The demand for softgel encapsulation machines in USA is valued at USD 40.4 million in 2025 and is projected to reach USD 60.9 million by 2035, reflecting a compound annual growth rate of 4.2%. Growth is shaped by stable production needs across pharmaceuticals, nutraceuticals and functional supplements, where softgel formats remain favored for dose consistency, ingredient protection and ease of swallowing. As manufacturers broaden product portfolios, equipment capable of precise filling, reliable sealing and continuous operation retains strong relevance. Facilities that scale output or replace aging machinery maintain routine procurement, reinforcing predictable adoption cycles. The sector also benefits from ongoing refinement in encapsulation processes that support diverse formulations and improved production efficiency across USA’s manufacturing environments.

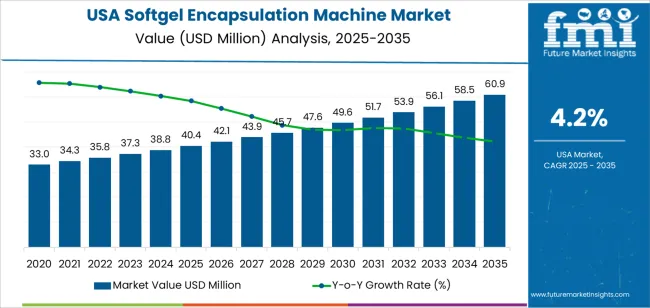

The growth curve shows a steady upward path, beginning at USD 33.0 million in earlier years and rising to USD 40.4 million in 2025 before advancing to USD 60.9 million by 2035. Annual movements remain consistent, with values progressing from USD 42.1 million in 2026 to USD 43.9 million in 2027 and continuing upward in evenly spaced increments through later years. This pattern reflects a mature but steadily expanding equipment category driven by routine line upgrades, expanded softgel capacity and stable demand for encapsulated dosage forms. As companies adopt improved controls, better material handling and flexible tooling options, softgel encapsulation machinery maintains reliable growth supported by clinical production needs, consumer supplement trends and regular modernization of manufacturing operations across USA.

Demand in USA for softgel encapsulation machines is projected to increase from USD 40.4 million in 2025 to USD 60.9 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 4.2%. The market starts at USD 33.0 million in 2020, rises steadily to USD 38.8 million in 2024 and USD 40.4 million in 2025. From 2025 to 2030 the value climbs to around USD 49.6 million, and by 2035 it reaches USD 60.9 million. Growth is driven by rising demand for softgel formats in pharmaceuticals and nutraceuticals, increasing production capacities, and the shift toward more automated encapsulation technologies.

Over the decade from 2025 to 2035 the total uplift equals USD 20.5 million. Early growth is largely volume led as manufacturers expand capacity and adopt softgel technology in new product lines. In the later years, value growth gains importance: machines are adopted with higher throughput, better accuracy, enhanced automation and connectivity, increasing average selling price. Suppliers who emphasise advanced features, servicing and scalability are well positioned to capture the incremental demand toward USD 60.9 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 40.4 million |

| Forecast Value (2035) | USD 60.9 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

The demand for softgel encapsulation machines in USA is influenced by growth in pharmaceutical and nutraceutical production where softgel formats are increasingly preferred for delivery of vitamins, supplements and specialised medications. Manufacturers in USA seek encapsulation lines that support high throughput, consistent fill weights and compliance with stringent manufacturing standards. As more brands launch or reformulate products into softgel formats to cater to consumer wellness trends and prescription therapies, equipment investment rises accordingly. The need for machines capable of managing small batch runs and flexible formats also supports demand among contract manufacturers and speciality capsule producers.

Further demand is supported by regulatory pressure and export opportunities. USA producers of softgel capsules must meet strict quality, traceability and automation requirements, which drives selection of machinery offering advanced monitoring and integrated controls. Export-oriented suppliers require equipment that complies with international standards and can adapt to global regulatory shifts. Equipment retrofit and expansion of capacity for new softgel product lines further enhance demand. Although high capital cost, integration into existing production lines and the need for skilled operation pose barriers, the overall trend indicates steady growth in demand for softgel encapsulation machines in USA.

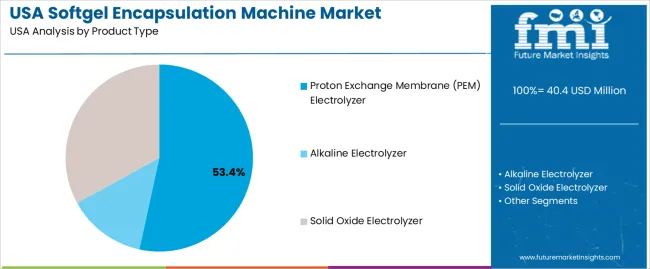

The demand for softgel encapsulation machines in USA is shaped by the product types listed in the provided segments and the capacity ranges used across different production environments. Product types include proton exchange membrane electrolyzers, alkaline electrolyzers and solid oxide electrolyzers, each offering distinct operating characteristics within the listed structure. Capacity categories such as low, medium and high ranges align with small batch requirements, mid-scale operations and large industrial workloads. As producers focus on equipment that supports stable throughput, manageable operation and predictable performance, the combination of machine type and output capacity guides equipment selection across varied manufacturing settings in USA.

Proton exchange membrane electrolyzers account for 53% of total demand within the provided product type categories. Their leading position reflects consistent performance, stable operation and suitability for production environments that require controlled processing conditions. Facilities value equipment that integrates smoothly with existing workflows and supports reliable output without extensive adjustments. This type offers predictable behavior across varied loads, contributing to steady adoption among users who prioritize straightforward operation. These qualities support continued reliance on proton exchange membrane electrolyzers within the listed framework for softgel encapsulation equipment demand in USA.

Demand for this product type also grows as producers adopt systems that allow measured expansion while maintaining operational stability. Proton exchange membrane models support incremental growth without major layout changes, which benefits facilities adjusting to evolving production needs. Their compatibility with structured production routines encourages long-term use in settings where consistency matters. The ability to maintain steady performance across different operating conditions further strengthens their role. As production strategies continue emphasizing predictable output, this product type maintains its leading position across USA.

Low capacity systems account for 21.0% of total demand within the listed capacity categories. This leading share reflects the importance of compact, manageable equipment suited to small batch production and controlled operational testing. Facilities with limited space or early-stage production needs adopt low capacity systems to maintain efficiency without unnecessary overhead. Users rely on these systems for their ease of handling, straightforward adjustments and predictable performance across short production runs. These traits support steady demand among producers evaluating new formulations or operating within confined production environments.

Demand for low capacity systems also increases as organizations adopt phased production approaches. Many facilities begin with modest output volumes before scaling into larger ranges, making low capacity equipment a practical starting point. These systems help teams manage resources efficiently while maintaining consistent throughput. Their stable performance across routine tasks fosters dependable operation for both established and emerging producers. As production environments continue prioritizing adaptability and control, low capacity systems remain an important option within USA’s equipment selection patterns.

Demand for softgel encapsulation machines in the USA is increasing as pharmaceutical and nutraceutical manufacturers require higher-throughput, more automated production lines for soft-gel capsules. Growth is supported by increasing use of softgels for dietary supplements, vitamins, and prescription medications, and pressure to modernize manufacturing for efficiency, regulatory compliance, and cost control. At the same time, barriers include high capital cost of advanced encapsulation equipment, rigorous validation and regulatory compliance requirements, and competition from contract manufacturers using older machines. These factors together shape installation decisions across the USA market.

How Are Industry Shifts in Pharmaceuticals and Nutraceuticals Influencing Demand for Softgel Encapsulation Machines in USA?

In the USA, the rising prevalence of chronic diseases and growing consumer interest in wellness and supplementation have led to increased production of soft-gel dosage forms. Manufacturers and CDMOs (contract development/manufacturing organisations) are investing in encapsulation machines that can handle variable batch sizes, high speed, and flexible formats to meet evolving demand. Technological advances such as modular machine design, digital controls and shorter change-over times further stimulate equipment purchases. However, adoption timelines are influenced by existing capacity, depreciation of older machinery, and availability of skilled operators.

Where Are Growth Opportunities Emerging for Softgel Encapsulation Machines in USA’s Market?

Growth opportunities in the USA exist in upgrades of legacy capsule lines, expansion of nutraceutical soft-gel product lines, and integration of plant-based or vegan soft-gel formats. The supplement industry’s move towards softgels for novel nutrient delivery and the growth of private-label wellness brands also drive demand. Additionally, smaller-scale or specialised production runs (e.g., niche supplements, personalized nutrition) create demand for smaller, more flexible encapsulation machines. Suppliers that offer modular, scalable, servicing-friendly systems tailored for these segments can capture growth.

What Challenges Are Limiting Broader Adoption of Softgel Encapsulation Machines in USA?

Despite strong drivers, several challenges slow broader adoption in the USA market. First, the high upfront cost and longer amortisation period for advanced encapsulation equipment deter investment, especially among smaller manufacturers. Second, regulatory and quality-control requirements (GMP compliance, validation, inspection) raise operational overhead and extend payback times. Third, competition from contract manufacturers and smaller producers who use simpler equipment or outsource soft-gel production means some firms defer investment. These barriers moderate how quickly new equipment becomes standard across all production tiers.

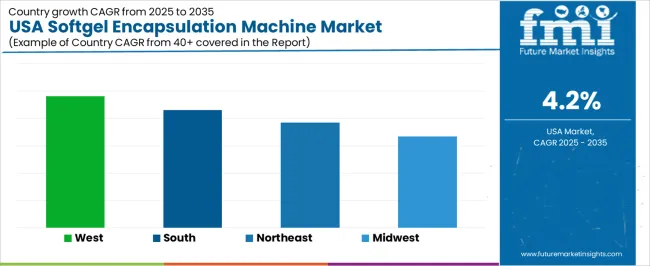

| Region | CAGR (%) |

|---|---|

| West | 4.8% |

| South | 4.3% |

| Northeast | 3.8% |

| Midwest | 3.3% |

Demand for softgel encapsulation machines in the USA is growing across regions, with the West leading at 4.8%. Growth in this region reflects strong activity among nutraceutical, pharmaceutical, and supplement manufacturers that rely on automated encapsulation systems. The South follows at 4.3%, supported by expanding production facilities and rising investment in capsule manufacturing equipment. The Northeast records 3.8%, shaped by established pharmaceutical hubs and steady modernization of encapsulation lines. The Midwest grows at 3.3%, where regional producers adopt new machinery to improve throughput for vitamins and OTC supplements. These patterns show consistent national demand as softgel formats remain widely used across health and wellness product categories.

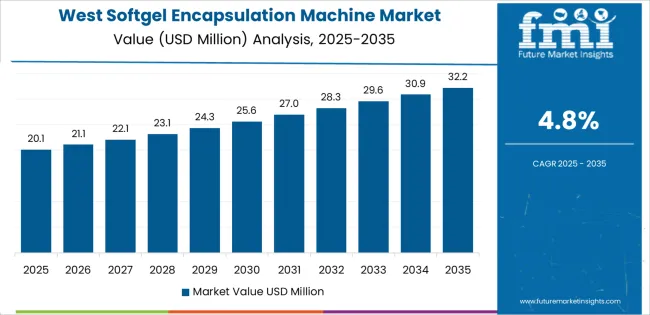

West USA is projected to grow at a CAGR of 4.8% through 2035 in demand for softgel encapsulation machines. California and neighboring states are increasingly adopting automated equipment for pharmaceutical, nutraceutical, and dietary supplement production. Rising demand for precise dosing, production efficiency, and consistent quality drives adoption. Manufacturers provide machines suitable for small, medium, and large batch operations. Suppliers and distributors ensure accessibility across urban industrial facilities. Growth in supplement and pharmaceutical manufacturing, process modernization, and regulatory compliance support steady adoption of softgel encapsulation machines in West USA.

South USA is projected to grow at a CAGR of 4.3% through 2035 in demand for softgel encapsulation machines. Texas, Florida, and Georgia are increasingly using automated softgel production equipment for pharmaceutical and nutraceutical products. Rising demand for accurate dosing, high production efficiency, and quality consistency drives adoption. Manufacturers provide machines compatible with multiple formulations and batch sizes. Retailers and distributors expand access across industrial and urban production facilities. Industrial growth, supplement production expansion, and facility modernization support steady adoption of softgel encapsulation machines across South USA.

Northeast USA is projected to grow at a CAGR of 3.8% through 2035 in demand for softgel encapsulation machines. New York, Boston, and Philadelphia are gradually adopting automated equipment for softgel production in pharmaceutical, nutraceutical, and dietary supplement manufacturing. Rising focus on consistent quality, accurate dosing, and efficiency drives adoption. Manufacturers supply machines suitable for small and medium batch operations. Retailers and distributors ensure accessibility across urban and suburban production facilities. Pharmaceutical and supplement manufacturing growth, along with industrial modernization, supports steady adoption of softgel encapsulation machines in Northeast USA.

Midwest USA is projected to grow at a CAGR of 3.3% through 2035 in demand for softgel encapsulation machines. Chicago, Detroit, and Minneapolis are gradually adopting automated equipment for pharmaceutical, nutraceutical, and dietary supplement softgel production. Rising demand for precise dosing, quality consistency, and production efficiency drives adoption. Manufacturers provide machines suitable for small, medium, and scalable batch operations. Retailers and distributors ensure accessibility across urban and semi-urban industrial facilities. Industrial expansion, pharmaceutical manufacturing growth, and regulatory compliance support steady adoption of softgel encapsulation machines across Midwest USA.

The demand for softgel encapsulation machines in the USA is propelled by strong growth in both pharmaceutical manufacturing and the nutraceutical segment. As USA producers increasingly launch softgel formulations for vitamins, omega-3s, herbal extracts and prescription therapeutics, manufacturers require machinery that can handle high throughput, maintain stringent regulatory compliance and adapt quickly to new product variations. Outsourcing trends and contract manufacturing organisations (CMOs) also drive equipment investment as capacity expansion is needed for softgel production. The focus on automation, cleanroom compatibility and reduction of human error reinforces demand for advanced encapsulation lines in the USA manufacturing base.

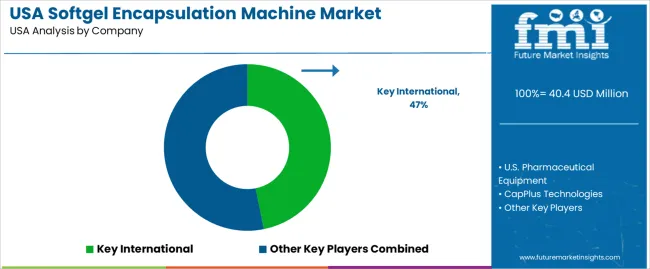

Key companies involved in the USA softgel encapsulation machine supply-chain include Key International, USA Pharmaceutical Equipment, CapPlus Technologies, ACIC Machinery, and Schaefer Technologies. These firms design and manufacture encapsulation systems, ancillary equipment and production lines tailored to USA pharmaceutical and nutraceutical industry requirements. Their offerings often include rotary die machines, continuous encapsulation systems and support services that meet FDA and GMP standards. Through their engineering, service networks and localisation in the USA, they influence how manufacturers select, integrate and operate softgel encapsulation machinery within USA-based production facilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Proton Exchange Membrane (PEM) Electrolyzer, Alkaline Electrolyzer, Solid Oxide Electrolyzer |

| Capacity | Low (<= 150 kW), Medium (150 kW – 1 MW), High (> 1 MW) |

| Outlet Pressure | Low (<= 10 Bar), Medium (10 Bar – 40 Bar), High (> 40 Bar) |

| End Use | Ammonia, Methanol, Refining / Hydrocarbon, Electronics, Energy, Power to Gas, Transport, Pharma & Biotech, Food & Beverages, Other |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Key International, USA Pharmaceutical Equipment, CapPlus Technologies, ACIC Machinery, Schaefer Technologies |

| Additional Attributes | Dollar by sales by product type and capacity; regional CAGR and adoption trends; usage in pharmaceutical, nutraceutical, and functional supplement production; growth of automated and continuous encapsulation lines; adoption of small, medium, and high-capacity systems; integration with cleanroom environments; automation and regulatory compliance influence; replacement and expansion of older lines; trends in plant-based/vegan softgel adoption; modularity and scalability of equipment; maintenance and service support; accuracy, throughput, and operational efficiency metrics; adoption in contract manufacturing organisations; evolving capsule formats and dosing requirements. |

The demand for softgel encapsulation machine in usa is estimated to be valued at USD 40.4 million in 2025.

The market size for the softgel encapsulation machine in usa is projected to reach USD 60.9 million by 2035.

The demand for softgel encapsulation machine in usa is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in softgel encapsulation machine in usa are proton exchange membrane (pem) electrolyzer, alkaline electrolyzer and solid oxide electrolyzer.

In terms of capacity, low (<= 150 kw) segment is expected to command 21.0% share in the softgel encapsulation machine in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Softgel Encapsulation Machine Market Growth - Trends & Forecast 2025 to 2035

Demand for Softgel Encapsulation Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bandsaw Machines in USA Size and Share Forecast Outlook 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

Demand for Slitting Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Labelling Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Box Sealing Machines in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Tire Marking Machine in USA Size and Share Forecast Outlook 2025 to 2035

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Demand for Feed Preparation Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cup Fill and Seal Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Trash Rack Cleaning Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Corrugated Cardboard Cutting Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Hand Towel Automatic Folding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Vertical Furnace Tube Cleaning Machine in USA Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA