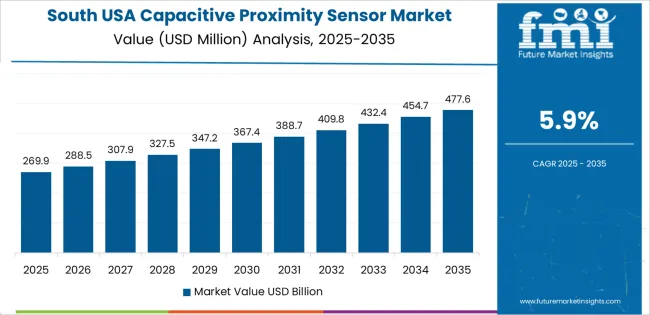

Demand for capacitive proximity sensors in the USA is growing across all regions, with the West leading at a 6.6% CAGR, driven by its focus on automation and high-tech industries. The South follows with a 5.9% CAGR, supported by the growing industrial and manufacturing sectors. The Northeast shows a 5.2% CAGR, driven by its high-tech industries like electronics and automotive. The Midwest experiences moderate growth at 4.6% CAGR, supported by its automotive and manufacturing sectors adopting automation technologies. As industries across the USA continue to modernize and embrace automation, the demand for capacitive proximity sensors is expected to continue growing, supporting more efficient and precise manufacturing processes across all regions.

The West USA is leading the demand for capacitive proximity sensors, with a 6.6% CAGR. This demand is primarily driven by the region’s focus on automation, robotics, and advanced manufacturing industries, particularly in California, Oregon, and Washington. Capacitive sensors are essential in these industries for precise, non-contact detection in applications ranging from assembly lines to robotics. The West’s booming tech sector, which emphasizes innovation in manufacturing and industrial processes, is further boosting demand for these sensors. With the rise of automation and the increasing use of sensors in manufacturing, electronics, and consumer products, capacitive proximity sensors are becoming a critical component in a wide range of applications. As businesses in the West continue to adopt automation and precision manufacturing, the demand for capacitive proximity sensors is expected to grow steadily, supporting technological advancements and improving operational efficiency.

The South USA is experiencing strong demand for capacitive proximity sensors, with a 5.9% CAGR. This demand is largely driven by the region’s expanding industrial sectors, including automotive, electronics, and manufacturing. States like Texas, Florida, and Georgia are seeing increased adoption of capacitive proximity sensors in industrial applications such as assembly lines, robotics, and process control systems. As manufacturers in the South increasingly focus on automation and precision in their production processes, the need for non-contact detection technologies like capacitive sensors is rising. The region’s growing focus on modernizing manufacturing infrastructure, combined with its expanding tech and automotive industries, is driving demand. With the continued expansion of industrial sectors and the growing emphasis on operational efficiency and automation, capacitive proximity sensor demand in the South is expected to remain strong.

The Northeast USA is seeing steady demand for capacitive proximity sensors, with a 5.2% CAGR. The demand in this region is primarily driven by the high-tech industries present in cities like New York, Boston, and Philadelphia, where precise sensing solutions are critical. Capacitive sensors are widely used in the electronics, automotive, and robotics industries, which are prominent in the Northeast. As these industries increasingly adopt automation technologies, the demand for capacitive proximity sensors is growing. The region’s focus on innovation, particularly in sectors such as manufacturing and process control, is supporting the adoption of advanced sensor technologies. The growing trend toward smart manufacturing and Industry 4.0 in the Northeast is fueling the need for non-contact sensors that enable precise monitoring and control. As demand for automation and technological solutions in the Northeast continues to rise, capacitive proximity sensors are expected to experience steady growth.

The Midwest USA is seeing moderate demand for capacitive proximity sensors, with a 4.6% CAGR. The region’s demand is driven by its strong automotive and manufacturing sectors, particularly in cities like Detroit, Chicago, and Indianapolis, which are hubs for industrial automation and robotics. Capacitive proximity sensors are increasingly being adopted in the Midwest to improve efficiency and precision in manufacturing processes, especially in automotive assembly lines and material handling applications. The rise of Industry 4.0 and smart factories in the Midwest is contributing to the demand for more advanced sensor technologies. As manufacturers in the region continue to focus on improving automation, reducing costs, and enhancing productivity, the demand for capacitive proximity sensors is expected to grow. While the growth rate is slower compared to other regions, the steady adoption of automation in manufacturing and process control is driving moderate growth in the demand for capacitive proximity sensors in the Midwest.

Demand for capacitive proximity sensors in the USA is growing as industries embrace automation, IoT, and non-contact sensing technologies. These sensors offer accurate detection of various objects, including non-metallic items such as plastics, liquids, and powders, enabling reliable level detection, presence sensing, touchless controls, and material-handling automation. With the adoption of Industry 4.0 and increasing automation across manufacturing, logistics, automotive, and consumer electronics sectors, the need for capacitive sensors has significantly increased.

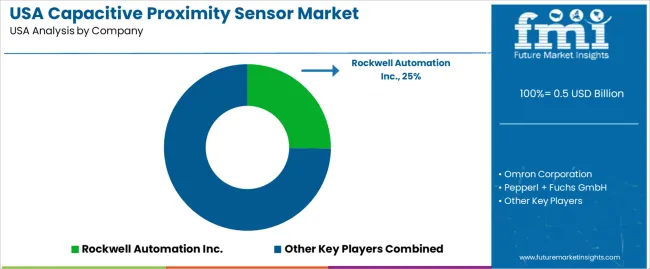

The leading providers of capacitive proximity sensors in the USA include Rockwell Automation Inc., Omron Corporation, Pepperl + Fuchs GmbH, Infineon Technologies AG, and Fargo Controls Inc. Rockwell Automation Inc. leads with a 25.2% industry share, offering capacitive sensors designed for industrial control, automation, and process management. Omron Corporation provides compact and reliable sensors for factory automation and OEM applications. Pepperl + Fuchs GmbH specializes in sensors for hazardous environments. Infineon Technologies AG focuses on advanced sensor technologies for consumer electronics and automotive applications. Fargo Controls Inc. provides sensors tailored for material handling and level detection.

The demand for capacitive proximity sensors is particularly strong in sectors such as automotive, industrial manufacturing, and consumer electronics. In automotive, these sensors are used in advanced driver assistance systems, in-vehicle interfaces, and level sensing. In industrial manufacturing, they are applied in material handling, packaging, and factory automation. Their ability to operate in harsh environments such as high humidity or dusty conditions, along with their capacity to detect non-metallic objects, gives capacitive sensors a distinct advantage over other sensor types.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Touch Sensors, Motion Sensors, Position Sensors, Others |

| End-Use | Industrial, Automotive, Aerospace & Defense, Marine, Others |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Rockwell Automation Inc., Omron Corporation, Pepperl + Fuchs GmbH, Infineon Technologies AG, Fargo Controls Inc. |

| Additional Attributes | Dollar sales by type and end-use; regional CAGR and adoption trends; demand trends in capacitive proximity sensors; growth in industrial, automotive, aerospace, and marine sectors; technology adoption for sensing solutions; vendor offerings including sensor technologies and integration solutions; regulatory influences and industry standards |

The demand for capacitive proximity sensor in USA is estimated to be valued at USD 0.5 billion in 2025.

The market size for the capacitive proximity sensor in USA is projected to reach USD 0.9 billion by 2035.

The demand for capacitive proximity sensor in USA is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in capacitive proximity sensor in USA are touch sensors, motion sensors, position sensors and others.

In terms of end-use, industrial segment is expected to command 36.0% share in the capacitive proximity sensor in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Capacitive Proximity Sensor Market Trends - Growth & Forecast 2025 to 2035

Demand for Capacitive Proximity Sensor in Japan Size and Share Forecast Outlook 2025 to 2035

Proximity Sensor Market Report - Growth, Demand & Forecast 2025 to 2035

Capacitive Sensor Market Analysis - Size, Share, and Forecast 2025 to 2035

Capacitive Tactile Sensor Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Position Sensors Market Size and Share Forecast Outlook 2025 to 2035

Inductive Proximity Sensors Market

Demand for Anthropomorphic Robot Inertial Sensor in USA Size and Share Forecast Outlook 2025 to 2035

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA