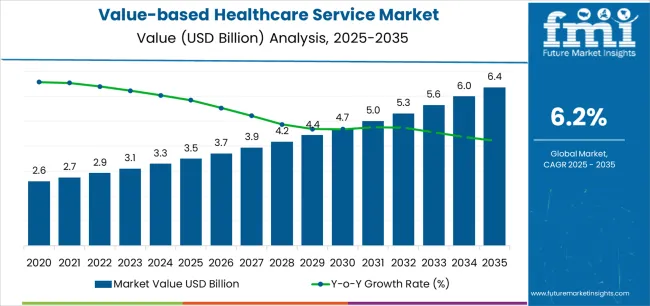

The Value-based Healthcare Service Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The Value-based Healthcare Service market is experiencing sustained growth, driven by the increasing global emphasis on improving patient outcomes while controlling healthcare costs. Adoption is being fueled by the transition from traditional fee-for-service models to value-based care frameworks that prioritize quality, efficiency, and patient satisfaction. Integration of advanced technologies, such as cloud-based data management, AI analytics, and predictive modeling, enables healthcare providers to monitor patient outcomes, optimize treatment plans, and reduce preventable hospitalizations.

The rising prevalence of chronic diseases and aging populations is increasing the demand for coordinated care and outcome-focused healthcare delivery models. Regulatory initiatives and government incentives are further encouraging the adoption of accountable care practices and performance-based reimbursement models.

The market is also supported by the growing focus on interoperability, real-time data sharing, and population health management, which enable providers to deliver proactive and patient-centered care As healthcare systems worldwide aim to improve operational efficiency and clinical effectiveness, the market is expected to maintain long-term growth, driven by technology-enabled value-based solutions and patient-centric care delivery.

| Metric | Value |

|---|---|

| Value-based Healthcare Service Market Estimated Value in (2025 E) | USD 3.5 billion |

| Value-based Healthcare Service Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

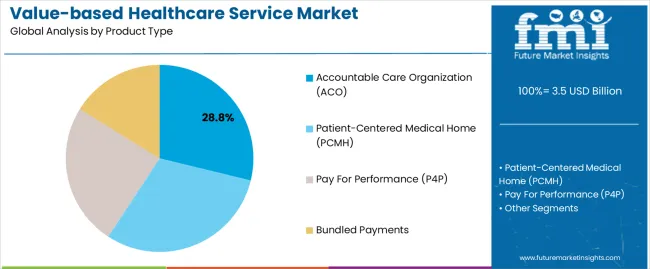

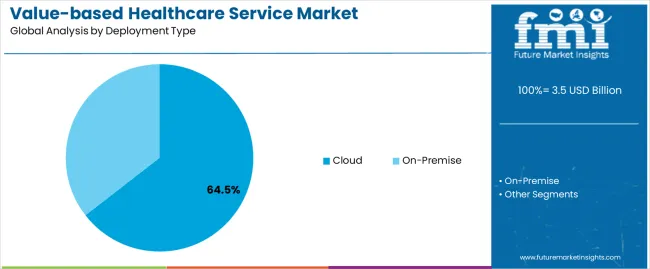

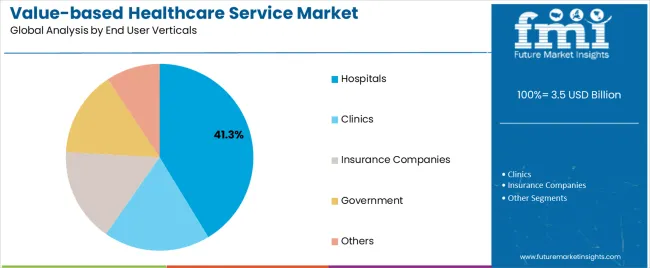

The market is segmented by Product Type, Deployment Type, and End User Verticals and region. By Product Type, the market is divided into Accountable Care Organization (ACO), Patient-Centered Medical Home (PCMH), Pay For Performance (P4P), and Bundled Payments. In terms of Deployment Type, the market is classified into Cloud and On-Premise. Based on End User Verticals, the market is segmented into Hospitals, Clinics, Insurance Companies, Government, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The accountable care organization (ACO) product type segment is projected to hold 28.8% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is being driven by the increasing focus on coordinated care, shared accountability, and outcome-based reimbursement models. ACO frameworks enable healthcare providers to deliver integrated care across multiple settings while reducing unnecessary procedures and hospital readmissions.

The ability to track performance metrics, patient outcomes, and financial efficiency through advanced analytics enhances adoption. Hospitals, physician groups, and care networks are leveraging ACO models to achieve improved clinical results while controlling operational costs.

Cloud-based platforms and software solutions supporting ACO management further strengthen the segment by enabling real-time monitoring, data sharing, and predictive analytics As healthcare systems continue to prioritize patient-centric models and performance-based payment structures, the ACO segment is expected to maintain its leadership position, supported by regulatory initiatives, technological innovation, and growing provider adoption.

The cloud deployment type segment is expected to account for 64.5% of the market revenue in 2025, making it the leading deployment method. Its growth is being driven by the scalability, accessibility, and cost-effectiveness offered by cloud-based platforms, which allow healthcare providers to manage large volumes of patient data efficiently. Cloud solutions enable real-time data sharing, interoperability, and remote access, which are critical for coordinated care and population health management initiatives.

Integration with advanced analytics, AI-driven decision support, and predictive modeling enhances clinical and operational outcomes. The ability to reduce IT infrastructure costs, streamline workflow management, and ensure compliance with healthcare regulations has further reinforced adoption.

Healthcare organizations are increasingly prioritizing cloud deployments to support value-based care models, monitor performance metrics, and enable outcome-focused treatment strategies With ongoing technological advancements and rising demand for patient-centric care delivery, cloud-based solutions are expected to remain the preferred deployment type, sustaining strong market growth.

The hospitals end user verticals segment is projected to hold 41.3% of the market revenue in 2025, establishing it as the leading end-use category. Growth in this segment is being driven by hospitals’ increasing adoption of value-based healthcare services to improve clinical outcomes and operational efficiency. Hospitals are leveraging coordinated care programs, advanced analytics, and cloud-based platforms to monitor patient health, reduce readmissions, and optimize treatment plans.

The integration of patient-centric data management, predictive modeling, and AI-driven decision support systems enhances quality of care and financial performance. Regulatory incentives and reimbursement structures are further motivating hospitals to implement value-based care frameworks and accountable care models.

The ability to deliver proactive, outcome-focused services while maintaining cost efficiency is strengthening adoption As hospitals continue to expand service offerings and invest in technology-enabled care delivery, the sector is expected to remain the primary driver of market growth, supported by ongoing innovation, performance monitoring, and population health management initiatives.

The market was valued at USD 1,868.9 million in 2020. From 2020 to 2025, the value-based healthcare services market registered a CAGR of 10.5%. The market value was about USD 3,261.7 million in 2025.

In a survey conducted among accountable care organizations, value-based payment models experienced a showdown during the pandemic crisis. Almost 60% quit their value-based contracting during this short-term period. Despite this, the response of the Centers for Medicare & Medicaid Services (CMS) to sustain value-based healthcare initiatives recovered after 2025.

| Attributes | Details |

|---|---|

| Value-based Healthcare Service Market Value (2020) | USD 1,868.9 million |

| Historical Market Revenue (2025) | USD 3,261.7 million |

| Historical CAGR (2020 to 2025) | 10.5% |

Advent of Digitization Altering the Mode of Delivering Medical Care

Due to digitization over time, healthcare policies and ways of delivering medical care have changed a lot. Greater collaborations will take place due to rapid expansion in value-based healthcare services.

Patients with any kind of disease will be diagnosed earlier through value-based healthcare with greater transparency. Therefore, rapid expansion in value-based healthcare services is driving the value-based healthcare services market growth.

Constantly Rising Chronic Diseases and Physical Disabilities Boost the Adoption

The increasing rate of chronic diseases is fueling the demand for value-based healthcare services. The rising incidence of chronic diseases is increasing the need for value-based care services across hospitals and clinics. With value-based care, patients can prevent and avoid chronic diseases before they start.

Ensuring reliable data in value-based healthcare services is a new challenge for administering medicare payment systems. Providers have to ensure the reliability of data as many of the payments are linked to quality and outcomes and also have to make sure the data is appropriate and resourceful.

The table highlights some leading countries that have been identified varying with respect to regional clusters and relative product lifecycle (PLC) positions.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 1.9% |

| Germany | 3% |

| United Kingdom | 3% |

| China | 2.3% |

| South Korea | 1.8% |

The United States value-based healthcare service market is to witness an upswing at 1.9% CAGR from 2025 to 2035.

The count of patients in the United States who use home health monitoring systems is higher in comparison to other countries creating a higher demand for pay-for-performance healthcare market. Leading tech companies such as Qualcomm Life are also involved in the sales of wireless and cloud technology products used in the healthcare industry.

The demand for value-based healthcare services in Germany is expected to experience a 3% CAGR through 2035.

Recent advancements in IT systems and treatment technologies have stressed the impact of value-based core models in the German healthcare sector. Also, federal mandates are encouraging healthcare organizations to adopt advanced IT systems and technologies in order to improve patient care experience and care team communication. In addition to managing the cost of care at reasonable levels and incentivizing various elements of the system to work coherently to achieve this.

The United Kingdom value-oriented healthcare service market is poised to display a CAGR of 3% over the forecast period.

In the recent past, the NHS reform proposals indicated a move away from activity-based payments towards more capitated payment structures around people. These reforms support inventive, value-based contracting approaches, anchored around enhancing health outcomes. It generated an opportunity for value-focused healthcare market players to become part of the strategy to enhance population health outcomes.

The value-based healthcare service industry in China is progressing at a 3% CAGR through 2035.

Higher adoption of IoT-enabled network connectivity shows the potential of healthcare systems in remote areas of China. An efficient and well-integrated patient-centric system established by the Chinese government is empowering the value-based healthcare service providers in the country. The demand for value-based healthcare services is projected to go up owing to procurement reforms that emphasize value over cost.

The value-based healthcare service providers in South Korea intend to follow an average CAGR of 1.8% until 2035.

In South Korea, value-based healthcare services are largely being used as providers have understood, how they can achieve high patient satisfaction with better care efficiencies. Now the pace to embrace value-based healthcare services is picking up in the country and patient awareness is playing a greater role in stimulating the growth.

Based on the model type, patients are opting more for accountable care organizations with around 28.8% market share in 2025.

| Attributes | Details |

|---|---|

| Top Model Type | Accountable Care Organization (ACO) |

| Market Share in 2025 | 28.8% |

Patient trust is built by providing information about the cost in simple terms and this insight impels healthcare systems to drive down costs and deliver quality care. Patients explore options and choose the best-suited health system in their care process through accountable care organizations. However, the demand for patient-centered medical homes (PCMH) is observed to be witnessing a slightly higher growth rate.

Based on the deployment type, a greater adoption rate of cloud systems account for 64.5% of the market in 2025.

| Attributes | Details |

|---|---|

| Top Deployment Type | Cloud |

| Market Share in 2025 | 64.5% |

Wireless and cloud technologies in healthcare IT provide medical professionals and patients with fast and easy access to clinical data in a cost-effective manner. Wireless and cloud technologies are expected to grow rapidly in the healthcare sector. This could be attributed to the convenient and cost-effective means of communication between the healthcare organization and the consumer.

Leading players are focused on developing innovative remote clinical monitoring systems and clinical communication platforms for in-home and outpatient remote monitoring. Meanwhile, governments of emerging economies are trying to lessen the healthcare expenditure burden through holistic measures.

Network-enabled healthcare equipment with cloud connectivity can enable medical professionals to store and access the health data of patients in underdeveloped areas of the country.

The companies are focusing on entering into collaboration with other businesses that offer complementary products, services, and technologies, which strengthen their market coverage and enhance their technological capabilities.

This strategy helps the company deliver more innovation to empower companies to connect with their customers in a whole new way. The company focuses on enhancing its solutions for value-based healthcare by collaborating with leading players.

For instance, in March 2024, Baker Tilly and IBM MarketScan collaborated to help healthcare companies unlock their growth potential with real-world evidence strategies. This collaboration enables Baker Tilly to provide its client with a one-stop partner for real-world evidence generation.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 3.5 billion |

| Projected Market Size (2035) | USD 6.4 billion |

| Anticipated Growth Rate (2025 to 2035) | 6.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Product Type, By Application, By gdgdg, By End Use Verticals, and By Region |

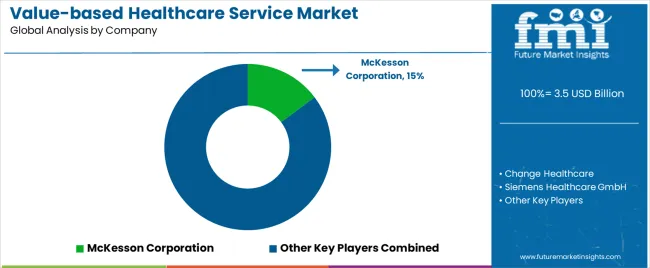

| Key Companies Profiled | Siemens Healthcare GmbH; NextStep Solutions; McKesson Corporation; NextGen Healthcare; Genpact Limited; Athena Healthcare; Boston Consulting Group; Change Healthcare; Baker Tilly, USA, LLC; ForeSee Medical |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global value-based healthcare service market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the value-based healthcare service market is projected to reach USD 6.4 billion by 2035.

The value-based healthcare service market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in value-based healthcare service market are accountable care organization (aco), patient-centered medical home (pcmh), pay for performance (p4p) and bundled payments.

In terms of deployment type, cloud segment to command 64.5% share in the value-based healthcare service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA