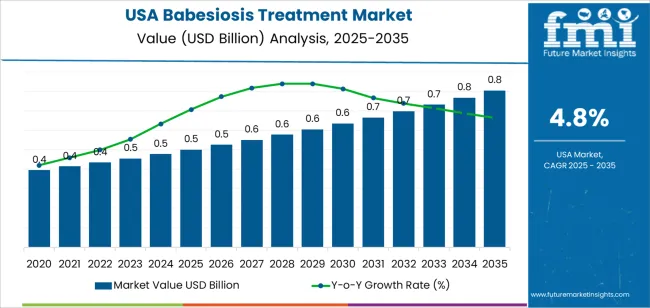

The demand for babesiosis treatment in the USA is expected to grow from USD 0.5 billion in 2025 to USD 0.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.8%. Babesiosis, a tick-borne disease caused by the Babesia parasite, requires timely and effective treatment to prevent severe complications, especially in immunocompromised individuals. As awareness of tick-borne diseases increases and more effective treatments are developed, the market for babesiosis treatment is expected to see steady growth over the forecast period.

The market will experience incremental growth, starting at USD 0.5 billion in 2025 and increasing to USD 0.5 billion in 2026. By 2027, demand will reach USD 0.6 billion, continuing to rise steadily each year. By 2035, the demand for babesiosis treatment is forecasted to reach USD 0.8 billion, driven by advances in treatment options, growing awareness, and increased healthcare access for affected populations.

The acceleration and deceleration pattern for babesiosis treatment demand shows a gradual increase in the early years (2025-2029), with moderate growth each year. The rate of growth remains steady, reflecting ongoing, incremental increases in demand as treatments improve and public awareness increases. However, the market will not experience a sharp acceleration in growth; instead, the demand will rise at a measured pace.

After 2029, the rate of growth is expected to stabilize and may decelerate slightly as the market matures. This reflects the natural progression of the treatment market as the adoption of available treatments reaches a steady state, and the disease is increasingly managed effectively. While there will be continued growth, the rate may slow as the population at risk stabilizes and healthcare infrastructure improves, reducing the urgency for rapid treatment expansion. This results in a gradual yet steady increase in market value through 2035.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 0.5 billion |

| Industry Forecast Value (2035) | USD 0.8 billion |

| Industry Forecast CAGR (2025-2035) | 4.8% |

Demand for treatment of babesiosis in the USA is increasing as incidence and awareness of the disease rise. Cases have become more frequent in regions where the tick vector is expanding its range. Many infections remain mild or asymptomatic, but serious illness can develop - especially in older individuals or those with weakened immune systems - leading to greater need for effective treatment. The broader tick borne disease burden in parts of the country contributes to greater recognition of babesiosis and increased diagnostic testing. Growing incidence, combined with rising concern among clinicians and public health authorities, supports stronger demand for medical management of babesiosis.

The demand is also driven by evolving medical standards and treatment practices. For symptomatic patients the standard therapy involves a course of antimicrobial drugs over 7 to 10 days. Severe or persistent infections may require longer or more intensive treatment, which increases demand for medical care resources, supportive therapy, monitoring and follow up. As awareness spreads that babesiosis can be serious if untreated - causing hemolytic anemia, organ complications or relapse - more patients seek formal diagnosis and treatment. Research into improved therapies, better diagnostics, and potential preventive measures further supports growth in demand for babesiosis treatment.

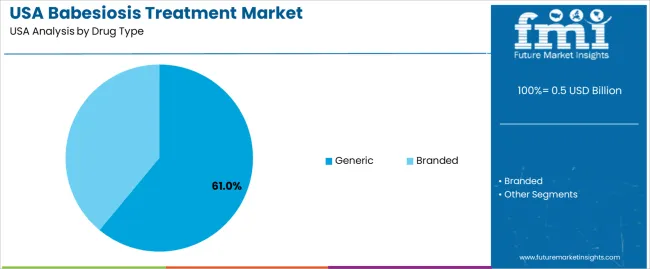

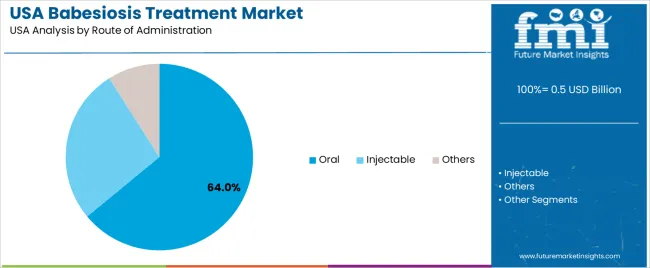

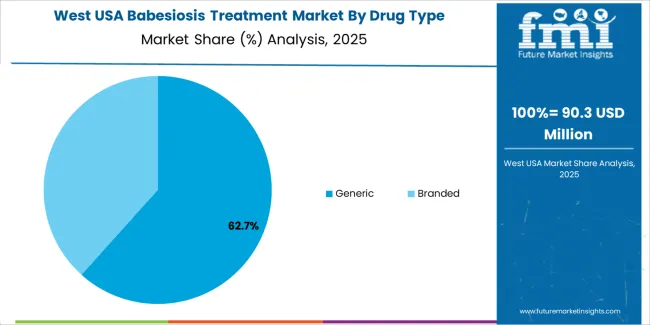

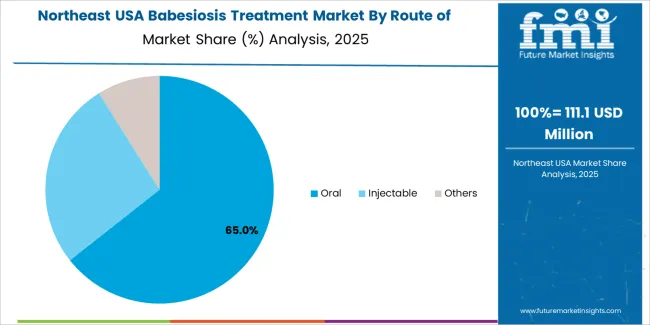

The demand for babesiosis treatment in the USA is primarily driven by drug type and route of administration. The leading drug type is generic, capturing 61% of the market share, while oral administration is the most common, accounting for 64% of the demand. Babesiosis, a parasitic infection caused by protozoa transmitted by ticks, requires effective treatment options. As the need for accessible and cost-effective treatments grows, the demand for generic drugs and oral administration methods remains strong in the USA.

Generic drugs lead the demand for babesiosis treatment in the USA, holding 61% of the market share. Generic treatments are cost-effective alternatives to branded drugs and offer the same therapeutic benefits. The demand for generic drugs is driven by the growing focus on affordable healthcare, as well as the increasing number of patients seeking accessible treatments for babesiosis, particularly those who are uninsured or underinsured.

Generic drugs are typically available at a lower price point than their branded counterparts, making them an attractive option for both patients and healthcare providers. As the prevalence of babesiosis rises and the need for effective treatments becomes more critical, the affordability and accessibility of generic drugs will continue to be a driving factor in the treatment landscape. The large share of generics in the market also reflects the success of generic formulations in offering a safe, reliable, and accessible treatment option for patients suffering from babesiosis in the USA.

Oral administration leads the route of administration demand for babesiosis treatment in the USA, accounting for 64% of the market share. Oral treatments are preferred due to their ease of use, convenience, and the ability for patients to self-administer the medication at home. Oral drugs for babesiosis are typically taken as tablets or capsules, offering an effective and less invasive method of treatment compared to injectable options.

The demand for oral administration is driven by patient preference and the widespread availability of oral medications that are effective in treating babesiosis. Oral treatments offer the advantage of better patient compliance, as they do not require healthcare facility visits or professional administration. With an increasing number of babesiosis cases in areas where tick-borne diseases are common, the demand for oral drugs will continue to lead the market, as they provide an accessible, effective, and patient-friendly treatment option.

Demand for Babesiosis treatment in the USA has increased due to a rise in reported cases and growing awareness of the disease. Babesiosis is a parasitic infection transmitted by ticks, mainly in the Northeast and Upper Midwest, that can lead to severe illness in certain populations. With more diagnoses, the demand for effective treatments, testing, and medical care has grown, especially as cases become more recognized in regions previously thought to be low risk.

What are the Drivers of Demand for Babesiosis Treatment in the USA?

Several factors drive the demand for Babesiosis treatment in the USA. One key factor is the increase in infections across previously low-risk areas, expanding the pool of potential patients. There is also a rise in awareness among healthcare providers, leading to more diagnoses and treatment prescriptions. Additionally, the vulnerable population, including the elderly and immunocompromised, requires effective treatment to prevent severe complications. The need for blood screening to prevent transfusion-transmitted Babesia further drives the demand for therapeutic interventions and preventive care.

What are the Restraints on Demand for Babesiosis Treatment in the USA?

Despite growing demand, several challenges limit the uptake of treatment. Many cases of Babesiosis are asymptomatic or mild, leading to underdiagnosis and fewer treatment needs. The difficulty of diagnosing the disease, especially outside high-prevalence areas, contributes to misdiagnoses or delayed treatment. Additionally, the current therapeutic options, while effective, may not be suitable for all cases, especially severe or drug-resistant infections. Prolonged treatment regimens and the uncertainty around recurrence also present barriers to widespread adoption.

What are the Key Trends Influencing Demand for Babesiosis Treatment in the USA?

Key trends influencing demand for Babesiosis treatment include the increasing spread of tick vectors, which expands the regions affected by the disease. As awareness among healthcare providers grows, more cases are being tested for and diagnosed, increasing the need for treatments. There is also growing interest in developing improved therapies with better efficacy and shorter treatment times. Additionally, the rise in blood safety protocols and the need for screening to prevent transfusion-transmitted Babesia is creating demand for both diagnostic and therapeutic solutions.

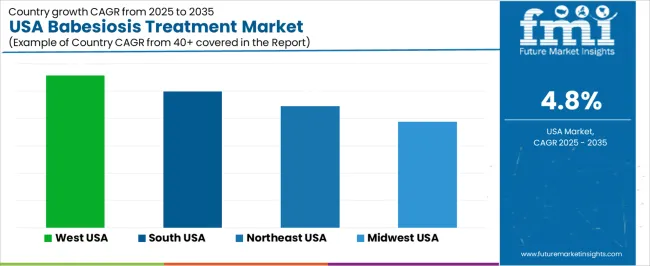

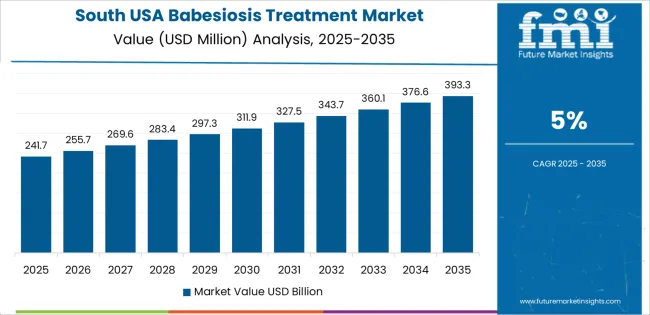

The demand for babesiosis treatment in the USA is projected to rise across all regions. The fastest growth is forecast for the West USA at 5.6% CAGR. The South USA follows at 5.0%, the Northeast USA at 4.5%, and the Midwest USA at 3.9%. These differences reflect variations in disease incidence (tick-borne infections), public health awareness, healthcare infrastructure, and regional adoption of diagnostic and treatment protocols.

| Region | CAGR (%) |

|---|---|

| West USA | 5.6 |

| South USA | 5.0 |

| Northeast USA | 4.5 |

| Midwest USA | 3.9 |

In the West USA, a projected 5.6% annual growth in demand for babesiosis treatment may be supported by rising awareness of tick-borne diseases and expanding healthcare services. Although babesiosis is most common in the Northeast and Midwest of the USA, sporadic cases have been reported on the West Coast, and increased mobility may raise the number of cases there over time. Healthcare providers may become more vigilant for babesiosis symptoms such as fever, hemolytic anemia, and flu-like signs, leading to higher diagnosis rates and treatment prescriptions. Improved diagnostics and growing physician awareness can also drive demand for treatment. Broader public health focus on vector-borne diseases and prevention may support this growth for treatment therapies in the West region.

In the South USA, a 5.0% CAGR for babesiosis treatment demand may reflect increased awareness of tick-borne illnesses, expanded travel, and population shifts. While classical hotspots are in the Northeast and Upper Midwest, movement of populations and possibly expanded tick habitats could lead to new cases. Medical practitioners in the South may increasingly consider babesiosis in differential diagnosis for patients presenting with anemia or flu-like symptoms, especially given rising national attention to tick-borne disease prevalence. Growth in treatment demand may also stem from increased public health screening, blood-transfusion screening, and demand for safe, effective therapies to manage infection and prevent transmission.

In the Northeast USA, the projected CAGR of 4.5% aligns with the region’s historically high incidence of babesiosis. The causative parasite, Babesiosis (most often Babesia microti), is transmitted by deer ticks common to this region. Rising case counts, improved reporting, and greater awareness among clinicians contribute to increasing demand for treatment. Further, as tick populations expand and climate patterns shift, more individuals may be exposed, prompting higher demand for diagnosis and therapy. Standard treatment regimens such as a combination of Atovaquone plus Azithromycin for mild cases are in use, and more demand for pharmaceuticals and supportive care is likely. As prevention and early intervention become more important, treatment demand may grow in tandem.

In the Midwest USA, a forecast CAGR of 3.9% for babesiosis treatment reflects the region’s role as an established endemic zone, though with lower growth compared to other regions. The presence of tick populations capable of transmitting Babesia, coupled with gradual expansion of awareness among healthcare providers and patients, supports a steady demand for treatment. However, the relatively lower growth may reflect fewer new cases compared with the Northeast, or slower expansion of tick habitats. Additionally, in some areas, under-diagnosis or misdiagnosis may limit recorded demand. As diagnostic capacity, physician awareness, and public health surveillance improve, demand for babesiosis treatment in the Midwest is likely to increase gradually.

Increasing incidence of babesiosis in the USA drives demand for therapeutic interventions. The overall treatment market globally is projected to grow at a 5.1% CAGR from 2025 to 2035, reflecting rising infections, improved diagnostics, and increasing recognition of the disease’s health risk. As more people contract the disease, need for effective treatments both for mild and severe cases grows. Regulatory attention, public health funding, and research into new therapies further support market expansion. For patients with mild-to-moderate babesiosis, standard therapy involves drugs such as atovaquone and azithromycin, while severe cases may require more aggressive treatment including clindamycin and quinine or even exchange transfusion. This expanding clinical demand underlies the rising projected growth in treatment adoption across regions.

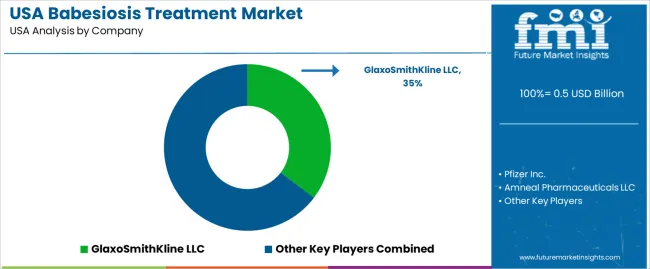

The treatment market for Babesiosis in the USA remains dominated by generic antiparasitic and antibiotic therapies rather than branded, proprietary products. The leading company listed is GlaxoSmithKline LLC (GSK) with about 35.3% share. Other firms named - Pfizer Inc., Amneal Pharmaceuticals LLC, Apotex Inc. and Lupin Pharmaceuticals - are among suppliers of generic drug formulations used in babesiosis therapy or supply of relevant antiparasitic or antibiotic agents. Demand arises from tick borne infections causing babesiosis in various USA regions. Prevalence influences demand for effective treatment regimens involving established medicines.

Treatment protocols for babesiosis typically rely on drug combinations such as Atovaquone plus Azithromycin for mild to moderate cases. This regimen is preferred because of effectiveness and relatively fewer adverse effects compared to older options. In cases where the preferred regimen may not be suitable, the alternative combination of Clindamycin plus Quinine remains in use, especially for severe infections or special patient conditions. Providers may supplement drug therapy with supportive care, including blood transfusions, renal support, or other measures for serious disease.

Competition among pharmaceutical suppliers of babesiosis treatment seems limited. Most key firms supply generic versions of recommended drugs rather than novel therapies. This results in emphasis on drug availability, regulatory compliance, manufacturing quality, and distribution networks. As new therapies remain under research, including drugs with activity against resistant strains, the market may evolve. Presently demand remains tied to known effective regimens and capacity to supply antiparasitic and antibiotic medicines across affected regions.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Drug Type | Generic, Branded |

| Route of Administration | Oral, Injectable, Others |

| End-Users | Hospitals, Home Healthcare, Academic Research Institutes, Others |

| Key Companies Profiled | GlaxoSmithKline LLC, Pfizer Inc., Amneal Pharmaceuticals LLC, Apotex Inc., Lupin Pharmaceuticals |

| Additional Attributes | Dollar sales by drug type, route of administration, and end-users indicate strong demand for both branded and generic treatments for babesiosis. Oral administration is common, though injectable options are preferred in hospitals. Leading companies like GlaxoSmithKline, Pfizer, and Amneal Pharmaceuticals provide effective treatments for babesiosis. The market is expected to grow with increasing awareness of the disease, improved treatment options, and the rising demand for home healthcare solutions. |

The demand for babesiosis treatment in USA is estimated to be valued at USD 0.5 billion in 2025.

The market size for the babesiosis treatment in USA is projected to reach USD 0.8 billion by 2035.

The demand for babesiosis treatment in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in babesiosis treatment in USA are generic and branded.

In terms of route of administration, oral segment is expected to command 64.0% share in the babesiosis treatment in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Babesiosis Treatment Market Analysis - Trends, Demand & Growth 2025 to 2035

USA Microbial Seed Treatment Market Analysis – Trends, Growth & Forecast 2025-2035

Global Postmenopausal Osteoporosis Treatment Market Insights – Size, Trends & Forecast 2024-2034

Demand for Burns Treatment in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Water Treatment System in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Endometriosis Treatment in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Autosomal Dominant Polycystic Kidney Disease Treatment in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA