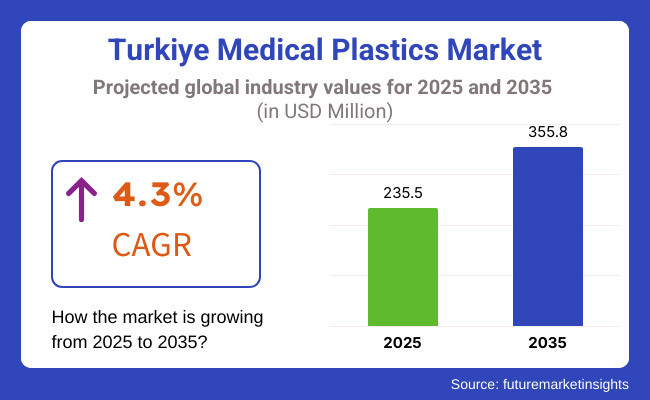

The Türkiye medical plastics market is set to witness USD 235.5 million in 2025. The industry is projected to grow at 4.3% CAGR from 2025 to 2035 and reach USD 355.8 million by 2035.

The increasing implementation of cost-efficient, weightless, and tough plastics in medical equipment making, disposables, and drug delivery systems have catalyzed market growth. Furthermore, the frequently demanded single-use medical devices due to the additional strict infection control measures enforced in hospitals and clinics are driving the growth trajectory.

Additionally, the entry in prosthetics, pharmaceutical packaging, and 3D-printed medical devices sectors is also a source of impetus for high-performance products. Türkiye has become a strong international player in the medical plastics industry with the help of its health care infrastructure development and the rise of the home-made medical devices sector. Movement toward sustainable and recyclable products, as well as inventions in the antibacterial properties of polymer technologies, are becoming key elements for the rise in demand.

Medical-grade plastics are of paramount importance as they are used in surgical instruments, catheters, implants, diagnostic equipment, and sterilization trays, since they possess these biocompatibility, chemical resistance, and lightweight features. Although it has significant prospects for development, the industry is faced with problems mainly dealing with compliance about regulations and waste management.

Besides, the EU's MDR (Medical Device Regulation) standards compel Turkish companies to perform extensive testing and certification of medical-grade plastics, thus increasing costs for manufacturers. The task of asserting high-quality production and therefore achieving lower prices relative to foreign competitors is the main obstacle faced by domestic companies that are attempting to internationalize.

The government and private sector's drive behind the construction of hospitals, the production of surgical equipment, and the drug packaging sector has created a strong demand for durable and regulatory-compliant polymer solutions.

PPPs are also playing a key role in local manufacturing which is helping reduce dependency on imports and thus strengthening Türkiye’s position as a medical trade hub between Europe, Asia, and Middle East. Other drivers of the growth are innovations in smart products and antibacterial technologies.

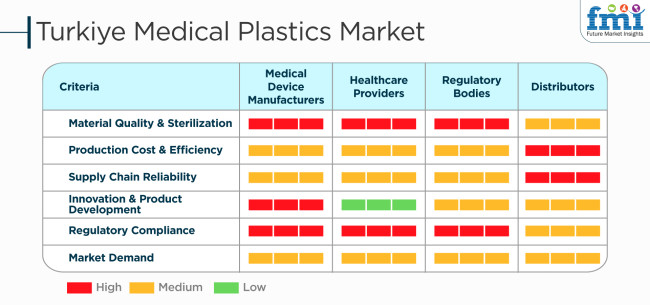

The medical plastics market in Türkiye is driven by a number of significant factors impacting medical device manufacturers, healthcare providers, regulatory agencies, and distributors. Material quality and sterilization are of utmost concern to all stakeholders, with a strong emphasis on safety and compliance. Production cost and efficiency pose moderate challenges, with manufacturers and distributors looking for cost-effective alternatives without compromising quality standards. Supply chain reliability is a medium-level issue that emphasizes the need for a stable supply of medical plastic products.

Product development and innovation are vital drivers of market expansion, with producers taking the initiative while distributors are confronted with a major challenge. Regulatory compliance will be a high priority among all concerned to stick hard to health care rules. The market demand continues to rise, offering space to grow but calling for strategic adjustment. It will be imperative to be cost-effective, have control over quality, remain regulatory-compliant, and be innovative to keep growing and cover the expanding healthcare needs of Türkiye and elsewhere.

Between 2020 and 2024, Türkiye industry experienced significant growth due to the expansion of the healthcare industry, high demand for disposable healthcare devices, and advancements in biocompatible technology. The COVID-19 pandemic bolstered the demand for medical-grade plastic in PPE, syringes, IV parts, and diagnostic equipment. Additionally, the growing medical tourism industry and Türkiye’s pharmaceutical and medical device manufacturing sector contributed to increased consumption of high-performance polymers such as polypropylene (PP), polyethylene (PE), polycarbonate (PC), and polyvinyl chloride (PVC). Supply chain issues and regulatory failures affected manufacturing processes and raw material availability.

Looking forward to 2025 to 2035, the Turkish medical plastics industry will shift under sustainability drives, digital healthcare advancements, and biodegradable medical polymers. The adoption of 3D printing, antimicrobial plastics, and recyclable biopolymers will redefine industry standards. Government incentives for local medical device production and Türkiye’s role as a regional hub will drive expansion. Smart products with embedded sensors and AI-integrated manufacturing will shape future applications.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Türkiye aligned with EU MDR standards, implementing stricter guidelines on products and sterilization. Increased oversight on plastic waste in healthcare. | Stricter environmental policies promote biodegradable products, recyclable materials, and low-carbon production, aligning with sustainability goals. |

| 3D-printed medical devices, antimicrobial coatings, and nanocomposites enhanced medical plastic performance. Wearable medical devices drove demand for flexible polymers. | Development of smart polymers with embedded sensors for real-time monitoring. AI-driven manufacturing enhances precision in customized medical devices. |

| Türkiye became a regional medical device export hub, boosting catheter, syringe, and surgical equipment production. Post-pandemic, disposable plastic demand surged. | Personalized medicine and 3D-printed implants increase demand for biocompatible plastics. Robotic-assisted surgery requires precision plastic components. |

| Initial hospital plastic waste minimization efforts through recycling. Limited bio-based plastic use in medical applications. | Greater focus on recyclable, biodegradable, and compostable products. Closed-loop recycling systems introduced in healthcare. |

| High demand for single-use, sterilizable medical packaging. PVC and PE dominated sterile barrier systems. | Expansion of self-sterilizing, antimicrobial, and biodegradable packaging. Smart packaging enables real-time tracking and tamper-proof designs. |

| COVID-19 and geopolitical factors disrupted supply chains, increasing reliance on local polymer production. Türkiye expanded medical plastic manufacturing. | AI-driven supply chain tracking and localized production reduce import dependence. Investment in medical plastic recycling facilities increases. |

| Growth driven by healthcare spending, medical tourism, and demand for cost-effective devices. Türkiye’s strategic location boosted exports. | Industry expands through digital health innovations, sustainability standards, and AI-powered manufacturing. Adoption of biopolymer implants and sustainable packaging accelerates. |

Regulatory compliance is the main risk in the Türkiye medical plastics market. The industry has to follow the strict health and safety rules dictated by the Turkish Medicines and Medical Devices Agency (TİTCK) and the international bodies like the EU MDR (Medical Device Regulation) and FDA. In cases of violation, legal penalties, product recalls, or industry access restrictions can take place.

The market competition is becoming increasingly challenging for both domestic and international manufacturers vying for a higher industry share. Companies that do not put money on product innovation, like biocompatible or biodegradable products, are at risk of losing their competitive edge. To be ahead, partnerships and R&D investments are crucial.

Innovations and changes in consumer behavior have both positive and negative outcomes. The shift towards recycling and compostable products in the medical field attracts companies to change their production methods. The ones who are late to take off would not only be confronted by the regulators but also the industry.

Economic and inflationary pressures in Türkiye could have an adverse effect on healthcare budgets and manufacturing expenses. Energy, labor, and logistics costs will rise which in turn would necessitate pricing and profitability pressure. To survive, firms should optimize their operations and should be on the lookout for cost-efficient methods of production.

Pricing strategies in the medical plastics market of Türkiye have to take into consideration such issues as production costs, regulatory compliance, competition, and healthcare institutions plus medical device manufacturers demand. To ensure both profitability and affordability, a balanced approach is necessitated.

Value-based pricing suits those products that are high performance, including antimicrobial or bioresorbable polymers. Manufacturers that target premium products, which include surgical implants or high-end medical devices, can justify the high price with product safety, durability, and regulatory approvals as the main arguments.

Cost-plus pricing strategy is an accrued method at times, it ensures that all production and regulatory compliance costs are covered with a fixed profit margin. Nonetheless, due to the fluctuating nature of Türkiye's currency and its dependency on imports, regular cost assessments are critical in avoiding pricing misalignment.

Dynamic pricing might be of help if the company wants to tweak prices according to the material costs, currency exchange rates, and the demand of the day. Producers would have the opportunity to execute the flexible pricing plan, so as to keep the customers satisfied and provide wholesale as well as long-term contracts, thereby retaining stable cash flows.

The penetration pricing strategy would be useful for firms entering the industry or launching new product categories. The once-off selling of lower prices to get a firm customer base can lead to a good spread of the product. Yet, it is advisable to implement step-by-step price adjustments that would assure a durable financial situation without the risk of depreciating the product.

Medical-grade PVC holds the largest share of the medical plastics market in Türkiye due to its relatively low cost, high durability, and extensive use in the production of medical tubing, blood bags, IV containers, and surgical gloves. Its chemical and sterilization resistance make it ideal for single-use medical devices.

End use for medical-grade PVC is increasing because the strict European Union (EU) regulations for a phthalate-free formulation (like under medical-grade PVC from Teknor Apex, BASF, etc) are extracting a market for compliant medical-grade PVC. Also, innovations in phthalate free and DEHP free alternatives are driving the future demand for PVC base products.

The biggest share of Türkiye’s medical plastics market comes from medical parts and components as more plastic-based medical devices are now being utilized by hospitals, clinics and laboratories. While they can be designed from metals, the broadest range of cost-effective, biocompatible, and chemically resistant plastics include PP (polypropylene), PC (polycarbonate), and PE (polyethylene) which are widely used in the manufacture of syringes, catheters, inhalers, IV components, and surgical instruments.

Demand of precision-engineered plastic components is booming, as Türkiye’s maturing healthcare infrastructure, driven by state investment programs and medical tourism deepens. Moreover, the strong growth of antimicrobial and biodegradable plastics has also supported innovation within this sector.

| Region | CAGR (2025 to 2035) |

|---|---|

| West Türkiye | 4.7% |

| Central Türkiye | 4.5% |

| Southern Türkiye | 4.3% |

The West Türkiye medical plastics industry is experiencing consistent growth with the growth of the healthcare industry, medical device production, and development of hospital infrastructure. Istanbul, Izmir, and Bursa are major centers for the production of medical equipment and pharmaceutical packaging, creating demand for sterilizable and biocompatible plastics. Increasing medical tourism in Istanbul is also creating demand for high-quality disposable medical devices, drug delivery systems, and diagnostic parts.

The growing use of lightweight and long-lasting polymers for prosthetics, orthopedic implants, and surgical devices is also defining industry patterns. Moreover, the shift toward sustainable and recyclable products aligns with Türkiye’s commitment to environmentally friendly manufacturing practices in the healthcare industry. FMI states that the West Turkiye industry is set to grow at 4.7% CAGR from 2025 to 2035.

| Key Drivers | Information |

|---|---|

| Aging population | Increasing elderly population driving demand for medical devices and equipment. |

| Advanced Healthcare Infrastructure | Presence of well-established hospitals and clinics boosting medical plastic consumption. |

The medical plastics industry in Central Türkiye is growing because of increased investments in medical research, higher pharmaceutical production, and growth in polymer-based healthcare uses. Ankara and Konya are among the cities leading in the development of medical devices, diagnostic kits, and hospital equipment, which further increase the demand for high-performance products.

The region’s strong government healthcare initiatives and academic research institutions are supporting the development of advanced polymer-based implants, medical tubing, and customized surgical components. The expansion of local pharmaceutical packaging production is further driving the need for biocompatible and chemical-resistant plastics in drug delivery systems. FMI cites that the industry in Central Turkiye is projected to witness 4.5% CAGR during the study period.

| Key Drivers | Information |

|---|---|

| Expanding Healthcare Facilities | Rapid development of hospitals and clinics in urban areas. |

| Medical Tourism Hub | Increasing influx of international patients driving demand for medical devices. |

The Southern Türkiye medical plastics industry is growing as more investments are being made in healthcare. Adana, Gaziantep, and Mersin are becoming major centers for medical plastic manufacturing, especially in sterile packaging, diagnostic consumables, and components of hospital furniture. FMI is of the opinion that the industry in Southern Turkiye is set to capture 4.3% CAGR during the study period.

With the growing population and rise in healthcare facilities, there is a greater demand for inexpensive, long-lasting, and cost-efficient plastic-based medical products. The development of medical exports to neighboring Middle Eastern and North African nations is also contributing to the demand for polymer-based syringes, IV bags, and surgical disposables.

| Key Drivers | Information |

|---|---|

| Population Growth | Rising population boosting demand for healthcare services. |

| Increasing Disposable Income | Higher income levels encouraging healthcare spending. |

The industry is driven by dominant players such as Epsan, Ravago Turkey, SEM Plastik, and Elif Plastik, who leverage advanced material science, manufacturing processes, and international standards in healthcare compliance. They benefit from a potent domestic backbone supported by export-led growth catering to both Turkish and European medical sectors. On the contrary, smaller manufacturers and specialized polymer companies are getting traction for customized products, antimicrobial coatings, and biopolymer solutions of sustainable nature. As regulatory stringency is seen to grow and demand from single-use medical plastic starts to escalate, a competitive advantage will belong to companies that are engaged in innovative research, regulatory compliance, and sustainable materials in an evolving medical plastics market in Turkey.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Ravago Petrokimya | 10-12% |

| Kimpur Polyurethanes | 8-10% |

| Elastron TPE | 7-9% |

| Epsan Plastik San. Tic. A.Ş. | 5-6% |

| Polyplast | 3-4% |

| Other Companies (combined) | 60% |

| Company Name | Key Offerings/Activities |

|---|---|

| Ravago Petrokimya | Provides medical-grade polypropylene (PP), polyethylene (PE), and engineering plastics for medical packaging, disposable devices, and surgical instruments. |

| Kimpur Polyurethanes | Specializes in polyurethane-based medical foams and elastomers, widely used in prosthetics, orthopedic cushions, and medical support systems. |

| Elastron TPE | Develops thermoplastic elastomers (TPEs) for medical tubing, catheters, seals, and soft-touch medical components, ensuring biocompatibility and flexibility. |

| Epsan Plastik San. Tic. A.Ş. | Produces engineering plastics such as polyamides (PA) and polycarbonate (PC) for medical housings, surgical devices, and diagnostic equipment. |

| Polyplast | Manufactures custom medical polymer compounds, including antimicrobial plastics and high-precision molding materials for dental and surgical applications. |

Ravago Petrokimya

Ravago Petrokimya is a major supplier of medical-grade polymers in Türkiye, providing a wide variety of thermoplastics such as polypropylene (PP), polyethylene (PE), and high-performance engineering plastics. Ravago is committed to regulatory compliance and has its materials conform to ISO 10993 biocompatibility standards for medical packaging, syringes, and disposable devices. Ravago's strong distribution network and R&D capabilities make it a leading player in the medical plastics market.

Kimpur Polyurethanes

Kimpur is a medical-grade polyurethane specialist with applications common in prosthetics, orthotics, medical cushions, and sterilization-resistant products. It focuses on lightweight and strong polyurethane foams especially for hospitals and medical equipment companies. Kimpur is investing in sustainable polyurethane technologies to align with global medical safety standards.

Elastron TPE

Elastron is a leading manufacturer of thermoplastic elastomers (TPEs) used in medical tubing, catheters, soft-touch grips, and seals. The company’s biocompatible and flexible materials provide high resistance to sterilization and chemicals, making them ideal for medical and pharmaceutical applications. Elastron’s expertise in customizable elastomer formulations positions it as a strong player in Türkiye's medical polymer sector.

Epsan Plastik San. Tic. A.Ş.

Epsan Plastik is a manufacturer of high-performance engineering plastics, including polyamides (PA), polycarbonate (PC), and PBT (polybutylene terephthalate), used in medical housings, surgical instruments, and diagnostic equipment. The company focuses on precision molding materials and antimicrobial polymer solutions to enhance medical device durability and safety.

Polyplast

Polyplast specializes in custom medical polymer compounds, offering antimicrobial plastics, high-precision molding materials, and impact-resistant polymers. The company’s products are widely used in dental, surgical, and laboratory applications, ensuring high performance and regulatory compliance with medical safety standards.

Other Key Players

The segmentation is as polyvinyl chloride (PVC), thermoplastic elastomer (TPE), polyethylene (PE), polycarbonate (PC), polypropylene (PP), PET, polyamides, thermoplastic polyurethane (TPU), polymethyl methacrylate, acrylonitrile butadiene styrene (ABS), silicone rubber, and others.

The segmentation is as medical parts and components, tubing, film and bags, medical cables and connectors, diagnostic equipment, prosthetics, and others.

The industry is divided into West Turkiye, Southern Turkiye, and Central Turkiye.

The industry is set to reach USD 235.5 million in 2025.

The market is projected to reach USD 355.8 million by 2035.

Key companies include Ravago Petrokimya, Kimpur Polyurethanes, Elastron TPE, Epsan Plastik San. Tic. A.Ş., Polyplast, Sanko Holding A.Ş., Plasthermo Plastik, Enplast Polimer A.Ş., Tisan Engineering Plastics, Kavram Plastik, Ultrapolymers Group, İzel Kimya, Petkim Petrokimya Holding A.Ş., Kastamonu Entegre, and Meltem Kimya.

West Turkiye, set to expand at 4.7% CAGR during the study period, is projected to observe fastest growth.

PVC-based products are widely used.

Table 01: Industry Value (US$ million) and Volume (kilo tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Plastic Type

Table 02: Industry Value (US$ million) and Volume (kilo tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Plastic Type

Table 03: Industry Value (US$ million) and Volume (kilo tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Plastic Type

Table 04: Industry Value (US$ million) and Volume (kilo tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 05: Industry Value (US$ million) and Volume (kilo tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 06: Industry Value (US$ million) and Volume (kilo tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 07: Industry Value (US$ million) and Volume (kilo tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Table 08: Industry Value (US$ million) and Volume (kilo tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use

Figure 01: Industry Volume (kilotons), 2018 to 2022

Figure 02: Industry Volume (kilotons), 2023 to 2033

Figure 03: Industry Value (US$ million), 2018 to 2022

Figure 04: Industry Value (US$ million) Forecast and Y-o-Y Growth, 2023 to 2033

Figure 05: Value, Absolute $ Opportunity Analysis

Figure 06: Industry Share and BPS Analysis By Plastic Type, 2023 to 2033

Figure 07: Industry Y-o-Y Growth Projections By Plastic Type, 2023 to 2033

Figure 08: Industry Attractiveness Analysis By Plastic Type, 2023 to 2033

Figure 09: Industry Absolute $ Opportunity by Polyvinyl Chloride (PVC) Segment, 2023 to 2033

Figure 10: Industry Absolute $ Opportunity by Thermoplastic Elastomer (TPE) Segment, 2023 to 2033

Figure 11: Industry Absolute $ Opportunity by Polyethylene (PE) Segment, 2023 to 2033

Figure 12: Industry Absolute $ Opportunity by Polycarbonate (PC) Segment, 2023 to 2033

Figure 13: Industry Absolute $ Opportunity by Polypropylene (PP) Segment, 2023 to 2033

Figure 14: Industry Absolute $ Opportunity by Polyethylene Terephthalate (PET) Segment, 2023 to 2033

Figure 15: Industry Absolute $ Opportunity by Polyamides Segment, 2023 to 2033

Figure 16: Industry Absolute $ Opportunity by Thermoplastic Polyurethane (TPU) Segment, 2023 to 2033

Figure 17: Industry Absolute $ Opportunity by Polymethyl Methacrylate Segment, 2023 to 2033

Figure 18: Industry Absolute $ Opportunity by Acrylonitrile Butadiene Styrene (ABS) Segment, 2023 to 2033

Figure 19: Industry Absolute $ Opportunity by Silicone Segment, 2023 to 2033

Figure 20: Industry Absolute $ Opportunity by Others Segment, 2023 to 2033

Figure 21: Industry Share and BPS Analysis By End-use, 2023 to 2033

Figure 22: Industry Y-o-Y Growth Projections By End-use, 2023 to 2033

Figure 23: Industry Attractiveness Analysis By End-use, 2023 to 2033

Figure 24: Industry Absolute $ Opportunity by Medical Parts and Components Segment, 2023 to 2033

Figure 25: Industry Absolute $ Opportunity by Tubing Segment, 2023 to 2033

Figure 26: Industry Absolute $ Opportunity by Film and Bags Segment, 2023 to 2033

Figure 27: Industry Absolute $ Opportunity by Surgical Tools Segment, 2023 to 2033

Figure 28: Industry Absolute $ Opportunity by Medical Cables and Connectors Segment, 2023 to 2033

Figure 29: Industry Absolute $ Opportunity by Diagnostic Equipment Segment, 2023 to 2033

Figure 30: Industry Absolute $ Opportunity by Prosthetics Segment, 2023 to 2033

Figure 31: Industry Absolute $ Opportunity by Others Segment, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA