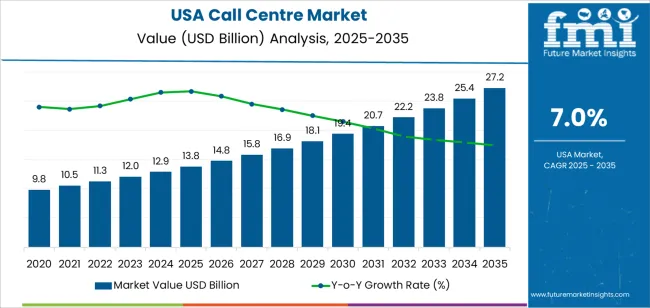

The USA call centre demand is valued at USD 13.8 billion in 2025 and is forecasted to reach USD 27.2 billion by 2035, recording a CAGR of 7.0%. Demand is supported by rising customer service volumes, expanded use of structured support operations across banking, retail, healthcare, and technology, and continued reliance on human-assisted interaction for complex inquiries. Call centres remain central to service delivery for organisations seeking consistent handling of customer issues, regulatory compliance, and structured workflow management. Growth in omnichannel communication and steady interaction volumes across voice and digital channels reinforce long-term service requirements.

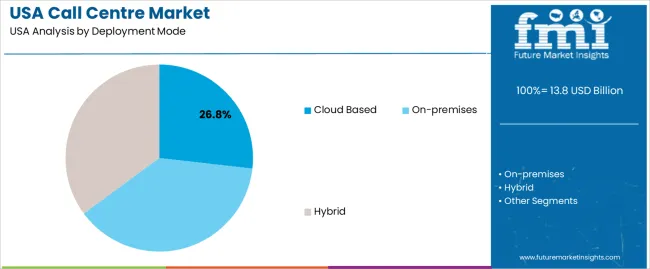

On-premises solutions represent the leading deployment mode, driven by their suitability for organisations that prioritise data governance, strict compliance controls, and integration with existing enterprise systems. These deployments provide stable performance, customisable routing capabilities, and consistent control over communication infrastructure. Improvements in workforce management tools, call analytics software, and interoperability with CRM platforms continue to support replacement cycles within established call centre networks.

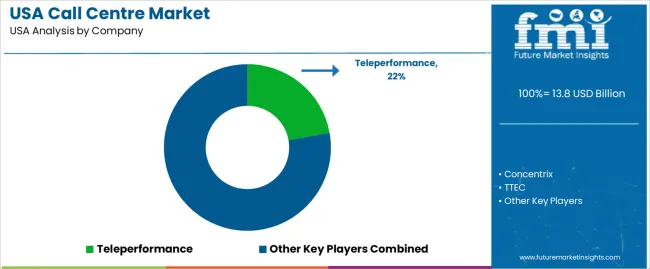

Demand is strongest in the West, South, and Northeast, where large customer service hubs, enterprise headquarters, and regional service centres are concentrated. Key companies include Teleperformance, Concentrix, TTEC, Foundever, and Alorica. Their focus is on operational consistency, technology integration, and structured service delivery across varied client sectors.

Peak-to-trough analysis shows a cyclic yet resilient pattern shaped by enterprise outsourcing needs, customer-experience investments, and labour-industry conditions. Between 2025 and 2028, the segment is expected to reach an early peak as organisations expand omnichannel support, integrate AI-driven assistance tools, and strengthen service capacity to manage growing digital-transaction volumes. Increased adoption of hybrid cloud contact-centre platforms will reinforce this upward phase.

A mild trough is likely between 2029 and 2031 as cost controls, operational consolidation, and fluctuations in domestic hiring cycles moderate short-term spending. This period may also reflect adjustment to automation deployments, with firms recalibrating the balance between human agents and AI-enabled self-service workflows. After 2031, the segment is expected to regain momentum as companies’ upgrade legacy systems, integrate advanced analytics, and expand multilingual support capabilities. Replacement and optimisation cycles will drive the recovery rather than rapid capacity expansion. The peak-to-trough pattern reflects a stable service segment influenced by enterprise budget cycles, technology integration phases, and continuing reliance on structured customer-support operations across USA industries.

| Metric | Value |

|---|---|

| USA Call Centre Sales Value (2025) | USD 13.8 billion |

| USA Call Centre Forecast Value (2035) | USD 27.2 billion |

| USA Call Centre Forecast CAGR (2025-2035) | 7.0% |

Demand for call centre services in the USA is increasing because organisations across retail, financial services, healthcare and technology sectors require scalable, high-quality support operations that handle large volumes of customer interactions. The shift toward digital commerce and omnichannel customer engagement means companies need platforms that integrate voice, chat, email and social media communications seamlessly. Automation, analytics and AI-enabled tools contribute to efficiency gains, which drives investment in professional call centre services. Outsourcing and onshore-managed service models are growing as firms prioritise cost reduction, service level optimisation and 24-hour support capabilities.

Regulation, data security requirements and the need for multilingual customer support elevate the value of established call centre providers with compliance credentials and skilled agent pools in the USA. Constraints include increasing wage and labour costs in the USA, competition from offshore and automated service models, and the challenge of talent retention in high-turnover environments. Organisations must also invest in technology upgrades and training to handle evolving customer expectations and complex workflows.

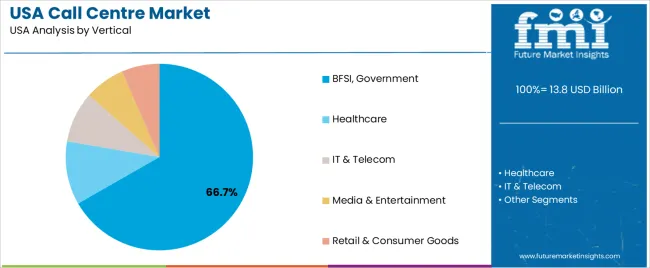

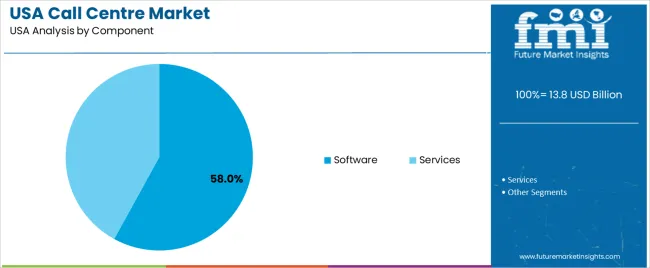

Demand for call-centre solutions in the United States is shaped by deployment preferences, sector-specific service requirements, and adoption of technology platforms. Distribution across deployment mode, end-use verticals, and system components reflects operational scale, regulatory considerations, and the need for reliable communication systems in high-volume environments.

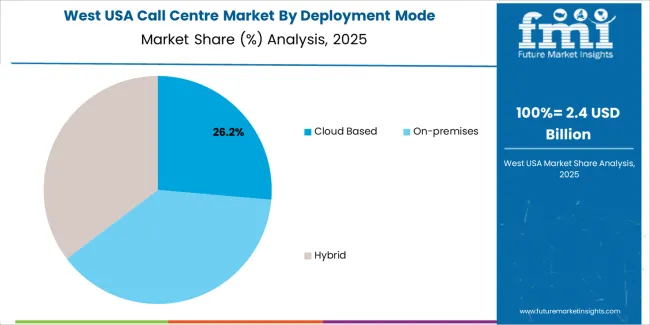

On-premises systems hold 38.1% of USA demand and represent the largest deployment mode. They remain widely used across sectors requiring controlled data environments, customised integration, and locally managed infrastructure. Organisations with established IT environments often maintain on-premises systems to retain full oversight of security protocols and performance management. Hybrid deployments account for 35.1%, reflecting a shift toward blended architectures that combine cloud scalability with local control. Cloud-based systems hold 26.8%, driven by subscription affordability, remote-work compatibility, and faster deployment cycles. Deployment preferences reflect organisational policy, infrastructure maturity, and compliance requirements across regulated industries.

Key drivers and attributes:

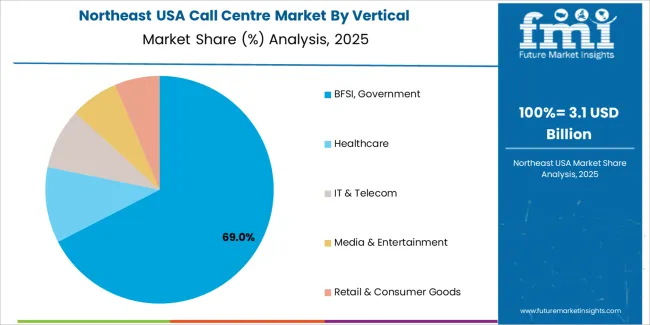

BFSI and government together hold 66.7% of USA demand, making them the dominant vertical group. These sectors require high-volume citizen and customer interactions, strict compliance frameworks, and resilient communication infrastructure. Call-centre platforms in these sectors support authentication, issue resolution, claims management, and service-related communication. Healthcare represents 11.0%, supported by scheduling, claims support, and remote-care coordination. IT and telecom hold 8.8%, driven by technical support and service-provision requirements. Media and entertainment represent 7.0%, while retail and consumer goods account for 6.5%, reflecting demand for order support, inquiry handling, and customer service.

