Bio-magnetic ear sticker demand in the USA is valued at USD 0.5 billion in 2025 and is projected to reach USD 1.0 billion by 2035 at a CAGR of 6.2%. Early growth is shaped by consumer interest in non-invasive wellness aids used for stress relief, sleep support, appetite control, and pain management. Sales are concentrated in over-the-counter wellness retail, chiropractic clinics, and acupuncture-linked therapy centers. Adhesive comfort, magnetic strength consistency, and skin compatibility drive repeat purchase behavior. Online channels account for a large share of early adoption as direct-to-consumer brands rely on educational content and bundled subscription models to sustain usage frequency across wellness-oriented consumers.

After 2030, demand expansion becomes more distribution-led than novelty-driven. Market value rises from about USD 0.7 billion in 2030 toward USD 1.0 billion by 2035 as bio-magnetic stickers gain wider placement in pharmacies, mass retail wellness aisles, and sports recovery programs. Workplace wellness initiatives and physical therapy networks add steady institutional volume. Product differentiation shifts toward hypoallergenic materials, longer wear cycles, and targeted point placement guides aligned with traditional pressure mapping systems. Supplier competition centers on adhesive durability, magnetic field stability, and packaging standardization for regulated retail environments. Growth in the later phase reflects broader normalization of bio-magnetic accessories within mainstream personal wellness spending rather than experimental consumer uptake.

Bio-magnetic ear stickers occupy a niche at the intersection of alternative wellness, self-care accessories, and non-invasive relaxation aids, which gives their demand curve a consumer-driven rather than clinically driven structure. Demand in USA increases from USD 0.5 billion in 2025 to USD 0.6 billion by 2030, adding USD 0.1 billion in absolute value. This phase reflects steady uptake through online wellness platforms, gift-oriented retail, and stress-relief product assortments rather than mass medical distribution. Growth is supported by repeat purchase behavior, impulse wellness spending, and rising visibility across social commerce channels. Product differentiation during this period remains focused on materials, aesthetics, and packaging rather than functional performance innovation.

From 2030 to 2035, the market expands from USD 0.6 billion to USD 1.0 billion, adding USD 0.4 billion in the second half of the decade. This back weighted acceleration reflects deeper penetration into lifestyle wellness routines, expansion across sleep support, anxiety management, and acupressure-inspired accessories, and wider international brand entry into the USA market. As branding sophistication improves and subscription-based wellness kits gain traction, unit volumes and average selling prices both rise. The category gradually shifts from novelty-oriented spending toward routine personal wellness consumption, strengthening long-term demand momentum.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 0.5 billion |

| Forecast Value (2035) | USD 1.0 billion |

| Forecast CAGR (2025–2035) | 6.2% |

The USA market for bio-magnetic ear stickers has emerged out of growing public interest in alternative wellness approaches, non-invasive therapies, and stress or pain management solutions that do not rely on traditional pharmaceuticals. Consumers concerned about chronic conditions such as headaches, joint pain, stress, or insomnia have increasingly looked toward drug-free interventions. Bio-magnetic ear stickers small magnetized patches applied to ear acupressure points gained traction as affordable, easy-to-use products. Early demand was driven by wellness-oriented individuals, users of holistic or complementary medicine, and buyers seeking at-home remedies. E-commerce platforms helped spread awareness and lowered access barriers, allowing niche products to reach a broader audience across the country.

Going forward, growth could accelerate if bio-magnetic ear stickers move beyond niche wellness circles into mainstream self-care and preventive health use. Trends such as rising healthcare costs, increased consumer skepticism toward long-term use of painkillers, and growing interest in holistic wellness may favor adoption. Manufacturers refining materials (hypoallergenic adhesives, durable magnets), improving user comfort, and offering subscription or recurring-use packs may broaden appeal. Demand may further climb if clinics or wellness centers integrate ear-stickers into complementary therapy offerings. Barriers remain significant: limited rigorous clinical evidence supporting efficacy, regulatory scrutiny over health claims, and consumer skepticism. Long-term market expansion will depend on transparent communication of benefits, product safety, and realistic positioning of stickers as adjunct wellness tools rather than cures.

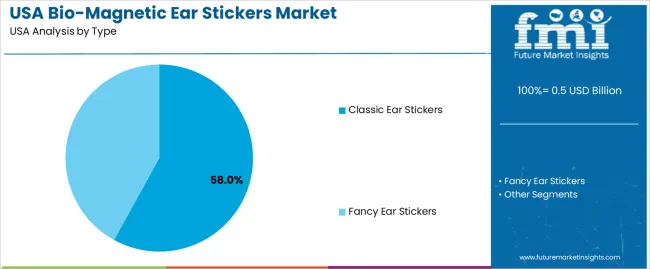

The demand for bio magnetic ear stickers in the USA is structured by product type and sales channel. Classic ear stickers account for 58% of total demand, followed by fancy ear stickers that serve style focused and gift-oriented segments. By sales channel, online retailers represent 34.0% of total consumption, followed by specialty stores, direct sales, and other distribution formats. Demand behavior is shaped by ease of use, price accessibility, perceived wellness benefits, and convenience of purchase. These segments reflect how functional design preferences and evolving retail access models influence product adoption across personal wellness consumers in the USA.

Classic ear stickers account for 58% of total bio magnetic ear sticker demand in the USA due to their simple design, consistent USAbility, and suitability for daily wellness routines. These products are commonly used for acupressure based applications associated with stress management, sleep support, appetite control, and general relaxation. Consumers prefer classic formats because they offer discreet appearance and predictable placement on standard auricular pressure points. The absence of decorative elements improves acceptance among older users and wellness focused buyers who prioritize function over visual design.

Classic ear stickers are also favored due to lower unit pricing compared with decorative variants, which supports repeat purchasing behavior. Bulk packs marketed through wellness platforms and online marketplaces further reinforce their dominance. Instructional content and self care programs frequently reference classic designs, which sustains steady demand. These USAbility, pricing, and routine integration factors collectively sustain classic ear stickers as the leading type segment in the USA bio magnetic ear sticker demand structure.

Online retailers account for 34.0% of total bio magnetic ear sticker demand in the USA due to the convenience of home delivery, wide product selection, and easy access to user reviews and instructional content. Consumers rely on e commerce platforms to compare magnetic strength, adhesive types, and package sizes before purchase. Subscription options and bundled wellness kits also support recurring purchases through digital channels. These features align well with wellness consumers who prefer privacy and convenience when purchasing self-care products.

Online platforms also enable direct access to imported products and small brand offerings that may not be stocked through physical retail outlets. Social media marketing and influencer driven product discovery play a role in driving traffic to online sales pages. Competitive pricing and frequent discount campaigns further support channel preference. These accessibility, assortment diversity, and digital marketing factors position online retailers as the dominant sales channel for bio magnetic ear stickers across the USA.

Demand for bio-magnetic ear stickers in the USA is driven less by clinical endorsement and more by consumer-led experimentation in wellness routines. These products circulate mainly through alternative therapy stores, online wellness platforms, and influencer-driven health content rather than hospitals or pharmacies. Users adopt them for appetite control, stress relief, sleep support, and pain management based on personal trial outcomes. The low price point and non-invasive nature reduce adoption risk for first-time users. This retail and self-care orientation allows demand to expand without dependence on formal diagnosis or medical prescription systems.

USA weight management behavior strongly influences bio-magnetic ear sticker demand. Consumers seeking non-diet, non-pharmaceutical aids use ear acupoint stimulation as a behavioral control tool for appetite regulation and snacking reduction. Stress-driven eating patterns and irregular sleep schedules reinforce interest in passive wellness aids that do not require daily planning. Fitness and detox communities treat these stickers as adjunct tools alongside fasting, supplements, and wearable trackers. This integration into self-directed wellness stacks explains why repeat purchases depend more on perceived habit control than on clinical outcome measurement.

Bio-magnetic ear stickers in the USA operate inside a gray zone between wellness accessories and medical devices. Lack of standardized clinical validation limits institutional adoption by hospitals, insurers, and licensed clinics. Marketing claims face regulatory scrutiny when they imply disease treatment rather than general wellness support. Product performance varies with magnet strength, adhesive quality, and point placement accuracy. Consumer skepticism also limits repeat use among outcome-driven buyers. These scientific and regulatory uncertainties prevent the category from scaling into mainstream medical retail despite steady niche consumer interest.

Demand for bio-magnetic ear stickers in the USA is increasingly shaped by digital storefronts rather than physical therapy clinics. Subscription bundles for monthly wellness use encourage repeat ordering without strong brand loyalty. Skin-tone neutral designs, transparent adhesives, and minimalist packaging reduce visual stigma during daily wear. Mobile apps and digital charts now guide point placement, replacing practitioner dependence. This shift transforms ear stickers into consumer-managed wellness products rather than therapist-controlled treatment tools. The demand structure now follows digital discovery and habit economics more than professional referral systems.

| Region | CAGR (%) |

|---|---|

| West | 7.1% |

| South | 6.4% |

| Northeast | 5.7% |

| Midwest | 4.9% |

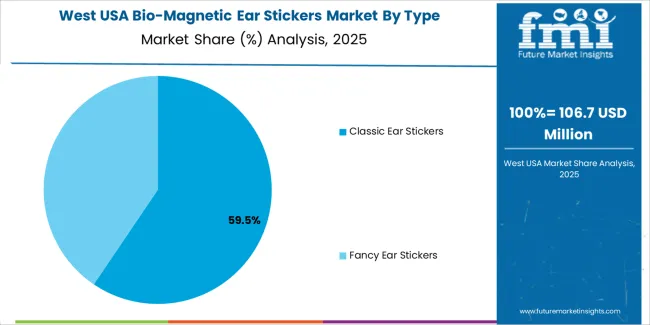

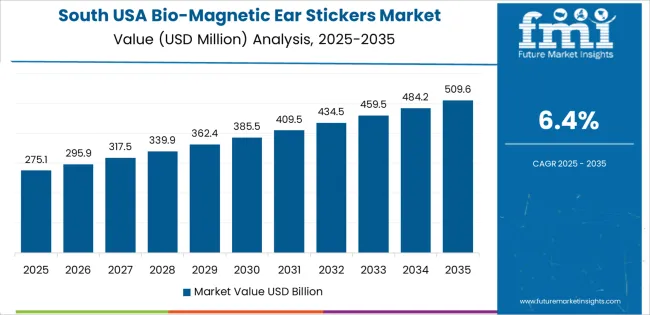

The demand for bio magnetic ear stickers in the USA is increasing steadily across all regions, with the West leading at a 7.1% CAGR. Growth in this region is supported by strong consumer interest in alternative wellness products, high penetration of health and lifestyle trends, and widespread availability through online and specialty wellness retail channels. The South follows at 6.4%, driven by rising awareness of noninvasive pain relief and stress management products among a broad consumer base. The Northeast records 5.7% growth, supported by urban wellness adoption, therapy clinics, and specialty health stores. The Midwest shows comparatively moderate growth at 4.9%, reflecting slower adoption of alternative wellness accessories and more cautious consumer spending patterns.

Consumer adoption in the West is advancing at a CAGR of 7.1% through 2035 for bio magnetic ear sticker demand, supported by strong interest in alternative wellness products, high participation in fitness and yoga communities, and broad access to holistic health retailers. Urban consumers use these products for stress management, sleep support, and weight management routines. Online wellness platforms and social commerce channels contribute to product visibility and repeat purchasing. Demand remains discretionary and lifestyle oriented, with purchasing influenced by peer usage, digital promotion, and availability through specialty wellness and personal care distribution networks.

Retail expansion in the South is supporting growth at a CAGR of 6.4% through 2035 for bio magnetic ear sticker demand, driven by rising demand for affordable wellness accessories, pharmacy based retail outreach, and growing participation in weight management programs. Warm climate encourages outdoor fitness activity that aligns with performance and recovery oriented wellness products. Drugstores and mass merchandisers play a central role in product diffusion. Demand remains price sensitive and volume driven, with steady sales tied to impulse buying and promotional bundling rather than structured clinical wellness programs.

Urban wellness adoption in the Northeast is sustaining a CAGR of 5.7% through 2035 for bio magnetic ear sticker demand, shaped by dense metropolitan populations, boutique wellness studios, and strong use of complementary health practices. Stress relief and sleep related applications remain the most common use cases among professionals and students. Distribution remains concentrated in specialty health stores and ecommerce platforms. Demand is replacement led rather than trial driven, supported by routine use among repeat consumers. Growth remains controlled and stability driven within structured urban wellness ecosystems.

Consumer uptake in the Midwest is expanding at a CAGR of 4.9% through 2035 for bio magnetic ear sticker demand, supported by gradual acceptance of complementary wellness products, community level fitness programs, and steady pharmacy based retail access. Adoption remains lower than coastal regions due to conservative purchasing behavior and limited exposure to alternative wellness marketing. Local health stores and regional drugstore chains remain the primary sales channels. Demand stays necessity adjacent rather than lifestyle driven, with growth tied to slow expansion of wellness awareness and selective consumer experimentation.

Demand for bio magnetic ear stickers in the USA is growing as more consumers explore non invasive, wellness oriented alternatives for pain management, stress relief, sleep support, and holistic therapy. Interest in complementary medicine, such as ear acupressure and auriculotherapy, aligns with rising demand for drug free health solutions. Many users view ear stickers as an accessible way to stimulate ear points associated with relaxation, circulation, and general wellness. The growth of online retail and e commerce platforms allows wide distribution and easy access. Rising health awareness and demand for easily adoptable wellness items (without prescription) further strengthen market uptake among adults seeking convenient self care options.

Key companies supplying bio magnetic ear stickers in the USA include Aculife Healthcare, AcuMed Magnetic Therapy, EarSeeds, Stimul8, and BioMagnetic Products. Aculife, AcuMed and EarSeeds lead with a broad product portfolio covering pain relief, sleep support, and acupressure based wellness. Stimul8 and BioMagnetic Products serve niche segments for stress management, circulation improvement, and lifestyle oriented wellness. These firms influence supply availability, pricing, and consumer awareness through direct to consumer sales channels, wellness store partnerships, and digital marketing. Their presence sustains a diversified vendor base and supports growing demand across home users and alternative therapy aware consumers.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Classic Ear Stickers, Fancy Ear Stickers |

| Sales Channel | Online Retailers, Specialty Stores, Direct Sales, Others |

| End-use Application | Personal Wellness, Stress Relief, Sleep Support, Appetite Control, Pain Management |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Aculife Healthcare, AcuMed Magnetic Therapy, EarSeeds, Stimul8, BioMagnetic Products |

| Additional Attributes | Dollar by sales by type, Dollar by sales by sales channel, Dollar by sales by region, Regional CAGR, Wellness-oriented distribution, Subscription-based sales models, Online direct-to-consumer penetration, Adhesive and magnetic quality performance |

The demand for bio-magnetic ear stickers in USA is estimated to be valued at USD 0.5 billion in 2025.

The market size for the bio-magnetic ear stickers in USA is projected to reach USD 1.0 billion by 2035.

The demand for bio-magnetic ear stickers in USA is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in bio-magnetic ear stickers in USA are classic ear stickers and fancy ear stickers.

In terms of sales channel, online retailers segment is expected to command 34.0% share in the bio-magnetic ear stickers in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio-Magnetic Ear Stickers Market Analysis – Growth & Forecast 2025 to 2035

Demand for Hearing Implant in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Switchgear in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Adaptive Shapewear in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Gearbox Valves in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Deep Groove Ball Bearings in USA Size and Share Forecast Outlook 2025 to 2035

Earphone and Headphone Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Early Phase Clinical Trial Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Early-Stage Lung Cancer Diagnostics Therapy Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Earth Anchors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Earplugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Earthen Plasters Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

Early Life Nutrition Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Earth Observation Drones Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA