Alu Alu cold blister films industry is developing aggressively as high-barrier packaging solutions are demanded by pharmaceutical and healthcare industries. Suppliers create resistant, moisture-resistant, and tamper-proof films for improving the safety of the products and improving the shelf life. Firms apply automation, quality control by artificial intelligence, and eco-friendly material to increase productivity and maintain tight regulatory norms.

Industry players concentrate on high-barrier laminates, eco-friendly film technology, and precision cold-forming processes to improve packaging integrity and environmental stewardship. The market is trending towards lightweight, recyclable, and high-protection blister films that guarantee pharmaceutical stability and compliance.

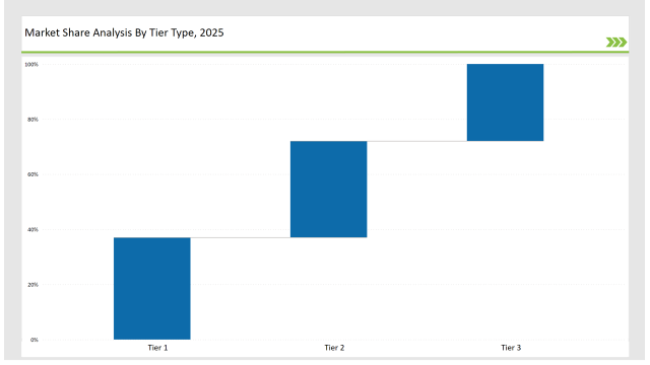

Tier 1 players like Amcor, Constantia Flexibles, and Uflex dominate 37% of the market through the use of sophisticated material science, high-speed manufacturing capabilities, and international distribution networks.

Tier 2 players such as Tekni-Plex, Winpak, and ACG Group possess 35% market share, leading innovation in high-barrier structures, tailor-made cold-form solutions, and sustainable packaging.

Tier 3 companies, which include regional and niche players, account for 28% of the market, with expertise in bio-based films, intelligent packaging, and AI-based quality control systems.

Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Constantia Flexibles, Uflex) | 17% |

| Rest of Top 5 (Tekni-Plex, Winpak) | 13% |

| Next 5 of Top 10 (ACG Group, Bilcare, Rollprint, Perlen Packaging, Essentra) | 7% |

Alu Alu cold blister films industry caters to various industries where high-barrier protection, sustainability, and tamper resistance are essential. Smart manufacturing practices and AI-based inspection systems are implemented by companies to improve product quality and conformity. Firms utilize advanced material testing techniques to confirm excellent film performance. Automated quality control is practiced by manufacturers to identify and rectify defects in real time. Companies optimize blister film flexibility for better compatibility with high-speed packaging lines.

Producers add multi-layer structures, eco-friendly laminates, and AI-based defect inspection systems to Alu Alu cold blister films. AI-driven real-time inspection enhances production efficiency and maintains consistent quality. Companies incorporate nanotechnology to enhance material strength and improve barrier properties. They create ultra-thin protective coatings to enhance packaging performance with minimal material use. Companies embrace laser-marking methods to enhance product traceability and authenticity. Producers upgrade thermal resistance in cold-form blister films to secure sensitive pharmaceuticals.

Companies accelerate Alu Alu cold blister film advancements by adopting AI-driven defect detection, high-speed cold-forming, and eco-friendly material innovations. They refine lightweight yet robust laminates to improve packaging performance and sustainability. Industry players adopt smart tracking technology for improved traceability and counterfeiting prevention. Manufacturers create superior multi-layer films to offer optimal protection against oxygen and moisture. Companies incorporate precise embossing methods to facilitate improved product branding and authenticity. Companies maximize sealing properties to seal products airtight and preserve shelf life. Businesses adopt energy-efficient production methods to minimize carbon footprints and operational expenses. Industry players investigate new bio-based solutions to enhance sustainability initiatives further. Producers use digital twin technology to model production operations and enhance operational effectiveness.

Year-on-Year Leaders

Technology suppliers should focus on sustainability, automation, and security enhancements to drive market growth. Collaborating with pharmaceutical, nutraceutical, and biotechnology sectors will accelerate product innovation and adoption. Companies should invest in AI-powered production analytics to improve efficiency and reduce waste. Manufacturers should develop lightweight, high-barrier materials to enhance product protection. Firms should integrate smart tracking solutions to strengthen supply chain transparency.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Constantia Flexibles, Uflex |

| Tier 2 | Tekni-Plex, Winpak, ACG Group |

| Tier 3 | Bilcare, Rollprint, Perlen Packaging, Essentra |

Leading manufacturers enhance AI-driven quality control, sustainable material adoption, and tamper-proof security features. They integrate smart packaging solutions to improve traceability and efficiency. Companies implement high-speed cold-forming techniques to boost production rates. They develop ultra-thin barrier films to reduce material usage while maintaining protection. Firms leverage blockchain technology to enhance supply chain transparency. Manufacturers integrate machine learning algorithms to predict and prevent defects.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Expanded sustainable film production (March 2024) |

| Constantia Flexibles | Launched high-barrier recyclable films (April 2024) |

| Uflex | Introduced custom cold-form laminates (May 2024) |

| Tekni-Plex | Released AI-driven defect detection (June 2024) |

| Winpak | Strengthened ultra-lightweight Alu Alu solutions (July 2024) |

| ACG Group | Innovated anti-counterfeit blister packaging (August 2024) |

| Bilcare | Improved high-barrier material supply chain (September 2024) |

The Alu Alu cold blister films market evolves as companies invest in automation, high-barrier materials, and sustainable solutions. Firms integrate AI-driven quality control, tamper-proof laminates, and lightweight designs to enhance efficiency and security. Manufacturers adopt advanced predictive maintenance systems to minimize production downtime. Companies optimize film thickness to balance material strength and cost-effectiveness. Firms enhance thermal resistance in cold-form blister films to improve drug stability. Businesses integrate eco-friendly coatings to enhance recyclability and regulatory compliance.

Manufacturers develop AI-powered customization, ultra-lightweight barrier films, and tamper-proof packaging. They refine recyclable and biodegradable materials while integrating IoT-enabled smart packaging to enhance security and reduce waste. Companies adopt predictive analytics to optimize production planning and reduce material wastage. They implement high-speed cold-forming techniques to improve efficiency and minimize defects. Firms explore bio-based polymer alternatives to enhance environmental sustainability. Manufacturers develop multi-layered protective films to extend product shelf life. Companies integrate real-time quality control systems to ensure consistent product performance. They leverage automation in packaging lines to increase output and reduce labor costs. Businesses enhance anti-counterfeit measures with serialized traceability solutions.

Amcor, Constantia Flexibles, Uflex, Tekni-Plex, Winpak, ACG Group, Bilcare, Rollprint, Perlen Packaging, Essentra

The top 3 players collectively hold 17% of the global market.

The market shows medium concentration, with top players holding 37%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Foil Zipper Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Alu-Alu Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Alunite Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA