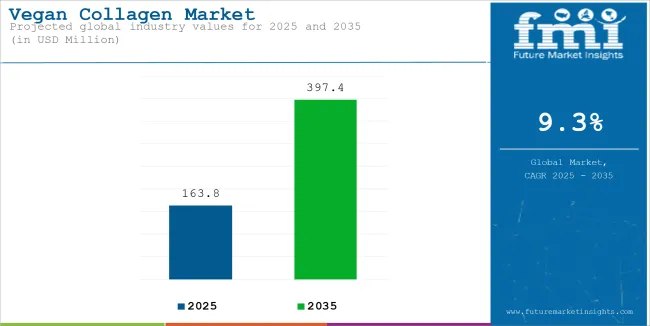

The global vegan collagen market is estimated to account for USD 163.8 million in 2025. It is anticipated to grow at a CAGR of 9.3% during the forecast period and reach a value of USD 397.4 million by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Vegan Collagen Market Size (2025E) | USD 163.8 million |

| Projected Global Vegan Collagen Market Value (2035F) | USD 397.4 million |

| Value-based CAGR (2025 to 2035) | 9.3% |

The vegan collagen market is booming; more consumers than ever are choosing cruelty-free, sustainable collagen sources for their diets because traditional collagen mainly comes from animals.

Bamboo, algae, and the acerola cherry are sourced from plants to stimulate collagen. Increasing awareness about how animal farming is linked to the deteriorating environment and seeking vegan-friendly food options fuels the shift.

Beauty and personal care businesses are rapidly entering the vegan collagen as demand is growing for beauty and wellness products that promote skin elasticity, joint health, and overall well-being. Vegan collagen is available as a mix of powders and drinks for end-users that addresses the health needs for consumers.

| Attributes | Details |

|---|---|

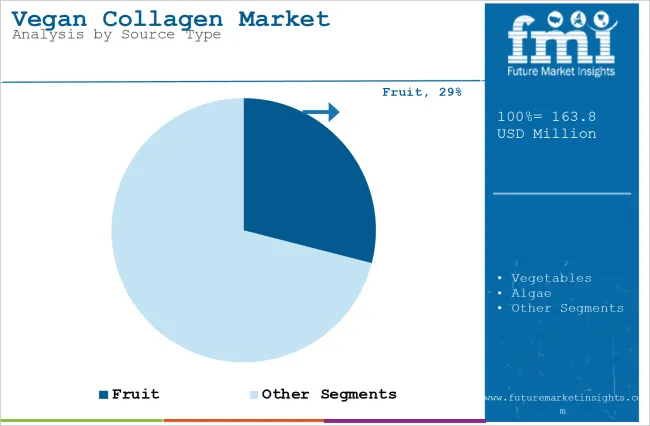

| Top Source Type | Fruit |

| Market Share in 2025 | 29% |

Citrus fruits, such as oranges and lemons, have a high vitamin C concentration that increases collagen formation and improves skin suppleness, making them important in the vegan collagen market. Antioxidants and vitamins included in berries like blueberries and strawberries promote the production of collagen and the health of the skin.

Vitamins A, C, and E are abundant in tropical fruits like papaya, pineapple, and mango, which encourage skin renewal and hydration. For example, Acai is especially well-liked because of their high levels of food amino acids and antioxidants, which help in producing collagens and anti-aging properties. Because they are high in essential nutrients, these fruits are frequently used in collagen supplements and cosmetics to promote healthy, and youthful skin.

| Attributes | Details |

|---|---|

| Top Form Type | Powder |

| Market Share in 2025 | 75% |

Vegan collagen powder is one of the most popular forms, often added to beverages such as smoothies, juices, or water. These powders typically contain plant-based collagen peptides or other plant-derived ingredients that promote collagen synthesis in the body.

| Attributes | Details |

|---|---|

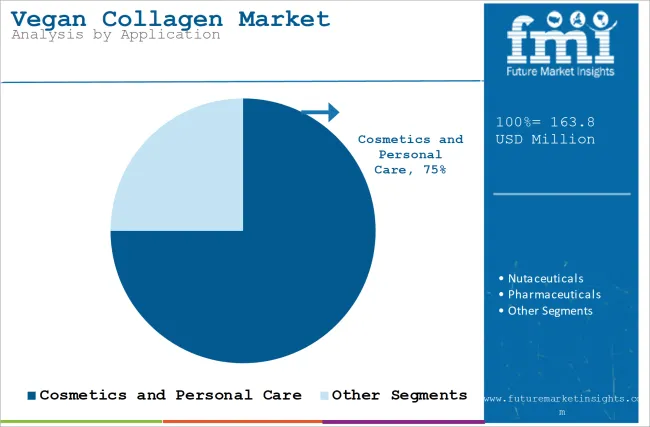

| Top Application | Cosmetics and Personal Care |

| Market Share in 2025 | 75% |

The cosmetics and personal care segment is the largest application category, with a dominant market share, reflecting the growing shift toward plant-based ingredients in beauty and personal care products.

Growing Interest in Plant-based Products

Consumers are looking for collagen and other animal-based product substitutes as plant-based diets and more ethical lifestyles gain popularity. The demand for vegan collagen made from plants like algae, soy, and other botanicals is rising as a result of this change.

Prioritize Health and Well-being

As the population has become more health conscious, they need products that improve their joint health, skin, and hair without depending on animal-based products. Vegan collagen fulfils these requirements, which is commonly marketed as a safer and natural substitute, allowing consumers to benefit from collagen while upholding their moral standards.

Environmental and Ethical Issues

Many people are looking for cruelty-free and sustainable options driven by concerns for animal welfare and environmental impact of animal-based products. Vegan collagen appeals to masses since it does not endorse animal-cruelty and environmental problems.

Lack of Awareness and Education

Many consumers are still unaware of vegan collagen and its benefits. While traditional collagen is widely recognized for its positive effects on skin, hair, and joints, vegan collagen is a newer option that requires more education to help the consumer understand its working advantages. The knowledge gap can deaccelerate the adoption of vegan collagen products.

Regulatory and Certification Hurdles

As vegan collagen is a relatively new category, there are still regulatory challenges around labeling, health claims, and ingredient approvals. Different markets may take time to establish clear guidelines for these products, which could delay their availability and complicate the process for brands trying to introduce vegan collagen products to consumers.

High Production Costs

Creating vegan collagen is a complex process that relies on advanced technologies such as fermentation and plant-based biotech, making it more expensive to produce. The higher cost is reflected in retail prices, which can make vegan collagen products less accessible to some consumers compared to traditional animal-based options.

Growing Consumer Interest in Ethical and Sustainable Products

There is a huge chance for brands to satisfy the need for vegan collagen since consumers are becoming more conscious of sustainability and ethical sourcing.

Businesses can draw in eco-aware consumers who are specifically searching for cruelty-free and environmentally friendly items thanks to this trend. Brands may differentiate themselves in a crowded market and forge closer bonds with consumers that value sustainability and transparency by highlighting these qualities.

Growth in Plant-Based and Vegan Lifestyles

The market for vegan collagen is expanding quickly as more individuals switch to plant-based and vegan diets. Companies can take advantage of this by providing vegan collagen in a variety of products, including drinks, beauty items, and gut health supplements.

Businesses may access a booming market and create opportunities for innovation and new product offers as the trend grows by catering to the preferences of health-conscious consumers.

Biotechnology Innovation

Thanks to the new breakthroughs in biotechnology, vegan collagen is becoming more effective and accessible. Companies are using ingredients such as fermented algae and plant peptides to create collagen-like proteins that help support body's natural collagen production, making it easier to keep skin and joints healthy.

Eco-Friendly Ingredients and Packaging

As people become more environmentally conscious, brands are choosing ingredients like bamboo and algae for their vegan collagen products. They're also opting for eco-friendly packaging, using recyclable or biodegradable materials to add transparency in product ingredient and its impact on the planet.

Vegan Collagen in Functional Foods and Beverages

Vegan collagen is present in everyday foods and drinks such as smoothies, protein bars, and beauty beverages. This makes it easy for people to boost their skin and joint health while enjoying their favorite snacks and drinks, without adding extra steps to their routine.

Health-Conscious Millennials

Mostly women in their late 20s to early 30s who are urban professionals or fitness enthusiasts are the major end-users. They prioritize products that reflect their commitment to natural, and clean living. Often shopping online, they make purchasing decisions based on influencers and prefer buying in bulk or through subscription models to streamline their routines. Premium, eco-friendly, and effective products are their top choice.

Eco-Conscious Beauty Enthusiast

Women aged 30-45 who are passionate about skincare and sustainability. They seek out vegan collagen for its anti-aging properties and are dedicated to ethical practices such as cruelty-free products and sustainable packaging. They frequently purchase from retailers or e-commerce platforms, often guided by beauty bloggers and influencers who share their values.

Vegan Lifestyle Advocate

This group mainly includes young adults (18-30), students and early-career professionals, committed to veganism and ethical living. They gravitate toward vegan collagen for its health benefits, especially for skin and hair, and are highly active on social media. While being budget-conscious, they prioritize shopping at vegan or ethical online marketplaces and follow recommendations from online vegan communities.

Baby Boomers Looking for Anti-Aging Solutions

Women between the ages of 50 and 65 who are retired or close to retirement are concerned about keeping their skin and general health looking young. They favor natural, non-toxic goods that support their overall wellness objectives.

As a part of their anti-aging regimen, they are more likely to spend their more disposable income on high-end vegan collagen products that claim to enhance skin elasticity and health.

Vegan Collagen Supplements (Powders/Capsules)

Vegan collagen supplements, whether in powder or capsule form, typically range from USD 20 to USD 80 per container, depending on the brand, the specific ingredients, and the quantity (usually between 30 to 60 servings). The higher-end products often feature premium plant-based sources like algae or peptides and may include extra nutrients for added health benefits.

Vegan Collagen Skincare (Serums, Creams)

Vegan collagen skincare products, such as serums and creams, generally fall within USD 30 to USD 150 range. The price can vary based on the brand reputation, quality of ingredients used, and the product size. More expensive skincare options often combine vegan collagen with other powerful ingredients like hyaluronic acid or antioxidants for a comprehensive skincare routine.

Vegan Collagen Beverages (Drinks, Teas)

Vegan collagen beverages, including drinks and teas, are typically priced from USD 3 to USD 10 per bottle or packet. Premium options, which may include added superfoods or other health-boosting ingredients, can cost anywhere from USD 15 to USD 30. These ready-to-drink alternatives provide an easy way for people to incorporate vegan collagen into their daily routine.

Vegan Collagen Bars (Snacks/Protein Bars)

Vegan collagen bars are usually priced between USD 2 and USD 6 each with some higher-end options featuring extra nutrients such as vitamins, minerals, and plant-based proteins. These bars serve as convenient and nutritious snacks that also offer the benefits of collagen.

Vegan Collagen Face Masks

Face masks with vegan collagen generally range from USD 10 to USD 50, depending on the brand and the specific formulation. Higher-priced masks may include additional skincare benefits or more potent ingredients, offering an extra boost for skincare routine.

Clean Beauty Trend on the Rise

The shift towards clean beauty is gaining momentum, with consumers-especially younger generations-placing a strong emphasis on natural, non-toxic skincare and beauty products. These consumers value transparency and ethical sourcing, making vegan collagen products increasingly appealing. As a cleaner, more sustainable alternative to traditional options, vegan collagen fits well with the growing demand for eco-friendly and health-conscious beauty solutions.

Plant-Based Collagen Perception is Changing

Although animal-based collagen has long been used because it increases skin suppleness and has anti-aging properties, many customers are now adopting plant-based substitutes. There is still considerable doubt, nevertheless, as to whether vegan collagen can produce the same outcome. In order to combat this, companies focus on informing customers about the long-term advantages and effectiveness of collagen derived from plants.

Willingness to Invest in Ethical Products

Customers are demonstrating willingness to spend money on goods that represent their values as they grow more in line with principles such as sustainability, cruelty-free business methods, and veganism. Price sensitivity is still a factor, despite the growing demand for high-quality vegan collagen. To meet the demands of changing market, brands must find a balance between providing premium, ethically sourced goods and keeping prices competitive.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 7.4% |

| Germany | 8.2% |

| China | 7.7% |

| India | 9.8% |

The USA continues to lead the global vegan collagen market, driven by a rising awareness of plant-based alternatives and sustainability. The demand is particularly high in the cosmetics, personal care, and health supplement sectors. Health-conscious consumers, a growing vegan population, and a focus on ethical beauty products are fueling this growth. By 2025, the USA is projected to account for substantial growth, around 35-40%, of the global market.

The market for vegan collagen is growing steadily, especially in the beauty and personal care sectors in Germany. As a leader in the European natural beauty market, Germany is witnessing a surge in demand for plant-based and eco-friendly products. The country growth is expected to reach a market share of 10% with a growing interest in vegan beauty, combined with strong support for ethical and sustainable consumption.

Western beauty trends and a growing emphasis on natural and sustainable beauty is driving a spiked interest in vegan collagen in China's personal care and health supplement industries. Due to its huge population and growing middle class, China is predicted to have a significant proportion of 12-15% of the worldwide vegan collagen market by 2025 as awareness for plant-based goods increases.

In India, plant-based and vegan products are gaining momentum, especially in the personal care market. Vegan collagen is becoming increasingly popular for skincare products as the awareness is growing. With a rising vegan community and increasing disposable income, India is projected to capture around 4-6% of the global vegan collagen market, and demand is set to grow high in the upcoming years.

The rapid growth in the vegan collagen market is caused by the increasing shift towards cruelty-free and plant-based beauty and health products on a global level.

Consumers increasingly are aware of the environmental and ethical implications that animal-derived collagen holds, resulting in the growing demand for cruelty-free, sustainable alternatives.

Vegan collagen offers a guilt-free option, supporting personal health without compromising ethical standards. Companies are capturing this demand with new, innovative, cruelty-free, and environmental considerations in the development of vegan collagen solutions.

| Company | Area of Focus |

|---|---|

| Revive Collagen Health Supplements | Specializes in vegan collagen powders and liquid supplements aimed at improving skin health, promoting hair growth, and supporting joints. |

| Golde Food & Beverages | Offers plant-based wellness products, including vegan collagen-infused powders and drinks designed for skin and overall health |

| Pai Skincare Cosmetics & Personal Care | Focuses on skincare products, particularly anti-aging solutions, using vegan and natural ingredients, including vegan collagen. |

| Unived Health Supplements | Specializes in plant-based collagen supplements, targeting benefits for skin, joints, and hair health through a vegan formulation. |

| SMPNutra Private Label Manufacturing | Provides manufacturing services for vegan collagen products, offering custom formulation and production for other brands |

Vegan Collagen for Health: Several companies, like Revive Collagen and Unived, focus on vegan collagen supplements that promote healthy skin and hair growth. Their joint support indicates a trend toward plant-based and natural wellness for many people.

Plant-Based Wellness Products: Golde stands out in the food and beverage category by offering vegan collagen-infused powders and drinks, combining the health benefits of plant-based ingredients with convenient, functional products.

Anti-Aging Skincare: In response to consumer demand for environmentally responsible and potent skin-rejuvenating products, companies such as Pai Skincare specialize in anti-aging skincare products made with natural and vegan ingredients.

Private Label Manufacturing: SMPNutra is taking advantage of the increasing demand by offering private label manufacturing services, which enable companies to produce vegan collagen products with unique formulas.

| Attribute | Details |

|---|---|

| Anima Mundi Apothecary | Anima Mundi Apothecary leads in holistic wellness by offering plant-based collagen powders that support beauty, wellness, and anti-aging benefits. The brand emphasizes clean, sustainably sourced ingredients, with a focus on holistic well-being. Their key products include vegan collagen powders made from plant-based sources such as bamboo silica, acerola cherry, and algae delivering natural support for skin health and vitality. |

| The Beauty Chef | Innovation in beauty nutrition is The Beauty Chef's primary focus, as it pioneers beauty supplements and skincare products based on organic ingredients and fermented foods. The brand specializes in vegan collagen options produced to enhance beauty from within. Their key product, Inner Beauty Collagen is a plant-based supplement that promotes skin elasticity and hydration, leveraging the power of organic, fermented ingredients for optimal skin health. |

| PlantFusion | Innovation in plant-based nutrition is PlantFusion's main focus, as it leads in creating plant-based protein powders and supplements made with clean, allergen-free, and non-GMO ingredients. The company specializes in offering vegan alternatives to traditional collagen products. Their key product, Collagen Builder, is a plant-based collagen booster made from a blend of botanical ingredients, including bamboo extract and silica, designed to support skin health and elasticity. |

| Vegan Collagen Co. | Vegan Collagen is focused on vegan collagen solutions, giving a strong base of ethics and sustainable sourcing. They offer supplements based on vegan collagen to promote skin elasticity, hair health, and joint support. Their products include plant-based supplements made from sustainably sourced ingredients like sea buckthorn and bamboo. |

| Algenist | Innovation in biotechnology is Algenist's foremost factor, as it is at the forefront of manufacturing skincare products based on sustainable, plant-based ingredients. They also use algae-based ingredients in vegan collagen products. Their key products include collagen-boosting serums and moisturizers that incorporate plant-based collagen making the skin more elastic and decreasing the signs of aging. |

The vegan collagen market is segmented by source type in fruits, vegetables, and algae.

The vegan collagen market is segmented into form through powder and liquids.

According to the applications, the vegan collagen market is segmented into nutraceuticals, pharmaceuticals, the food industry, and cosmetics.

The region's vegan market is segmented into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

Vegan collagen is a plant-based alternative to traditional animal-derived collagen, offering ethical and sustainable benefits.

Vegan collagen supports skin elasticity, joint health, and hair health, similar to animal-based collagen.

Vegan collagen is produced using biotechnology techniques like fermentation, primarily from plant sources like algae and bamboo.

The primary sources of vegan collagen are fruits (29% market share in 2025), algae, and bamboo.

The cosmetics and personal care sector holds the largest share, driven by demand for plant-based beauty products.

Table 1: Global Market Value (US$ million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (MT) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ million) Forecast by Source, 2019 to 2034

Table 4: Global Market Volume (MT) Forecast by Source, 2019 to 2034

Table 5: Global Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 6: Global Market Volume (MT) Forecast by Form, 2019 to 2034

Table 7: Global Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 8: Global Market Volume (MT) Forecast by Application, 2019 to 2034

Table 9: North America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ million) Forecast by Source, 2019 to 2034

Table 12: North America Market Volume (MT) Forecast by Source, 2019 to 2034

Table 13: North America Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 14: North America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 15: North America Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 16: North America Market Volume (MT) Forecast by Application, 2019 to 2034

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ million) Forecast by Source, 2019 to 2034

Table 20: Latin America Market Volume (MT) Forecast by Source, 2019 to 2034

Table 21: Latin America Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 22: Latin America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 23: Latin America Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 24: Latin America Market Volume (MT) Forecast by Application, 2019 to 2034

Table 25: Europe Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 26: Europe Market Volume (MT) Forecast by Country, 2019 to 2034

Table 27: Europe Market Value (US$ million) Forecast by Source, 2019 to 2034

Table 28: Europe Market Volume (MT) Forecast by Source, 2019 to 2034

Table 29: Europe Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 30: Europe Market Volume (MT) Forecast by Form, 2019 to 2034

Table 31: Europe Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 32: Europe Market Volume (MT) Forecast by Application, 2019 to 2034

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 34: East Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 35: East Asia Market Value (US$ million) Forecast by Source, 2019 to 2034

Table 36: East Asia Market Volume (MT) Forecast by Source, 2019 to 2034

Table 37: East Asia Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 38: East Asia Market Volume (MT) Forecast by Form, 2019 to 2034

Table 39: East Asia Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 40: East Asia Market Volume (MT) Forecast by Application, 2019 to 2034

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 42: South Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 43: South Asia Market Value (US$ million) Forecast by Source, 2019 to 2034

Table 44: South Asia Market Volume (MT) Forecast by Source, 2019 to 2034

Table 45: South Asia Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 46: South Asia Market Volume (MT) Forecast by Form, 2019 to 2034

Table 47: South Asia Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 48: South Asia Market Volume (MT) Forecast by Application, 2019 to 2034

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 50: Oceania Market Volume (MT) Forecast by Country, 2019 to 2034

Table 51: Oceania Market Value (US$ million) Forecast by Source, 2019 to 2034

Table 52: Oceania Market Volume (MT) Forecast by Source, 2019 to 2034

Table 53: Oceania Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 54: Oceania Market Volume (MT) Forecast by Form, 2019 to 2034

Table 55: Oceania Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 56: Oceania Market Volume (MT) Forecast by Application, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (MT) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ million) Forecast by Source, 2019 to 2034

Table 60: Middle East and Africa Market Volume (MT) Forecast by Source, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 62: Middle East and Africa Market Volume (MT) Forecast by Form, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 64: Middle East and Africa Market Volume (MT) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ million) by Source, 2024 to 2034

Figure 2: Global Market Value (US$ million) by Form, 2024 to 2034

Figure 3: Global Market Value (US$ million) by Application, 2024 to 2034

Figure 4: Global Market Value (US$ million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (MT) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ million) Analysis by Source, 2019 to 2034

Figure 10: Global Market Volume (MT) Analysis by Source, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 13: Global Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 14: Global Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 17: Global Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 18: Global Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 21: Global Market Attractiveness by Source, 2024 to 2034

Figure 22: Global Market Attractiveness by Form, 2024 to 2034

Figure 23: Global Market Attractiveness by Application, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ million) by Source, 2024 to 2034

Figure 26: North America Market Value (US$ million) by Form, 2024 to 2034

Figure 27: North America Market Value (US$ million) by Application, 2024 to 2034

Figure 28: North America Market Value (US$ million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ million) Analysis by Source, 2019 to 2034

Figure 34: North America Market Volume (MT) Analysis by Source, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 37: North America Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 38: North America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 41: North America Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 42: North America Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 45: North America Market Attractiveness by Source, 2024 to 2034

Figure 46: North America Market Attractiveness by Form, 2024 to 2034

Figure 47: North America Market Attractiveness by Application, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ million) by Source, 2024 to 2034

Figure 50: Latin America Market Value (US$ million) by Form, 2024 to 2034

Figure 51: Latin America Market Value (US$ million) by Application, 2024 to 2034

Figure 52: Latin America Market Value (US$ million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ million) Analysis by Source, 2019 to 2034

Figure 58: Latin America Market Volume (MT) Analysis by Source, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 61: Latin America Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 62: Latin America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 65: Latin America Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 66: Latin America Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Source, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Form, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Europe Market Value (US$ million) by Source, 2024 to 2034

Figure 74: Europe Market Value (US$ million) by Form, 2024 to 2034

Figure 75: Europe Market Value (US$ million) by Application, 2024 to 2034

Figure 76: Europe Market Value (US$ million) by Country, 2024 to 2034

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 78: Europe Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Europe Market Value (US$ million) Analysis by Source, 2019 to 2034

Figure 82: Europe Market Volume (MT) Analysis by Source, 2019 to 2034

Figure 83: Europe Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 85: Europe Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 86: Europe Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 87: Europe Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 89: Europe Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 90: Europe Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 93: Europe Market Attractiveness by Source, 2024 to 2034

Figure 94: Europe Market Attractiveness by Form, 2024 to 2034

Figure 95: Europe Market Attractiveness by Application, 2024 to 2034

Figure 96: Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ million) by Source, 2024 to 2034

Figure 98: East Asia Market Value (US$ million) by Form, 2024 to 2034

Figure 99: East Asia Market Value (US$ million) by Application, 2024 to 2034

Figure 100: East Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 101: East Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: East Asia Market Value (US$ million) Analysis by Source, 2019 to 2034

Figure 106: East Asia Market Volume (MT) Analysis by Source, 2019 to 2034

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 109: East Asia Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 110: East Asia Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 113: East Asia Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 114: East Asia Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 117: East Asia Market Attractiveness by Source, 2024 to 2034

Figure 118: East Asia Market Attractiveness by Form, 2024 to 2034

Figure 119: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 120: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia Market Value (US$ million) by Source, 2024 to 2034

Figure 122: South Asia Market Value (US$ million) by Form, 2024 to 2034

Figure 123: South Asia Market Value (US$ million) by Application, 2024 to 2034

Figure 124: South Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 125: South Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia Market Value (US$ million) Analysis by Source, 2019 to 2034

Figure 130: South Asia Market Volume (MT) Analysis by Source, 2019 to 2034

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 133: South Asia Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 134: South Asia Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 137: South Asia Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 138: South Asia Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 141: South Asia Market Attractiveness by Source, 2024 to 2034

Figure 142: South Asia Market Attractiveness by Form, 2024 to 2034

Figure 143: South Asia Market Attractiveness by Application, 2024 to 2034

Figure 144: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 145: Oceania Market Value (US$ million) by Source, 2024 to 2034

Figure 146: Oceania Market Value (US$ million) by Form, 2024 to 2034

Figure 147: Oceania Market Value (US$ million) by Application, 2024 to 2034

Figure 148: Oceania Market Value (US$ million) by Country, 2024 to 2034

Figure 149: Oceania Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: Oceania Market Value (US$ million) Analysis by Source, 2019 to 2034

Figure 154: Oceania Market Volume (MT) Analysis by Source, 2019 to 2034

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 157: Oceania Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 158: Oceania Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 161: Oceania Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 162: Oceania Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 165: Oceania Market Attractiveness by Source, 2024 to 2034

Figure 166: Oceania Market Attractiveness by Form, 2024 to 2034

Figure 167: Oceania Market Attractiveness by Application, 2024 to 2034

Figure 168: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ million) by Source, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ million) by Form, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ million) by Application, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ million) Analysis by Source, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (MT) Analysis by Source, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Source, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Form, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA