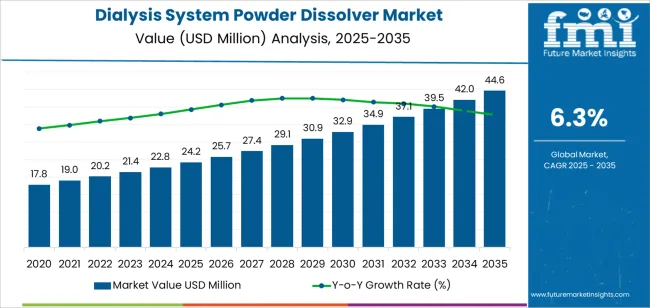

Valued at USD 24.2 million in 2025, the global dialysis system powder dissolver market is projected to reach USD 44.6 million by 2035, reflecting a CAGR of 6.3%. This increase represents an absolute dollar opportunity of USD 20.4 million across the forecast timeline. Rolling CAGR evaluation shows a steady upward trend, supported by the modernization of dialysis facilities, automation in concentrate preparation, and the growing global incidence of renal failure requiring routine treatment.

Dialysis powder dissolvers play a vital role in producing consistent and accurately mixed dialysis solutions, replacing manual preparation with automated precision systems. Recent product innovations emphasize improved solute dispersion, faster dissolution rates, and integrated digital control for monitoring concentration accuracy. Compact modular designs and simplified cleaning processes are also gaining traction, enabling healthcare providers to improve workflow and hygiene compliance.

Asia Pacific continues to show the highest expansion rate due to healthcare infrastructure upgrades and an increasing number of dialysis patients. North America and Europe maintain solid demand, with a focus on equipment quality and regulatory certification. Through 2035, technological refinement in system automation, enhanced operator safety features, and scalable production capacity are expected to shape sustained progress within the dialysis system powder dissolver industry.

Between 2025 and 2030, the Dialysis System Powder Dissolver Market is projected to grow from USD 24.2 million to USD 32.9 million, recording a growth volatility index (GVI) of 1.10, indicating a moderate acceleration phase. This period’s growth will be driven by the rising global prevalence of kidney diseases, increasing dialysis sessions worldwide, and continuous innovation in automated dialysis fluid preparation systems. Hospitals and clinics are shifting toward efficient powder-based dissolvers to minimize preparation time, reduce human error, and ensure fluid consistency. Advancements in dissolver automation, compact device design, and improved solubility performance will further accelerate adoption in both developed and emerging healthcare systems.

From 2030 to 2035, the market is forecast to rise from USD 32.9 million to USD 44.6 million, yielding a GVI of 0.90, signifying a mild deceleration as the market approaches maturity. This stabilization will occur as most dialysis centers adopt standardized fluid preparation systems and efficiency gains plateau. However, sustained demand will continue to come from developing regions investing in dialysis infrastructure and clinics transitioning from manual to automated dissolvers. Future innovation will focus on user-friendly interfaces, IoT-based monitoring, and integration with central dialysis fluid delivery systems to optimize operational control and quality assurance.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 24.2 million |

| Market Forecast Value (2035) | USD 44.6 million |

| Forecast CAGR (2025–2035) | 6.3% |

The dialysis system powder dissolver market is growing as healthcare facilities adopt automated mixing solutions to improve accuracy, safety, and efficiency in dialysis fluid preparation. These systems dissolve concentrated dialysis powders typically containing electrolytes and buffering agents into purified water to create dialysate for patient treatments. Automated dissolvers reduce manual labor, minimize contamination risk, and ensure precise composition consistency across large dialysis units. Rising global prevalence of end-stage renal disease and the expansion of in-center hemodialysis facilities sustain strong demand for reliable fluid preparation equipment. Hospitals and clinics increasingly invest in dissolvers to support standardized workflows and regulatory compliance.

Market expansion is supported by technological advancements in mixing chamber design, flow control, and real-time conductivity monitoring. Manufacturers integrate digital sensors and automated alarms to ensure proper solute dispersion and maintain fluid quality according to ISO and AAMI standards. Growing emphasis on centralized dialysis operations, particularly in high-volume treatment centers across Asia-Pacific and the Middle East, strengthens adoption. Compact and energy-efficient models tailored for smaller clinics also broaden accessibility in developing regions. While high upfront equipment costs limit penetration in low-resource settings, continuous innovation in automated dosing, sterilization, and maintenance systems ensures stable growth within the global dialysis equipment ecosystem.

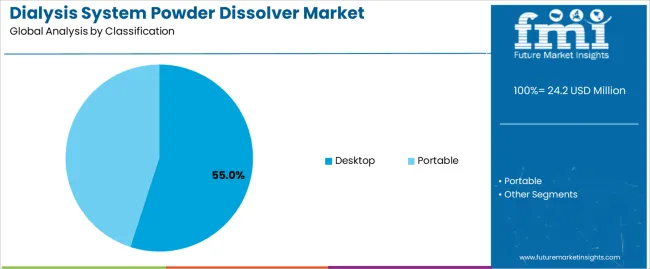

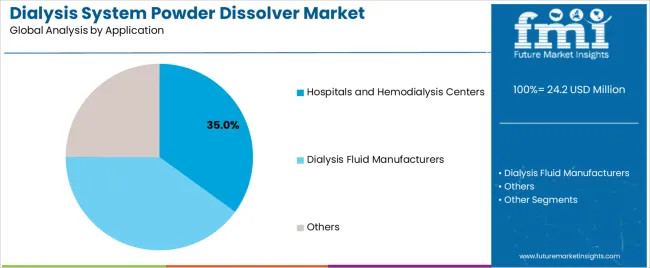

The dialysis system powder dissolver market is segmented by classification, application, and region. By classification, the market is divided into desktop and portable units. Based on application, it is categorized into hospitals and hemodialysis centers, dialysis fluid manufacturers, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments define system design preferences, operational settings, and regional healthcare infrastructure factors influencing the production and utilization of dialysis fluid preparation systems.

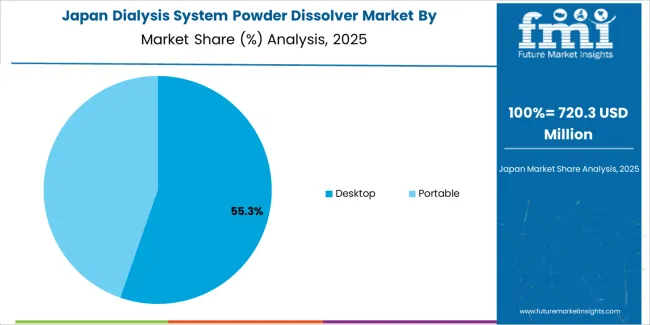

The desktop segment accounts for approximately 55.0% of the global dialysis system powder dissolver market in 2025, representing the leading classification category. Its leadership is supported by widespread adoption in fixed healthcare settings such as hospitals and hemodialysis centers, where consistent powder dissolution performance and controlled concentration output are critical. Desktop dissolvers provide precise mixing capability for bicarbonate and electrolyte concentrates used in dialysis fluid preparation, ensuring uniformity and patient safety during treatment.

These systems are valued for their operational stability, automation compatibility, and capacity to handle large solution volumes with minimal manual intervention. Manufacturers focus on design improvements that enhance flow regulation, temperature control, and real-time monitoring, supporting compliance with international dialysis fluid preparation standards. The segment benefits from ongoing expansion of hospital-based dialysis units in regions with growing renal disease prevalence, particularly in East Asia and North America. Desktop dissolvers remain the preferred choice for healthcare facilities prioritizing reliability, throughput, and adherence to strict concentration control requirements within centralized fluid preparation environments.

The hospitals and hemodialysis centers segment represents about 35.0% of the total dialysis system powder dissolver market in 2025, making it the largest application category. This dominance is attributed to the increasing number of dialysis treatments conducted in institutional settings requiring accurate, high-volume dialysis fluid preparation. Hospitals and specialized centers rely on powder dissolvers for consistent solute blending, ensuring correct bicarbonate and electrolyte levels in dialysate production.

The segment’s growth is driven by the global increase in chronic kidney disease prevalence and expansion of hemodialysis infrastructure to meet patient demand. Facilities prioritize automated and hygienic powder dissolving systems to minimize preparation time and reduce contamination risks. Manufacturers continue to introduce integrated dissolver units with programmable control systems and data logging for process traceability. Regional adoption is highest in North America, Europe, and East Asia, where dialysis services are consolidated under clinical quality frameworks. The hospitals and hemodialysis centers segment remains central to market growth due to its reliance on high-precision fluid preparation technologies, ensuring operational efficiency and consistent treatment outcomes across institutional dialysis facilities.

The dialysis system powder dissolver market is expanding as hemodialysis facilities seek efficient and automated solutions for preparing dialysate fluid from powder concentrates. These systems enable centralised dissolving of acid and bicarbonate powders, improving fluid consistency, operator safety and treatment throughput. Growth is supported by rising incidence of end-stage renal disease (ESRD), increasing dialysis centre capacity in emerging regions, and a shift toward automation in fluid preparation. Constraints include high capital costs, rigorous regulatory requirements for medical equipment, and the need for reliable performance in critical healthcare environments.

Demand is driven by the growing number of patients undergoing hemodialysis globally and the expansion of dialysis centres, especially in Asia-Pacific and Latin America. As treatment volumes increase, centres require systems that can handle larger batches and reduce manual errors. Powder dissolver systems support high-volume operations by ensuring precise mixing, reduced waste of concentrates and consistent dialysate quality across sessions, which is critical under regulatory oversight of dialysis fluids.

Adoption is constrained by the substantial investment required to purchase and install powder dissolvers, as well as by long validation and regulatory approval processes. These systems must meet stringent standards for fluid composition, microbiological safety and integration with dialysis equipment. Smaller clinics may defer adoption due to cost or prefer simpler manual methods. Maintenance, operator training and compatibility with existing infrastructure also present additional operational hurdles.

Key trends include integration of dissolver systems with dialysis machines for seamless workflows, development of closed-loop systems to minimise contamination risk, and use of real-time monitoring for conductivity and composition of dialysate. Manufacturers are also designing modular and compact units for smaller clinics or home-based dialysis settings. Automation and connectivity are becoming differentiators as centres look for solutions that reduce hands-on work and enhance patient safety.

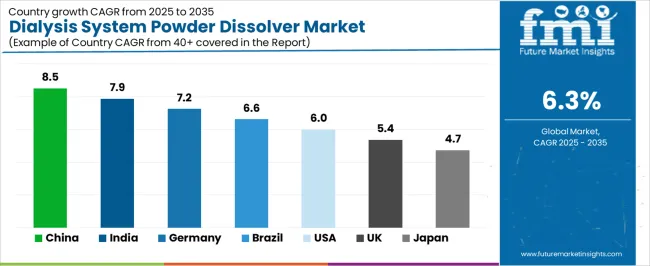

| Country | CAGR (%) |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| Brazil | 6.6% |

| USA | 6.0% |

| UK | 5.4% |

| Japan | 4.7% |

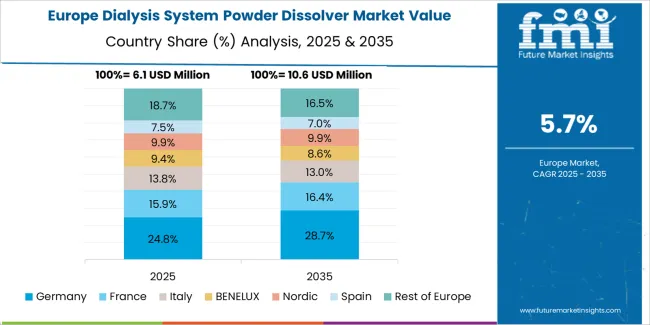

The dialysis system powder dissolver market is experiencing rapid global growth, with China leading at an 8.5% CAGR through 2035, driven by expanding dialysis infrastructure, increased prevalence of renal diseases, and domestic innovation in healthcare technology. India follows at 7.9%, supported by rising dialysis demand, government-backed healthcare programs, and improvements in hospital-grade medical equipment. Germany records 7.2%, reflecting strong R&D capabilities, precision manufacturing, and stringent clinical quality standards. Brazil grows at 6.6%, benefiting from greater access to renal treatment facilities and public healthcare modernization. The USA, with a 6.0% CAGR, continues to lead in technological advancement and automation in dialysis systems, while the UK (5.4%) and Japan (4.7%) emphasize system efficiency, patient safety, and integration of digital control solutions in medical fluid preparation.

China is experiencing rapid progress in the dialysis system powder dissolver market, projected to grow at a CAGR of 8.5% through 2035. Expanding dialysis treatment centers and increasing renal disease incidence are driving installation demand. Domestic manufacturers are enhancing automation and safety in fluid preparation systems to meet large-scale hospital needs. Ongoing healthcare infrastructure investment and technology partnerships with medical device firms continue to support operational efficiency. Government efforts to expand public dialysis access reinforce long-term market potential.

India is witnessing strong growth in the dialysis system powder dissolver market, advancing at a CAGR of 7.9% through 2035. Rising demand for affordable dialysis services and domestic manufacturing expansion are driving product adoption. Local suppliers are developing energy-efficient and user-friendly dissolver systems for government hospitals and private clinics. The implementation of healthcare schemes promoting chronic kidney care ensures consistent demand. Increased awareness of operational safety and precision dosing supports long-term market stability across major medical institutions.

Across Germany, the dialysis system powder dissolver market is advancing at a CAGR of 7.2%, supported by advanced engineering and strong compliance with medical device regulations. Manufacturers emphasize high-precision mixing, contamination prevention, and automated monitoring technologies. Integration of smart data interfaces allows real-time performance tracking in clinical settings. Growing adoption in both public hospitals and private dialysis chains ensures stable consumption. Continuous R&D in hygiene design and system durability enhances operational reliability across the market.

Brazil is recording steady growth in the dialysis system powder dissolver market, projected to rise at a CAGR of 6.6% through 2035. Expanding public healthcare infrastructure and greater awareness of kidney disease are stimulating product installations. Local distributors are collaborating with international suppliers to improve technology transfer. Investment in dialysis clinics and rural healthcare accessibility programs continues to strengthen regional market participation. Development of portable and low-maintenance dissolver systems supports sustained adoption across public and private sectors.

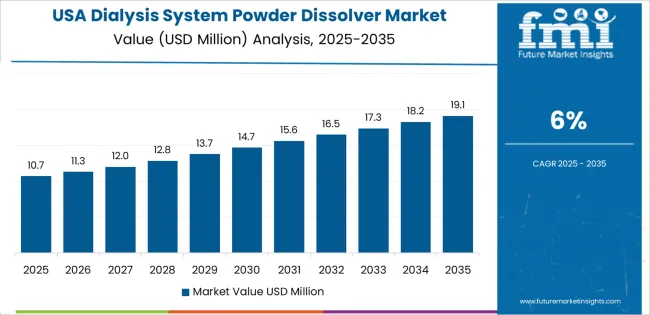

In the United States, the dialysis system powder dissolver market is expanding at a CAGR of 6.0% through 2035. Increasing automation in dialysis centers and focus on infection control are driving adoption of advanced dissolver systems. Manufacturers are developing touchless, digitally controlled models to enhance safety and consistency. Growth in outpatient dialysis facilities and regulatory emphasis on precision fluid mixing support stable product demand. Integration of digital monitoring platforms ensures traceability and performance optimization.

Across the United Kingdom, the dialysis system powder dissolver market is advancing at a CAGR of 5.4% through 2035. Hospital modernization and adoption of smart dialysis equipment are improving treatment efficiency. Local and imported devices featuring automated dosing and digital monitoring systems are gaining traction. Demand from NHS dialysis centers and private clinics remains consistent. Ongoing focus on infection prevention and healthcare digitalization supports continuous system upgrades across dialysis networks nationwide.

Japan is progressing steadily in the dialysis system powder dissolver market, forecast to grow at a CAGR of 4.7% through 2035. Domestic manufacturers emphasize compact, automated units suited for hospital space optimization. Continuous advancements in precision mixing, error detection, and disinfection control enhance reliability. Growing renal treatment centers and aging demographics sustain equipment procurement. Partnerships with medical engineering firms strengthen R&D for efficient, high-performance dissolver systems.

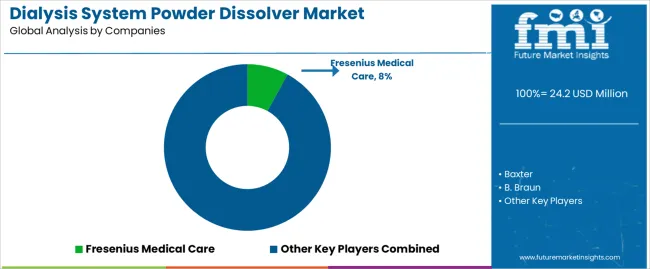

The global dialysis system powder dissolver market is highly concentrated, shaped by leading dialysis technology companies integrating powder dissolution units within renal therapy infrastructure. Fresenius Medical Care leads the market through advanced automated dissolver systems designed for consistent dialysis fluid preparation and stringent quality control in clinical environments. Baxter and B. Braun maintain strong global positions, emphasizing safety-focused designs that ensure accurate electrolyte composition and operational efficiency. Nipro Corporation and JMS strengthen competitiveness through compact and modular dissolver units compatible with centralized dialysis setups. Shibuya Kogyo and Asahi Kasei contribute technical expertise in automation and precision fluid management, supporting optimized workflow in multi-patient facilities.

Bellco enhances market diversity with flexible dissolver configurations suited for both hospital and satellite dialysis centers. Competition across this segment is influenced by dissolution accuracy, system reliability, and ease of integration with existing dialysis machines. Strategic differentiation depends on digital control systems, simplified maintenance, and compliance with global medical standards for dialysis solution preparation. Long-term competitiveness will rely on innovation in closed-loop systems, remote monitoring capabilities, and reduced manual handling to improve patient safety and operational efficiency. As healthcare facilities modernize dialysis operations, demand continues to grow for automated, precise, and hygienic powder dissolver systems supporting sustainable treatment delivery worldwide.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type (Classification) | Desktop, Portable |

| Application | Hospitals and Hemodialysis Centers, Dialysis Fluid Manufacturers, Others |

| End User | Hospitals, Hemodialysis Centers, Dialysis Equipment Manufacturers, Healthcare Service Providers |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Fresenius Medical Care, Baxter, B. Braun, Nipro Corporation, JMS, Shibuya Kogyo, Asahi Kasei, Bellco |

| Additional Attributes | Market estimation by classification and application segments; regional analysis of dialysis infrastructure expansion; competitive focus on automation, precision mixing, and compliance with international fluid safety standards. |

The global dialysis system powder dissolver market is estimated to be valued at USD 24.2 million in 2025.

The market size for the dialysis system powder dissolver market is projected to reach USD 44.6 million by 2035.

The dialysis system powder dissolver market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in dialysis system powder dissolver market are desktop and portable.

In terms of application, hospitals and hemodialysis centers segment to command 35.0% share in the dialysis system powder dissolver market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dialysis Water Filters Market Size and Share Forecast Outlook 2025 to 2035

Dialysis Equipment Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Dialysis Equipment Market Insights - Growth & Forecast 2025 to 2035

Dialysis Induced Anemia Treatment Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dialysis Device and Concentrates Market Growth - Trends & Forecast 2025 to 2035

Hemodialysis and Peritoneal Dialysis Market Size and Share Forecast Outlook 2025 to 2035

Home Dialysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Diffusion Dialysis Membrane Market Size and Share Forecast Outlook 2025 to 2035

Bipolar Electrodialysis Membrane Market Size and Share Forecast Outlook 2025 to 2035

Continuous Ambulatory Peritoneal Dialysis Bags Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA