The ASEAN plant-based Pet food market is set to grow from an estimated USD 743.0 million in 2025 to USD 2,530.1 million by 2035, with a compound annual growth rate (CAGR) of 13.0% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 743.0 million |

| Projected ASEAN Value (2035F) | USD 2,530.1 million |

| Value-based CAGR (2025 to 2035) | 13.0% |

ASEAN residents are choosing plant-based pet foods at increasing rates because society is shifting toward more sustainable practices while customers want nutrition for their pets and pet owners want healthier ingredients in their pets' diets. Thus plant-based pet food sales are surging in this region.

Pet owners today actively monitor their pets' dietary ingredients while seeking plant-based nutritional foods that maintain eating quality and nutritional value. Recent urban demographic trends show increasing pet adoption as consumers choose environmentally friendly veterinarian-approved meat-free options for their pet animals in urban settings.

Product variety in the market extends from kibble to treats and wet food which incorporates premium plant-based components. These products serve multiple pet types, especially focusing on the two leading categories where dogs and cats dominate the market spread.

Market expansion of plant-based pet food is supported by improved distribution through both brick-and-mortar outlets and electronic platforms which heighten consumer purchasing accessibility.

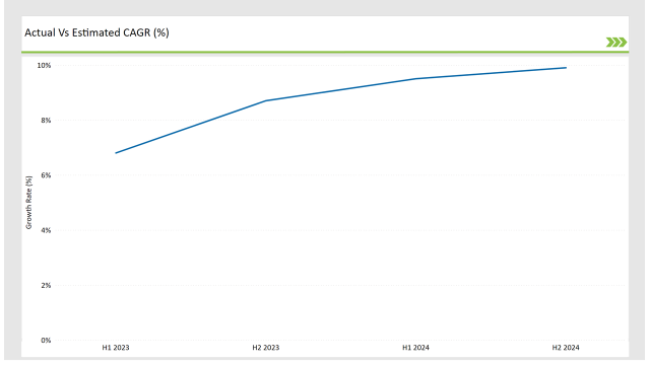

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Plant-based Pet food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN plant-based Pet food market, the sector is predicted to grow at a CAGR of 6.8% during the first half of 2024, with an increase to 8.7% in the second half of the same year. In 2025, the growth rate is expected to decrease slightly to 10.5% in H1 but is expected to rise to 13.0% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Launch of "Green Paws," a new line of plant-based dog food in Thailand, focusing on locally sourced ingredients and sustainable packaging. |

| 2023 | Malaysia's "Pet Wellness Co." introduced a range of plant-based treats for cats, emphasizing health benefits such as improved digestion and skin health. |

| 2024 | India's "EcoPet Foods" announced a partnership with local farmers to source organic plant ingredients for their new line of vegan pet food. |

| 2024 | Thailand's "Pet Nutrition Innovations" unveiled a freeze-dried raw plant-based food option, catering to the growing demand for premium pet food products. |

Rising Demand for Health-Conscious Pet Food Options

Pet owners understand nutrition for their pets because of growing health awareness resulting in increased demand for nutritional pet food options. The expanding understanding of plant-based diet advantages leads owners to select products because these options contain fewer calories but more essential nutrients.

The pet food market attracts consumers who strive to find products that support their pets' health through enhanced digestion improved skin and coat appearance and higher energy maintenance.

The manufacturing industry develops novel vegetarian product formulations containing diverse elements including beans as well as grains and fruits and vegetables. These dietary products combine appropriate nutritional content with tastes that appeal to animal consumers. Plant-based options for pets gain increasing demand from pet wellness trends that combine functional ingredients for specific health needs.

Growth of E-commerce and Online Retail Channels

Modern pet food distribution follows fundamental changes as e-commerce platforms transform retail marketing approaches. Consumers choose to buy plant-based pet food products through digital shopping channels at an increasing rate. Various plant-based pet food products are available through online retailers that provide in-depth information about ingredient composition and nutritional value with patient feedback data.

Future consumer trust grows because of the transparency that supports their discovery of new brands and products. Numerous online platforms provide reusable subscription programs enabling pet owners to get scheduled deliveries of their selected products while keeping up convenience levels.

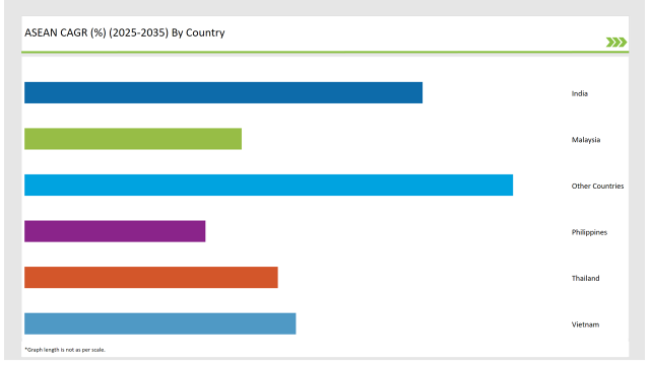

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Indian plant-based pet food market shows quick expansion because of climbing pet ownership adoption and rising consciousness about pet nutrition and health. Pet adoption trends among households create rising consumer demand for quality nutritional pet food selections. Indian consumers show increased health awareness about both human and pet nutrition because they have adopted plant-based dietary choices.

Social media capabilities coupled with the growth of e-commerce platforms have powered the plant-based pet food market development across India. The online marketplace gives customers convenient access to multiple products including plant-based options which traditional retail stores usually lack.

Additionally, the rising abundance of pet nutrition information on social media and online platforms gives pet owners better capabilities to make knowledgeable decisions regarding their pets' diets.

Innovation together with premium pet food brands sustain Thailand's plant-based pet food market expansion. Thai pet owners actively look for premium animal food packages including purpose-built nutrition and diets for pets. Different plant-based pet food products such as kibble and treats and wet food developed with premium ingredients have arisen because of this growing pattern.

Manufacturers in the Thai pet food industry now focus on generating plant-based freeze-dried and dehydrated products because they combine production simplicity with prolonged storage capabilities. The industry focuses on generating new products while introducing components that promote pet health to follow market trends.

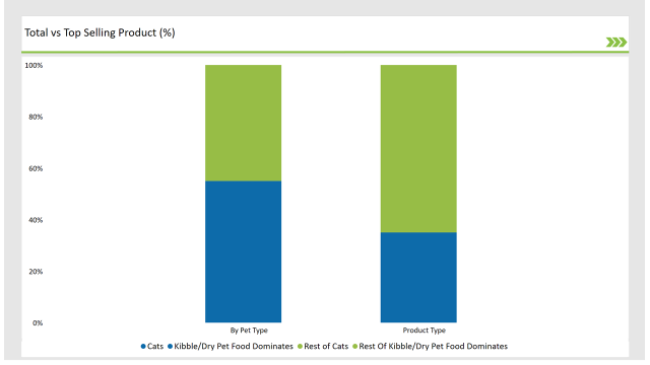

By Product Type: Kibble/Dry Pet Food Dominates the sale of Plant base pet food

Increasing numbers of pet owners are choosing high-quality nutritious kibble options because they want to become more health-conscious with their pets. The manufacturing industry now invests in whole food components such as sweet potatoes and peas together with chickpeas to make plant-based kibble products that serve health needs in addition to appealing to pet tastes. The surge in consumer demand for clear ingredient details matches the new requirement for manufacturers to disclose their product's composition.

Producers within the kibble market now offer functional ingredients that deliver targeted health advantages to pets through digestive benefits from probiotics skin and coat improvements from omega fatty acids and immune system protection from antioxidants. The new pet health solutions attract owners who seek products to improve their pet's overall wellness.

The Cats Lead is the largest Consumption for Plant-based Pet food.

According to industry data, the segment serving cats dominates the plant-based pet food industry with a current market share of 55%. More cat owners combined with better recognition of feline dietary requirements drives this trend.

Pet owners of carnivorous cats look at plant-based eating as a nutritional alternative because it combines balanced nutrition with environmental and animal welfare goals but carnivores still need meat in their diets. Manufacturing companies have developed unique plant-based recipes that meet the exclusive dietary specifications of cats.

Specialized plant-based products consistently combine premium plant proteins alongside necessary vitamins along essential minerals to provide cats with complete nutrients for health maintenance. Many brands implement flavors together with textures that appeal to cats because these features help pet owners shift their feline pets to plant-based food.

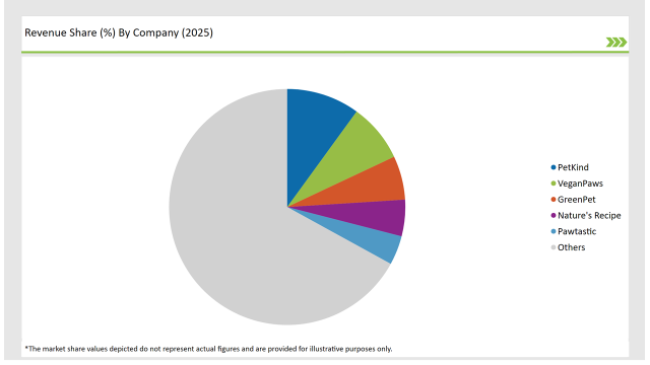

2025 Market Share of ASEAN Plant-based Pet Food Manufacturers

Note: The above chart is indicative

The competitive landscape of plant-based pet food has intensified because more companies are producing these products to satisfy expanding consumer needs.

Plant-based pet food iterations have appeared in product lines of traditional pet food firms along with emerging market startups that introduce novel formulations and exclusive sales propositions. The heightened competition brings about both advanced product modifications and original differentiation strategies to the marketplace.

As per Product Type, the industry has been categorized into Kibble/Dry, Dehydrated Food, Treats and Chews, Freeze-Dried Raw, Wet Food, and Frozen

As per Pet Type, the industry has been categorized into Cat, Dog, Birds, and Others

As per Sales Channel, the industry has been categorized into Store-based Retailing, Online Retailers

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN plant-based Pet food market is projected to grow at a CAGR of 13.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 2,530.1 million.

India are key Country with high consumption rates in the ASEAN plant-based Pet food market.

Leading manufacturers include MycoTechnology, ADM (Archer Daniels Midland), BASF SE, DSM Nutritional Products, Ecoverse, and Others are the key players in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Postbiotic Pet Food Market Analysis – Demand, Growth & Forecast 2025-2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA