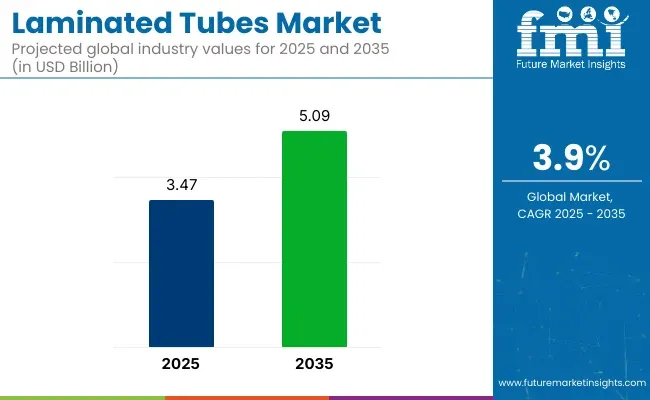

The global laminated tubes market is estimated to generate USD 3.47 billion in 2025 and is projected to reach USD 5.09 billion by 2035, with a compound annual growth rate (CAGR) of 3.9% during the forecast period. Laminated tubes are widely used across various industries, including cosmetics, pharmaceuticals, and food, due to their superior barrier properties, lightweight design, and excellent printability, making them ideal for packaging products that require protection from light, air, and moisture.

Recent developments in the laminated tubes market highlight a significant shift towards sustainability and innovation. Manufacturers are increasingly focusing on producing eco-friendly laminated tubes by incorporating recyclable materials and reducing plastic content.

This move aligns with the growing consumer demand for sustainable packaging solutions and stricter environmental regulations. Additionally, advancements in printing technologies have enabled brands to achieve high-quality, customizable designs on laminated tubes, enhancing product appeal and brand identity.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 3.47 billion |

| Market Size in 2035 | USD 5.09 billion |

| CAGR (2025 to 2035) | 3.9% |

In 2024, Huhtamäki Oyj introduced the blueloop™ Tube ONE, a groundbreaking high-barrier laminated tube that eliminates the need for EVOH (ethylene vinyl alcohol) in its construction. This innovation offers enhanced recyclability and cost-effectiveness, aligning with the industry's shift towards more sustainable packaging solutions. The blueloop™ Tube ONE has been recognized with the prestigious "Tube of the Year" award, underscoring its significance in advancing eco-friendly packaging technologies. This was officially announced in the company's press release.

The market's growth is also driven by the expanding applications of laminated tubes in various sectors. In the cosmetics industry, laminated tubes are preferred for packaging creams, lotions, and other personal care products due to their ability to maintain product integrity and enhance shelf life.

The pharmaceutical sector utilizes laminated tubes for packaging ointments and gels, ensuring precise dosage and preventing contamination. In the food industry, laminated tubes are used for packaging sauces and condiments, offering convenience and portion control to consumers.

As the laminated tubes market continues to evolve, ongoing research and development efforts are expected to lead to the introduction of more specialized and efficient products. These advancements will cater to the diverse needs of industries seeking to leverage laminated tubes for improved packaging solutions, further driving the market's growth and impact on global packaging trends

The below table presents the expected CAGR for the global laminated tubes market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 1.8% |

| H2 (2024 to 2034) | 3.0% |

| H1 (2025 to 2035) | 2.7% |

| H2 (2025 to 2035) | 3.9% |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 1.8%, followed by a slightly higher growth rate of 3.0% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to decrease slightly to 2.7% in the first half and remain relatively moderate at 3.9% in the second half. In the first half (H1) the market witnessed a decrease of 90 BPS while in the second half (H2), the market witnessed an increase of 90 BPS.

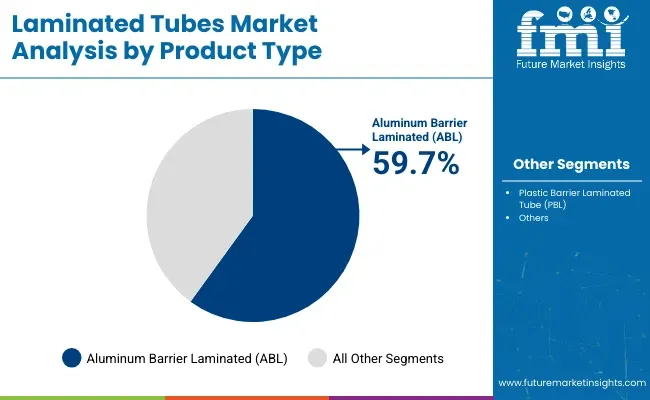

The global laminated tubes market is projected to experience strong growth from 2025 to 2035. Key segments contributing to this growth include aluminum barrier laminated (ABL) tubes and the 50 to 100 ml capacity. These segments are driven by increasing demand for packaging solutions that offer superior protection, convenience, and sustainability across industries such as cosmetics, pharmaceuticals, and food & beverages. Leading companies like Amcor and Essel Propack are expanding their offerings to cater to the evolving needs of the packaging market.

Aluminum barrier laminated (ABL) tubes are expected to account for 59.7% of the market share in 2025. This segment dominates due to ABL tubes' exceptional barrier properties, which protect the contents from air, moisture, and light, ensuring longer shelf life and maintaining product integrity.

These tubes are particularly favored in the cosmetics, pharmaceuticals, and food industries, where preserving the quality of the product is crucial. ABL tubes are ideal for packaging sensitive products such as creams, gels, ointments, and food pastes, offering both protection and convenience.

Key players like Amcor and Essel Propack are innovating in the ABL segment by using advanced materials and manufacturing techniques to create stronger, more sustainable packaging solutions. The growth of eco-friendly packaging is further driving the adoption of ABL tubes, as they offer recyclability and reduced environmental impact compared to other plastic-based packaging options. As industries continue to prioritize product protection and sustainability, ABL tubes are expected to remain a dominant segment in the laminated tubes market.

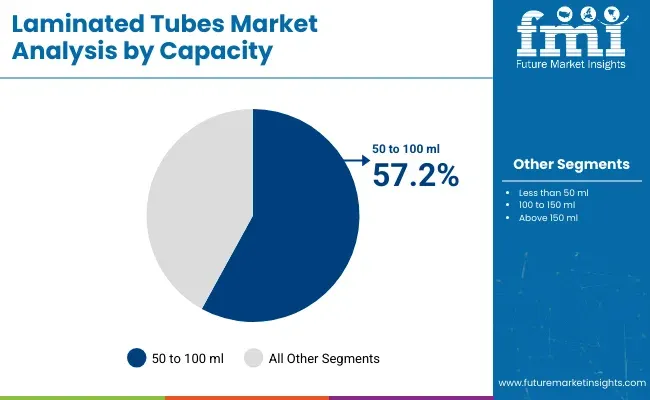

The 50 to 100 ml capacity segment is projected to hold 57.2% of the market share in 2025. This segment is experiencing strong growth driven by the versatility and consumer preference for medium-sized packaging across various industries.

The 50 to 100 ml range is particularly popular for personal care products such as lotions, shampoos, toothpaste, and pharmaceuticals, where the size is ideal for both retail and travel applications. This capacity is also well-suited for products that require precise dosing or are used frequently, offering an optimal balance between product quantity and convenience.

Manufacturers in the laminated tubes market, including companies like Mondi and Huhtamaki, are focusing on expanding their product offerings within this capacity range by developing functional, user-friendly designs. Innovations in tube dispensing, ease of use, and improved sealing technology are enhancing the appeal of 50 to 100 ml laminated tubes.

The ongoing trend toward smaller, more convenient packaging solutions, along with the growth of e-commerce and on-the-go lifestyles, is further supporting the strong demand for this capacity segment. As consumer demand for smaller, more sustainable packaging grows, the 50 to 100 ml capacity segment is expected to continue its strong market position.

Need for Barrier Protective Packaging Propels Laminated Tubes Demand

The global laminated tubes market is driven by the growing demand for barrier protective packaging. Since consumers require products to have long shelf life and better protection against external forces, the laminated multi-layered tubes has become the ideal solution. For instance, moisture, oxygen, and light penetration are barred by barrier layers made of aluminum or EVOH.

Industrially, today, more pharma, food and cosmetic brands are turning their attention toward using laminated tubes for products while ensuring their safe quality. As hygiene awareness improves and the value of convenience gets higher, even more customers fall in line and demand this innovative packaging option, which not only supports market interest in the preference for more and more green friendly packaging options.

Pharma & Cosmetic Industry Push Demand for Laminated Tubes for Enhance Product Protection and Appeal

Laminated tubes are fast becoming a preferred choice in the pharmaceutical industry, as there are stringent regulatory standards on the protection of products, especially ointments, gels, and creams. Such tubes possess better barrier properties to ensure sensitive products remain safe and effective, free from contamination, fresh, and with longer shelf life.

Demand for laminated tubes is increasing in the cosmetics and personal care industries due to their premium, visually attractive packaging that addresses consumer needs. Laminated tubes are flexible, and a brand can get custom designs with vibrant graphics; hence, laminated tubes can be very appealing for skincare, haircare, and hygiene products. The combination of functionality benefits with versatility places laminated tubes as the leading choice in the global market.

Availability of Alternative and Environmental Friendly Packaging May Hinder Growth

As the laminated tubes market continues to grow there is more competition from alternative packaging solutions such as flexible pouches, plastic bottles and airless pumps. These alternatives offer similar functionality in terms of ease of use protection against contaminants and efficient dispensing but typically are lower cost. Flexible pouches are lightweight and convenient for transportation.

Airless pumps preserve the product with better quality as they ensure fewer risks of contamination. Importantly, green products have tremendous market drive due to the rise of biodegradable and compostable packaging among consumers and brands focusing on sustainability. If laminated tubes fail to adjust and become more environmentally friendly by changing their production materials then this future may hinder growth due primarily in the form of greener alternatives.

Tier 1 companies comprise market leaders capturing significant market share in laminated tubes market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include CCL Industries, Inc., Berry Global Group, Inc., Albéa S.A. and Hoffman Neopac AG.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include Huhtamäki Oyj, Essel Propack Limited, ALLTUB Group, Montebello Packaging Inc., LINHARDT GmbH & Co. KG., CTL PACK, APackaging Group, Tubapack A.S., Antilla Propack Inc., Guangzhou Rego Packing Industry Co., Ltd and San Ying Packaging (Jiangsu) Co., Ltd.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

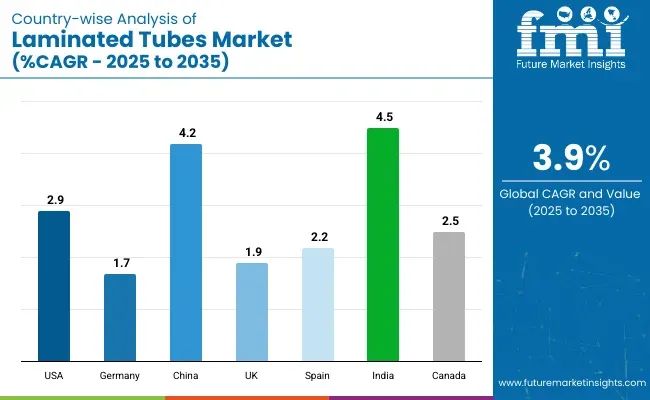

The section below covers the future forecast for the laminated tubes market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 2.9% through 2035. In Europe, Spain is projected to witness a CAGR of 2.2% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.9% |

| Germany | 1.7% |

| China | 4.2% |

| UK | 1.9% |

| Spain | 2.2% |

| India | 4.5% |

| Canada | 2.5% |

Consumer demand for convenient packaging in the USA raises demand for laminated tubes mainly for personal care and healthcare products. Consumers crave easy-to-use products that are portable and mess-free. Laminated tubes possess these advantages through their lightness, squeezability, and controlled dispensing to perfectly work for on-the-go use.

For instance, toothpaste tubes from companies like Colgate and Sensodyne are laminated so that one can squeeze down the last drop from the tube without wasting a lot of the product inside. This is something that people greatly value because it contributes to the total user experience; therefore, laminated tubes become the best for daily personal care items.

The demand for premium packaging in the UK market is increasing, especially among personal care and luxury goods as these consumers are investing in outwardly attractive, high-quality packaging. Laminated tubes are preferred as an effective means to combine functionality with the visual appearance for that premium look and feel.

In addition, these tubes also meet consumers' demand for convenience. For instance, very expensive high-class skincare products always use laminated tubes with a flip top in order not to waste a thing while applying and for a friendly use in their everyday applications. Such friendly use is reflective of the customer need for both the convenience as well as quality during daily applications.

Key players of global laminated tubes industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies

Key Developments:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.47 billion |

| Projected Market Size (2035) | USD 5.09 billion |

| CAGR (2025 to 2035) | 3.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Product Types Analyzed (Segment 1) | Plastic Barrier Laminated Tube (Ethylene Vinyl Alcohol, Polyamide (PA), Polyester), Aluminum Barrier Laminated Tube |

| Neck Diameters Analyzed (Segment 2) | 13.5 mm, 16 mm, Other Customized Sizes |

| Capacities Analyzed (Segment 3) | Less than 50 ml, 50 to 100 ml, 100 to 150 ml, Above 150 ml |

| Cap Types Analyzed (Segment 4) | Stand-up Cap, Nozzle Cap, Fez Cap, Flip Top Cap, Others |

| End-uses Analyzed (Segment 5) | Cosmetics (Haircare, Skincare/Facial Care, Body Care, Make-up, Baby Care, Hand Care), Commercial (Sealants & Adhesives, Lubricants, Others), Pharmaceuticals (Ointments, Creams), Oral Care, Home & Other Personal Care (Laundry Gel, Toiletries & Hand Wash Gels, Others), Food, Others (Paints, Crayons, Shoe Polish) |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Laminated Tubes Market | CCL Industries, Inc., Berry Global Group, Inc., Albéa S.A., Hoffman Neopac AG, Huhtamäki Oyj, Essel Propack Limited, ALLTUB Group, Montebello Packaging Inc., LINHARDT GmbH & Co. KG., CTL PACK |

| Additional Attributes | dollar sales, CAGR trends, product type segmentation, neck diameter demand, cap type preferences, capacity distribution, end-use industry trends, competitor dollar sales & market share, regional growth patterns |

In terms of product type, the industry is segmented into plastic barrier laminated tube (PBL) and aluminum barrier laminated tube (ABL). Plastic barrier laminated tube include ethylene vinyl alcohol, polyamide (PA) and polyester.

In terms of neck diameter, the industry is segmented into include 13.5 mm, 16 mm and other customized sizes.

Laminated tubes include multiple capacities such as less than 50 ml, 50 to 100 ml, 100 to 150 ml and above 150 ml.

In terms of cap type, the industry is segmented into stand-up cap, nozzle cap, fez cap, flip top cap and others.

End users of laminated tubes include cosmetics, commercial, pharmaceuticals, oral care, home & other personal care, food and others (paints, crayons, shoe polish, etc.). Cosmetics include haircare, skincare/facial care, body care, make-up, baby care and hand care. Commercial includes sealants & adhesives, lubricants and others (specialty grease and pesticides.). Pharmaceuticals include ointments and creams. Home & other personal care include laundry gel, toiletries & hand wash gels and others.

Haircare further includes shampoo, conditioner, hair oil, hair gels, hair color, and other hair styling products. Skincare/facial care includes cleanser, toner, moisturizer, sunscreen and serums & tonics. Body care includes body scrub, body wash, moisturizer and sunscreen. Make-up includes foundation, concealer, eyeshadow, eyeliner/ mascara and lipstick/lip gloss. Baby care includes baby shampoo/ baby wash, baby lotion, sunscreen and baby oil. Hand care includes hand wash/ gel, hand cream/lotions and hand sanitizer.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

The global laminated tubes industry is projected to witness CAGR of 3.9% between 2025 and 2035.

The global laminated tubes industry stood at USD 3.40 billion in 2024.

Global laminated tubes industry is anticipated to reach USD 5.09 billion by 2035 end.

South Asia & Pacific is set to record a CAGR of 6.0% in assessment period.

The key players operating in the global laminated tubes industry include CCL Industries, Inc., Berry Global Group, Inc., Albéa S.A. and Hoffman Neopac AG.

Explore Packaging Formats Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.