Key drivers and attributes:

Software platforms hold an estimated 58.0% share of USA demand. Call-centre software supports routing, analytics, workforce management, voice systems, compliance monitoring, and omnichannel integration. Organisations prioritise software capable of handling high call volumes, integrating with CRM systems, and enabling automated workflows. Services account for 42.0%, spanning installation, training, system optimisation, and managed support. Service demand remains steady due to frequent upgrades, configuration needs, and ongoing operational assistance. Component distribution reflects the reliance on scalable software capabilities and the need for technical and operational support across industries.

Key drivers and attributes:

Organisations in the USA are expanding call-centre operations to support higher customer expectations for 24/7 access, faster response times and personalised service across phone, chat and social-media channels. Growth in e-commerce, subscription services and digital platforms multiplies contact-volume and complexity, which fuels demand for both in-house and outsourced call-centre units. Industries such as financial services, healthcare, telecommunications and retail are investing in call centres to manage customer onboarding, technical support, billing inquiries and retention activities. Enhanced cloud infrastructure, remote-agent capability and analytics-driven call-routing strengthen call-centre value and support greater deployment.

Running call centres involves significant expense for staffing, training, real-time supervision and infrastructure upgrades; some businesses are delaying expansions due to cost concerns. Advances in automation, artificial-intelligence chatbots and digital self-service reduce the volume of traditional voice interactions, which may lessen the rate of growth for human-agent call-centre demand. Recruiting, retaining and training highly skilled agents, especially for specialised support roles, remains challenging in the USA, which can slow scaling of new call-centre operations.

Many US organisations now deploy call centres with remote or hybrid agent work-forces to access broader talent pools, reduce real-estate costs and support flexible staffing. Call-centre systems increasingly incorporate AI analytics, sentiment detection, real-time coaching and workforce-management tools to improve agent productivity and customer-experience metrics. There is also a rising preference for on-shore or near-shore call-centre outsourcing that maintains cultural alignment and security control, rather than solely offshore models. These trends support evolving call-centre demand across the USA, even as automation transforms some service functions.

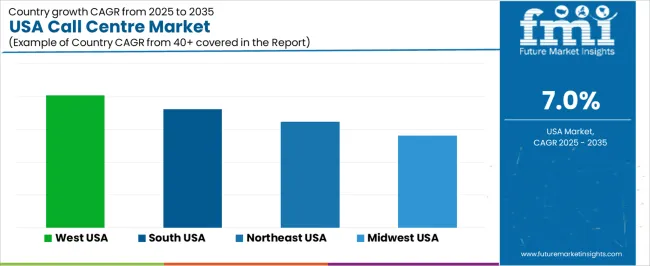

Demand for call centres in the United States is rising through 2035, driven by expanding service outsourcing, higher customer-support volumes across digital commerce, and broader adoption of omnichannel communication platforms. Companies rely on call centres for technical support, sales coordination, retention services, and inbound query management. Growth also reflects increased integration of analytics, automated routing, and cloud-based contact-centre solutions. Regional differences align with labor availability, operational costs, and the concentration of service-oriented industries. The West leads with an 8.1% CAGR, followed by the South (7.2%), the Northeast (6.5%), and the Midwest (5.6%). Demand remains strong across finance, healthcare, telecom, and technology-driven customer-service environments.

| Region | CAGR (2025-2035) |

|---|---|

| West | 8.1% |

| South | 7.2% |

| Northeast | 6.5% |

| Midwest | 5.6% |

The West grows at 8.1% CAGR, supported by extensive adoption of cloud-based customer-service platforms, strong demand from technology firms, and high service volumes across e-commerce and telecommunications operations. States such as California, Washington, Colorado, and Arizona maintain large workforces involved in inbound and outbound support functions. Companies rely on call centres to manage multi-channel communication, including voice, chat, and email support. Startups and software firms generate strong demand for technical-assistance operations, while insurance and healthcare providers depend on call centres for claims support and appointment coordination. Regional focus on digital services increases usage of workforce-management systems and quality-monitoring tools, reinforcing steady expansion of call-centre infrastructure.

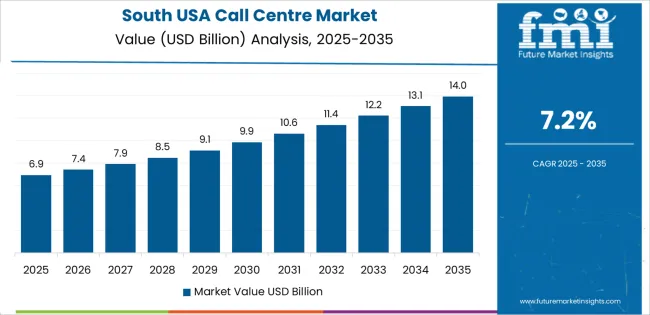

The South grows at 7.2% CAGR, supported by competitive labor industries, large service-sector activity, and strong adoption of outsourced customer-support operations. States such as Texas, Florida, Georgia, and North Carolina attract call-centre deployments due to favorable operating costs and established business-services ecosystems. Regional companies operate large facilities handling sales inquiries, billing support, and technical-service workflows. Healthcare, telecom, and retail sectors rely heavily on call-centre partners to manage high-volume customer interactions. The South’s growing population increases inbound support needs across utilities, service subscriptions, and consumer-product companies. Expansion of remote-work models also broadens regional recruitment capacity for distributed call-centre teams.

The Northeast grows at 6.5% CAGR, supported by dense service industries, strong financial-services presence, and extensive demand for technical and administrative support functions. States including New York, New Jersey, Massachusetts, and Pennsylvania maintain call-centre operations that manage banking inquiries, insurance claims, healthcare administration, and public-service hotlines. Financial institutions rely on call centres for compliance-related communication, authentication tasks, and account-assistance workflows. Technology and telecom providers also contribute steady demand for specialized support teams. High population density generates consistent customer-service volume, while corporate headquarters in the region maintain in-house and outsourced call-centre operations.

The Midwest grows at 5.6% CAGR, supported by established customer-support operations, strong activity in insurance and manufacturing-service sectors, and stable inbound-service volumes across utilities, banking, and logistics companies. States such as Illinois, Ohio, Michigan, and Wisconsin operate call-centre networks that manage scheduling, product-service inquiries, claims assistance, and technical troubleshooting. Regional cost structures favor medium-sized call-centre setups serving national service networks. Manufacturing firms rely on call centres for distributor support, warranty coordination, and equipment-service communication. Although growth is moderate due to stable population trends, recurring service needs and consistent commercial activity maintain reliable regional demand.

Demand for call-centre services in the USA is shaped by a concentrated group of global business-process providers supporting customer service, technical assistance, sales engagement, and outsourced contact-centre operations. Teleperformance holds the leading position with an estimated 22.2% share, supported by its extensive USA delivery network, multilingual staffing capacity, and established operational frameworks for large enterprise clients. Its position is reinforced by consistent service-level performance and broad experience across telecom, banking, healthcare, and retail accounts.

Concentrix and TTEC follow as major participants, offering structured omnichannel support, analytics-driven workflow management, and scalable operations suited to complex customer engagement programmes. Their strengths include documented quality processes, integration with automation tools, and strong relationships with USA technology and service brands. Foundever maintains a significant role through diversified service centres and long-term partnerships with consumer electronics, travel, and financial-services clients. Alorica contributes additional depth with widespread USA and nearshore operations, supporting high-volume voice and digital interactions. Its position is supported by stable workforce management, flexible staffing models, and consistent performance across seasonal demand cycles.

Competition across this segment centers on service reliability, peak-demand scalability, training quality, cost structure, digital-channel integration, and compliance with USA data-security requirements. Demand remains strong due to continuous outsourcing of customer-support functions, rising interaction volumes across digital and voice channels, and growing reliance on providers capable of delivering predictable response quality, efficient issue resolution, and integrated human-plus-automation support for enterprise clients.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Deployment Mode | Cloud Based, On-premises, Hybrid |

| Vertical | BFSI, Government, Healthcare, IT & Telecom, Media & Entertainment, Retail & Consumer Goods |

| Component | Software, Services |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Teleperformance, Concentrix, TTEC, Foundever, Alorica |

| Additional Attributes | Dollar sales by deployment mode, vertical, and component categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of call centre service providers and CX technology vendors; advancements in cloud contact centre platforms, AI-driven automation, and omnichannel support; integration with large enterprises, public sector operations, and digital customer experience transformation initiatives in the USA. |

The global demand for call centre in USA is estimated to be valued at USD 13.8 billion in 2025.

The market size for the demand for call centre in USA is projected to reach USD 27.2 billion by 2035.

The demand for call centre in USA is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in demand for call centre in USA are cloud based, on-premises and hybrid.

In terms of vertical, bfsi, government segment to command 66.7% share in the demand for call centre in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Call Centre Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Centre And Drag Link Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Call Center AI Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA