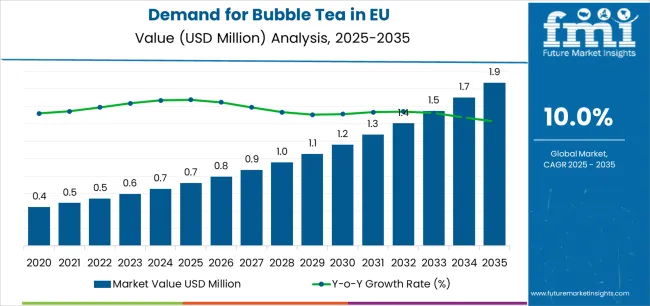

Demand for bubble tea in the European Union is forecast to increase from USD 0.7 million in 2025 to almost USD 1.9 million by 2035, representing a compound annual growth rate of 10.0%. The expansion reflects the growing fascination with specialty beverages, where consumers are drawn toward customized formats, exotic flavors, and interactive drinking experiences. Originally popularized in Asia, bubble tea has transitioned into a fashionable beverage choice across major European cities, with cafés, tea houses, and quick-service restaurants introducing diverse variants. The incorporation of fruit flavors, dairy and non-dairy bases, and functional add-ons has broadened its appeal beyond younger demographics into mainstream beverage culture.

Between 2025 and 2035, sales are expected to rise by USD 1.2 million, translating into a total increase of 171.4%. This performance indicates that the market is on track to expand by nearly 2.71X during the forecast period. The growth is tied to lifestyle-driven consumption trends, where beverages are not only viewed as refreshments but also as personalized indulgences. Bubble tea aligns strongly with the European preference for novel café experiences, customizable drink formats, and visually appealing products that resonate on social media platforms. The emergence of bubble tea delivery through food service aggregators and dedicated online platforms has further amplified access to a wider audience.

Flavor innovation continues to define the trajectory of this segment. Toppings such as tapioca pearls, fruit jellies, popping boba, and cheese foam are being paired with classic teas, fruit blends, and milk alternatives to create highly differentiated offerings. Plant-based variations using oat milk, almond milk, or soy milk are increasingly common, aligning with the broader plant-based beverage movement in Europe. The functional beverage trend is also opening opportunities for bubble tea fortified with probiotics, vitamins, and adaptogens, creating overlap with the wellness beverage segment.

Germany, France, and the United Kingdom are recognized as key early adopters, driven by their vibrant café culture and exposure to global food trends. Southern European countries, including Spain and Italy, are beginning to embrace bubble tea through urban foodservice establishments and university towns, while Eastern Europe is expected to emerge gradually as awareness and retail penetration expand. Specialty food chains and modern convenience outlets are accelerating distribution, while franchised bubble tea outlets are increasing visibility across shopping districts.By 2030, the European bubble tea industry is projected to evolve into a more structured category, with both premium artisanal cafés and mass-market formats coexisting. Retail-ready bubble tea kits and bottled options are anticipated to extend consumption beyond cafés into at-home occasions. As innovation in flavors, textures, and functional enhancements continues, the EU bubble tea industry is positioned to remain one of the most dynamic beverage segments over the coming decade.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 0.7 million |

| Forecast Value in (2035F) | USD 1.9 million |

| Forecast CAGR (2025 to 2035) | 10% |

Industry expansion is being supported by the rising influence of Asian culture among European consumers and the demand for customizable, Instagram-worthy beverages that deliver both sensory and social experiences. Bubble tea enables convenient incorporation of diverse flavors, textures, and visual elements into personalized drinks without the limitations of traditional beverages. The category benefits from dual drivers: necessity-driven adoption by food service operators seeking differentiated offerings to attract younger customers, and choice-driven consumer demand for novel experiences like popping boba and cheese foam toppings. This convergence of customization, visual appeal, and experiential value is creating sustained opportunities across food service, retail, and online channels.

The growing body of social media content linking bubble tea with lifestyle, fashion, and cultural trends is driving uptake across multiple demographic segments. European millennials and Generation Z consumers view bubble tea as more than a beverage—it represents cultural sophistication, global awareness, and social currency. The ritualistic aspects of ordering, customizing, and consuming bubble tea create memorable experiences that traditional beverages cannot replicate. Producers with established brand recognition and authentic Taiwanese or Asian heritage gain competitive advantages by offering credibility and quality assurance. At the same time, local adaptations incorporating European flavors and preferences provide differentiation while maintaining the core bubble tea experience.

Expanding distribution channels and consumption occasions further elevate the role of bubble tea in EU industry. The beverage's versatility allows positioning as an afternoon refreshment, a dessert replacement, or a social drink, creating multiple daily consumption opportunities. Regulatory trends favoring natural ingredients over artificial additives support bubble tea's use of real fruit, natural sweeteners, and authentic tea bases. Beyond core food service applications, bubble tea is increasingly seen as a customizable platform for innovation, enabling operators to introduce seasonal offerings, limited editions, and collaborative flavors.

Sales of bubble tea are segmented by product type (toppings), nature (format), application (flavor), distribution channel, and region. By product type, demand spans tapioca pearls, popping boba, taro balls, coconut jelly, red bean, grass jelly, fruit bits, and mochi, with tapioca pearls leading but gradually losing share to innovative alternatives. By nature, the industry is split between ready-to-drink and instant mixes, with ready-to-drink dominant but instant mixes gaining traction. Application segmentation includes flavored, unflavored, and residential categories; flavored variants lead and continue expanding. By distribution channel, products are sold through food service, indirect retail, and online retail; food service leads but online shows fastest growth. Regionally, sales cover Germany, France, Italy, Spain, Netherlands, and Rest of Europe, with Rest of Europe demonstrating the highest growth rates.

.webp)

The tapioca pearls segment is projected to account for 42.6% of EU bubble tea sales in 2025, declining to 40% by 2035, while maintaining its position as the largest topping category despite gradual industry share erosion to innovative alternatives. This dominant position reflects tapioca pearls' iconic status as the original and most recognizable bubble tea component, with their distinctive chewy texture and subtle sweetness providing the authentic bubble tea experience that consumers expect. The slight share decline indicates industry maturation and diversification as consumers explore novel toppings while still maintaining strong loyalty to traditional offerings.

Popping boba emerges as a key growth driver, expanding from 13.0% share in 2025 to 14.0% by 2035, capitalizing on its Instagram-worthy appeal and explosive flavor delivery. These juice-filled spheres provide dramatic burst-in-mouth sensations that enhance the multisensory experience and create shareable social media moments. Fruit bits demonstrate similar expansion from 11.0% to 12.0% share, benefiting from health-conscious consumers seeking real fruit ingredients with natural sweetness and nutritional benefits.

Traditional Asian toppings maintain stable niche positions, with grass jelly holding 7.0% share, coconut jelly growing from 8.0% to 8.5%, and taro balls expanding from 7.0% to 7.5%, while red bean declines from 6.0% to 5.5% and mochi maintains 5.4-5.5% share throughout the forecast period.

Key advantages:

.webp)

Ready-to-drink bubble tea is positioned to represent 87.6% of total EU industry demand in 2025, declining slightly to 85.0% by 2035, reflecting sustained consumer preference for professionally prepared beverages despite growing instant mix alternatives. This leading share demonstrates the importance of authentic preparation, optimal texture achievement, and immediate consumption convenience in driving bubble tea adoption across European industrys.

The RTD segment benefits from the expertise required for proper pearl cooking, tea brewing, and flavor balancing that ensures consistent quality difficult to replicate at home. Food service outlets provide the social environment, customization options, and experiential elements that transform bubble tea from mere beverage to lifestyle experience. Bottled and canned RTD options in retail channels offer grab-and-go convenience while maintaining quality standards through specialized packaging and preservation techniques.

The instant mix segment's growth from 12.4% share in 2025 to 15.0% by 2035 reflects evolving consumer capabilities and industry education, with improved product quality, detailed preparation instructions, and readily available ingredients enabling satisfactory home preparation experiences.

Key drivers:

EU bubble tea sales are advancing rapidly due to increasing influence of Asian popular culture, rising demand for customizable and Instagram-worthy beverages, and the shift toward experiential consumption that prioritizes novelty and personalization over traditional beverage attributes. However, the industry faces challenges, including high sugar content concerns driving regulatory scrutiny, premium pricing that can limit mass industry adoption, and supply chain complexities tied to specialized ingredients and equipment. Continued innovation in health-conscious formulations and sustainable packaging remains central to addressing consumer concerns while unlocking new industry segments across demographics and consumption occasions.

The rapid proliferation of Asian popular culture across Europe is fundamentally transforming beverage preferences and consumption patterns among younger demographics. K-pop, anime, and Asian drama consumption creates cultural affinity that extends to food and beverage choices, with bubble tea serving as accessible entry point to Asian lifestyle trends. Social media platforms, particularly TikTok and Instagram, amplify bubble tea's visual appeal through viral challenges, aesthetic presentations, and influencer endorsements that drive awareness and trial among trend-conscious consumers.

Major European cities witness bubble tea shops becoming social hubs comparable to traditional cafes but with distinct cultural positioning appealing to digitally native generations. The photogenic nature of colorful drinks with distinctive toppings creates user-generated content that provides organic industrying reach exceeding traditional advertising effectiveness. Customization options enabling personalized creations further enhance social sharing potential while building emotional connections with brands.

Modern bubble tea producers systematically address health concerns through reformulation strategies, offering reduced sugar options, natural sweeteners, and functional ingredients that align with wellness trends. The ability to customize sweetness levels empowers consumers to balance taste preferences with health goals, while expanding non-dairy alternatives caters to lactose intolerant and vegan segments. Integration of superfoods, probiotics, and adaptogens positions bubble tea within the broader functional beverage category rather than purely indulgent treat.

Leading operators implement transparency initiatives, providing detailed nutritional information and ingredient sourcing details that build trust with health-conscious consumers. Partnerships with fitness influencers and wellness brands help reposition bubble tea from guilty pleasure to acceptable treat within balanced lifestyles. Development of low-calorie toppings and sugar-free options expands addressable industry while maintaining taste and texture expectations.

European consumers increasingly prioritize environmental considerations in purchase decisions, pushing bubble tea operators toward sustainable practices throughout value chains. The transition from plastic to biodegradable straws and cups addresses immediate environmental concerns while demonstrating brand responsibility. Implementation of reusable cup programs with incentive structures builds customer loyalty while reducing single-use packaging waste.

Supply chain sustainability extends to ingredient sourcing, with organic tea bases, fair trade practices, and local fruit suppliers where feasible reducing environmental footprints while supporting premium positioning. Energy-efficient store designs, waste reduction programs, and carbon offset initiatives align with European sustainability values. These environmental commitments transition from differentiators to table stakes as consumers expect responsible practices from food service operators.

| Country | CAGR % (2025–2035) |

|---|---|

| Rest of Europe | 10.8% |

| Netherlands | 10.5% |

| Spain | 10.2% |

| Italy | 9.8% |

| France | 9.4% |

| Germany | 9.2% |

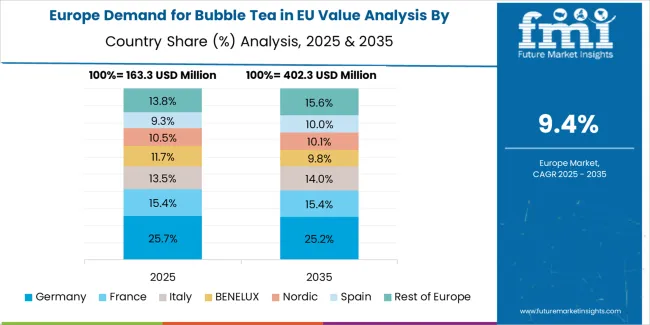

Germany is projected to remain the largest EU bubble tea industry, expanding from USD 173.0 million in 2025 to USD 417.1 million by 2035, at a 9.2% CAGR. Growth is anchored by Germany's large population, urban concentration, and established Asian communities that provide both supply and demand foundations. Major cities like Berlin, Munich, and Hamburg demonstrate high bubble tea shop density, with Berlin emerging as the European bubble tea capital featuring diverse offerings from premium chains to innovative independents.

German industry development benefits from systematic expansion strategies, with chains leveraging franchise models for rapid scaling while maintaining quality standards. Local adaptation includes reduced sweetness levels aligning with German preferences and seasonal flavors incorporating local fruits. Strong delivery infrastructure and digital adoption enable omnichannel strategies reaching consumers across multiple touchpoints.

Growth drivers:

France is forecast to grow from USD 129.7 million in 2025 to USD 318.6 million in 2035, recording a 9.4% CAGR. Growth is supported by French consumers' appreciation for quality beverages, willingness to pay premiums for authentic preparation, and integration of bubble tea into established café culture. Parisian adoption leads national trends, with specialized shops in trendy arrondissements setting standards for presentation and quality that influence broader industry development.

French operators emphasize artisanal preparation methods, premium ingredients, and sophisticated flavor profiles that resonate with discerning consumers. Integration of French culinary elements, such as lavender, violet, and local fruit varieties, creates unique positioning while maintaining bubble tea authenticity. The industry benefits from strong tourist flows seeking Instagram-worthy experiences and authentic Asian beverages.

Success factors:

Italy's bubble tea sales are projected to expand from USD 100.9 million in 2025 to USD 257.0 million in 2035, reflecting a 9.8% CAGR that exceeds larger industrys despite initial resistance from strong coffee culture. Growth is shaped by younger Italian consumers' increasing openness to international beverages and desire for novel experiences that differentiate from traditional options. Milan leads adoption as a fashion and business hub with international exposure, while Rome, Turin, and Naples show expanding presence.

Italian industry development requires careful positioning that respects coffee culture while offering distinct value propositions. Smaller serving sizes, afternoon consumption positioning, and integration with aperitivo culture enable bubble tea to complement rather than compete with established beverages. Quality emphasis on tea selection and preparation methods appeals to Italian appreciation for craftsmanship and authenticity.

Development factors:

Spain's bubble tea demand is set to grow from USD 79.3 million in 2025 to USD 209.4 million by 2035, at a 10.2% CAGR, the highest among major established industrys. Expansion is supported by Spanish social culture emphasizing group gatherings, extended leisure time, and openness to international trends. Madrid and Barcelona lead with vibrant scenes in university districts and shopping areas, while coastal cities benefit from tourist demand.

Spanish consumption patterns favor larger sharing sizes, group orders, and extended consumption occasions that increase average transaction values. Late-night culture creates additional dayparts beyond traditional beverage timings. Price sensitivity drives value positioning and promotional strategies that build trial and repeat purchase behavior among student and young professional segments.

Growth enablers:

The Netherlands is forecast to expand from USD 43.2 million in 2025 to USD 117.4 million by 2035, advancing at a 10.5% CAGR, reflecting the industry's innovation orientation and early adopter characteristics. Growth is driven by Dutch consumers' international outlook, experimental nature, and appreciation for novel experiences that differentiate from traditional offerings. Amsterdam's multicultural environment supports diverse bubble tea concepts from authentic Taiwanese to fusion innovations.

Dutch industry development benefits from high population density, cycling infrastructure enabling easy access, and digital payment adoption facilitating transactions. Innovation extends to sustainable packaging, plant-based alternatives, and technology integration that positions the Netherlands as a testing ground for concepts potentially scalable across Europe. Strong English proficiency enables international brands to enter easily while local operators expand internationally.

Innovation drivers:

The Rest of Europe segment, including Belgium, Austria, Poland, Scandinavia, and Eastern Europe, is projected to grow from USD 194.6 million in 2025 to USD 544.6 million by 2035, at the fastest 10.8% CAGR. Growth reflects diverse industry dynamics: Nordic countries demonstrate premium positioning with high willingness to pay, Eastern European industrys offer volume opportunities with expanding middle classes, and smaller Western European industrys benefit from spillover effects from neighboring countries.

Poland emerges as a significant growth driver with young demographics, rising disposable incomes, and increasing Western influence. Scandinavian industrys command premium pricing through quality positioning and sustainability emphasis. Belgium benefits from EU institution presence and international population. Austria leverages proximity to Germany for supply chain efficiencies. Collectively, these industrys provide portfolio diversification and growth acceleration opportunities.

Potential drivers:

EU bubble tea sales are projected to grow from USD 720.7 million in 2025 to USD 1,864.0 million by 2035, registering a strong CAGR of 10.0% over the forecast period. The Rest of Europe region is expected to demonstrate the fastest growth trajectory with a 10.8% CAGR, supported by emerging industry dynamics, lower saturation levels, and rapid adoption among youth populations. The Netherlands follows with a 10.5% CAGR, attributed to its innovation ecosystem, early adopter consumers, and strategic position as a testing ground for new concepts.

Spain records a 10.2% CAGR, supported by youth enthusiasm, tourism influences, and late-night consumption culture. Italy shows 9.8% CAGR, reflecting accelerating adoption despite initial coffee culture resistance. France contributes a 9.4% CAGR, underpinned by premiumization trends and sophisticated flavor preferences. Germany, while the largest individual industry, grows at 9.2% CAGR, reflecting industry maturity balanced with continued expansion opportunities.

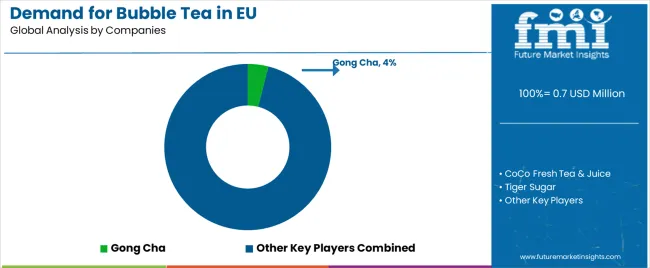

The EU bubble tea industry is characterized by fragmentation with specialized chains, regional operators, and independent shops collectively shaping competitive dynamics. Industry leadership remains distributed, with the top four chains collectively holding only 10.9% industry share, while independent operators and local chains account for 89.1%. This fragmentation reflects low entry barriers, diverse consumer preferences, and the importance of local industry knowledge in successful operations.

Gong Cha leads the industry with an estimated 4% share, leveraging its Taiwanese heritage, global brand recognition, and systematic expansion through franchising. The company's extensive menu, consistent quality standards, and established supply chains provide competitive advantages in scaling across diverse European industrys while maintaining authenticity.

CoCo Fresh Tea & Juice follows with 3.5% share, positioned as a premium chain emphasizing fresh ingredients and extensive customization options. Its strong presence in major European capitals and focus on product innovation through seasonal offerings and limited editions maintains consumer interest and supports premium pricing.

Tiger Sugar holds 1.8% share through distinctive positioning around its signature brown sugar pearl milk creation that achieved viral social media status. The brand's limited availability and queue culture create exclusivity perceptions that support premium pricing despite smaller store networks.

Sharetea maintains 1.6% share by balancing authenticity with local adaptation, offering extensive customization options at competitive prices that appeal to price-conscious students and young professionals.

The fragmented nature of the remaining 89.1% industry share creates both opportunities and challenges. Independent operators provide innovation, local adaptation, and competitive pricing that prevents consolidation while ensuring diverse consumer options. However, fragmentation also limits economies of scale, industrying efficiency, and negotiating power with suppliers. Consolidation trends are expected to accelerate as the industry matures, with successful regional chains potentially emerging as acquisition targets for international players seeking European industry entry or expansion.

| Item | Value |

|---|---|

| Industry Value | USD 0.7 million |

| Quantitative Units | USD Million |

| Nature | Ready-to-Drink, Instant Mixes |

| Product Type | Tapioca Pearls, Popping Boba, Taro Balls, Coconut Jelly, Red Bean, Grass Jelly, Fruit Bits, Mochi |

| Application | Flavored, Unflavored, Residential |

| Distribution Channel | Food Service, Indirect (Retail), Online Retail |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, Rest of Europe |

| Key Companies Profiled | Gong Cha, CoCo Fresh Tea & Juice, Tiger Sugar, Sharetea, plus regional and emerging players |

The global demand for bubble tea in eu is estimated to be valued at USD 0.7 million in 2025.

The market size for the demand for bubble tea in eu is projected to reach USD 1.9 million by 2035.

The demand for bubble tea in eu is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in demand for bubble tea in eu are tapioca pearls, popping boba, taro balls, coconut jelly, red bean, grass jelly, fruit bits and mochi.

In terms of nature (format), ready-to-drink segment to command 87.6% share in the demand for bubble tea in eu in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Bubble Tea Market Trends – Growth, Demand & Forecast 2025–2035

Bubble Tea Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bubble Tea Industry Analysis in USA - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Bubble Tea Providers

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

UK Bubble Tea Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Western Europe Garment Steamer Market Analysis - Size, Share & Trends 2025 to 2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Western Europe Bubble Wrap Packaging Market Analysis – Growth & Forecast 2023-2033

Bubble Wrap Machine Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bubble Wrap Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bubble Lined Courier Bags Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA