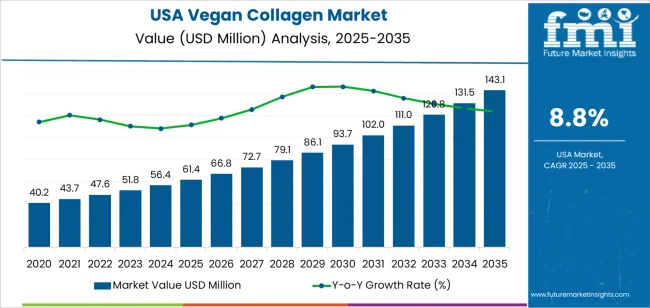

The demand for vegan collagen in USA is valued at USD 61.4 million in 2025 and is projected to reach USD 143.1 million by 2035, reflecting a compound annual growth rate of 8.8%. Growth is shaped by rising interest in plant based alternatives within beauty, nutrition and wellness categories. Vegan collagen appeals to consumers seeking non animal formulations with consistent performance across supplements, beverages and topical products. As manufacturers refine extraction methods and expand ingredient combinations, product lines become more diverse across retail and online channels. The market benefits from increasing interest in functional ingredients that support skin care, joint health and everyday nutrition. These factors contribute to a steady increase in demand throughout the forecast period.

The growth curve shows a clear upward pattern beginning at USD 40.2 million in earlier years and rising to USD 61.4 million in 2025 before progressing toward USD 143.1 million by 2035. Yearly increments remain consistent, moving from USD 66.8 million in 2026 to USD 72.7 million in 2027 and continuing through the timeline with predictable spacing. This progression reflects expanding use of vegan collagen across powders, ready to drink formats and beauty formulations. As distribution networks broaden and product innovation accelerates, adoption increases among both new and repeat consumers. The steady trajectory indicates a maturing category supported by improved ingredient quality, targeted positioning and growing inclusion of collagen alternatives in everyday wellness routines across USA.

Demand in USA for vegan collagen is projected to increase from USD 61.4 million in 2025 to USD 143.1 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 8.8%. Starting from USD 40.2 million in 2020, the demand rises gradually through USD 56.4 million in 2024 and hits USD 61.4 million in 2025. Over the decade from 2025 to 2035, demand then increases steadily, reaching USD 93.7 million in 2030 and ultimately USD 143.1 million in 2035. Growth is driven by rising consumer interest in plant based, ethical and sustainable nutritional solutions, increasing exploration of vegan supplementation options, and broader adoption across the beauty, nutrition and wellness segments.

The uplift of USD 81.7 million between USD 61.4 million and USD 143.1 million over the forecast period underscores both unit volume growth and higher value per product. Early growth is led by expanding consumer uptake as vegan friendly products move from niche to mainstream. In later years premiumisation becomes more pronounced as formulations incorporate advanced plant derived peptides, enhanced bioavailability, and branded functional benefits such as joint support, skin health and hair care. The combination of wider accessibility, stronger brand innovation and higher margin product tiers supports sustained expansion toward USD 143.1 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 61.4 million |

| Forecast Value (2035) | USD 143.1 million |

| Forecast CAGR (2025 to 2035) | 8.8% |

The demand for vegan collagen in USA is being driven by growing consumer interest in cruelty-free, plant-based alternatives to animal-derived products. Beauty and wellness buyers are increasingly selecting supplements, skincare serums and ingestible products that avoid bovine or marine sources of collagen. The aging USA population further supports this trend, as skincare and joint-health concerns prompt demand for collagen that aligns with ethical values. The expanding presence of vegan-certified brands and direct-to-consumer wellness platforms is making these products more accessible to a broader audience.

In addition, wellness-oriented routines and clean-label expectations are reinforcing uptake in USA. Consumers are seeking formulations that combine plant-based or fermentation-derived collagen with other functional ingredients such as vitamins, peptides and botanical extracts. The intersection of nutrition and beauty “inner wellness” approaches have elevated vegan collagen from niche to mainstream within health and beauty categories. Cost remains a consideration since production of plant-based collagen is often higher, yet the ethical, environmental and wellness drivers suggest that demand for vegan collagen in USA will continue to grow steadily.

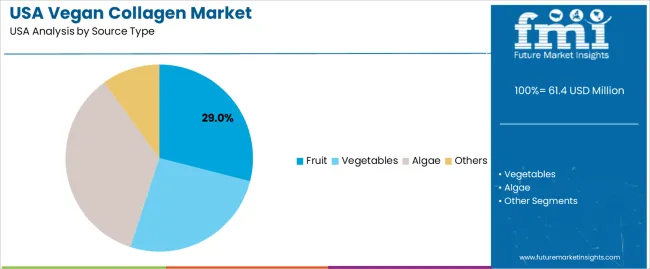

The demand for vegan collagen in the USA is shaped by the diversity of source types and the formats in which these products are offered. Sources include fruit, vegetables, algae and other plant-derived materials that support collagen production through amino acids and supportive nutrients. Form types such as powders and liquids serve different usage preferences and mixing habits among consumers. These segments reflect growing interest in plant-based beauty and wellness products, where clean-label ingredients and flexible consumption methods guide purchasing patterns. As consumers seek alternatives to animal-derived collagen, the combination of source variety and preferred formats shapes overall market demand.

Fruit sources account for 29% of total demand for vegan collagen in the USA. Their leading share reflects strong consumer familiarity and trust in fruit-derived nutrients that support natural collagen synthesis. Fruits provide vitamin C, antioxidants and amino acids that are frequently included in plant-based collagen formulations. Their broad acceptance and association with wellness and skin health reinforce consistent use in supplements. Manufacturers rely on fruit inputs to create formulations with predictable taste profiles and clear ingredient stories, which align with consumer expectations for transparency and plant-based authenticity.

Demand for fruit-based vegan collagen also grows as brands integrate blends featuring berries, citrus fruits and other botanicals that appeal to health-conscious buyers. Fruit-derived components support convenient daily consumption routines and adapt well to powdered and ready-to-mix formats. Their compatibility with broader functional nutrition trends, such as immunity support and antioxidant intake, strengthens their position in the category. As consumers continue seeking plant-forward solutions, fruit sources remain a major element in sustaining demand for vegan collagen products.

Powder forms account for 75.0% of total demand for vegan collagen in the USA. This strong share reflects the convenience and versatility of powders, which dissolve easily in smoothies, beverages and meal preparations. Many consumers prefer powders for their customizable serving sizes and straightforward integration into daily routines. Powders also support longer shelf life and simpler storage compared with liquid options. Their format enables higher concentrations of active ingredients, which appeals to buyers seeking more targeted nutritional support in collagen-boosting products.

Demand for powder formats is further strengthened by the popularity of functional beverages and home-prepared wellness drinks. Powders align well with trends in personalized nutrition, allowing users to adjust intake based on taste or health priorities. They also support clean-label formulations with fewer additives, reinforcing trust among plant-focused consumers. As the wellness market expands and users seek flexible, easy-to-use supplements, powder-form vegan collagen continues to dominate purchasing preferences across the USA.

Demand for vegan collagen in the USA is growing as consumers increasingly prefer cruelty-free, plant-based and sustainable alternatives to animal-derived ingredients. Interest in clean-label beauty, wellness energy supplements and functional foods supports this shift. Affordable production via fermentation and biotechnology expands supply. At the same time, higher cost of vegan collagen, limited consumer awareness and competition from traditional collagen products act as barriers. These forces together influence how quickly vegan collagen moves from niche to broader use across skincare, nutrition and supplement categories in the USA.

USA consumers are showing stronger preference for ethical and environmentally responsible products. Vegan collagen appeals to individuals who avoid animal-based ingredients for ethical, health or sustainability reasons. The convergence of lifestyle trends-plant-based diets, wellness-oriented supplements, and “beauty from within” claims-motivates brands to include vegan collagen in serums, functional beverages and snack formats. This alignment between consumer values and product promise accelerates the adoption of vegan collagen in USA personal care and nutrition segments.

Key opportunities in the USA lie in direct-to-consumer subscription skincare and ingestible collagen drinks or bars. Brands that combine vegan collagen with other active ingredients-such as antioxidants or probiotics-can differentiate. The use in clean-label supplements, sport-nutrition formats and plant-based wellness snacks also presents growth avenues. E-commerce channels, influencer marketing and boutique wellness stores further amplify reach. Suppliers that provide high-purity vegan collagen peptides and support formulation flexibility are well placed to benefit.

Several constraints slow softer expansion of vegan collagen in the USA market. Production costs remain high compared with legacy animal-derived collagen, which raises retail price. Many consumers are unfamiliar with vegan collagen’s benefits and may doubt its efficacy or equivalency to conventional collagen. Regulated claims around skin-health and supplement benefits also complicate marketing. Lastly, competition from traditional collagen sources and other functional ingredients means vegan collagen must prove value. These factors moderate how quickly vegan collagen moves into mass-market consumption.

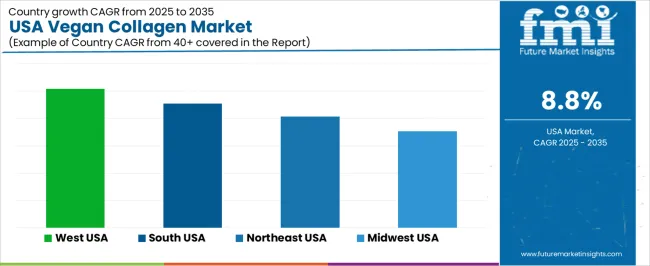

| Region | CAGR (%) |

|---|---|

| West | 10.2% |

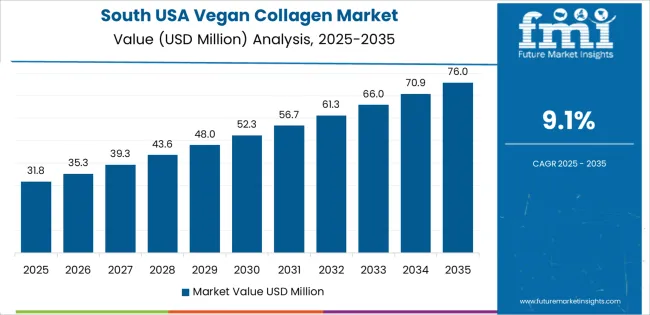

| South | 9.1% |

| Northeast | 8.1% |

| Midwest | 7.1% |

Demand for vegan collagen in the USA is steadily increasing across all regions. The West leads at 10.2%, driven by strong consumer interest in plant-based beauty and wellness products and widespread availability across retail channels. The South follows at 9.1%, supported by growing health-conscious populations and rising adoption of alternative collagen sources. The Northeast records 8.1%, influenced by dense urban markets and steady demand from nutraceutical and skincare consumers. The Midwest grows at 7.1%, reflecting gradual uptake as plant-based supplements gain visibility. Together, these regions show broad acceptance of vegan collagen across both dietary and cosmetic applications.

West USA is projected to grow at a CAGR of 10.2% through 2035 in demand for vegan collagen. California and neighboring states are adopting plant-based collagen supplements, powders, and functional foods to meet rising consumer interest in health, beauty, and sustainable nutrition. Retailers and e-commerce platforms provide a wide range of products to health-conscious individuals. Manufacturers are producing vegan collagen from algae, soy, and other plant sources to replace animal-derived alternatives. Rising wellness trends, dietary restrictions, and preference for cruelty-free ingredients further support steady growth in vegan collagen adoption across West USA.

South USA is projected to grow at a CAGR of 9.1% through 2035 in demand for vegan collagen. Urban centers such as Houston, Miami, and Atlanta are increasingly incorporating plant-based collagen into dietary supplements, beverages, and skincare products. Rising consumer awareness of wellness, clean nutrition, and ethical sourcing drives adoption. Manufacturers in the South are producing innovative formulations suitable for different dietary preferences. Retail and e-commerce channels expand product availability. The combination of lifestyle trends, health-focused consumption, and ethical product sourcing ensures steady growth in the adoption of vegan collagen across southern states.

Northeast USA is projected to grow at a CAGR of 8.1% through 2035 in demand for vegan collagen. Cities like New York, Boston, and Philadelphia are adopting plant-based collagen in dietary supplements, beverages, and functional foods to meet rising consumer interest in wellness and beauty. Retailers and distributors ensure access to products in urban centers. Manufacturers are producing collagen from algae, soy, and other plant-based sources. The combination of urban consumer health trends, preference for cruelty-free ingredients, and demand for sustainable nutrition supports steady adoption of vegan collagen in Northeast USA.

Midwest USA is projected to grow at a CAGR of 7.1% through 2035 in demand for vegan collagen. Urban centers and suburban households in Chicago, Detroit, and Minneapolis increasingly adopt plant-based collagen in supplements, beverages, and skincare products. Rising consumer interest in ethical, sustainable, and wellness-focused products drives adoption. Manufacturers are producing plant-derived collagen using algae, soy, and other sources to meet diverse dietary needs. Retailers and online platforms expand availability in smaller and medium-sized cities. Growth is supported by increased awareness of cruelty-free alternatives, functional nutrition trends, and the demand for clean-label vegan products in Midwest USA.

The demand for vegan collagen in the USA is driven by increasing consumer awareness of health, beauty and ethical sourcing. Many consumers seek supplements and skincare products that offer collagen benefits without animal-derived sources. Shifts toward plant-based diets and the growing number of flexitarians support adoption of vegan collagen alternatives. The beauty-from-within trend and interest in nutricosmetics encourage use of vegan collagen in serums, supplements and functional food applications. In addition, sustainability concerns, cruelty-free certification and demand for clean-label ingredients further elevate interest in vegan collagen offerings. Advances in biotechnology and ingredient innovation allow the production of high-purity, plant-based collagen analogues that support market expansion.

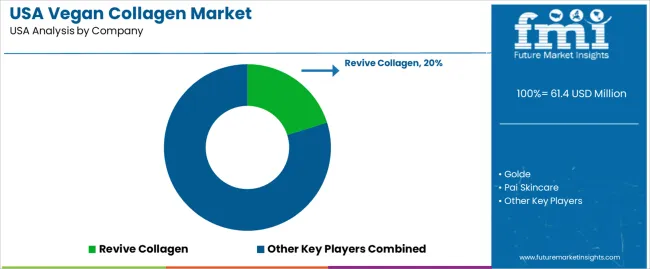

Key companies shaping this segment in the USA include Revive Collagen, Golde, Pai Skincare, Unived, SMPNutra and Olena Health. These brands cater to vegan- and health-conscious consumers with products that emphasize animal-free sourcing, transparency and nutritional benefit. They offer various formats including liquid supplements, powders, capsules and skincare infusions to meet different user preferences. By focusing on clean-label positioning, aesthetic packaging and digital marketing, they influence how vegan collagen is perceived and adopted in the USA market. Their collaborations with ingredient suppliers and wellness influencers further accelerate growth in this space.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Source Types | Fruit-Based, Vegetable-Based, Algae-Based, Other Plant-Derived Sources |

| Form Types | Powder, Liquid, Capsule, Other Formats |

| Applications | Dietary Supplements, Beverages, Skincare and Topical Products, Functional Foods |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Revive Collagen, Golde, Pai Skincare, Unived, SMPNutra, Olena Health |

| Additional Attributes | Dollar by sales by source type, form type, application, and region; regional CAGR and adoption trends; product innovation and ingredient purity; functional benefits such as skin, hair, joint health; clean-label and cruelty-free positioning; e-commerce and retail distribution channels; plant-based formulation development; growth of direct-to-consumer channels; influence of wellness and nutricosmetic trends; premiumisation and higher margin products; production scale and biofermentation technology; consumer awareness campaigns; competitive pricing and marketing strategies. |

The global demand for vegan collagen in USA is estimated to be valued at USD 61.4 million in 2025.

The market size for the demand for vegan collagen in USA is projected to reach USD 143.1 million by 2035.

The demand for vegan collagen in USA is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in demand for vegan collagen in USA are fruit, vegetables, algae and others.

In terms of form type, powder segment to command 75.0% share in the demand for vegan collagen in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Collagen Casings Market Analysis – Size, Share & Forecast 2025–2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Market - Innovations & Consumer Demand Trends

Demand for Vegan Collagen in Japan Size and Share Forecast Outlook 2025 to 2035

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Collagen Supplement Market Size and Share Forecast Outlook 2025 to 2035

Collagen Water Market Forecast and Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Collagen Skin Matrix Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA