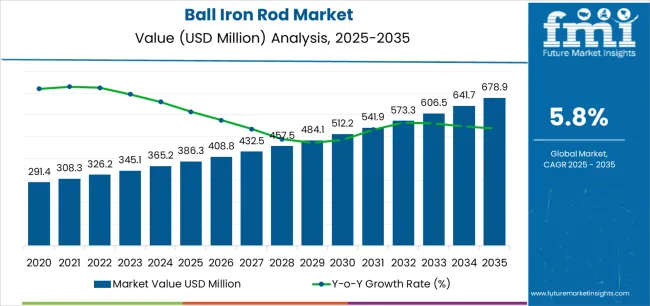

The ball iron rod market is forecast to grow from USD 386.3 million in 2025 to USD 678.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.8%. This growth pattern highlights a moderate yet continued increase, driven by increasing demand in industries such as construction, automotive, and manufacturing, where ball iron rods are used in structural applications, machinery, and reinforcement systems.

The ball iron rod market growth curve from 2030 to 2035 will reflect a gradual but notable acceleration. Several key factors will contribute to this acceleration, including an increase in large-scale infrastructure projects, which will drive demand for high-quality construction materials like ball iron rods. The demand will be further bolstered by the expansion of the automotive industry and the increasing need for durable, high-performance materials in automotive manufacturing. Technological advancements in the production of ball iron rods, including innovations that improve their strength and performance, will expand their use in other sectors, driving further ball iron rod market expansion. The overall growth pattern for the ball iron rod market can be classified as a steady, stable growth curve with moderate acceleration. The early part of the forecast period will experience slow, steady growth, followed by an acceleration in ball iron rod market value during the later part of the period. The predictable increase in demand, combined with the gradual expansion of the construction and automotive sectors, ensures a growth curve for the ball iron rod market.

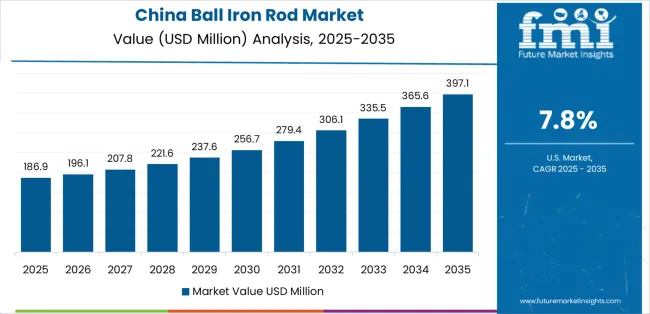

The initial phase of market growth, from 2025 to 2030, is characterized by gradual, consistent increases in market value. Starting at USD 386.3 million in 2025, the market will increase incrementally, reaching USD 484.1 million by 2030. This period is marked by a steady demand for ball iron rods due to continued industrial growth, infrastructure development, and rising urbanization. The market’s growth curve during this phase is expected to be relatively linear, reflecting the gradual yet reliable adoption of ball iron rods in various applications. The increasing use of ball iron rods in the construction and automotive sectors, where they serve as reinforcement materials and components for machinery, will ensure consistent demand, leading to gradual growth.

From 2030 to 2035, the growth rate will remain steady, but with slightly accelerated expansion. The market will continue to expand from USD 484.1 million to USD 678.9 million, benefiting from further investments in industrial and infrastructural projects, as well as the growing emphasis on improving manufacturing processes and enhancing machinery durability. The mid-term phase of the market's growth will likely see continued development in both established and emerging markets, spurred by rising construction activities, manufacturing growth, and technological advancements that increase the demand for high-strength materials like ball iron rods.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 386.3 million |

| Market Forecast Value (2035) | USD 678.9 million |

| Forecast CAGR (2025–2035) | 5.8% |

The ball iron rod market is growing steadily, driven by increasing demand for high-quality materials in construction, infrastructure, and manufacturing sectors. Ball iron rods, with their enhanced strength, durability, and corrosion resistance, are increasingly being used in a variety of applications, from reinforcing steel bars in concrete to serving as key components in industrial machinery. The continued urbanization, infrastructure expansion, and increasing construction activities, particularly in emerging economies, are major drivers of this market growth.

Advancements in the production and treatment of ball iron rods, such as improved casting techniques and innovative alloy formulations, are further enhancing the material’s appeal. These improvements lead to greater efficiency, performance, and cost-effectiveness in industries that rely on high-strength iron products. Growing focus on renewable energy projects and the demand for reliable and durable infrastructure in sectors such as automotive and manufacturing are contributing to the increasing use of ball iron rods.

While market growth is strong, challenges such as fluctuations in raw material prices and environmental concerns around production methods need to be addressed to ensure continued growth. Nonetheless, the robust demand from industrial and infrastructure sectors, coupled with technological innovations in the manufacturing of ball iron rods, ensures that the market will continue to expand in the coming years.

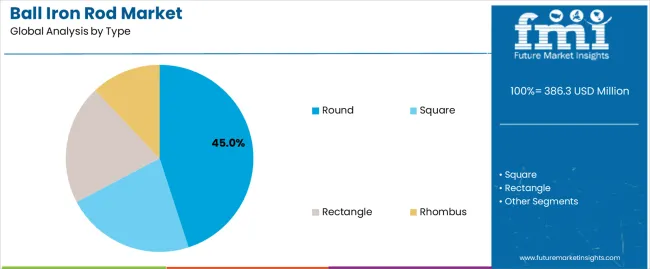

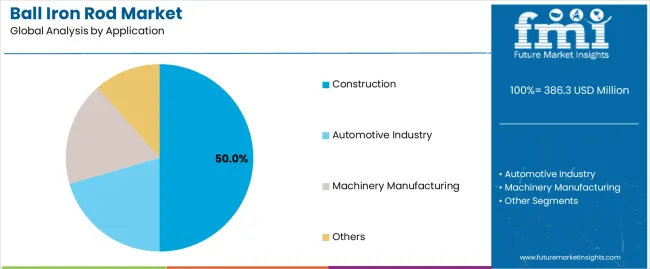

The market is segmented by type, application, and region. By type, the market is divided into round, square, rectangle, and rhombus iron rods. Based on application, the market is categorized into construction, automotive industry, machinery manufacturing, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The round type category accounts for approximately 45.0% of the Ball Iron Rod Market. This segment largely comprises rods with a circular cross‑section, which are widely used in structural, reinforcement, and general engineering applications due to their efficient load distribution and ease of fabrication. Round rods are preferred in construction and infrastructure projects where uniform strength and bending resistance are critical. The dominance of this type reflects strong demand from building foundations, concrete reinforcement, and framework applications where circular‑section rods integrate seamlessly with standard reinforcing practices.

Manufacturers serving the Round segment focus on optimizing diameter, tensile strength and surface finish to meet infrastructure standards. As construction volumes grow in urbanizing regions, demand for round iron rods increases accordingly. Continued emphasis on durability and corrosion resistance also supports this segment, as rod producers introduce improved material treatments and coatings. Given the strong alignment between round‑section rods and prevailing construction norms, the Round type segment is likely to remain influential in the market’s evolution.

The construction application category represents roughly 50.0% of the Ball Iron Rod market. In the construction sector, iron rods serve essential roles in reinforcing concrete structures, creating support frameworks, and forming structural tie ins in buildings, bridges and civil infrastructure. Ball iron rods, which are typically produced through specialized casting or rolling processes to offer enhanced strength and consistency, find major usage in these high demand applications. Infrastructure investment in emerging economies, increased urbanization, and large scale public works are amplifying demand within this segment.

Construction users favour rods that meet specified mechanical properties—such as high yield strength, elongation and bending performance—because structural safety and code compliance are paramount. As such, manufacturers tailor product specifications for construction usage norms, offering rods with optimized chemical composition, disciplined quality control and adequate length/tolerance configurations. Contractors and engineers increasingly adopt ball iron rods because of their predictable performance under load and in severe environments. Taking into account expanding construction volumes globally, the Construction application is projected to drive the iron rod market’s growth in the coming years.

The market is primarily driven by increased demand in the construction, automotive, and machinery manufacturing sectors. Rising urbanization and infrastructure development are key growth factors. Emerging trends include advancements in material processing and the diversification of rod types. Market growth is constrained by raw material price volatility and supply chain challenges.

Infrastructure development projects in emerging economies are significantly increasing the demand for high-quality iron rods for reinforcement. The automotive and machinery manufacturing industries rely on these rods for producing durable parts and components, further expanding market potential. The need for reliable, high-strength materials that can withstand mechanical stress and environmental exposure is driving the adoption of ball iron rods.

Furthermore, increasing investments in infrastructure projects globally and advancements in steel production technology are enhancing production capacity, thus supporting overall market expansion. Government initiatives promoting industrial growth and the emphasis on energy-efficient building techniques further increase demand for high-performance materials like ball iron rods, making them an essential part of the modern construction and manufacturing landscape.

One significant trend is the development of rods with varied cross-sectional shapes, such as square, rectangular, and rhombus profiles, which cater to specific engineering applications beyond the standard round design. This diversification of rod types is driven by the growing need for customized solutions in sectors like construction and heavy machinery manufacturing. Furthermore, technological innovations in steel production, including higher-grade materials and improved surface treatments, have resulted in stronger, more durable rods with better resistance to wear and corrosion.

Sustainability is becoming a key focus, with manufacturers exploring the use of recycled materials in production and adopting greener manufacturing techniques. These trends not only address industry-specific needs but also align with broader efforts to reduce environmental impacts and improve material performance. As these technologies evolve, they are expected to enhance the value and functionality of ball iron rods in various applications.

A primary challenge is the volatility of raw material prices, particularly for iron ore and other alloying elements. Fluctuations in material costs can lead to unpredictable pricing, making it difficult for manufacturers to maintain stable profit margins. Strict environmental regulations related to steel production and waste management are adding to production costs and limiting capacity expansion in certain regions. Supply chain disruptions, particularly in remote or underdeveloped infrastructure areas, can also delay product delivery, further hindering market growth.

In developed regions, the market faces slow growth in the replacement and refurbishment of existing infrastructure, limiting incremental demand. The high initial cost of high‑performance rods and the availability of cheaper alternatives in some regions also act as barriers to more widespread adoption. Overcoming these challenges will be crucial for ensuring the sustained expansion of the ball iron rod market in the coming years.

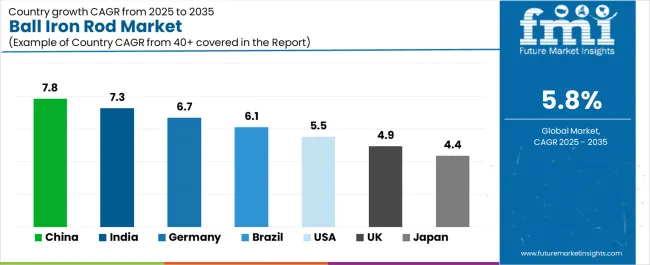

The ball iron rod market is experiencing notable growth across key regions globally. China leads the market with a 7.8% CAGR, driven by rapid industrialization, infrastructure development, and increasing demand for high-strength materials in construction and manufacturing sectors. India follows with a 7.3% CAGR, fueled by urbanization, infrastructure expansion, and growing demand for durable materials in construction and automotive industries. Germany sees a 6.7% CAGR, supported by its strong industrial base and the growing need for reinforcement materials in construction projects and manufacturing.

Brazil records a 6.1% CAGR, driven by its expanding infrastructure and the demand for high-quality materials for construction and industrial applications. The USA experiences a 5.5% CAGR, largely due to demand in the construction and automotive sectors, coupled with advancements in manufacturing technologies. The UK grows at a 4.9% CAGR, supported by the infrastructure development, particularly in the construction and automotive sectors. Japan has a 4.4% CAGR, driven by technological advancements, industrial demand, and the country's ongoing construction projects.

| Country | CAGR (%) |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

| USA | 5.5% |

| UK | 4.9% |

| Japan | 4.4% |

China leads the ball iron rod market with a 7.8% CAGR, primarily driven by rapid industrialization and infrastructure development. As the world’s largest producer and consumer of construction materials, China’s demand for high-quality, durable materials like ball iron rods continues to grow, particularly in urbanization projects and large-scale infrastructure developments. The construction of new cities, transportation networks, and commercial buildings fuels the demand for reinforced steel products, including ball iron rods.

The growing automotive and manufacturing sectors in China also contribute significantly to the rise in demand for high-strength iron rods. As the government continues to invest heavily in infrastructure and technology, including the development of smart cities, the market for ball iron rods is expected to maintain a steady upward trajectory. The shift towards more sustainable construction practices in China, with a focus on long-lasting, durable materials, further drives the adoption of ball iron rods across various industries.

India is experiencing strong growth in the ball iron rod market, with a 7.3% CAGR, supported by the country’s rapid urbanization and infrastructure development. As one of the fastest-growing economies in the world, India is witnessing an increasing demand for construction materials due to the rise in residential, commercial, and infrastructure projects. Ball iron rods are essential components in the construction sector for reinforcing concrete structures, ensuring their durability and safety. The government’s push towards the development of smart cities, transportation networks, and industrial hubs further propels the demand for these materials.

The automotive and manufacturing industries in India also contribute to the growing need for high-performance ball iron rods. The demand for durable, cost-effective, and reliable materials for industrial applications drives the adoption of iron rods, particularly in sectors that require strong and long-lasting components. The shift towards modern building materials, improved manufacturing techniques, and a focus on infrastructure expansion contribute to the increasing market share of ball iron rods. As India continues to invest in both infrastructure and industrial growth, the ball iron rod market is poised for significant expansion in the coming years.

Germany is experiencing steady growth in the ball iron rod market, with a 6.7% CAGR. The country’s strong industrial base, especially in construction and automotive manufacturing, drives the demand for high-strength materials like ball iron rods. As Europe’s largest economy, Germany places significant emphasis on high-quality, durable materials, especially in infrastructure projects such as bridges, roads, and commercial buildings. The construction of new commercial spaces, along with renovations of older structures, continues to support the demand for reinforced steel products like ball iron rods.

Germany’s automotive sector, one of the largest in the world, further contributes to the market demand for high-strength iron rods, as manufacturers require durable components for vehicles and parts production. The increasing focus on sustainable construction and the adoption of advanced building technologies are also key drivers of growth. Germany’s commitment to energy-efficient infrastructure and its growing investments in green construction projects, like energy-efficient buildings and smart city initiatives, further increase the need for durable materials like ball iron rods. As the country modernizes its infrastructure and embraces new building technologies, the demand for ball iron rods is expected to remain strong.

Brazil is witnessing steady growth in the ball iron rod market, with a 6.1% CAGR, driven by the country’s expanding infrastructure sector. As the largest economy in South America, Brazil is heavily investing in infrastructure development, including the construction of new roads, bridges, and housing projects. Ball iron rods are critical for reinforcing concrete in these projects, ensuring the durability and safety of the structures. Brazil’s rapid urbanization and the need for modern infrastructure are key contributors to the increasing demand for iron rods.

The automotive and manufacturing industries in Brazil play a vital role in driving the demand for high-strength materials. As industrial production increases and the country continues to grow its manufacturing capabilities, the need for durable components like ball iron rods remains high. Furthermore, Brazil’s government is focusing on improving its infrastructure to better connect regions and facilitate economic growth, which is creating opportunities for the ball iron rod market to expand. With continued investments in both public and private sectors, Brazil’s ball iron rod market is set to benefit from long-term growth in construction and manufacturing sectors.

The USA is experiencing steady growth in the ball iron rod market, with a 5.5% CAGR, driven by increasing demand in the construction and automotive sectors. As the USA continues to prioritize infrastructure renewal and growth, the need for durable and high-strength materials, such as ball iron rods, increases. These rods are essential in reinforcing concrete structures and ensuring the stability of buildings, highways, and bridges, which is driving growth in the market.

The automotive industry in the USA, one of the largest globally, is another significant driver. As automakers and suppliers require high-performance materials for vehicle parts and production processes, ball iron rods are used for manufacturing durable components. Moreover, the growing adoption of green building technologies, sustainable construction methods, and energy-efficient infrastructure further contributes to the need for high-quality, long-lasting materials like ball iron rods. With ongoing investments in infrastructure and a rising focus on sustainable development, the USA ball iron rod market is expected to grow consistently in the coming years.

The UK is experiencing moderate growth in the ball iron rod market, with a 4.9% CAGR, driven by the increasing need for high-strength materials in construction and infrastructure projects. As the UK continues to invest in urbanization, public transportation networks, and housing development, the demand for ball iron rods for concrete reinforcement remains strong. The construction sector’s focus on durability, safety, and sustainability further increases the market for these materials.

The UK also sees demand from the automotive and manufacturing industries, where ball iron rods are essential for producing durable components. The adoption of green building technologies and energy-efficient construction methods is further propelling growth in the sector. As the country focuses on modernizing its infrastructure, including improving energy-efficient and environmentally friendly buildings, the need for high-quality, reliable materials such as ball iron rods will continue to rise. The UK’s ongoing investments in infrastructure and sustainable development ensure that the market for ball iron rods will remain robust.

Japan is experiencing steady growth in the ball iron rod market, with a 4.4% CAGR, driven by the need for high-strength materials in the construction and industrial sectors. As Japan continues to invest in both new infrastructure projects and the renovation of existing structures, the demand for durable, high-performance materials like ball iron rods increases. Japan’s emphasis on seismic resilience and building safety in its infrastructure projects contributes to the growing adoption of high-quality iron rods.

The automotive and machinery manufacturing sectors in Japan also play a significant role in driving demand for ball iron rods. As these industries require durable materials for producing strong, long-lasting components, the need for iron rods remains strong. Japan’s commitment to sustainable construction and energy-efficient building practices continues to fuel the adoption of ball iron rods for infrastructure development. The country's advancements in material science and manufacturing technology further support the steady growth of the ball iron rod market in Japan.

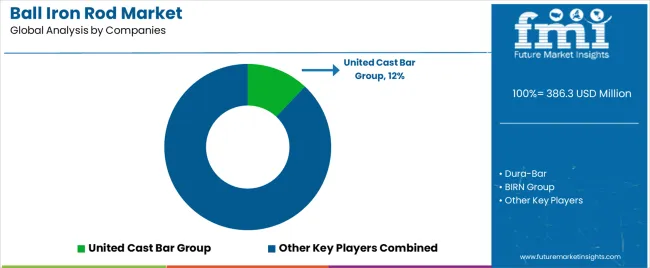

The ball iron rod industry is marked by a mix of large global players and regional specialists, each using unique strategies across product innovation, geographic reach, and material application. United Cast Bar Group, holding approximately 12% of the market, leads with its continuous‑cast iron bar production capabilities. The company offers a wide variety of grades and cross‑sections (round, square, rectangle) from its European foundries, and its global distribution network and long‑term production investments reinforce its market leadership.

Dura‑Bar competes by offering continuous cast iron bar stock tailored for machine, automotive, and industrial applications. They focus on cost performance and machinability rather than broad commodity supply, which allows them to serve more technical parts production. Other significant players like BIRN Group, ACO Eurobar, Hitachi Metals, and various Chinese manufacturers (such as Jiangsu Hualong Precision Intelligent Manufacturing and Henan Guotai Profile Technology) further diversify the market. These companies leverage localized production, material grade specialization, and regional distribution to strengthen their positions.

The competitive landscape is shaped by factors such as production quality, material grade range, cross‑section flexibility, and responsiveness to customer‑specific geometry needs. Manufacturers with advanced metallurgical capabilities, robust foundry‑machining connections, and strong global supply chains maintain a competitive edge. As the construction, automotive, and manufacturing sectors continue to grow, firms that can adapt quickly and provide cost‑efficient, high‑performance products are best positioned for long‑term success.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Round, Square, Rectangle, Rhombus |

| Application | Construction, Automotive Industry, Machinery Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | United Cast Bar Group, Dura-Bar, BIRN Group, ACO Eurobar, Hitachi Metals, KOGI Corporation, Encore Metals, Nippon Chuzo, Hengong Precision Equipment, Jiangsu Hualong Precision Intelligent Manufacturing, Henan Guotai Profile Technology, Wuan City Qichang Casting, Shanghai Accidentally Times Machinery Equipment, Hongye Hardware |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in ball iron rod manufacturing technologies, integration with construction and automotive industries. |

The global ball iron rod market is estimated to be valued at USD 386.3 million in 2025.

The market size for the ball iron rod market is projected to reach USD 678.9 million by 2035.

The ball iron rod market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in ball iron rod market are round, square, rectangle and rhombus.

In terms of application, construction segment to command 50.0% share in the ball iron rod market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Balloon Catheters for Bile Stone Removal Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Protection Material Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Floatation Vest Market Size and Share Forecast Outlook 2025 to 2035

Ball Picking Robot Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Protection Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Composites Market Size and Share Forecast Outlook 2025 to 2035

Balloon Catheters Analysis by Product Type by Indication and by End User through 2035

BGA Packaging Market Insights – Size, Demand & Growth through 2034

Ballistic Protection Scanners Market

Ballast Tank Corrosion Inhibitors Market

Ball screw Market

Ballast Water Treatment System Market

DIY Ball Mill Market Size and Share Forecast Outlook 2025 to 2035

Football Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Cryoballoon Ablation System Market – Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Hairball Cat Food Market

Golf Ball Picker Robot Market Size and Share Forecast Outlook 2025 to 2035

The Dual Balloon Angioplasty Catheter Market is segmented by Peripheral, and Coronal from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA