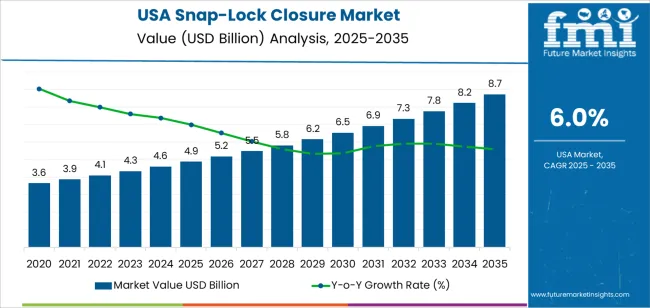

The USA snap-lock closure demand is valued at USD 4.9 billion in 2025 and is forecast to reach USD 8.7 billion by 2035, reflecting a CAGR of 6.0%. Demand is defined by consistent utilization of secure reclosable packaging formats in bottled water, carbonated beverages, household care liquids, and personal care products. Growth in on-the-go consumption, refill-oriented packaging, and ergonomically designed closures reinforces uptake across fast-moving packaged goods. Plastic remains the leading material category due to its moulding efficiency, cost competitiveness, and performance in maintaining product integrity under varied handling conditions. Light weighting initiatives and compatibility with high-volume automated capping systems also influence selection.

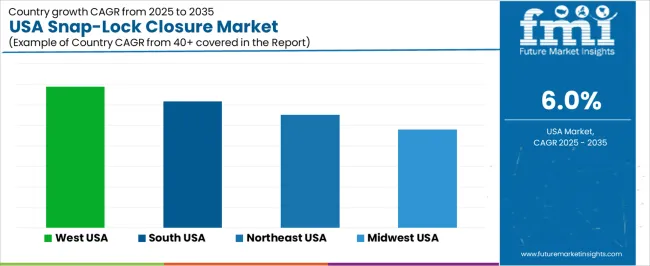

West USA, South USA, and Northeast USA exhibit the highest consumption levels. The presence of beverage fillers, consumer goods production facilities, and distribution networks sustains procurement volumes, along with regional investment in packaging upgrades supporting user convenience and leakage prevention. Key suppliers include Albéa, Berry Global, Closure Systems International, Crown Holdings, and Graham Packaging. These companies provide standard and customized snap-lock closure systems for plastic containers used in beverage, household, and personal care applications, supporting secure sealing, product preservation, and repeat-use packaging performance.

Snap-lock closures in the United States remain at a mid-growth stage, supported by continued USAge across food packaging, household consumables, and personal-care products. Demand benefits from resealability and ease-of-use features that align with convenience-driven consumer behavior. Fresh-produce bags, snack packaging, and storage applications continue to fuel incremental adoption. Contribution from e-commerce packaging persists due to reuse and product-protection requirements during handling.

Signs of gradual saturation appear in mature consumer packaged goods categories where snap-lock formats are already an established standard. Replacement cycles show more emphasis on material optimization rather than expansion into new uses. Sustainability measures influence future uptake, as brands shift toward recyclable or mono-material closure systems. Innovation in bio-based resins and lightweight closure designs delays saturation by enhancing regulatory compliance and waste-reduction benefits.

Industrial and institutional adoption remains a smaller but steady contributor, offering long-term cushioning against plateauing growth in household categories. Industry maturity in high-volume segments suggests that growth will increasingly depend on product differentiation, compatibility with circular-economy packaging, and automation-friendly manufacturing. The saturation point approaches slowly, indicating stable but moderated long-run growth potential for snap-lock closures in the United States.

| Metric | Value |

|---|---|

| USA Snap-Lock Closure Sales Value (2025) | USD 4.9 billion |

| USA Snap-Lock Closure Forecast Value (2035) | USD 8.7 billion |

| USA Snap-Lock Closure Forecast CAGR (2025 to 2035) | 6.0% |

Demand for snap-lock closures in the USA is increasing because food, household and personal-care brands require packaging that offers quick sealing, product protection and convenient opening for consumers. These closures provide a secure mechanical lock that improves freshness retention and reduces leakage, which supports adoption in snacks, refrigerated items and dry food packaging. Growth in on-the-go consumption and portioned packaging strengthens use in resealable pouches and rigid containers. U.S. retailers and e-commerce channels also prefer packaging that prevents accidental opening during transport, and snap-lock closures help reduce product damage in last-mile delivery.

Manufacturers introduce closures that support clean label packaging goals, including lightweight designs and options compatible with mono-material recycling streams. Consumer interest in convenience and child-resistant features expands use in household chemicals and health-wellness products. Automated filling and closing lines in U.S. factories further encourage procurement because snap-locks integrate well with high-speed machinery. Constraints include cost pressure relative to simpler closure types, tooling investment for custom designs and performance requirements that vary by product viscosity or barrier needs. Some brands delay packaging changes until industry testing confirms consumer acceptance.

Demand for snap-lock closures in the United States aligns with secure fastening needs across flexible packaging and structural applications. Performance priorities include repeated locking capability, tamper evidence, moisture protection, and stability under handling stress. U.S. adoption remains linked to retail packaging, industrial logistics, and construction safety requirements. Manufacturers emphasize durability, standardized locking interfaces, and compatibility with automation for high-volume production.

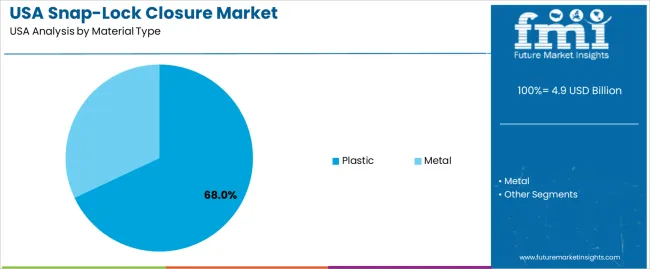

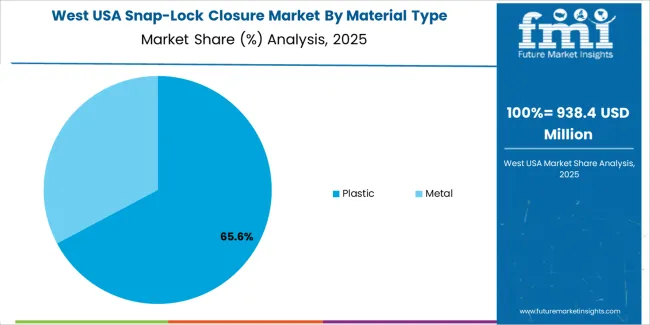

Plastic snap-lock closures represent 68.0%, driven by their lightweight structure, molding flexibility, and suitability for diverse packaging configurations. Plastic supports cost-efficient customization in size, shape, and snap-fit design, helping maintain secure enclosure for consumer products. Metal closures account for 32.0%, used in applications requiring high mechanical strength, extended weather resistance, and long-term load stability. U.S. industries focus on recyclability improvements for plastic variants and increased corrosion resistance in metal formats used in structural or industrial environments.

Key points:

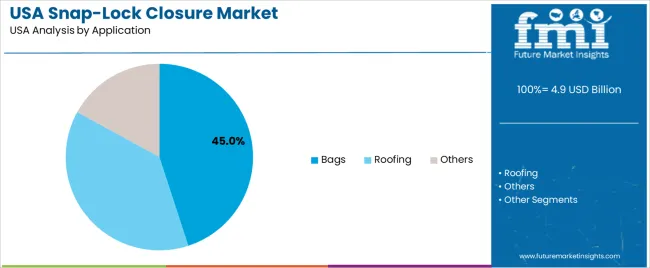

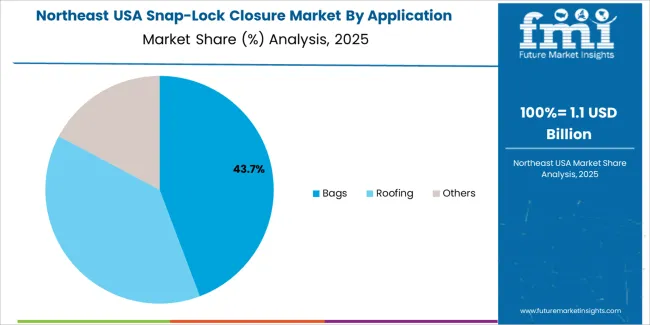

Bags account for 45.0%, supported by strong penetration in food packaging, consumer goods, and resealable storage formats. Users prioritize ease of opening and closing, product protection, and compatibility with automated filling lines. Roofing represents 38.0%, driven by the need for secure structural locking that resists wind uplift and moisture penetration in residential and commercial construction. Others hold 17.0%, including specialty fastening in industrial packaging or hardware components. Application trends reflect increased reliance on reliable closure systems that support reusable designs and reduce product waste during distribution and handling.

Key points:

Increased demand for leak-resistant packaging in food and household products, expansion of convenience formats in retail channels and growth of single-serve containers are driving demand.

In the United States, snap-lock closures support strong USAge in dairy, condiments, snacks and ready-to-eat packaged foods that require secure sealing for freshness during multi-day consumption. Household cleaners and automotive fluids rely on tamper-evident snap-lock closures to prevent spills during transport and in-home handling. Retailers emphasize convenience packaging such as squeezable bottles and single-hand open containers, encouraging manufacturers to standardize snap-lock closures for ease of use. Ready-to-use products sold across club stores, grocery chains and dollar-format retailers depend on durable closures that maintain product quality through long-distance logistics.

Price pressure from resin costs, limited recyclability in some closure-bottle combinations and slower adoption in premium beauty segments restrain growth.

Fluctuating polyolefin pricing raises packaging costs for mass-market brands and may delay closure upgrades for cost-sensitive product lines. Many closures use multi-material components that complicate separation in recycling streams, reducing appeal for brands pursuing ecofriendly goals. Premium beauty and personal care brands may prefer threaded or specialty dispensing closures for upscale appearance and controlled flow, limiting snap-lock penetration in higher-margin categories. These economic and design considerations moderate adoption in specific retail segments.

Shift toward tethered closures to improve recyclability, increased use in e-commerce liquid shipments and rising customization for brand differentiation define key trends.

The U.S. brands are adopting tethered snap-lock closures that remain attached to bottles to support recycling infrastructure and comply with emerging ecofriendly commitments. E-commerce fulfillment centers require packaging that prevents leakage during parcel handling, increasing demand for robust snap-lock mechanisms on detergents, cleaners and personal care bottles. Packaging teams are introducing customized shapes, printing and ergonomic profiles to strengthen brand identity while maintaining the reliability of snap-lock functionality. Modular closure platforms that fit multiple bottle types improve procurement efficiency for contract packers.

Demand for snap-lock closures in the United States reflects requirements in food packaging, personal-care bottles, household cleaning containers, and pharmaceutical products where re-closability and product integrity influence packaging selection. PET and HDPE bottles with snap-fit closures support high shelf turnover and frequent consumer use. West USA records 6.9%, followed by South USA (6.2%), Northeast USA (5.5%), and Midwest USA (4.8%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 6.9% |

| South USA | 6.2% |

| Northeast USA | 5.5% |

| Midwest USA | 4.8% |

West USA grows at 6.9% CAGR, supported by strong bottled beverage USAge, extensive personal-care manufacturing, and ecofriendly goals that influence closure design. California and Washington retain major filling operations for juices, cold-brew beverages, and plant-based drinks sold in re-closable plastic bottles for portability. Personal-care brands located in Los Angeles and San Diego require snap-lock closures for shampoos, lotions, and skincare packaging used in daily routines across dense consumer populations. Packaging suppliers near coastal ports maintain consistent supply of polyethylene and polypropylene required for closure molding. Automated lines benefit from closures compatible with rapid torque-free application. Retail expectations for spill-prevention and easy re-sealing sustain demand across grocery, drugstore, and convenience channels. Packaging development focuses on weight-optimized closures that reduce material use while preserving grip strength and sealing security.

South USA posts 6.2% CAGR, driven by large consumer-goods filling clusters in Texas, Florida, and Georgia. Cleaning liquids, additives, and multi-use home-care products rely on HDPE bottles paired with snap-lock closures due to spill-resistance and re-sealing reliability. Warm climates sustain strong packaged beverage consumption that supports multi-serve re-closable formats for juice and hydration segments. Regional contract packers supply national retailers, reinforcing closure procurement consistency across packaging lines. Inbound resin logistics through Gulf Coast ports reduce transportation distance for closure manufacturers and improve cost alignment with high-volume production requirements. Brand owners place importance on tamper-recognition features integrated into closure design for retail compliance.

Northeast USA expands at 5.5% CAGR, influenced by compact-format packaging and high retail density emphasizing user convenience. New York, New Jersey, and Massachusetts distribute large volumes of single-serve beverages and personal-care bottles used by commuters and students who require portable formats engineered to prevent leakage. Healthcare distribution networks use snap-fit closures for liquid over-the-counter medications and hygiene solutions that travel through hospitals and pharmacies. Packaging converters maintain flexible production for multi-SKU environments where short runs and frequent closure-size changes occur. Retailers prioritize closures that integrate clean opening and predictable resealing for repeat handling in constrained household storage spaces.

Midwest USA grows at 4.8% CAGR, supported by food processing, dairy bottling, and household product packaging across Illinois, Ohio, and Wisconsin. HDPE bottles for sauces, condiments, and refrigerated beverages commonly use snap-lock closures designed for repeated opening during home consumption. Household and automotive fluids require impact-resistant closures that secure during distribution through long-haul transport routes. Installed filling equipment favors closures with consistent compression fit and alignment properties to avoid disruptions during high-speed sealing. Procurement teams evaluate closure options based on material reliability and maintenance of line throughput rather than rapid structural changes.

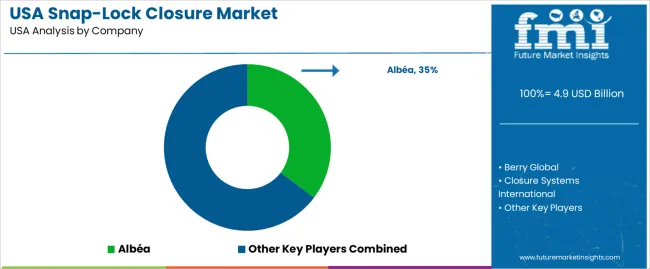

Demand for snap-lock closures in the USA is shaped by packaging-component suppliers serving personal care, household care, food, and industrial product applications. Albéa holds an estimated 35.3% share, supported by controlled molding precision, stable hinge-performance design, and strong supply relationships with U.S. personal-care brands. Its closures deliver consistent opening force, reliable snap engagement, and secure leak resistance under retail handling conditions. Berry Global maintains strong participation with snap-lock closure systems produced across multiple U.S. plants. Its products provide predictable dimensional accuracy, wide compatibility with HDPE and PET bottles, and steady availability across national filling operations. Closure Systems International contributes presence in beverage and household-product categories with closures that ensure reliable retention and durable hinge-function performance throughout distribution cycles.

Crown Holdings supports domestic food and household-chemical applications through snap-closure solutions offering controlled sealing and impact resistance for rigid-container formats. Graham Packaging adds integrated container-and-closure solutions that maintain closure engagement stability during high-speed filling and capping processes, serving major U.S. consumer-goods producers. Competition in the USA centers on seal reliability, hinge durability, compatibility with automated capping, resin-use efficiency, recyclability alignment, and national supply-chain coverage. Demand remains steady as brands seek dependable snap-lock systems that balance user convenience, secure resealability, and consistent performance across varying resin types and distribution environments in U.S. rigid-packaging applications.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Material Type | Plastic, Metal |

| Application | Food Packaging, Beverage Packaging, Personal Care & Cosmetics, Household Chemicals, Industrial Packaging |

| End-Use Product Types | Containers, Bottles & Jars, Pouches, Bags, Roofing, Others |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | Albéa, Berry Global, Closure Systems International, Crown Holdings, Graham Packaging Company |

| Additional Attributes | Adoption influenced by tamper-evident features, eco-friendly plastics, and recycled resin USAge; shift toward lightweight metal closures in beverages; demand driven by large-scale packaged food and household chemical producers; includes product differentiation through child-resistant, easy-open, and resealable mechanisms; competitive landscape shaped by packaging OEM partnerships and regional manufacturing clusters in the U.S. |

The demand for snap-lock closure in USA is estimated to be valued at USD 4.9 billion in 2025.

The market size for the snap-lock closure in USA is projected to reach USD 8.7 billion by 2035.

The demand for snap-lock closure in USA is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in snap-lock closure in USA are plastic and metal.

In terms of application, bags segment is expected to command 45.0% share in the snap-lock closure in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA