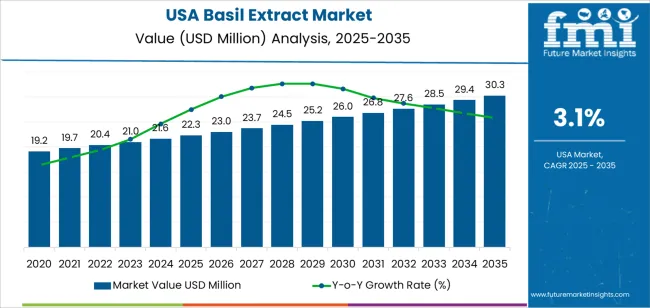

The demand for basil extract in the USA is expected to grow from USD 22.3 million in 2025 to USD 30.4 million by 2035, with a compound annual growth rate (CAGR) of 3.1%. Basil extract, derived from the leaves of the basil plant, is recognized for its wide range of health benefits, including antioxidant, anti-inflammatory, and antimicrobial properties. As a result, it has become a highly sought-after ingredient in various industries, such as food and beverages, cosmetics, and pharmaceuticals. In food and beverages, basil extract is used for its flavoring properties, as well as its health-promoting effects. In cosmetics, it is used in formulations aimed at improving skin health, while in pharmaceuticals, it is incorporated into natural remedies and wellness products.

As consumers increasingly prioritize natural, plant-based ingredients in their products, the demand for basil extract is expected to rise steadily. The growing trend toward organic and clean-label products will play a significant role in this demand surge. The rise in wellness and herbal supplements further drives basil extract's adoption, as it is viewed as a versatile, effective ingredient for maintaining health. The beauty and personal care sectors are also likely to see increased use of basil extract due to its skin-rejuvenating and soothing effects.

Between 2025 and 2030, the demand for basil extract in the USA is expected to rise from USD 22.3 million to USD 23.0 million. This phase will experience steady growth, with incremental increases in demand driven by the increasing popularity of natural and functional ingredients in food and personal care products. The food industry, especially in health-conscious eating trends, will continue to expand its use of basil extract for flavoring and its purported health benefits. The rise in demand for plant-based and herbal wellness products will drive adoption in the cosmetic and nutraceutical sectors, as consumers seek products with natural, beneficial properties.

From 2030 to 2035, demand for basil extract will experience a faster rise, growing from USD 23.0 million to USD 30.4 million. The acceleration in growth during this period is expected to be driven by the increasing trend toward herbal supplements and plant-based products, which continue to gain popularity as consumers become more focused on natural health solutions. The rise of the wellness industry and growing awareness of the antioxidant and anti-inflammatory benefits of basil extract will further stimulate demand. Basil extract’s use in cosmetic products like skin-care formulas and anti-aging products is expected to increase as the beauty and personal care industry moves toward more clean beauty solutions.

| Metric | Value |

|---|---|

| Demand for Basil Extract in USA Value (2025) | USD 22.3 million |

| Demand for Basil Extract in USA Forecast Value (2035) | USD 30.4 million |

| Demand for Basil Extract in USA Forecast CAGR (2025 to 2035) | 3.1% |

The demand for basil extract in the USA is growing due to its wide range of applications in the food and beverage, cosmetics, and health supplement industries. Basil extract, derived from the leaves of the basil plant, is valued for its antioxidant, antimicrobial, and anti-inflammatory properties, making it a sought-after ingredient in natural and functional products. As consumers continue to seek healthier, plant-based alternatives, the demand for basil extract is rising in both culinary and wellness industries.

A key driver behind the growth of basil extract is the increasing preference for natural ingredients in food and beverage products. Basil extract is used in a variety of applications, from flavoring sauces and beverages to providing functional health benefits in teas, dietary supplements, and other wellness products. As the demand for clean-label, natural, and organic products rises, basil extract is gaining popularity as a versatile, plant-based ingredient that can meet these consumer needs.

The rising trend of wellness and self-care is contributing to the demand for basil extract in the health and beauty sectors. Its antioxidant and anti-inflammatory properties make it a valuable ingredient in skincare products, helping to improve skin health and reduce signs of aging. As consumers increasingly prioritize natural and holistic wellness, the demand for basil extract in the USA is expected to grow steadily through 2035, driven by its versatility in both food and personal care applications.

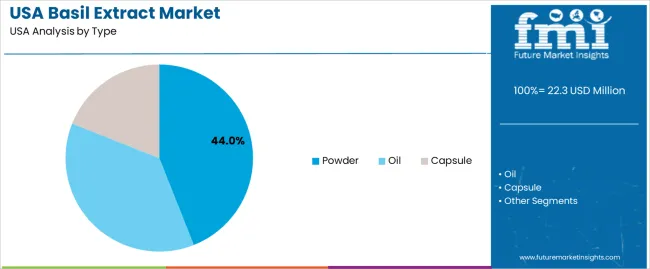

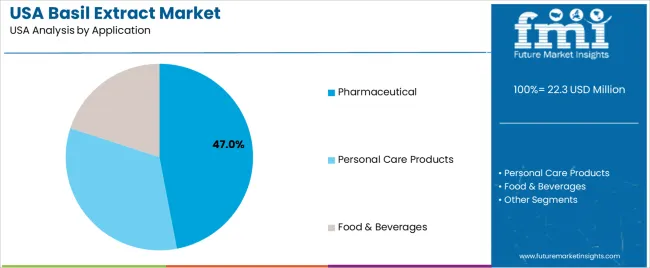

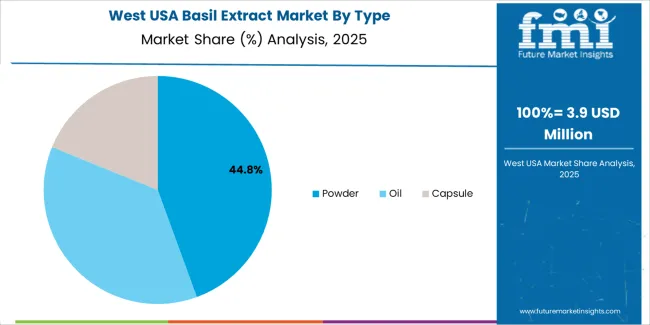

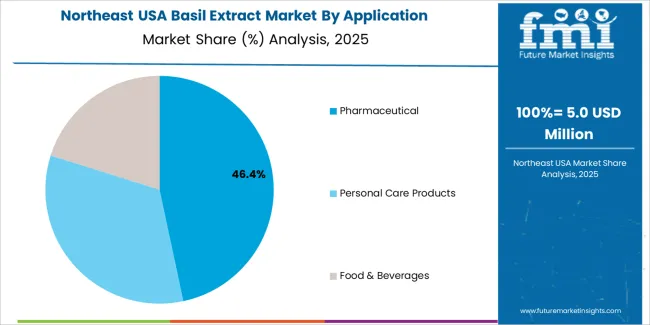

Demand for basil extract in the USA is segmented by type, application, and region. By type, demand is divided into powder, oil, and capsule, with powder holding the largest share at 44%. The demand is also segmented by application, including pharmaceutical, personal care products, and food & beverages, with pharmaceuticals leading the demand. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA, with specific regions contributing to the growing use of basil extract in various industries.

Powdered basil extract accounts for 44% of the demand for basil extract in the USA. Its popularity is driven by its versatility and ease of use across a wide range of applications. In powdered form, basil extract can be seamlessly incorporated into various pharmaceutical products, dietary supplements, and functional food items. This form offers convenience in storage, measurement, and long shelf life, making it an attractive option for manufacturers and consumers alike. Powdered basil extract is known for its medicinal properties, including stress relief, digestive support, and antioxidant benefits, which further contribute to its demand in the wellness industry. As consumers increasingly seek natural health solutions, the demand for powdered basil extract is expected to remain strong, especially in the growing supplement and natural product sectors.

Pharmaceuticals account for 47% of the demand for basil extract in the USA. Basil extract is highly valued for its wide array of health benefits, making it a key ingredient in the pharmaceutical industry. Its natural compounds, including antioxidants and anti-inflammatory agents, are widely used in treatments for stress relief, digestive health, and immune support. As the demand for plant-based health solutions continues to rise, basil extract is becoming increasingly popular in the production of natural remedies and supplements. Its potential therapeutic benefits align well with the growing trend of holistic health and wellness. The increasing consumer preference for herbal and natural alternatives further drives the demand for basil extract in the pharmaceutical sector, solidifying its dominant role in the industry.

Demand for basil extract in USA is rising as multiple sectors food & beverage, nutraceuticals, and personal care/cosmetics increasingly favor botanical and plant‑based ingredients over synthetic additives. The industry for herbal and botanical extracts is growing rapidly, driven by increasing consumer interest in natural, clean‑label products that offer health and wellness benefits. Basil extract’s versatility used as a natural flavoring in foods, a functional ingredient in supplements, and a bioactive component in cosmetics helps expand its addressable industry. Constraints include volatility in supply and raw material quality (herbal sourcing depends on agriculture), the need for standardization (active‑compound consistency), and competition from other botanical extracts or synthetic alternatives

In USA, demand for basil extract is growing because consumers are increasingly health‑ and wellness‑conscious, seeking natural ingredients in food, supplements, and personal care. Basil extract is valued for its antioxidant, anti‑inflammatory, and antimicrobial properties, which make it suitable for use in dietary supplements, herbal wellness products, and functional foods. Shifting consumer lifestyles and greater interest in clean‑label and plant‑based solutions are boosting use of botanical extracts as alternatives to synthetic flavorings, preservatives, or additives. This growing preference for “natural wellness” and preventive health fuels formulation of basil‑extract based products across food, beverage, nutraceutical and cosmetic categories.

Recent advances in extraction technologies (improved solvent extraction, distillation, purification) and quality‑control processes make basil extract more reliable, consistent and scalable for large‑scale production. This helps meet the standards required in nutraceuticals, food & beverage flavoring, and cosmetics. Manufacturers are also offering basil extract in multiple forms liquid, powder, encapsulated supplements which broadens application across consumer packaged goods, dietary supplements, functional beverages, and personal‑care products. Liquid forms and standardized extracts make formulation easier for food manufacturers or supplement brands, helping drive broader adoption.

Despite growing demand, several challenges limit wider adoption of basil extract in USA. First, variability and volatility in raw‑material supply since basil cultivation depends on climate, soil and agro‑conditions can lead to inconsistent quality or supply disruptions. Second, the need for standardization and quality assurance means producers must ensure consistent levels of bioactive compounds (e.g. flavonoids, essential oils), which adds complexity and cost for extract manufacturers. Third, competition from other botanical extracts, synthetic flavorings or alternative natural ingredients may constrain growth, especially if cost or formulation ease matters more than “natural” positioning. Regulatory compliance and permissible health‑claims for botanical extracts especially in dietary supplements or therapeutic uses can be cumbersome, which may discourage some manufacturers from scaling up basil‑extract USAge in certain product categories.

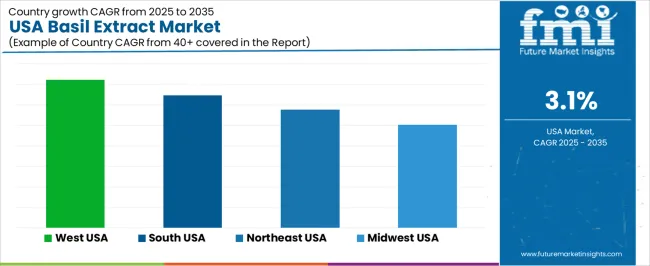

| Region | CAGR (%) |

|---|---|

| West USA | 3.6% |

| South USA | 3.2% |

| Northeast USA | 2.9% |

| Midwest USA | 2.5% |

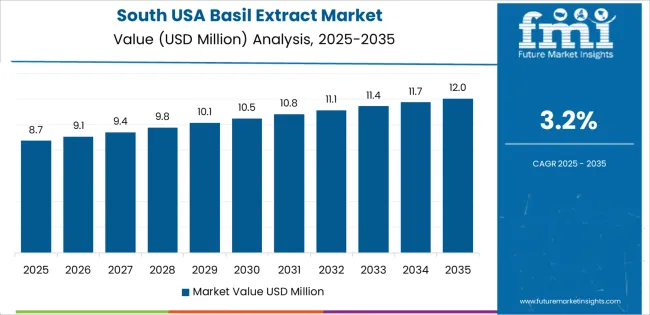

Demand for basil extract in the USA is growing steadily, with West USA leading at a 3.6% CAGR, driven by the region’s strong food, beverage, and wellness industries, which increasingly favor natural, plant-based ingredients. South USA follows with a 3.2% CAGR, supported by the region’s food industry, where basil extract is popular for flavoring and its health benefits. Northeast USA shows a 2.9% CAGR, fueled by growing interest in herbal products and natural ingredients in food, supplements, and skincare. Midwest USA experiences a 2.5% CAGR, driven by the rising demand for basil extract in food products and its growing use in health-conscious and plant-based formulations. As consumer preferences shift towards clean-label, organic, and functional foods, the demand for basil extract is expected to continue rising across all regions.

West USA is seeing the highest demand for Basil extract, growing at a 3.6% CAGR. The region’s strong food and beverage industry, including a growing trend in natural and herbal ingredients, is a key driver of this growth. Basil extract is widely used in culinary applications, health supplements, and personal care products for its antioxidants and anti-inflammatory properties. West USA, particularly in California, has a well-established wellness industry that increasingly favors plant-based and natural ingredients, driving the popularity of basil extract in a variety of health and beauty products. The demand is further supported by the growing consumer interest in organic and herbal products, which are becoming more prevalent in the region’s industry. As West USA continues to embrace clean-label and functional foods, the use of basil extract in food products, supplements, and personal care formulations is expected to grow steadily, contributing to the region’s leading position in the industry.

South USA is experiencing steady demand for Basil extract, with a 3.2% CAGR, primarily driven by the region’s thriving food industry. Basil extract is increasingly used in cooking, flavoring, and seasoning, particularly in the preparation of sauces, soups, and dressings. With the region’s emphasis on bold flavors and natural, fresh ingredients, basil extract is becoming a popular choice in both commercial and home kitchens. The demand for basil extract in health and wellness products is growing as consumers in South USA embrace more herbal and plant-based alternatives for their nutritional benefits. The region’s growing health-conscious population, along with increasing consumer demand for organic and natural products, is further supporting the adoption of basil extract in dietary supplements, skincare products, and functional foods. As wellness trends continue to rise and natural ingredients become more prominent in food and personal care formulations, the demand for basil extract in South USA is expected to continue growing steadily.

Northeast USA is witnessing moderate growth in demand for Basil extract, with a 2.9% CAGR. The region’s growing health and wellness industry, particularly in metropolitan areas like New York and Boston, is driving this demand. As consumers seek natural and functional ingredients in food, supplements, and skincare products, basil extract is gaining traction for its antioxidant and anti-inflammatory properties. The region’s strong interest in herbal and plant-based products supports the increasing incorporation of basil extract in functional foods, teas, and cosmetics. The Northeast’s focus on organic and sustainable products is contributing to the rise in popularity of basil extract, as it aligns with consumer preferences for natural, clean-label ingredients. As the demand for plant-based health solutions grows in the Northeast, the use of basil extract in various industries, including food, beverage, and personal care, is expected to increase, maintaining steady growth in the region’s industry.

Midwest USA is experiencing steady demand for Basil extract, growing at a 2.5% CAGR. The region’s food industry, particularly in the manufacturing of sauces, condiments, and seasonings, is a major driver of this demand. Basil extract is valued for its unique flavor and health benefits, making it a popular ingredient in cooking and food products. The rise in health-conscious consumers and the growing trend of plant-based and organic foods are contributing to the demand for basil extract in dietary supplements and functional foods. As the wellness movement continues to gain traction in the Midwest, the demand for natural ingredients like basil extract in personal care products is also increasing. With a growing emphasis on sustainable and clean-label products, basil extract is expected to see steady growth in the region’s food, health, and beauty industries. As these trends continue to evolve, the demand for basil extract in Midwest USA is projected to rise gradually.

The demand for basil extract in the USA is increasing due to its versatile applications in the food, beverage, cosmetics, and pharmaceutical industries. Basil extract, known for its aromatic properties, is widely used as a natural flavoring agent in food and beverages, as well as for its potential health benefits, such as anti-inflammatory and antioxidant properties. The growing consumer interest in natural and organic ingredients, along with the increasing trend of health-conscious eating, is fueling the demand for basil extract. The extract is gaining popularity in wellness products due to its therapeutic qualities.

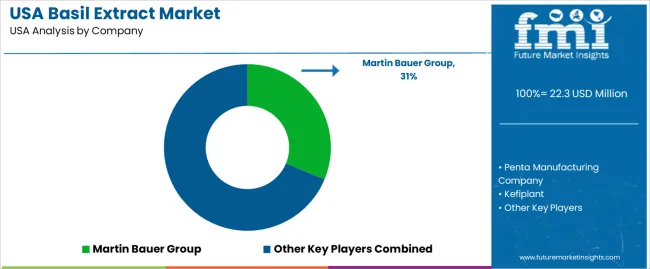

Key players in the basil extract industry in the USA include Martin Bauer Group, Penta Manufacturing Company, Kefiplant, Amoretti, and FLAVEX Naturextrakte GmbH. Martin Bauer Group leads with an industry share of 31.3%, offering high-quality basil extract that is widely used in both food and health products. Penta Manufacturing Company specializes in providing basil extract and other botanical extracts for the food, beverage, and nutraceutical sectors. Kefiplant offers natural basil extract for functional food and beverage applications, while Amoretti provides premium basil extracts used in culinary applications, such as flavoring oils and sauces. FLAVEX Naturextrakte GmbH focuses on offering natural extracts, including basil, for use in beverages, cosmetics, and personal care products.

Competition in the basil extract industry is driven by the rising consumer demand for natural, organic, and health-focused ingredients. Companies compete by offering high-quality, sustainably sourced extracts that meet the growing demand for clean-label products. The ability to deliver consistent, high-potency basil extracts, as well as offer customization for specific product applications, is a key factor in the competitive landscape. Durability and traceability are also important drivers, as consumers and businesses alike are increasingly prioritizing eco-friendly and ethically sourced ingredients.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Powder, Oil, Capsule |

| Application | Pharmaceutical, Personal Care Products, Food & Beverages |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Martin Bauer Group, Penta Manufacturing Company, Kefiplant, Amoretti, FLAVEX Naturextrakte GmbH |

| Additional Attributes | Dollar sales by type and application; regional CAGR and adoption trends; demand trends in basil extract; growth in pharmaceutical, personal care, and food sectors; technology adoption for extraction processes; vendor offerings including basil extract products and services; regulatory influences and industry standards |

The demand for basil extract in USA is estimated to be valued at USD 22.3 million in 2025.

The market size for the basil extract in USA is projected to reach USD 30.3 million by 2035.

The demand for basil extract in USA is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in basil extract in USA are powder, oil and capsule.

In terms of application, pharmaceutical segment is expected to command 47.0% share in the basil extract in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Basil Extract Market Size, Growth, and Forecast for 2025 to 2035

USA Licorice Extract Market Insights – Size, Share & Industry Growth 2025-2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Demand for Coffee Extracts in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Black Tea Extracts in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cassia Seed Extract in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Basil Leaves Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA