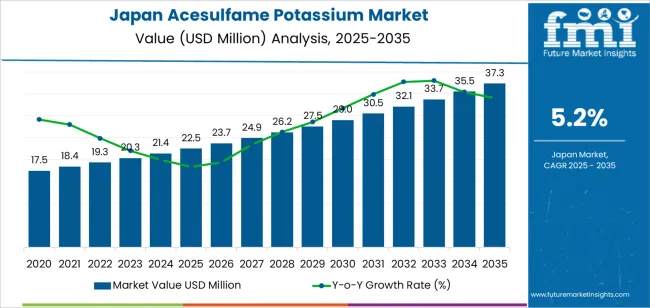

Demand for acesulfame potassium in Japan reaches USD 22.5 million in 2025, climbing to USD 37.4 million by 2035 at a compound annual growth rate of 5.2%. This progression connects directly to Japan's regulatory framework under the Food Sanitation Act, which sets precise limits on high-intensity sweeteners across beverage and food categories. Japanese manufacturers face distinct formulation challenges because consumer acceptance of synthetic sweeteners remains selective compared to natural alternatives like stevia.

Acesulfame potassium gains traction specifically in combination sweetener systems where its synergistic effect with aspartame or sucralose reduces off-notes that Japanese palates detect more readily than Western consumers. Pharmaceutical tablet manufacturers adopt it for pediatric formulations, driven by guidance from the Pharmaceuticals and Medical Devices Agency encouraging palatability improvements in children's medications.

Values begin at USD 18.4 million in 2020, rising to USD 19.1 million in 2021, then USD 19.9 million in 2022. By 2023, demand touches USD 20.7 million before advancing to USD 21.6 million in 2024 and USD 22.5 million in 2025. The trajectory extends through USD 23.4 million in 2026, USD 24.4 million in 2027, USD 25.4 million in 2028, and USD 26.4 million in 2029. Further growth shows USD 27.5 million in 2030, USD 28.7 million in 2031, USD 29.8 million in 2032, USD 31.1 million in 2033, USD 32.4 million in 2034, and USD 33.7 million in 2035.

These increments reflect procurement cycles tied to Japan's tabletop sweetener replacement patterns, pharmaceutical reformulation schedules, and beverage product launches timed around seasonal consumption peaks. Unlike rapid-expansion scenarios, this pattern shows measured adoption shaped by regulatory approval timelines and consumer education efforts that Japanese food companies undertake before launching products with unfamiliar ingredient profiles.

Japan's acesulfame potassium consumption increases from USD 22.5 million in 2025 to USD 37.4 million by 2035, representing a compound annual growth rate of 5.2%. Starting from USD 18.4 million in 2020, the value rises through USD 19.9 million in 2022, USD 21.6 million in 2024, and USD 22.5 million in 2025. Between 2025 and 2030, demand advances to approximately USD 27.5 million, then continues upward to USD 37.4 million by 2035. This expansion stems from specific Japanese conditions: the Ministry of Health, Labour and Welfare's 2019 revisions to acceptable daily intake guidelines for high-intensity sweeteners, which clarified usage parameters and reduced uncertainty among food manufacturers. Beverage companies reformulate products to comply with Tokyo Metropolitan Government's voluntary sugar-reduction initiatives targeting childhood obesity prevention. Pharmaceutical firms incorporate acesulfame potassium into liquid medicines and chewable tablets following PMDA guidance encouraging taste-masking innovations for pediatric compliance.

The incremental value gain from USD 22.5 million to USD 37.4 million represents USD 14.9 million in additional consumption over ten years. Early-period growth between 2025 and 2030 derives primarily from volume increases as more SKUs incorporate the sweetener across carbonated soft drinks, sports beverages, and confectionery. Late-period expansion from 2030 to 2035 shifts toward value-driven growth: premium formulations using ultra-pure grades of acesulfame potassium command higher prices, particularly in pharmaceutical applications where impurity limits fall below standard food-grade specifications. Japanese manufacturers who secure stable supply relationships with certified producers and who invest in blending technologies that optimize sweetness delivery while minimizing metallic aftertastes will capture disproportionate shares of this USD 14.9 million opportunity.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 22.5 million |

| Forecast Value (2035) | USD 37.4 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

Historical demand for acesulfame potassium in Japan developed slowly compared to aspartame and sucralose adoption because early formulations produced metallic aftertastes that conflicted with Japanese flavor expectations. Initial uptake occurred in pharmaceutical applications where taste-masking benefits outweighed flavor concerns, particularly in children's cough syrups and vitamin supplements. Food and beverage manufacturers remained cautious until blending technologies improved, allowing acesulfame potassium to function synergistically with other sweeteners.

The 2015 Japanese Society for the Study of Obesity's recommendations on sugar reduction created regulatory tailwinds, prompting beverage companies to explore zero-calorie formulations. Japan's vending machine culture, which accounts for significant beverage sales, required sweetener solutions that remained stable under temperature fluctuations, acesulfame potassium's heat stability met this operational requirement better than some alternatives.

Future trajectories depend on Japan's accelerating health policy focus and demographic pressures from an aging population with rising diabetes prevalence. The Ministry of Health, Labour and Welfare's "Health Japan 21 (Third Term)" initiative targets sugar intake reduction across all age groups, which directly supports acesulfame potassium adoption in reformulated products. Confectionery manufacturers face pressure to reduce calories while maintaining taste in products marketed to health-conscious consumers in their 40s and 50s, Japan's largest consumer demographic by purchasing power.

Tabletop sweetener growth connects to the expanding home-cooking trend among retirees seeking to manage blood sugar levels. However, long-term challenges include consumer skepticism about synthetic additives, which remains higher in Japan than in North America, and competition from monk fruit extract and erythritol, which some Japanese manufacturers position as more "natural" alternatives despite higher costs.

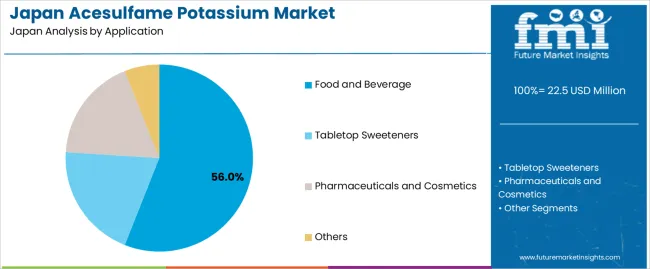

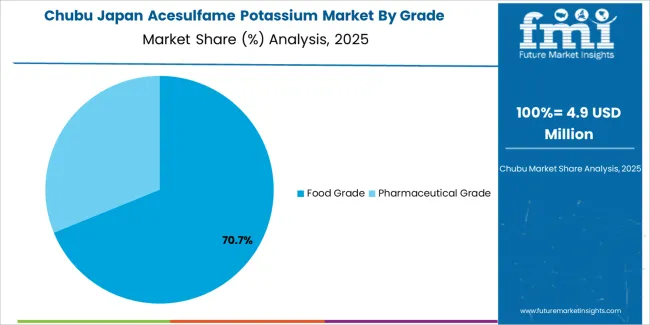

Demand patterns for acesulfame potassium in Japan split across application categories and grade specifications that determine end-use suitability. Application segments include food and beverages, pharmaceuticals and nutraceuticals, and tabletop sweeteners. Grade classifications separate food-grade material from pharmaceutical-grade material, each meeting different purity and testing standards. Japanese regulatory bodies impose distinct requirements on these categories, influencing which producers can supply which segments. As health ministries tighten standards and as consumer awareness grows regarding ingredient sourcing, the interaction between application needs and grade availability shapes procurement strategies across Japan's food, pharmaceutical, and consumer goods sectors.

Food and beverages account for 56% of total acesulfame potassium consumption across application categories in Japan. This dominance reflects the sector's scale and the ingredient's functional advantages in liquid formulations. Carbonated soft drink manufacturers value acesulfame potassium's stability during pasteurization and its resistance to pH variations common in citrus-flavored beverages. Sports drink producers incorporate it into electrolyte formulations where caloric content must remain minimal while taste acceptance stays high, critical for products marketed to amateur athletes and school sports clubs. Confectionery applications include hard candies and chewing gum, where heat processing occurs at temperatures that would degrade less stable sweeteners.

The segment grows as Japanese beverage companies respond to declining sugar-sweetened drink sales, which fell 8% between 2018 and 2023 according to industry data. Major players like Suntory and Asahi reformulated flagship products to offer zero-calorie variants without abandoning established brand identities. These reformulations required extensive consumer testing because Japanese consumers demonstrate lower tolerance for off-flavors than Western counterparts.

Acesulfame potassium's role in these formulations often involves blending with sucralose at ratios optimized through sensory panels that include regionally diverse participants from Hokkaido to Kyushu. Smaller regional producers follow these reformulation patterns with lag times, creating steady demand growth as zero-calorie options proliferate across convenience store shelves and supermarket aisles throughout Japan.

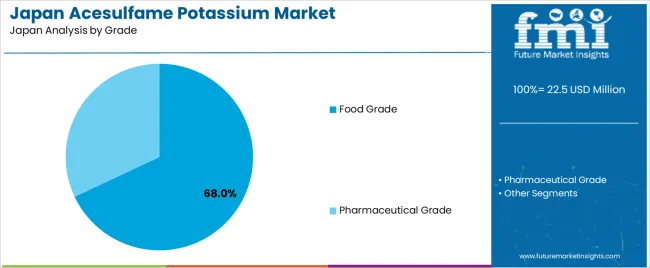

Food-grade acesulfame potassium represents 68.0% of total volume across grade classifications in Japan. This share corresponds to the food and beverage sector's volumetric dominance and the regulatory framework governing food additives. Japanese food manufacturers require suppliers to meet standards outlined in the Specifications and Standards for Foods, Food Additives, etc., which reference purity levels, heavy metal limits, and residual solvent restrictions. Food-grade material typically contains 99.0% minimum purity, suitable for applications where taste and safety meet consumer expectations without requiring pharmaceutical-level documentation.

Procurement patterns favor food-grade material because cost structures remain significantly lower than pharmaceutical-grade equivalents while still satisfying regulatory requirements for consumables. Large-scale beverage production facilities in Kanto and Kinki regions purchase food-grade acesulfame potassium in bulk quantities, often through trading houses like Mitsubishi Corporation or Mitsui & Co. that maintain long-term supply agreements with Chinese producers.

These trading relationships include quality verification protocols where samples undergo testing at Japanese laboratories before shipment acceptance. As food manufacturers expand zero-calorie product lines and as tabletop sweetener brands introduce new formats targeting home bakers, food-grade demand maintains its leading position across Japan's acesulfame potassium consumption profile.

Current consumption patterns emerge from Japan's unique intersection of regulatory structure, consumer behavior, and demographic reality. The country's aging population drives demand for products that manage caloric intake without sacrificing taste, essential for individuals managing diabetes, which affects approximately 11% of Japanese adults according to recent health ministry data. Japanese physicians actively recommend dietary modifications as first-line diabetes interventions, creating clinical support for zero-calorie sweetener adoption that extends beyond consumer preference alone. This medical endorsement influences purchasing decisions differently than in cultures where dietary guidance plays a smaller role in chronic disease management.

Acesulfame potassium uptake accelerates because Japan's Food Sanitation Act requires clear labeling of all sweeteners, creating transparency that builds consumer trust over time. Unlike jurisdictions where generic "artificial sweetener" labels suffice, Japanese products must specify "acesulfame potassium" on ingredient lists, allowing consumers to research and familiarize themselves with the ingredient.

This transparency initially slowed adoption as consumers researched unfamiliar additives, but now supports steady growth as familiarity increases. Japanese consumers also demonstrate strong preference for products that combine multiple sweeteners rather than single-sweetener formulations, reflecting cultural focus on balance and harmony extending even to flavor profiles. This preference drives manufacturers toward blending technologies rather than single-ingredient solutions.

Opportunities concentrate in pharmaceutical formulations, particularly pediatric medications where taste compliance significantly affects treatment outcomes. Japanese pharmaceutical companies face pressure from the PMDA to improve palatability of children's medicines following studies showing non-compliance rates above 30% for bitter-tasting treatments. Acesulfame potassium addresses this challenge in liquid antibiotics, cough preparations, and vitamin supplements designed for children aged 3 to 12.

Another opportunity exists in the rapidly expanding senior nutrition segment, where protein supplements and nutritional drinks require sweetening without adding calories that elderly consumers with reduced physical activity levels cannot efficiently metabolize. Regional opportunities emerge in Kyushu, where Fukuoka-based food companies develop products tailored to local taste preferences distinct from Tokyo-dominant flavor profiles.

Home-use tabletop sweeteners represent untapped potential as younger Japanese households adopt home cooking influenced by social media recipe trends. Traditional Japanese cooking rarely involved sweeteners in the way Western baking does, but younger generations increasingly attempt Western-style desserts requiring sugar substitutes for health-conscious modifications. Manufacturers who develop portion-controlled formats with recipe conversion guides specifically for Japanese measurements (grams rather than cUPS) position themselves advantageously. E-commerce expansion through platforms like Rakuten and Amazon Japan enables direct-to-consumer brands to bypass traditional retail relationships, lowering barriers for specialized product launches targeting health-focused demographics.

Constraints originate from persistent consumer associations between "natural" ingredients and superior quality, a cultural preference that extends across food categories in Japan. While acesulfame potassium meets all safety standards, its synthetic origin creates marketing challenges that stevia and monk fruit extract avoid. Some Japanese consumers reference traditional dietary principles like shokuiku (food education) that emphasize whole foods and minimal processing, positioning any artificial sweetener as philosophically inconsistent regardless of safety data. This constraint particularly affects premium product segments where manufacturers emphasize natural ingredients as value justifications for higher price points.

Regulatory approval requirements for new applications remain rigorous, requiring extensive testing documentation that smaller companies struggle to compile. Even when acesulfame potassium gains approval for a specific use case, expanding to adjacent categories demands separate approval processes. Import dependency creates supply chain vulnerabilities, as Japan produces minimal quantities domestically and relies on Chinese suppliers for the majority of volume.

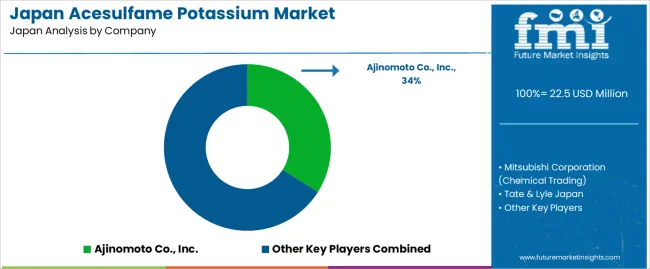

Recent geopolitical tensions and supply chain disruptions during 2020-2022 heightened awareness of this dependency, prompting some manufacturers to explore domestic production possibilities despite higher cost structures. Additionally, retail shelf space limitations in Japanese supermarkets and convenience stores create intense competition among sweetener options, with established brands like Ajinomoto's Pal Sweet maintaining strong positions that new entrants find difficult to displace.

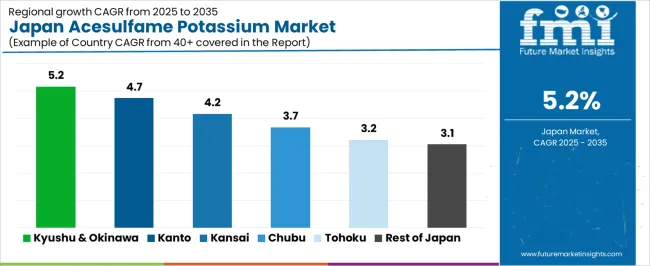

| Region | CAGR (%) |

|---|---|

| Kyushu & Kanto | 5.2% |

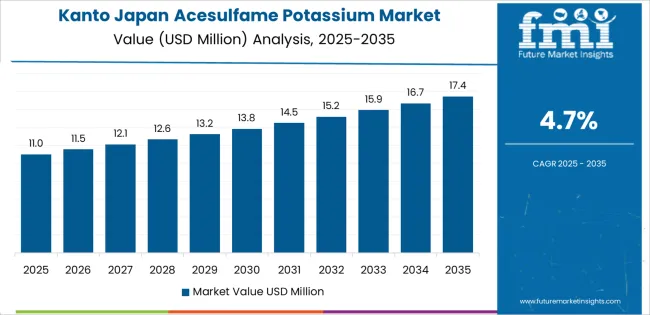

| Kanto | 4.7% |

| Kinki | 4.2% |

| Chubu | 3.7% |

| Tohoku | 3.2% |

| Rest of Japan | 3.1% |

Regional consumption patterns for acesulfame potassium across Japan show Kyushu & Kanto leading at 5.2% growth through 2035. This region benefits from concentrated food processing infrastructure and beverage production facilities that serve both domestic and export channels. Kanto follows at 4.7%, reflecting Tokyo's role as headquarters location for major food and pharmaceutical companies making procurement decisions affecting nationwide production.

Kinki registers 4.2%, shaped by Osaka's position as a secondary manufacturing hub with strong confectionery and pharmaceutical sectors. Chubu reaches 3.7%, influenced by Nagoya's automotive-adjacent food processing industry serving convenience store supply chains. Tohoku posts 3.2%, showing moderate adoption through regional food producers and agricultural cooperatives developing value-added products. The rest of Japan achieves 3.1%, capturing gradual uptake across smaller prefectures where local specialty food manufacturers explore reformulation opportunities.

Kyushu & Kanto projects 5.2% compound annual growth through 2035 in acesulfame potassium consumption. Fukuoka's position as a gateway to Asian markets drives beverage manufacturers to develop export-oriented formulations that require shelf-stable sweetener systems capable of withstanding tropical shipping conditions. Kumamoto's confectionery cluster, known for traditional sweets, increasingly experiments with reduced-sugar variants that maintain texture profiles essential to product identity. Local health initiatives in Okinawa, which faces Japan's highest obesity rates despite traditional dietary patterns, encourage reformulation of popular beverages and snacks.

Distribution networks in Kyushu leverage the region's port infrastructure, enabling cost-effective imports of acesulfame potassium from Chinese suppliers through direct shipping routes that bypass Tokyo trading house markups. Regional food manufacturers maintain relationships with wholesalers in Hakata who specialize in sweetener and ingredient distribution to smaller producers across the island. This infrastructure supports product development cycles shorter than those in Tokyo-centered operations, allowing faster response to emerging consumer preferences around health and wellness positioning.

Kanto registers 4.7% compound annual growth through 2035 in acesulfame potassium consumption. Tokyo serves as decision-making headquarters for Suntory, Asahi, Kirin, and other beverage leaders whose reformulation strategies influence nationwide product availability. These companies operate research facilities in Kanagawa and Saitama where sensory scientists develop sweetener blends optimized for Japanese taste preferences, requiring substantial acesulfame potassium volumes for testing and production scale-up. Pharmaceutical companies in Tokyo's Nihonbashi district incorporate the sweetener into over-the-counter medications and nutritional supplements distributed through Japan's extensive pharmacy network.

Kanto's dense population concentration creates ideal conditions for test marketing reformulated products before national rollout. Convenience store chains like 7-Eleven and Lawson use Kanto as primary testing ground for private-label beverages and snacks, providing real-time sales data that guides procurement volumes. The region's sophisticated logistics infrastructure ensures rapid distribution from production facilities to retail endpoints, supporting just-in-time manufacturing approaches that minimize inventory holding costs for specialty ingredients like acesulfame potassium.

Kinki shows 4.2% compound annual growth through 2035 in acesulfame potassium consumption. Osaka's confectionery industry, historically centered on traditional sweets like dorayaki and mochi, now explores sugar-reduced variants responding to health-conscious consumer segments. Companies like Ezaki Glico maintain major production facilities in the region, integrating acesulfame potassium into candy and chewing gum formulations that require heat processing. Kyoto's pharmaceutical manufacturers, including smaller generics producers, adopt the sweetener for liquid formulations and chewable tablets targeting elderly patients managing multiple chronic conditions.

The region's culinary tradition creates unique challenges and opportunities for sweetener adoption. Osaka's food culture emphasizes bold, assertive flavors that can mask metallic notes some consumers detect in acesulfame potassium, making the region ideal for testing higher-concentration applications. Kyoto's tea ceremony culture and associated confectionery products demand subtle sweetness profiles, requiring precise blending ratios that manufacturers refine through extensive consumer testing panels.

Chubu projects 3.7% compound annual growth through 2035 in acesulfame potassium consumption. Nagoya's position between Tokyo and Osaka creates logistical advantages for distribution to both regions, making it attractive for food ingredient warehousing and blending operations. The region's automotive industry concentration indirectly supports sweetener demand through workplace cafeteria operations and vending machine contracts that increasingly feature zero-calorie beverages. Shizuoka's green tea industry explores sweetener additions in bottled tea products, though this application remains controversial among purists who oppose any modification to traditional tea preparation.

Manufacturing clusters in Gifu and Mie produce private-label products for national retailers, operating with cost structures that favor standardized formulations using established ingredients like acesulfame potassium rather than premium alternatives. These facilities supply products to regional supermarket chains throughout central Japan, creating stable baseline demand independent of Tokyo-driven trends. Seasonal confectionery production tied to regional festivals and tourism creates periodic spikes in sweetener procurement that manufacturers manage through forward contracting with distributors.

Tohoku registers 3.2% compound annual growth through 2035 in acesulfame potassium consumption. Sendai's role as regional administrative and commercial center concentrates food processing operations serving northern prefectures with distinct seasonal consumption patterns. The region's agricultural cooperatives develop value-added products from local specialty crops, increasingly incorporating sugar reduction strategies to appeal to urban consumers in Tokyo who purchase regional products through online channels and department store food halls. Sake breweries in Yamagata and Akita experiment with low-alcohol, sweetened beverages targeting younger consumers unfamiliar with traditional sake consumption practices.

Regional health challenges, including above-average rates of metabolic syndrome in rural areas, drive local government initiatives promoting dietary modification. These programs create demand for educational materials and product reformulations that reduce sugar content without compromising taste, objectives that acesulfame potassium helps manufacturers achieve. However, Tohoku's aging population and traditional dietary preferences slow adoption compared to urban regions where younger consumers drive food trend acceptance.

The Rest of Japan region posts 3.1% compound annual growth through 2035 in acesulfame potassium consumption. Smaller prefectures across Hokkaido, Chugoku, and Shikoku show gradual adoption as local specialty food producers explore health-positioning strategies for products sold through regional tourism channels and online platforms. Hokkaido's dairy industry tests sweetener applications in yogurt drinks and dessert products marketed to health-conscious consumers concerned about added sugar in dairy categories. Shikoku's citrus processors develop low-calorie juice blends that maintain fruit flavor profiles while reducing overall sugar content from natural and added sources.

Rural demographic patterns create different consumption drivers than urban regions. Elderly populations in depopulated areas purchase tabletop sweeteners through agricultural cooperative stores and regional supermarkets, often based on healthcare provider recommendations for diabetes management. These purchasing patterns create steady, predictable demand less subject to trend volatility affecting urban convenience store categories. Local governments in rural prefectures sometimes subsidize health-focused food product development as economic development strategy, supporting small manufacturers who reformulate traditional regional specialties with modern nutritional profiles.

Demand for acesulfame potassium in Japan connects to the nation's demographic trajectory toward an aging society, where chronic disease management becomes central to healthcare strategy. Approximately 29% of Japan's population exceeds 65 years of age, creating substantial consumer segments managing diabetes, hypertension, and obesity through dietary modifications that healthcare providers actively support. Pharmaceutical companies respond by improving medication palatability, particularly for elderly patients taking multiple daily medications who experience taste fatigue. Food manufacturers target this demographic with functional beverages and nutritional supplements that deliver protein, vitamins, and minerals without excessive calories, formulations where acesulfame potassium's sweetening power proves valuable.

Simultaneously, younger Japanese consumers demonstrate increasing health consciousness shaped by social media influencers promoting wellness lifestyles and by government campaigns addressing childhood obesity prevention. This generational shift creates dual demand streams: elderly consumers seeking medical necessity solutions and younger consumers pursuing preventive health strategies. Technological improvements in sweetener blending allow manufacturers to minimize off-notes that historically limited acesulfame potassium acceptance in Japan, where taste standards exceed tolerance levels common in Western contexts.

Key participants include Ajinomoto Co., Inc., which maintains extensive sweetener experience through its aspartame business and leverages existing distribution networks for acesulfame potassium products. Mitsubishi Corporation operates as primary trading house handling imports from Chinese manufacturers, providing quality verification services and inventory management for Japanese food companies.

Tate & Lyle Japan supplies ingredient solutions including acesulfame potassium blends optimized for Japanese applications, offering technical support that smaller manufacturers value. Celanese Corporation products reach Japan through established trading relationships, though the company lacks direct operations comparable to its presence in other Asian industries. Anhui Jinhe Industrial Co., Ltd., one of China's largest acesulfame potassium producers, supplies Japanese customers through distributor networks rather than direct sales, reflecting typical import patterns for Chinese specialty chemicals entering Japan's tightly controlled food ingredient channels.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Application | Food and Beverages, Pharmaceuticals and Nutraceuticals, Tabletop Sweeteners |

| Grade | Food Grade, Pharmaceutical Grade |

| Region | Kyushu & Kanto, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Ajinomoto Co., Inc., Mitsubishi Corporation (Mitsubishi Shoji Kaisha, Ltd.), Tate & Lyle Japan KK, Celanese Corporation (imported products), Anhui Jinhe Industrial Co., Ltd. (via distributors) |

| Additional Attributes | Dollar value by application and grade, regional CAGR timing, and volume-value contribution are analyzed alongside food vs. pharma penetration, heat-stable processing advantages, regulatory compliance, demographic acceptance, import-linked supply chains, natural-sweetener competition, and domestic vs. imported specialty chemical rivalry. |

The demand for acesulfame potassium in Japan is estimated to be valued at USD 22.5 million in 2025.

The market size for the acesulfame potassium in Japan is projected to reach USD 37.3 million by 2035.

The demand for acesulfame potassium in Japan is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in acesulfame potassium in Japan are food and beverage, tabletop sweeteners, pharmaceuticals and cosmetics and others.

In terms of grade, food grade segment is expected to command 68.0% share in the acesulfame potassium in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acesulfame Potassium Market Trends & Outlook 2025 to 2035

Demand for Food Grade Dipotassium Phosphate in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Potassium Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Potassium Formate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Potassium Tetrafluoroborate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Fluoborate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Propionate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Acetate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Citrate Market Growth - Trends & Forecast 2025 to 2035

Potassium Formate Industry Analysis in North America - Size, Share & Forecast 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA