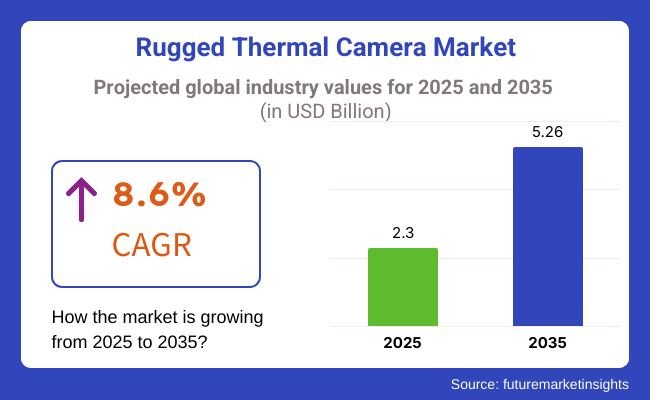

The Rugged Thermal Camera Market is poised to experience stable growth between 2025 and 2035 as demand for high-performance thermal imaging solutions across industrial, defense, and surveillance segments continues to grow. It is projected to reach USD 2.30 billion in 2025 and expand to USD 5.26 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.6% during the forecast period.

The growing adoption of rugged thermal cameras for predictive maintenance, firefighting, military operations, and perimeter security is fueling expansion. These cameras provide enhanced ruggedness, improved infrared imaging technology, and better performance under harsh environmental conditions. In addition, advancements in AI-driven image processing, high-definition thermal imaging sensors, and real-time data transmission are also fueling innovation in the industry.

Edge computing, AI-powered anomaly detection, and wireless connectivity in thermal cameras is driving their use in industries. Companies are utilizing solutions to monitor infrastructure, navigate autonomous vehicles, and detect environmental hazards to keep them safe and operationally efficient.

Cooled thermal cameras hold the highest share (58.2%) and are driven by higher sensitivity, longer detection range, and high-resolution thermal imaging. These cameras eliminate sensor noise using cryogenic cooling, which enables better accuracy and is well-suited for defense, aerospace, industrial monitoring, and high-end security applications.

Cooled thermal cameras are often used for missile tracking, border security, and critical infrastructure protection, where even minute temperature differentiations must be detected. FLIR Systems, Leonardo DRS, and Raytheon Technologies continue to develop cooled thermal imaging systems for military and commercial applications.

However, cooled thermal camera systems for industrial and government applications inherently cost more and require more maintenance, pricing them out of many budget-constrained applications. However, rapid advances in compact, cryogenic cooling technology and AI-enabled image processing mean this technology is anticipated to soon be more affordable and widespread.

The second division distinguishes uncooled thermal cameras, which account for 41.8% of the share, due to the affordability of cost, smaller package size , and low energy intake. They use microbolometer sensors instead of cryogenic cooling, so they can be more easily adapted to various purposes compared to cooled cameras.

From commercial security, automotive night vision, search & rescue, and firefighting to industrial safety, their three-dimensional or two-dimensional infrared imaging cameras with high sensitivity and performance find use in ubiquitous applications. This is why they are so commonly used: they can work perfectly well in some extremely hostile environments and need very little maintenance.

Companies, including Seek Thermal, Teledyne FLIR, and Hikvision, are embracing AI-powered uncooled thermal for additional features like real-time analytics, wireless connectivity, and better thermal contrast. Uncooled cameras are not as sensitive and do not provide as much dynamic range as cooled systems. Still, as resolution continues to improve for sensors and AI-driven image quality enhancements, mature uncooled systems should deliver better performance.

The best application segment is security & surveillance. It accounted for 41.7% of the market. Governments and private organizations are increasingly using Thermal Cameras, Perimeter security, airport monitoring, and public safety.

With the increased attachment to the advancement of security threats, the need for integrated thermal cameras using AI processors to identify the target and faces, as well as tracking in real-time , is increasing. For example, FLIR Systems, Axis Communications, and Dahua Technology are implementing next-generation surveillance cameras that utilize AI-based analytics, edge computing, and cloud connectivity.

Based on the solution type, the monitoring & inspection segment holds the dominant share of 58.3% of the total revenue in 2022 due to the rising adoption of thermal cameras for industrial inspection, predictive maintenance, firefighting, and environmental monitoring.

Industries such as oil & gas, power generation, and manufacturing apply thermal imaging to detect equipment failures, hotspots, abnormal gas emissions, and structural weaknesses. Increasing emphasis on workplace safety, predictive maintenance, and energy efficiency is fueling demand for high-performance thermal cameras. AI-based thermal imaging solutions developed by companies such as Bosch Security Systems, FLIR Corporation, and Opgal Optronic Industries will allow real-time monitoring and better accuracy.

The considerable rise in the Rugged Thermal Camera Market can be attributed to acquisitions of military, industrial, public safety, and automotive as the dominant segments. For the military & defense segment, thermal cameras are necessarily tough, waterproof, and precisely detecting capabilities in harsh atmospheres so that the wear and tear factor and thermal sensitivity are the priorities of the rigidness.

Industrial inspection applications have to be highly accurate and long-lasting for monitoring equipment performance, heat detection, and safety assurance in hazardous surroundings. Public safety agencies, on the other hand, seek ease of use, portability, and cost-effectiveness for their thermal cameras in firefighting, search and rescue, and law enforcement.

The automotive industry, on the other hand, is incorporating thermal cameras into advanced driver-assistance systems (ADAS) and night vision technology aside from emphasizing thermal sensitivity and environmental resistance.

Right from the start, thermal cameras in research & development have been crucial to supporting scientific analysis, material testing, and medical imaging, which all require the highest accuracy. The trend towards the utilization of AI-powered and more compact thermal cameras is also a factor that is pushing the market ahead.

| Company | Contract Value (USD Million) |

|---|---|

| FLIR Systems | Approximately USD 80 - 90 |

| L3Harris Technologies | Approximately USD 70 - 80 |

| Fluke Corporation | Approximately USD 60 - 70 |

| Seek Thermal | Approximately USD 50 - 60 |

| Opgal Optronic Industries | Approximately USD 55 - 65 |

In 2024 and early 2025, the rugged thermal camera market demonstrated significant momentum driven by growing demand in defense, industrial, and critical infrastructure sectors. Leading companies such as FLIR Systems, L3Harris Technologies, Fluke Corporation, Seek Thermal, and Opgal Optronic Industries have secured pivotal contracts and strategic partnerships, underscoring the industry's commitment to deploying high-performance thermal imaging solutions that deliver reliable, rugged performance in extreme conditions.

Between 2020 and 2024, the stringent thermal camera market grew at a rapid rate based on defense, industrial security, and advanced thermal imaging technology. Thermal cameras were used by governments in night missions and perimeter monitoring, driving demand for AI systems. Thermal cameras were used by heavy industry for infrastructure inspection, predictive maintenance, and fault detection to reduce downtime and enhance safety.

Emergency responders utilized them for search-and-rescue, wildland fire detection, and fever screening during the pandemic. Though cost and regulatory compliance are issues to be resolved, vendors introduced miniaturized, AI-powered thermal sensors with better image quality and lower energy consumption.

From 2025 to 2035, the rugged thermal camera market will be revolutionized with AI analytics, edge computing, and multispectral imaging. AI-powered cameras will provide real-time anomaly detection and threat assessment, boosting security and minimizing false alarms. Edge computing will provide in-device heat signature analysis to accelerate emergency response and industrial surveys.

Multispectral imaging will merge thermal, visible, and infrared data for better visibility in low-light and occluded environments. Wearable and autonomous thermal cameras will aid in high-risk operations, and solar-rechargeable and energy-efficient design will increase camera life for use in remote environments.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Tough industry standards (OSHA, IEC, MIL-STD-810) demanded rugged thermal cameras to achieve higher durability, accuracy, and environmental safety standards. | AI-based, blockchain-based compliance models provide real-time regulatory compliance, automatic calibration, and secure thermal imaging data logging for industrial and defense sectors. |

| AI-based thermal cameras enhance object detection, anomaly detection, and predictive analytics for industrial inspection and security. | Artificially intelligent, autonomous learning thermal imaging platforms include real-time heat signature classification, threat detection through automation, and mission-critical predictive maintenance. |

| Greater use of thermal cameras for electrical inspections, fire fighting, and predictive maintenance led to increasing demand for highly precise rugged thermal cameras. | Industrial smart thermal sensors equipped with artificial intelligence allow fault diagnosis in real-time, automatic monitoring of machine health, and efficient energy-consumption-based heat mapping for advanced predictive maintenance systems. |

| Thermal cameras with IoT and edge computing capabilities enable real-time surveillance in dangerous environments. | AI-driven, edge-native thermal imaging networks independently interpret thermal data, identify safety risks, and streamline resource allocation within industrial and smart city infrastructures. |

| Rugged thermal cameras were used by the military and law enforcement to further night vision, border patrol, and situational awareness. | Autonomous, artificial intelligence-driven thermal monitoring systems allow for real-time tracking of objects, threat detection, and self-adaptive heat signature identification for upcoming defense operations. |

| The minimization of thermal sensors made them viable for inclusion in rugged wearables for engineers, military personnel, and first responders. | Ultra-lightweight thermal imaging wearables driven by AI offer augmented situational awareness, biometric heat monitoring, and real-time guided diagnostics for field experts. |

| Integration of thermal imaging with visible light, infrared, and LiDAR enhanced precision and detection. | AI-powered, multispectral fusion cameras provide better target discrimination, self-adaptive environment, and high-accuracy analytics for search and rescue, defense, and aerospace. |

| Increasing security compromise issues led to stronger encryption, AI-based anomaly detection, and tamper-resistant hardware in thermal imaging technology. | AI-secured, quantum-encrypted thermal imaging solutions inherently defend against cyber threats, delivering tamper-proof thermal data transfer and secure cloud storage for sensitive applications. |

| Firms optimized thermal sensors for energy efficiency and created recyclable materials to reduce environmental footprint. | AI-powered, green thermal imaging solutions utilize self-sustaining sensors, ultra-low-power infrared processing, and carbon-neutral production for environmentally friendly thermal monitoring. |

| Accelerated connectivity enhanced real-time thermal imaging data transmission for industrial automation, remote inspection, and emergency response. | AI-driven, 6G-enabled thermal networks enable immediate, ultra-high-resolution imaging, autonomous data analysis, and low-latency remote control for security, healthcare, and industrial applications. |

Risks in the Rugged Thermal Camera Market are supply chain dysfunctions and strong competition. The major risk that needs to be addressed is the availability and cost of the main components, including infrared sensors, specialized lenses, and durable housing materials. Supply chain issues, geopolitical tensions, and material shortages can lead to high costs and production delays. Manufacturers should consider making multiple supplier networks to handle such risks.

Technological breakthroughs continue to be the biggest hurdle. The thermal imaging technology evolves so fast that some companies may find it challenging to introduce new or better products such as an increased resolution, wider detection range, and AI integration compared to other companies that offer them at a cheaper price.

Compliance with the law is also significant, especially involving the export of infrared and thermal imaging technology. Countries such as the USA and Europe have strict rules on the sale and export of thermal cameras due to their possible military applications. If the rules are not followed, there could be legal issues involved, as well as getting access to the industry may be restricted.

Besides that, technical imaging products such as LiDAR, night vision, and multispectral imaging may also affect demand. Differentiated products through better performance, all-weather durability, and extra smart features should be the approaches followed by manufacturing companies to hold strong positions.

Manufacturers should mitigate these risks by diversifying supply, investing in R&D, keeping an eye on trade policies, and venturing into applications not only in the defense and industrial sectors but also in smart surveillance, firefighting, and medical diagnosis.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 8.7% |

| The UK | 8.5% |

| European Union | 8.9% |

| Japan | 8.6% |

| South Korea | 9.0% |

The USA Rugged Thermal Camera Market is expanding with rising demand for industrial inspections, defense operations, and intelligent surveillance technology. Companies are adopting high-performance thermal imaging for security, safety, and predictive maintenance.

The Department of Homeland Security (DHS) and the Department of Defense (DoD) are fueling investments in artificial intelligence-based thermal surveillance, night vision devices, and military-grade thermal imaging for border protection and combat operations.

Industrial automation and the development of smart infrastructure are also driving the adoption of thermal cameras for firefighting and predictive maintenance. FLIR Systems, Seek Thermal, and Teledyne Technologies are leading with weather-sealed and ruggedized designs, high-resolution thermal sensors, and AI-based anomaly detection. FMI is of the opinion that the USA market is slated to grow at 8.7% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Homeland Security and Defense investments | The DoD and DHS heavily invest in AI-powered thermal night vision for border security, surveillance drones, and night vision in inclement weather. |

| Industrial and Fire Protection Applications | Thermal cameras aid in manufacturing, firefighting, and protecting infrastructure through real-time monitoring and predictive maintenance. |

| AI and Sensor Technology Advances | Companies concentrate on AI-powered night vision thermal imaging, high-resolution sensors, and weather-resistant design to ensure peak efficiency and lifespan. |

The Rugged Thermal Camera Market in the UK is rising steadily with rising applications in law enforcement, industrial security, and energy. UK Home Office and Ministry of Defence (MoD) fund AI-driven fire detection cameras, surveillance drones, and night vision armored vehicles to deliver defense and infrastructure security.

Thermal imaging applications in manufacturing for quality control and machine condition monitoring gain momentum. Innovators like Leonardo, Hikvision, and Axis Communications are pioneering AI-based thermal imaging, rugged small cameras, and enhanced environmental ruggedness. FMI is of the opinion that the UK is slated to grow at 8.5% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Defense and Security Applications | The MoD is spending on advanced thermal surveillance drones and rugged night vision systems for defense and border security. |

| Fire Protection and Homeland Infrastructure Monitoring | Artificial intelligence-based fire detection and smart city surveillance systems create more throughput for thermal imaging technology. |

| Industrial and Manufacturing Development | Thermal cameras are used in broad applications in machine diagnostics, predictive maintenance, and energy. |

The European Union Rugged Thermal Camera Market is expanding with border protection expenditure, industrial automation, and measurement of energy consumption. The EU is focusing on green infrastructure, defense modernization, and smart cities.

Germany, France, and the Netherlands take the lead in thermal imaging predictive maintenance, AI-based fire detection, and surveillance drones. The expanded use of AI-based environmental monitoring and energy audits drives expansion. Leaders Bosch, Thales Group, and FLIR Systems showcase future-proof rugged thermal cameras, AI-based anomaly detection, and cloud thermal analytics. FMI is of the opinion that the EU market is slated to grow at 8.9% CAGR during the study period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| Border Defense and Security Enhancement | Eurasian countries deploy AI-based surveillance drones and defense thermal cameras. |

| Industrial Automation and Smart Cities | Industries use thermal cameras for predictive maintenance, AI-based energy audits, and the detection of fires. |

| Sustainable Infrastructure and Environmental Monitoring | The EU encourages thermal monitoring for low energy consumption to mute carbon prints. |

Japan's stringent thermal camera market is transforming rapidly with the boom created by government-led campaigns for industrial security, growing automotive night vision penetration, and smart city surveillance programs. The Ministry of Economy, Trade, and Industry (METI) encourages AI-assisted thermal analysis, advanced fire-detecting technologies, and real-time equipment condition diagnostics. Thermal imaging for autonomous cars and drone security is increasing.

Key leaders, Fujitsu, NEC, and Panasonic offer miniaturized rugged thermal cameras, AI diagnostics, and real-time thermal monitoring for critical infrastructure. FMI is of the opinion that Japan is slated to grow at 8.6% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Government-Sponsored Safety Initiatives | METI invests in machine health diagnostics and AI-based thermal analysis for workplace safety. |

| Smart City and Autonomous Vehicle Integration | Autonomous car and drone-based security mania fuel demand for next-generation thermal cameras. |

| Industrial Automation and Robotics | Industrial applications of high-precision thermal imaging are for the monitoring of critical infrastructure and automated production lines by industries. |

The South Korean rugged Thermal Camera Market is developing strongly with smart infrastructure development national initiatives, investments in AI-based surveillance, and an increase in demand for high-performance thermal imaging by the defense and industrial automation sectors. The Ministry of Science and ICT (MSIT) is investing in real-time thermal anomaly detection, AI-enabled border security solutions, and disaster relief next-generation rugged imaging.

Among the trends gaining momentum are the uses of thermal imaging in consumer hardware and medical diagnosis. Samsung Techwin, Hanwha Vision, and LG Electronics are among the companies working on ultra-rugged thermal cameras, AI-enabled thermal analysis, and cloud-enabled remote monitoring solutions. FMI is of the opinion that South Korea's market is slated to grow at 9.0% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| AI-Driven and Intelligent Infrastructure Monitoring | Government expenditure on AI-driven monitoring and smart city surveillance fuels growth. |

| Industrial and Military Applications | Thermal imaging with high resolution fuels border security, predictive maintenance, and disaster recovery operations. |

| Emerging Healthcare and Consumer Applications | Thermal imaging penetrates medical diagnosis and home security systems. |

The Rugged Thermal Camera Market develops because industries demand high-performance imaging solutions for harsh environments. These cameras serve the following purposes: defense, industrial inspections, firefighting, and outdoor surveillance. They endow enhanced thermal sensitivity, durability, as well as provide analytics fueled by AI. Adoption is propelled by advances in sensor technology, increasing security risks, and the necessity for imaging to be accurate even with harsh conditions.

Major leaders include FLIR Systems (Teledyne), Leonardo DRS, Seek Thermal, Axis Communications, and Opgal Optronic Industries, servicing the military-grade thermal imaging and rugged industrial cameras along with the AI-integrated analytics solutions. Newer players and focused companies are geared to innovating various lightweight, low-power, and high-resolution thermal imaging solutions, marking a step in cutting-edge competition.

Continuous development of uncooled infrared sensors has also increased the popularity of compact thermal optics and cloud-enabled imaging platforms within the rugged thermal camera industry. Real-time edge processing, AI-powered anomaly detection, and wireless connectivity integration will even facilitate usability across industries.

Strategic factors in shaping competition include sensor miniaturization, compliance with defense and industrial standards, and extended applications for autonomous systems and IoT-driven monitoring. Businesses promising cost-effective, high-pixel-count, and net-integrated rugged thermal cameras boost up their market stronghold.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| FLIR Systems (Teledyne) | 20-25% |

| Seek Thermal | 15-20% |

| Leonardo DRS | 12-16% |

| Axis Communications | 10-14% |

| Opgal Optronic Industries | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| FLIR Systems (Teledyne) | Develops advanced rugged thermal cameras for military, industrial, and law enforcement applications. |

| Seek Thermal | Specializes in compact, high-resolution thermal imaging for professionals and outdoor use. |

| Leonardo DRS | Innovates in military-grade thermal cameras with AI-powered analytics and real-time connectivity. |

| Axis Communications | Focuses on rugged thermal cameras for perimeter security and industrial monitoring. |

| Opgal Optronic Industries | Provides high-performance thermal imaging for firefighting, surveillance, and aerospace applications. |

Key Company Insights

FLIR Systems (Teledyne) (20-25%)

FLIR is the leading player in the rugged thermal camera segment, with an outstanding thermal imaging system that has applications in military, industrial, and emergency response operations.

Seek Thermal (15-20%)

Seek Thermal leads the pack when it comes in terms of portable, high-resolution thermal cameras, bringing thermal imaging into the hands of a broad consumer market-space-consistent professionals, contractors, and outdoor aficionados.

Leonardo DRS (12-16%)

Leonardo DRS is at the forefront of the evolution of defense-grade thermal imaging, which has been added to AI-based analytics and rugged connectivity for real-time processing of data.

Axis Communications (10-14%)

Axis offers cameras that are rugged enough to be specifically used in extreme weather conditions for perimeter security and even hazardous industrial thermal imaging applications.

Opgal Optronic Industries (6-10%)

Opgal is a prominent player providing advanced thermal imaging solutions, mainly targeting applications in firefighting, aerospace, and industrial monitoring.

Other Key Players (20-30% Combined)

The market includes cooled thermal cameras and uncooled thermal cameras.

The market covers security & surveillance, monitoring & inspection, detection & measurement, and other applications.

The market comprises government use, industrial use, commercial use, and residential use.

The market spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

The industry is slated to reach USD 2.30 billion in 2025.

The industry is predicted to reach a size of USD 5.26 billion by 2035.

Key companies include FLIR Systems Inc., Leonardo S.p.A., Axis Communications AB, Opgal, Xenics, BAE Systems Inc., L3 Technologies Inc., SKF, Bosch Security Systems Inc., Thermoteknix Systems Ltd., and Raytheon Technologies Corp.

South Korea, driven by advancements in defense, industrial safety, and surveillance applications, is expected to record the highest CAGR of 9.0% during the forecast period.

Cooled thermal cameras are widely used for their superior image clarity and long-range thermal detection capabilities, particularly in defense, industrial monitoring, and high-precision applications.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Technology, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Technology, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 142: MEA Market Attractiveness by Application, 2023 to 2033

Figure 143: MEA Market Attractiveness by End User, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Camera Accessories Market Size and Share Forecast Outlook 2025 to 2035

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thermal Energy Harvesting Market Size and Share Forecast Outlook 2025 to 2035

Thermally Stable Antiscalant Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spa and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Camera Lens Market Size and Share Forecast Outlook 2025 to 2035

Camera Module Market Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Inks Market Size and Share Forecast Outlook 2025 to 2035

Thermal Liner Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA