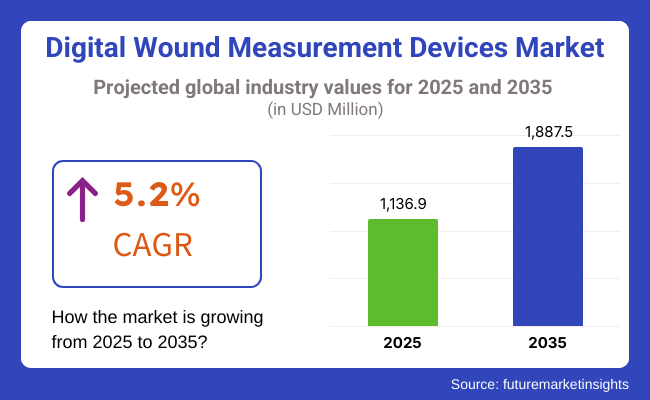

In the coming years the digital wound measurement devices products market is expected to reach USD 1,136.9 million by 2025 and is expected to steadily grow at a CAGR of 5.2% to reach USD 1,887.5 million by 2035. In 2024, digital wound measurement devices have generated roughly USD 1,080.7 million in revenues.

Digital Wound Measurement Devices are modern instruments intended to measure and watch wounds with high accuracy, using new technologies such as 3D imaging, laser scanning, and infrared sensors. These instruments obtain full data about wound size, depth, volume, and other aspects that are critical to medical professionals in their decision making by confirming the healing procedure with the help of accurate, real-time insights.

The overall growth of the number of cases being reported as chronic wounds is the leading factor driving the increase of digital wound measurement device adoption. The growing prevalence of chronic diseases, particularly diabetes, has majorly contributed to the increase in the number of patients suffering from complications associated with wounds.

Preferential shift toward personalized and data-driven healthcare has been a driving factor to seek more precise ways of managing wounds. Moreover, the development of new products fueled by better insurance coverage and ubiquitous information on proper wound care contributed to the growth of the market.

The market for digital wound measurement devices grew between 2020 and 2024 because of the increasing number of chronic wounds, such as diabetic foot ulcers and pressure ulcers, and the advancement in the capabilities that have resulted in the devices being more efficient and the appealing tech that has taken the market by storm.

Evolutions in tech environments have resulted in these tools being more quite accurate and handsome to use them no longer only with the help of a 3D system but also by laser scanning, and communication with cell applications and electronic health records (EHR). This is technology that is characterized by these technologies and they are the ones that allow doctors to keep an eye on wound healing in real time.

High Prevalence of Diabetes and its Related Complications aid Diabetic Ulcer segment to hold Dominant Position in the Market

Diabetic foot ulcers remain the vast impetus in the genesis of Digital Wound Measurement Devices due to the rising diabetes prevalence worldwide. For instance, the absence of appropriately supplied blood and a related nerve defect causes wounds in persons afflicted with diabetes to be exceptionally tough to heal.

With such characteristics, chronic ulcers that require close monitoring are developed. Wound measurement instruments move into the digital arena to deliver an accurate, real-time snapshot of the way wounds are healing, enabling clinicians to modify treatment quickly and effectively.

This detects emerging problems, thus averting the possibility of infection or amputation. In the near future, as the diabetic population grows increasingly within North America and Europe, demand for more sophisticated, reliable devices to treat these wounds will increase, and the diabetic ulcer segment will be at the core of interest in the industry.

Expanding Demand for Long-Term Monitoring Solutions surges Demand for Chronic Wound Products

Chronic wounds, including pressure ulcers, venous leg ulcers, and surgical non-healing wounds, form a large and lucrative segment owing to the long healing time and heavy treatment cost. Wound management is not a one-way process, as chronic wounds need to be monitored continuously to determine the progress of healing and change treatment according to the condition.

Wound measurement instruments digitalize documentation, give real-time analysis of the wound size, and risk assessments of infections that improve patient outcomes. Increased aging population, growing hospitalization cases associated with chronic wounds, and the phenomenon of developing AI-based imaging of wounds serve as the hands to drive this sector.

Moreover, more and more health centers are adopting a digital wound management system to streamline clinical processes and help in reducing the clinical workload of the wound care specialists.

Hospital segment dominates the Digital Wound Measurement Devices systems market due to their focus on Adopting Advanced Technologies

Hospitals are leading the market for digital wound measurement devices, with a large caseload of complex wounds needing complete monitoring and accurate measurement. With an increase in surgical wounds as well as traumatic and burn injuries, hospitals are widely adopting advanced technologies into their wound care practice.

These services are equipped with 3D imaging sytem, AI-driven analysis, and cloud-based record-keeping to enhance personalized customer care. The rising number of specialized wound care centers, better reimbursement policies, and integration of digital devices into electronic health records (EHRs) are driving growth in this segment of advancement in wound care solutions.

Increase in Adoption of Telemedicine Anticipates Industry further Growth

Clinics are also increasing their stake in wound management, particularly with the increase in outpatient services and telemedicine. Increasingly, wound care and dermatology clinics are equipped with digital measurement devices that have made remote monitoring even more accurate and accessible for patients with diabetic ulcers or chronic wounds, as well as those recovering from surgery.

Portable AI devices are now a blessing for clinics as they offer the possibility of efficient and low-cost assessment. They also help limit the unnecessary rate of readmissions to hospitals. With government initiatives championing outpatient service and the tendency to emphasize home care, clinics are becoming players in advancing the accessibility and convenience of wound care.

With the growing incidence of chronic conditions like diabetes, vascular diseases, and pressure ulcers, healthcare professionals now face more pressures to provide effective treatment to the patients with complex wounds.

Rapid advances in technology have rendered these devices easy to operate and maximum reliable. The present digital wound measurement systems use high technology such as 3D imaging and laser scanning to derive real-time information. This technology allows practitioners in tracking would healing status expeditiously while minimizing the burden of labor-intensive manual measurements.

Growing focus and need of individualized care, leads to increase in adoption of digital technology. This technology allows healthcare professionals to create treatment plans that are specifically tailored for patient's individual needs. This sort of individualized care optimizes care and is ultimately a great cost saver.

Also, with increasing insurance coverage and awareness of proper wound care, the devices are increasingly becoming within reach. Consequently, the traction being gained by hospitals and patients on the digital wound measuring instruments is growing its usage across North America.

The invention of these technologies has evolved the gadgets into more user-friendly and efficient export platforms. Health providers can thus carry out real-time monitoring of wounds using 3D-imaging, laser scanning, and infrared sensors, thereby providing accurate information to facilitate the optimization of treatment decisions. Such accuracy allows the clinician to care and heal faster.

Yet another driver for adoption now comes in the form of the personalization revolution in Europe. With the shift toward individualized therapy, the digital wound-measuring devices give providers the possibility to customize therapy to the needs of individual patients. Once the need for adequate wound management is recognized and insurance funds it, these devices will become viable and thus promote good wound care throughout Europe.

Increasing population of chronic diseases, such as diabetes and cardiovascular diseases, which might lead to complications such as diabetic foot ulcers and pressure sores. The forthcoming generation of "aged" people in the region will invariably require good wound care management.

Technical advancement allows such devices to have greater precision and use. Up-to-date digital wound size measuring devices that have features of 3D imaging, laser scanning, and infrared sensors have enabled healthcare practitioners to have real-time knowledge of the healing progress, size, and depth of the wounds. It helps make treatment effective and supports fast recovery, and hence considered an interesting thing to healthcare service providers.

Other than that, there is also a focus on developing healthcare infrastructure among most nations in Asia Pacific. Consequently, high-end medical devices like digital wound measuring devices are being consumed.

Governments and private enterprises that invest heavily in healthcare have also increased the availability of the devices meaning that they are now readily available for patients and health care centers. Increasing awareness pertaining to the significance of effective wound care, the expanding insurance coverage, increasing demand for Digital Wound Measurement Devices, and beyond throughout the region.

Higher Costs Associated with Products Act as a Significant Barrier to the Growth of the Market

Price is one of the most significant barriers faced by Digital Wound Measurement Devices. Many of the healthcare facilities, especially those placed in low-resource areas, find it difficult to invest in such high initial investment required for implementing these devices. The clinics that are smaller or rural health-care providers are usually budget constrained and often lack infrastructure that can take such technology in.

However, such devices could improve their results and reduce the long-term costs of healthcare, making them less likely to be easily adopted due to initial economic cost and limited coverage in particular areas. This challenge is even more evident in developing countries where healthcare tech expenditure remains limited.

To close this gap, manufacturers and health providers will have to come up with ways of making these devices cheaper and more accessible-maybe through creative pricing practices, better insurance policies, and government aid.

Emphasis on Developing Devices that can provide Accurate Information to the End Users can bring New Business Opportunities to the Players

Digital Wound Measurement Devices is driven by the growing need to more efficaciously handle chronic conditions, especially diabetes. Diabetes rates are growing globally, inevitably bringing along its complications, chronic wounds being one of them.

Therefore, a real-time accurate information provided by digital devices can keep track of the healing of wounds and give health professionals relevant information towards more productive and targeted treatments. With the move of medical systems towards value-based care, the more reason that these devices will have-increasingly demonstrating their value through improved patient outcomes and lower readmissions.

And as these devices make headway into both becoming cheaper and much easier to use, the possibilities increase for home care use, allowing patients to monitor recovery comfortably in their own homes.

How Digital Measurement Devices, AI, and 3D Imaging Are Transforming Patient Outcomes:

The market for digital wound measurement devices is undergoing interesting changes due to the technological advancement and greater emphasis on patient-centric care. Perhaps the most remarkable development is the availability of non-contact wound measuring devices.

They basically offer less painful procedures for patients and probably can enhance compliance as the whole process can be made much more comfortable. Another important trend can be seen in the connectivity of these devices to Electronic Health Records (EHRs), where actually a wide perspective about the medical history of a patient is brought, and thus enhancing wound care overall.

3D imaging technology is also making waves, as it is offering a much more accurate and detailed assessment of wounds. On top of this, artificial intelligence integration is further enhancing data analysis and allowing for predictive insights, meaning these technologies will grow in their applications and value continually.

All these developments are moving toward achieving smarter, intuitive approaches to wound care management that eventually improve patient outcomes and streamline healthcare workflows.

The Growing Role of Telemedicine and AI in Digital Measurement Devices:

Possibly the most overt trend within digital wound measurement is that of increasing telemedicine and remote monitoring technologies. Such technologies indeed revolutionize the access individuals have to immediate knowledge of the status of their wounds without necessitating an on-site visit for observation, hence providing much ease and accessibility for people watching their own care regardless of location.

This raises public involvement in the market beyond the more familiar clinical setting and into the broader realm of telehealth. Another interesting trend is the increasing adoption of such devices within home care and their use by clinicians to manage healing remotely over their patients' wounds and to bring such products into the home healthcare market.

There is also a generic demand for more connected devices like mobile applications, cloud interfaces, etc., which support real-time data sharing and physicians' remote monitoring of conditions.

Furthermore, the devices are increasingly integrating artificial intelligence and machine learning for more tailored insights and predictive analytics in wound care to make it less general and more individualized, meeting each patient's needs.

The increasing need for better wound care management catalyzed by chronic diseases like diabetes and heart disease has significantly led to increase in adoption of digital wound measurement devices. Both patients and the healthcare authorities sought better and easy-to-utilize instruments to more effectively monitor and aid the wound healing process.

Real-time and accurate measurements of wound healing trends became necessary for tailoring individualized care plans. With the advancements in 3D imaging, highly resolved sensors, and portability, the price for using such devices within different places in health care became affordable; however, high expenditures and meager availability in certain areas especially in poor regions remain an obstacle.

Artificial Intelligence (AI) will also redefine the operations of such smart devices within the timeframe of 2025 to 2035, making them even smarter and more intuitive. AI would then be enabled to analyze healing patterns, anticipate complications, and make tailored treatment recommendations, resulting in improved patient outcomes.

With continued development toward cheaper and simpler devices, new insurance coverage, and government subsidies, we expect wider uptake, especially from developing markets. The introduction of non-invasive technologies and the longer durability of the devices would improve the patient experience and further fuel growth in the global wound care market..

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | FDA and CE approvals focused on accuracy and clinical validation; limited reimbursement coverage. |

| Technological Advancements | Growth in 3D imaging, AI-powered wound measurement, and cloud-based data storage. |

| Consumer Demand | Increased adoption in hospitals, wound care centers, and home healthcare due to rising chronic wounds. |

| Market Growth Drivers | Rising cases of chronic wounds, demand for data-driven wound assessment, and advancements in imaging. |

| Sustainability | Limited focus on sustainability; high use of disposable components and energy-intensive imaging. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardized regulatory guidelines for digital wound measurement; expanded reimbursement policies. |

| Technological Advancements | AI-driven predictive analytics, smartphone-compatible wound measurement tools, and integration with telehealth. |

| Consumer Demand | Growth in remote patient monitoring, expansion into home care settings, and greater adoption in emerging markets. |

| Market Growth Drivers | Expansion of personalized wound care, AI-driven diagnostics, and improved integration with EHR systems. |

| Sustainability | Development of eco-friendly materials, energy-efficient imaging systems, and reusable digital wound sensors. |

Market Outlook

In the United States, it makes a boom in the Digital Wound Measurement Devices as chronic diseases in the country are growing more, most especially the diabetes category. The future of an evolving medical technology is that these devices will become more efficient and patient-friendly for healthcare professionals.

Individualized patient care transition within hospitals, outpatient clinics, and better-patient outcomes are increasing demand on digital wound care. With insurance scope and reforms on the healthcare system that will enhance accessibility, it means that more patients will greatly benefit from such high-tech devices, thus ensuring a bright future for the sector.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

Market Outlook

Germany is experiencing a notable surge in the usage of Digital Wound Measurement Devices owing to its developed healthcare system and developmental technologies. Similarly, its elderly population is increasing with corresponding examples of increasing chronic diseases such as diabetes that would increase the demand from effective and accurate solutions for wound treatment.

The health policies in the country facilitate the use of such progressive devices in hospitals and medical centers, which increasingly utilize such kinds of equipment to improve patient care. This generates an optimistic scenario for the digital wound measurement market in Germany owing to its continuous growth and expansion.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.7% |

Market Outlook

With the mounting incidence of chronic diseases such as diabetes, India's healthcare sector is witnessing a paradigm shift with newer developments that increasingly demand digital wound measurement devices. With extremely high population density and not enough specialized thousands of wound care specialists, India is full of empty spaces to be filled by digital alternatives.

It is an important feature in a country that has a rapidly growing demand for healthcare since these technologies provide the most accurate, projected, streamlined method of assessment and healing of wounds. The changing perception around this technology and more focus placed on economical solutions put India well on track for consistent growth within the digital wound care domain.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 3.4% |

Market Outlook

Demand for digital wound measurement Devices is on the rise in China because of advancing health care and an increasing prevalence of chronic diseases such as diabetes among populations. The demand is raised even more within an increasing number of developing urban populations and modernization of medical technology across the country.

Healthcare professionals in China are adopting digital wound care technologies in an attempt to maximize their care and enhance their outcomes. Increasing government concentration on healthcare modernization along with growth telemedicine now gives more ground to digital wound measurement devices in the market for further expansion.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 3.8% |

Market Outlook

The tools of digital wound measurement devices become increasingly important in Japan's aging population because the country has increasing numbers suffering from chronic diseases such as diabetes. With advanced healthcare infrastructure already set up, Japan is very well poised to accept the digital technologies for wound care.

Clinics and hospitals rapidly adopt the devices providing real-time wound monitoring accurate to have better outcomes on the patients. The emphasis of the government of Japan on innovations in healthcare and pressure towards better delivery of care to older populations creates an essentially supportive environment for market growth. With rising demand, Japan's digital wound care market is likely to grow in the next few years.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

The increasing awareness regarding the advantages of digital measurements is the most significant growth driver for the digital wound measurement devices market. The rise in surgical wounds, chronic wounds, and diabetic ulcers has increased the demand for effective management by practitioners, therefore creating the need for advanced digital measuring devices.

On the other hand, next-generation digital devices with greater accuracy, portability, and electronic health record compatibility will come to be adopted, thereby further boosting market growth. The new entry of many innovative companies increasingly heightens competition by disrupting the more established players in the game.

The increasing focus on digital healthcare solutions and collaborations with healthcare organizations will improve the capacity of companies to establish a competitive advantage. A constant rise in the demand for more affordable and efficient-to-use wound measurement tools will therefore maintain the momentum of growth in the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Smith & Nephew plc | 28.2% |

| MolecuLight Inc. | 22.5% |

| WoundVision | 12.7% |

| ARANZ Medical Ltd. | 11.2% |

| Other Companies | 25.4% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Smith & Nephew plc | Provides advanced wound imaging and digital assessment tools for clinical settings. |

| MolecuLight Inc. | Specializes in fluorescence imaging for bacterial detection in wounds. |

| WoundVision | Develops thermal imaging solutions for wound monitoring and healing assessment. |

| ARANZ Medical Ltd. | Offers 3D wound measurement and digital tracking technologies. |

Key Company Insights

Smith & Nephew plc (28.2%)

Smith & Nephew leads the digital wound measurement market with its advanced imaging tools, focusing on clinical efficiency and improved wound care outcomes.

MolecuLight Inc. (22.5%)

MolecuLight specializes in fluorescence imaging technology, allowing for real-time bacterial detection to improve wound assessment accuracy.

WoundVision (12.7%)

WoundVision provides thermal imaging solutions that assist in early detection of pressure ulcers and other chronic wounds.

ARANZ Medical Ltd. (11.2%)

ARANZ Medical offers advanced 3D wound measurement technology that enhances precision in wound monitoring and treatment planning.

Several other companies contribute significantly to the digital wound measurement devices market by offering innovative and cost-effective solutions. They include:

The overall market size for digital wound measurement devices market was USD 1,136.9 million in 2025.

The digital wound measurement devices market is expected to reach USD 1,887.5 million in 2035.

Rising cases of chronic wound as well as rise in adoption in private sector has significantly increased the demand for digital wound measurement devices.

The top key players that drives the development of digital wound measurement devices market are Smith & Nephew plc, MolecuLight Inc., WoundVision, The MolecuLigh and ARANZ Medical Ltd.

Diabetic Ulcer by wound type in digital wound measurement devices market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Wound Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Wound Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Wound Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Wound Type, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Wound Type, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Wound Type, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Wound Type, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Wound Type, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Wound Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Wound Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Wound Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Wound Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 17: Global Market Attractiveness by Product, 2023 to 2033

Figure 18: Global Market Attractiveness by Wound Type, 2023 to 2033

Figure 19: Global Market Attractiveness by End User , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Wound Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Wound Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Wound Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Wound Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 37: North America Market Attractiveness by Product, 2023 to 2033

Figure 38: North America Market Attractiveness by Wound Type, 2023 to 2033

Figure 39: North America Market Attractiveness by End User , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Wound Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Wound Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Wound Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Wound Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Wound Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Wound Type, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Wound Type, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Wound Type, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Wound Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 77: Europe Market Attractiveness by Product, 2023 to 2033

Figure 78: Europe Market Attractiveness by Wound Type, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Wound Type, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Wound Type, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Wound Type, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Wound Type, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Wound Type, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Wound Type, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Wound Type, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Wound Type, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Wound Type, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Wound Type, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Wound Type, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Wound Type, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Wound Type, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Wound Type, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Wound Type, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Wound Type, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Wound Type, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Wound Type, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Wound Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 157: MEA Market Attractiveness by Product, 2023 to 2033

Figure 158: MEA Market Attractiveness by Wound Type, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Pen Market Size and Share Forecast Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Digital Credential Management Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Twin In Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA