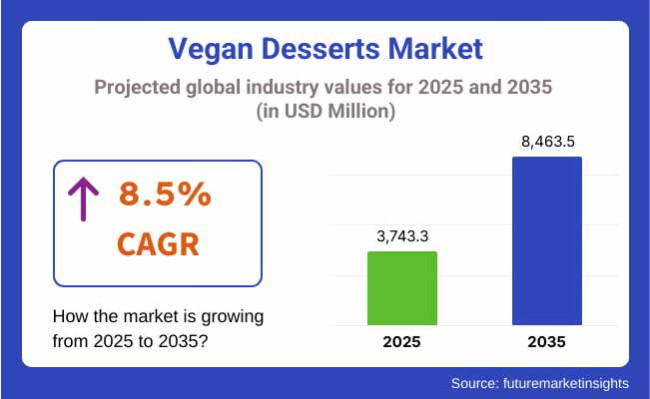

Global market for vegan desserts was USD 3,205.07 million in 2023 and grew at a pace of 8.5% year on year in 2024, and market size reached USD 3,743.3 million in 2025. For the period assumed as considered (2025 to 2035), sales of vegan desserts globally will rise at a rate of CAGR 8.5% and be worth an estimated amount of USD 8,463.5 million by 2035.

Rising trend towards consuming vegan foods has been one of the major demand drivers of vegan sweets as consumers are looking for healthy, humane, and green alternatives to conventional sweets. Growing awareness of dairy-free and gluten-free food facts and growing availability of plant food items such as almond milk, coconut cream, cashew butter, and oat-based substitutes have also driven the market.

Among some of the brands that are filling their stores with massive quantities of vegan ice cream, cake, and pastry to welcome health-conscious and green-conscious buyers are So Delicious Dairy Free, Häagen-Dazs, and Ben & Jerry's. Confectioneries and bakeries worldwide are filling their stores with increasingly large quantities of vegan brownies, cookies, and cheesecakes, taking the market to new levels.

Evolved consumer concerns for natural sweeteners, ingredients for organic foodstuffs, and less sugar are driving reformulation by producers keen to deliver enhanced taste, texture, and nutrition. Greater innovation of plant-based vegan dessert and chocolate foods using fruit is also dominating the market with growing use of food processing technology on plant foods making this possible.

Europe and North America are business leaders with stable demand for plant-based ice cream, cake, and chocolate. The Asia-Pacific region grows at the fastest growth rate, driven by rising disposable incomes, urbanization, and improved education on plant-based food among consumers.

E-commerce business expansion and ordering food online also spurred the presence of plant-based dessert shelves, allowing business to expand the base and serve niche diet needs.

More cases of lactose intolerance and milk allergy, cultural attitude shift towards buying ethically, and saving the world are going to drive growth in the vegan desserts market in the future.

Below is comparative six-monthly variation analysis of CAGR of base year (2024) and current year (2025) of the world vegan desserts market. Growth trends and variations in growth trends have been analyzed here, and stakeholders have been provided with beneficial information.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 8.2% |

| H2 (2024 to 2034) | 8.3% |

| H1 (2025 to 2035) | 8.4% |

| H2 (2025 to 2035) | 8.5% |

The industry will deliver an 8.4% CAGR in H1 of 2025 to 2035 and a pick-up to 8.5% in H2. Compared to the previous cycle (2024 to 2034), H1 and H2 have seen compound growth of 10 BPS, reflecting unmatched growth of demand. Due to continuous product innovation, increased spending on plant food production, and evolving consumer perception, vegan sweets demand will see astounding growth in the next decade.

Vegan desserts market is expanding with tremendous pace because increasingly more consumers are looking for plant-based, dairy-free, and gluten-free desserts. Organised and unorganised markets are the terms that are used to define the manner in which this market is segmented and the competition varies from huge multinationals to small-scale producers.

Organised Market, Structured category involves large food corporations, plant-based specialty companies, and private-label dessert companies producing dairy-free ice cream, plant-based cakes, cookies, puddings, and chocolates. Few of the well-established brands here are Ben & Jerry's (Unilever), Daiya, So Delicious (Danone), Oatly, Wicked Kitchen, and NadaMoo!.

These people focus on recipe innovation with almond, oat, coconut, and cashew-based dairy alternatives to achieve dense textures and rich flavors using no animal-derived products. Systematized buyers are sweeping North American, European, and Asian-Pacific markets with an increasing demand for vegan, organic, and clean-label desserts.

They possess favorable retail distribution, supermarket ties, and e-retailing. They are investing in green packaging, upscale placement, and allergen-friendly launches to reach health-conscious and ethics-driven consumers. Leading brands keep reinventing themselves by launching high-protein, sugar-free, or probiotic-enriched versions and staying in sync with changing food trends. Chains of vegan dessert cafes and restaurant chains keep building their foundations in the global market.

Unorganised segment involves small plant-based bakeries, local dessert cafes, and plant-based hand dessert players. Such players are situated mainly in regional farmers' markets, specialty foods stores, and the web and sell bespoke vegan cakes, frozen goods, and pastry. Without production and distribution capabilities, unorganised participants cannot expand business to national scales.

They do, however, cater to clients looking for innovative, small-format, or allergy-free desserts. Small independent companies are making strides using social media marketing, direct-to-consumer sales, and partnerships with health-oriented cafes. As demand for vegan and sustainable desserts grows, the market will increase. Organized players will fuel mass-scale retailing and innovation while unorganized players will grow through premium positioning, online retailing, and specialist store tie-ups.

Indulgent Health - Nutrient-Dense, Clean Label Vegan Desserts

Shift: The engine behind our acceleration: Health-conscious consumers increasingly want indulgent but healthy desserts, but they want plant-based ingredients that fit clean-label beauty and wellness and ethical values. Millennials and Gen Z, as well as health-minded parents, want vegan desserts that don’t have artificial ingredients, refined sugars, dairy or trans fats, but that hold fiber, protein and superfood ingredients.

Desire to indulge without losing nutritional functionality is driving demand for whole-food-ingredient-based desserts; think nuts, seeds, oat milk, coconut milk, dates and all-natural sweetening ingredients like agave or maple syrup. This was especially true in North America, Western Europe and Australia, where consumers will spend a few extra Naira for better-for-you treats.

Strategic Response: USA brand So Delicious redesigned its vegan ice cream range, using organic coconut milk and less sugar, but highlighting the use of natural flavors and less processing, leading to a 12 percent jump in retail sales in health food stores. Meanwhile in Germany, Luve launched lupin-based vegan puddings featuring prebiotic fiber to capture gut health aware shoppers and add to a +7% uptick in grocery sales.

Australian company Over the Moo introduced chia seed and almond protein fortified low-cal vegan desserts targeted at gym and wellness focused retailers which led to a 10% increase in monthly sales. These innovations herald a strategic pivot toward indulgent nutrition, without any of the sacrifice.

Heels and Brews: Steady Growth in the Vegan Dessert Market

Shift: A new class of consumers is seeking gourmet, artisanal vegan treats that deliver high-end flavor, playful textures and intriguing flavors. Driven by urban workers and well-heeled consumers who see desserts as an experience, rather than a bite. Artisanal production, sustainably sourced components and culinary flair are all helping to stoke demand for upscale plant-based desserts like vegan cheesecakes, mousse cakes, tiramisu and pastries.

Such a trend is not unusual in urban markets like New York, London, Paris and Tokyo, where people who eat dessert are ready to pay for merit, provenance and excitement.

Strategic Response: So UK brand Nush Foods has expanded its line of almond milk-based vegan cheesecakes in flavors such as Lemon & Ginger and Raspberry Swirl, netting 15% sales growth in premium retailers like Waitrose. USA-based Vegan Treats Bakery offered a selection of extravagant vegan eclairs and macarons made in handmade batches and customized with artisanal Belgian vegan chocolate and organic fruit compotes, which received a 20% increase in online pre-orders one holiday season.

Japanese patisserie Planté Tokyo introduced new vegan mousse cakes in “matcha” and “black sesame” that drew high foot traffic to Tokyo’s premium dessert cafes and delivered 9% sales growth in a single quarter. They are companies that are remaking vegan desserts into pricey treats for discerning consumers.

New Plant-Based Frozen Dessert Products

Shift: The frozen dessert sector continues its breakneck change with a flurry of plant-based ice creams, gelatos, sorbets and frozen yoghurts, fueled by non-lactose, vegan and flexitarian patrons. Climactic heatwaves, seasonal demand spikes and a taste for frozen convenience are fuelling innovation here, with brands ranging from cashew and almond to oat, coconut, soy and pea protein in an array of alternative dairy bases.

Consumers also desire interesting flavors, low sugar or functional frozen desserts infused with probiotics, adaptogens or immunity-boosting ingredients.

Strategic Response: Global ice cream brand Ben & Jerry’s launched oat milk-based flavors like Peanut Butter & Cookies and Cherry Garcia as part of its expanded non-dairy frozen dessert portfolio, contributing to a 10 percent increase in project sales of its plant-based products globally.

Oatly (Sweden) introduced low-calorie frozen oat-based desserts, in flavours such as Salted Caramel and Strawberry Swirl and gained a massive retail share of supermarkets in Europe (+15%). A 9% sales growth of health snacks across North America's health food stores was also attributed to the Canadian brand Halo Top's 80 calorie vegan frozen desserts fortified with plant protein. This is where brands put Frozen innovations and health into their own hands to respond to year round demand for plant-based indulgence.

Vegan Dessert has Expansion Opportunities with OTR, JSP, Ready-To-Drink

Shift: Consumer and consumer lives today, busy and mobile have created a shift to on-the-go, single-serve, and (RTD) vegan desserts formats-especially in urban epicenters and office park hangouts. Consumers are looking for convenience that can be made in small quantities. Vegan dessert cups, mousse pots, protein-packed dessert bars and RTD vegan shakes in dessert-inspired flavors are the formats in vogue. One factor is the expansion of online food delivery services, vending machine sales and subscription-based snack boxes.

Strategic Response: United States-based brand Ripple Foods launched RTD vegan dessert shakes in flavors such as Chocolate Brownie and Vanilla Caramel, enriched with pea protein and omega-3s, which pushed up sales by 14% in online and retail channels. In France, NOMOO introduced vegan dessert pots in Tiramisu and Chocolate Lava Cake flavour in recyclable glass jars, which delivered a 12% sales increase in key convenience stores and meal delivery app.

Some of the vegan dessert bars are single-serve and made by South Korean company Planty, which improved vending machine sales by 10%.ราMore than one office worker has asked for matcha and black bean paste. From here, these innovations continue to show how brands are responding to the mobility and convenience expectations from consumers.

The Demand of Buyers for Sustainable, Ethically and Locally-Sourced Products

Shift: As the world becomes more aware, consumer attitudes around vegan desserts seek sustainably sourced and ethically made ingredients and environmental friendly packaging. Things to think about include carbon footprint, water usage, the impact of deforestation (palm oil, in particular) and whether you’re buying from local farms.

Xier Brands using organic, Fair Trade, and locally sourced plant ingredients are thriving - especially with Gen Z and Millennials who consider their purchasing a matter of climate justice and social justice. And this trend is accentuated in parts of Europe, Canada and the USA, where eco-labelling and sustainability metrics influence purchasing behavior.

Strategic Response: Booja-Booja, a UK brand that uses organic and Fair Trade ingredients and plastic-free packaging for its vegan truffles and frozen desserts, reported a 20 percent increase in online orders from environmentally minded consumers. Olive oil-based vegan ice cream, from USA start-up Wildgood, the olive oil used to make their products grown with regenerative agriculture and so low carbon impact, up 15% in specialty organic stores.

The Canadian brand Nomz uses locally grown nuts and dates for its vegan dessert bites, supporting local agriculture and in the meantime boosting regional sales 12 percent. Part of this is down to brands who carefully nest sustainability at the heart of their brand identity, appealing to the ethically-aware consumer.

The following table shows the estimated growth rates of the top five territories. These markets are set to experience high consumption through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 8.2% |

| Germany | 8.7% |

| China | 8.4% |

| Japan | 8.1% |

| India | 9.0% |

Consumer interest in plant-based, dairy-free, and allergen-free sweet indulgences is on the rise as well, propelling the USA market for vegan desserts forward. The rising incidence of lactose intolerance, coupled with the increasing demand for cruelty-free and clean-label products, has accelerated demand for vegan desserts such as ice creams, cakes and pastries.

Supermarkets, specialty stores and online retailers have cast their elastic net wider, to include a range of plant-based confections. In response to the growing flexitarian and health-orientated consumer, restaurant and café chains are adding to their menu of vegan desserts. Uptake is being further improved by improvements in plant-based ingredients, in particular oat milk and almond-based substitutes, which are improving product taste and texture.

As pioneers in the plant-based food movement, Germany is among the largest markets for vegan desserts. The consumers are much aware of ethical production of food and the sustainability is the main path towards dairy-free and gelatin-free confectioneries. Organic and health food stores, along with mainstream supermarkets, are responding to food trends by broadening their selection of vegetarian and vegan desserts.

Furthermore, the growing availability of strong regulatory support for vegan labeling and the launch of new products in the vegan category (such as sugar-free and high-protein vegan desserts) is driving the market growth. One of the benefits of higher demand for greener packaging solutions is the differentiation it offers brands looking to attract a consumer base.

The increasing urbanization of China, surging disposable incomes, and Western dessert trends have driven the demand for plant-based alternatives, including vegan desserts. Exposure to dairy-free and plant-based sweet treats has surged due to the effect of social media and international travel, fuelling awareness and demand.

Online retailers sell a large variety of vegan-friendly dessert products, and market diffusion is aided by e-commerce platforms. These have been complemented by a rising interest in healthier eating and government-supported campaigns encouraging plant-based diets, all of which have helped boost the popularity of vegan desserts.

With greater health awareness, religious dietary preferences, and a burgeoning middle class, India is experiencing a wave of plant-based food adoption. From dairy free desserts to plant based cakes and classic treats made using non dairy ingredients, vegan desserts are on the rise. The growth of specialty vegan stores, cafés and e-commerce is increasing the availability of these products.

The growing popularity of Western-style desserts and the rich food culture of India also coincide with this emergence of sweet vegan delicacies. Celebrity endorsements and social media campaigns have been particularly effective in this space as awareness and sales continue to grow.

| Segment | Value Share (2025) |

|---|---|

| Biscuits/Cookies (By Product) | 35.4% |

One of the most trending product categories under plant-based desserts is vegan biscuits, cookies. This segment has seen a lot of innovation due to increased consumer demand for healthier, dairy-free and egg-free products. Now brands are using plant-based ingredients like almond flour, coconut oil and flaxseeds to create deliciously guilt-free cookies.

As consumers are more focused on what they eat, cookies that represent to these needs, such as gluten-free, organic, and high-protein vegan cookies, have become very popular. Chickpea flour, pea protein and nut butter are being hitched to food trends in order to meet the require for guilt-free delights. Moreover, superfood-infused cookies including chia seeds, matcha, and dark chocolate are trending among health-savvy shoppers.

The growth of this segment is also driven by the greater availability of these cookies in most supermarkets, convenience stores, and online websites. Social media trends, influencer marketing, and endorsements by fitness enthusiasts have also driven demand for plant-based cookies among consumers.

Pursuing clean-label and ethical food products, the biscuits and cookies segment is set to remain the market's leader among vegan desserts. With brands perfecting their formulations and the introduction of exciting new flavors, this segment is poised for continued growth in coming years.

| Segment | Value Share (2025) |

|---|---|

| E-commerce (By Distribution Channel) | 39.5% |

E-commerce is one of the most prevailing distribution channels in vegan desserts fueled by the fast is the rise of digitalization in the food industry. Due to the fact that consumers are logging onto their computers to make shopping easy, they are able to browse through many more options of plant-based desserts than they can find in a local brick and mortar retailer.

The trend has many plant-based dessert companies exploring direct-to-consumer (DTC) opportunities via their websites so they can provide exclusive flavors, subscription boxes, and seasonal limited editions. Such a strategy has played a big role in growing brand loyalty and business engagement. In addition, vegan dessert brands can utilize e-commerce platforms to market themselves and their products, without having to be on the shelves of stores globally.

Social media and digital marketing have also impacted sales of vegan cakes significantly. Today's consumers increasingly come across new products via social media influencers, brand partnerships and targeted ads. Also, reviews and testimonials from other consumers share trust and drive first-time purchases.

One such advantage of the e-commerce channel is the opportunity to meet niche consumer needs. There are several online retailers that focus on organic, gluten-free, and allergen-free vegan desserts, allowing consumers to source vegan desserts with confidence. Subscription models and bundling options have helped encourage repeat purchases, giving customers a way to enjoy a variety of plant-based sweets on a regular basis.

With the continued evolution of digital retail, the e-commerce sector is projected to experience continued growth. As technology advances, online sales of vegan desserts are expected to grow much faster than traditional retail sales due to personalized recommendations, and ease of online purchase with doorstep delivery.

The global vegan desserts market is evolving and the major players in the market are using various techniques, including product launches, expanding geographical reach, and leveraging associations, to achieve competitive advantages. These companies have managed to expand consumer preferences by presenting a range of plant based desserts from ice creams, cheesecakes, brownies to puddings - keeping in mind both vegan and health conscious consumers.

Such variety not only helps retain more customers but also keeps these companies in fierce competition with regular dessert brands in the market. Recent launch of innovative flavors along with the healthy formulation such low sugar, gluten-free and protein-added vegan desserts in response to rising healthy indulgences have started to give companies an edge. Moreover, environment-safe and hermetic packs are also used to provide convenience and for sustainability-minded consumers.

For instance:

Market segmented into Biscuits/Cookies, Cakes & Pastries, Custard & Puddings, Frozen Desserts (Ice-creams, Yogurts, etc.), and Others.

Market segmented into Unflavored, Vanilla, Chocolate, and Others (Banana, Strawberry, etc.).

Market segmented into Liquid and Solid.

Market segmented into E-commerce and Offline. Offline sales further segmented into Vitamins & Supplements Stores, Retail and Departmental Stores, Supermarkets, Vegan Fairs, and Others.

Market segmented into North America, Latin America, Europe, Asia Pacific (APAC), and the Middle East & Africa (MEA).

The global vegan desserts market is projected to grow at a CAGR of 8.5% during the forecast period.

The market is estimated to reach approximately USD 8,463.5 million by 2035.

The plant-based ice creams segment is expected to witness the fastest growth due to increasing consumer preference for dairy-free and lactose-free dessert options.

Key growth drivers include rising adoption of plant-based diets, growing awareness of dairy alternatives, and increasing demand for clean-label, allergen-free, and health-conscious dessert options.

Leading companies in the market include HP Hood (Planet Oat), Unilever, Danone S.A., Cado & Bliss Unlimited, LLC.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Source Type, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Source Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Source Type, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Source Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Source Type, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Source Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Source Type, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Source Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: East Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Source Type, 2018 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Source Type, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: South Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Source Type, 2018 to 2033

Table 40: Oceania Market Volume (MT) Forecast by Source Type, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 42: Oceania Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Source Type, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Source Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Source Type, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Source Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Source Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Source Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Source Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Source Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Source Type, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Source Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Source Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Source Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Source Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Source Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Source Type, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Source Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Source Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Source Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Source Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Source Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Source Type, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Source Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Source Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Source Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 70: Europe Market Attractiveness by Source Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Source Type, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ Million) Analysis by Source Type, 2018 to 2033

Figure 81: East Asia Market Volume (MT) Analysis by Source Type, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Source Type, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Source Type, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 85: East Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Source Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) by Source Type, 2023 to 2033

Figure 92: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ Million) Analysis by Source Type, 2018 to 2033

Figure 99: South Asia Market Volume (MT) Analysis by Source Type, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Source Type, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Source Type, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 103: South Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Source Type, 2023 to 2033

Figure 107: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ Million) by Source Type, 2023 to 2033

Figure 110: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 111: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ Million) Analysis by Source Type, 2018 to 2033

Figure 117: Oceania Market Volume (MT) Analysis by Source Type, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Source Type, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Source Type, 2023 to 2033

Figure 120: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 121: Oceania Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Source Type, 2023 to 2033

Figure 125: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: MEA Market Value (US$ Million) by Source Type, 2023 to 2033

Figure 128: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: MEA Market Value (US$ Million) Analysis by Source Type, 2018 to 2033

Figure 135: MEA Market Volume (MT) Analysis by Source Type, 2018 to 2033

Figure 136: MEA Market Value Share (%) and BPS Analysis by Source Type, 2023 to 2033

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Source Type, 2023 to 2033

Figure 138: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 139: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 140: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 141: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 142: MEA Market Attractiveness by Source Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA